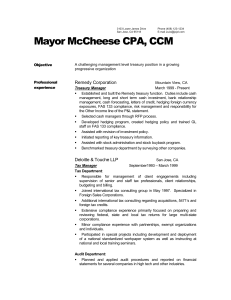

Scott Davis - Resume Updated 1/14/2016

Scott E. Davis

13552 Del Poniente Rd

Poway, CA 92064

(650) 703-6694

Scottdavis650@gmail.com

SKILLS

Twenty years of financial management experience including:

A/P & Payroll management

A/R and Credit & Collections

Debt management

eCommerce & PCI compliance

Equity operations

FX system design & trading

International finance

Mergers & acquisitions integration

Process redesign

Risk Management & SOX coordination

Systems design & implementation

Working capital management

EXPERIENCE

Consultant - San Diego/Los Angeles 2011 - Present

Designed, documented and aided implementation of central internal bank concept for major university in Los Angeles

Designed policies, procedures, roles and responsibilities for newly formed treasury department for major university

Redesigned, documented and optimized all finance processes for San Diego Biotech company.

Director of Finance/CFO - Conventus Biomedical Solutions (San Diego) 2012 - 2014

Manage all aspects of finance including payables, receivables and invoicing, payroll, general ledger, banking, and purchasing.

Bid development, contract pricing and terms negotiation.

Prepare profitability and productivity analysis on all customer contracts and all employees/subcontractors.

Responsible for budget and forecasting.

Assistant Treasurer/Director, Banking & Commerce – Stanford University 2007 – 2011

Responsible for university cash flow functions including funding payroll and disbursements, determining investment position, and identification and booking of all funds transfers.

Management of $100M merchant card/eCommerce program including PCI compliance.

Management of $300M commercial paper program

Involvement in all stages of debt issuance including primary responsibility for ratings agency presentations around $2B long term debt program.

Primary responsibility for monitoring and reporting of university and hospitals ’ liquidity.

Created recurring savings of $650K annually through redesign of processes, renegotiation of banking contracts, and optimization of interchange rates.

Responsible for university Cashier’s Office and analytic reporting group

Sr. Treasury Manager – Lam Research Corporation 2004 - 2007

Management of daily treasury functions including cash portfolio of up to $800M.

Foreign exchange hedging, design of revenue hedging program including FAS 133 compliance.

Senior management and board reporting.

Management of outsourcing relationships including transactional treasury, portfolio management, and treasury reporting.

Project work including change in legal structure of company, initiation of SOX compliance, interest rate swaps, initiation of share repurchase program, systems (SAP) steering committee, and repatriation of foreign entity funds.

Co-founder/Co-owner – CoreBio Group, Inc 2001 – 2004

Co-founder and co-owner of biotech consulting firm. Performed all financial and legal duties.

Assistant Treasurer – Excite@Home 1999-2001

Management of daily treasury functions including $600M investment portfolio.

Responsible for risk management worldwide.

Management of 20 staff in Accounts Payable, Payroll, Credit & Collections, and Treasury.

Member of corporate mergers and acquisitions integration team.

Corporate “Galaxy” (outstanding employee) and Finance MVP awards

Sr. Treasury Manager/Equity Operations Manager - Raychem Corporation 1992-1999

Management of five treasury and equity operations professionals at $2B material science firm.

Oversight of treasury operations in Europe, Middle East, and Africa regions with entities in 26 countries. Duties include set up of new entities, financing activities, approval of bank relationships, coordination of investments and cash levels, repatriation of funds, and maintenance of operational procedures and controls.

Management of stock option plans and Section 423 employee stock purchase plan serving

9,000 employees internationally.

Administration of corporate stock repurchase program.

Worldwide coordinator of company’s Euro conversion effort.

Management of treasury operations in United States region and oversight of treasury operations in Asia Pacific region with entities in twelve countries.

Created PC based intercompany payments system (integrated with SAP) which facilitated foreign exchange hedging and all intercompany payments worldwide.

Traded spot and forward foreign exchange contracts in twenty-five currencies.

Administration of worldwide variable pay program.

Helped obtain initial debt ratings with S&P and Moodys.

Reengineering Specialist - Raychem Corporation 1990 - 1992

Core team member in project that reduced cycle time from close to press release from nineteen days to ten days. One of five original team members on project that encompassed financial operations in 45 countries. Active in current state, benchmarking, visioning and implementation phases of the project. Cost of finance worldwide was reduced 25% through the implementation of best practices, improved systems and regional accounting centers.

Consultant - Andersen Consulting (Arthur Andersen)

Systems and finance consulting including supervision of 9 consultants.

1988 - 1990

EDUCATION

MBA: Finance, investments and banking, University of Wisconsin-Madison, 1988.

BA: Psychology, University of Minnesota, 1982.

Numerous seminars in cash management, foreign exchange hedging, international treasury, project management, reengineering, venture capital and systems.

ACTIVITIES

Peninsula Treasury Management Association – Past President, other offices

Tyco Electronics Employees Federal Credit Union – Past Chairman of Board of Directors for

$50 million Credit Union, other offices

San Francisco Treasury Symposium - Planning Committee, speaker, panel moderator

Local Schools – Site Council President, PTA Treasurer, Foundation board member

Toastmasters - Toastmaster of the year at local and area levels