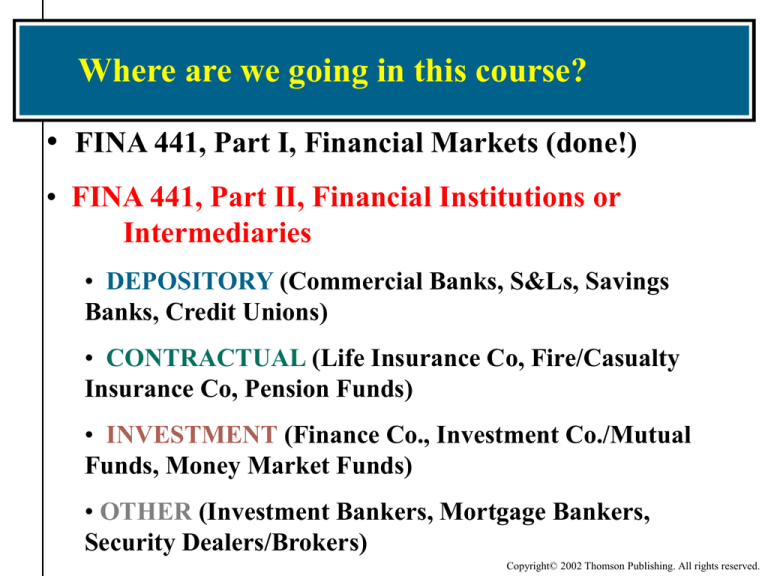

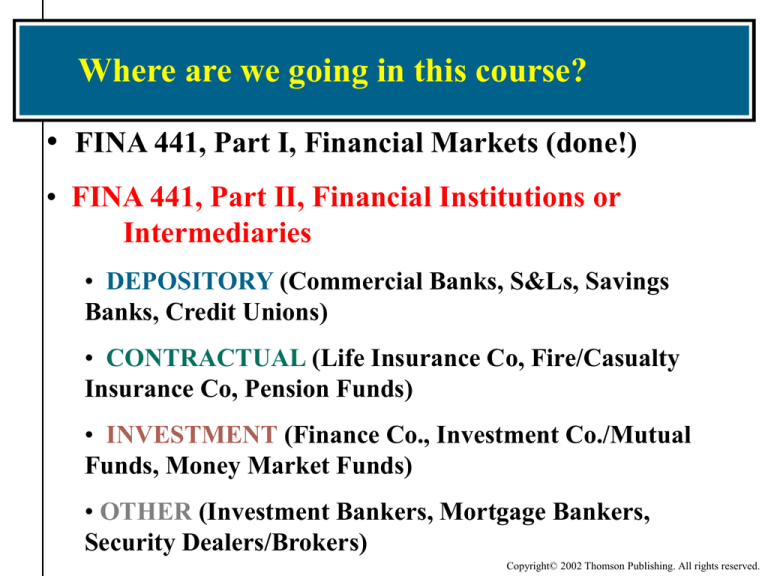

Where are we going in this course?

• FINA 441, Part I, Financial Markets (done!)

• FINA 441, Part II, Financial Institutions or

Intermediaries

• DEPOSITORY (Commercial Banks, S&Ls, Savings

Banks, Credit Unions)

• CONTRACTUAL (Life Insurance Co, Fire/Casualty

Insurance Co, Pension Funds)

• INVESTMENT (Finance Co., Investment Co./Mutual

Funds, Money Market Funds)

• OTHER (Investment Bankers, Mortgage Bankers,

Security Dealers/Brokers)

Copyright© 2002 Thomson Publishing. All rights reserved.

FINANCIAL INTERMEDIARIES

DIRECT

- involves only one contract between lender & borrower

- called dis-intermediation

- E.g. you loan money to your neighbor

SEMI-DIRECT

- Involves essentially one contract but . . .

- A middle party is needed to execute it

- E.g. you buy Intel stock through Charles Schwab from your neighbor

INDIRECT

- Involves two contracts

- Financial intermediary is in the middle

- E.g. you deposit money in the bank which loans it to your neighbor

Copyright© 2002 Thomson Publishing. All rights reserved.

FUNCTIONS OF FIN. INTERMEDIARIES

Maturity & Liquidity Intermediation

E.g. You deposit $ in savings account, which is loaned out in a 30-yr fixed-rate mortgage to your neighbor;

even though the loan won’t be paid off for many years, yet you can get your money at any time. Financial

intermediaries absorb liquidity risk!

Interest-rate and Inflation Risk Intermediation

E.g. Bank absorbs risk from borrower locking into fixed rate for 30 years.

Repackaging Size

E.g. Bank can re-package the size of a security to the level desired. Most of us don’t have $100,000 sitting

around to lend to our neighbor, so many of us poor investors can pool our $.

Diversification & Default Risk

E.g. You deposit $ in savings account, pooled together with other investors, so that no one investor is

lending to only one borrower. Depository institutions also offer government deposit insurance. In short,

financial intermediaries absorb default risk.

Efficiencies & Specialization

E.g. Bank is better able to invest in mortgages (legal issues, credit approval, etc.). Since the bank has

specialized in this, it has economies of scale (full-time lawyers, appraisers, credit specialists, etc.)

Clearing House for Payments

E.g. financial intermediaries make possible EFT, credit/debit cards, checks, etc. which wouldn’t exist

otherwise

Copyright© 2002 Thomson Publishing. All rights reserved.

Types of Financial Intermediaries

Assets of Financial Institutions (in $ billions)

1970

Type

$

%

Depository

Commercial Banks

517 39%

S&Ls & Savings Banks

250 19%

Credit Unions

18

1%

Contractual

Life Insurance Co.

201 15%

Fire & Casualty Insurance Co.

50

4%

Pensions (private)

112

8%

Pensions (gov't)

60

5%

Investment

Finance Companies

64

5%

Mutual Funds (Invest. Co.)

47

4%

Money Mkt Mutual Funds

0

0%

Total

1319 100%

GDP

GDP as % of total assets

1980

$

1990

%

$

2010

%

$

%

40 year

Growth%

20 year

Growth%

10 year

Growth%

1481

792

67

37%

20%

2%

3334

1365

215

30%

12%

2%

14133

1254

883

33%

3%

2%

2733

501

4905

953

157

1317

423

91

410

464

182

504

197

11%

5%

12%

5%

1367

533

1629

737

12%

5%

15%

7%

4826

1369

5471

2686

11%

3%

13%

6%

2400

2737

4884

4476

1039

751

1085

1362

352

256

335

363

1663

4%

6962 16%

3259

8%

42506 100%

14256

34%

2597

14812

n/a

3222

810

9945

4287

1052

272

1064

653

387

205

5%

70

2%

76

2%

4038 100%

2788

69%

610

6%

654

6%

498

5%

10942 100%

Copyright© 2002 Thomson Publishing. All rights reserved.

Role of Financial Institutions

Types of Depository Financial Institutions

Commercial

Banks

Total Assets

$15.2T

(2014)

Savings

Institutions

Total Assets

$1.1 T

(2014)

Credit Unions

Total Assets

$1.05 T

(2014)

https://www2.fdic.gov/hsob/HSOBRpt.asp

Copyright© 2002 Thomson Publishing. All rights reserved.

Copyright© 2002 Thomson Publishing. All rights reserved.

CHAPTER

17

Commercial

Bank

Operations

Copyright© 2002 Thomson Publishing. All rights reserved.

Commercial Bank Consolidations

Today there are half as many banks as there were in

1985. Today, the largest 5 banks control half of bank

assets vs. 30% of the assets in 2001.

Copyright© 2002 Thomson Publishing. All rights reserved.

Largest U.S. Banks

2015

Copyright© 2002 Thomson Publishing. All rights reserved.

Bank Participation in Financial Conglomerates

Impact of the Financial Services

Modernization Act (1999)

Prompted by the Citicorp-Traveler’s merger

Gave more freedom to merge and offer a range of

financial services

Insurance

Securities services

Many banks are now subsidiaries of a

financial conglomerate

Copyright© 2002 Thomson Publishing. All rights reserved.

Bank Participation in Financial Conglomerates

Benefits of diversified services

To Individuals: they can obtain all their

financial services at a single place (one stop

shop)

Deposits

Loans

Investing (brokerage)

Insurance

To Businesses: they can obtain loans, issue

stocks and bonds, and have their pension

fund managed by the same institution

Copyright© 2002 Thomson Publishing. All rights reserved.

Bank Participation in Financial Conglomerates

Benefits of diversified services to the

financial institution

Reduce reliance on demand for single

service

Economies of scale and scope

Diversification (service and geographical)

may result in less risk

Generate new business

Risks of conglomerates: too big to fail

NOTE: there are bills currently before Congress

now that would split big banks and their

diversified services. This is an attempt to prevent

the “too-big-to-fail” syndrome.

Copyright© 2002 Thomson Publishing. All rights reserved.

Sources of Funds (right hand of Balance Sheet)

Source: Federal Reserve

Copyright© 2002 Thomson Publishing. All rights reserved.

Bank Sources of Funds

Transaction deposits

Demand deposit account

Negotiable order of withdrawal (NOW) account

Interest-bearing checking account

Requires larger minimum balance

Savings Deposits

Checking account that does not pay interest

Passbook savings

Regulation Q until 1986 – max. interest rate

Auto Transfer Service (ATS) created in 1978 allows

ZBA accounts and overdraft protection.

Copyright© 2002 Thomson Publishing. All rights reserved.

Bank Sources of Funds

Time Deposits (have specific maturity)

Retail certificate of deposit (CD)

Negotiable CD

No secondary market

Early withdrawal penalty

New: Bull-market, bear-market and callable CDs

Short-term, minimum $100,000, usually $1m, no

FDIC insurance

Marketable -- can trade among investors via dealer

Money Market Deposit Accts (MMDAs)

More liquid than CDs with no maturity

Limited check writing (e.g. 5 per month)

Created in 1982 with Garn St. Germain Act

Copyright© 2002 Thomson Publishing. All rights reserved.

Bank Sources of Funds

Federal Funds Purchased

Short-term loans between banks (usually 1-7 days), often to meet reserve

requirements (most report weekly on Wed.)

Allows banks to borrow S/T (seasonal, etc.) or may provide a S/T

investment

Interest rate is the Federal Funds Rate, typically above the T-bill rate since

small amounts of liquidity and default risk may exist.

Borrowing from the Federal Reserve Banks

Borrowing at the discount window, which is discouraged

Discount Rate (usually 1% higher than Fed Fds Rate)

Intended for meeting temporary short-term reserve requirement needs

Must get Fed approval, Fed may frown at you

Copyright© 2002 Thomson Publishing. All rights reserved.

Bank Sources of Funds

Repurchase agreements

Sale of T-bills (usually) by bank to a business with

excess cash and an agreement to repurchase the

securities at a later date and higher price

Source of funds for a few days for the bank

Collateralized by the Treasury bills

Form of paying interest on large customer

checking balances (Rogers Elementary!)

Copyright© 2002 Thomson Publishing. All rights reserved.

Bank Sources of Funds

Eurodollar borrowings

Banks outside the United States make dollardenominated loans (maybe even to US banks)

Eurodollar market is very large (Saddam Hussein

was caught with a briefcase full of what?)

Bonds issued by the bank

Like other businesses, banks issue bonds to

finance long-term fixed assets

Usually subordinated to deposits

Copyright© 2002 Thomson Publishing. All rights reserved.

Bank Sources of Funds

Bank capital

Represents amount of equity stockholders have

Obtained from issuing stock and retaining earnings

The more capital, the more “safe” the bank is because

capital is a buffer to absorb future losses

Banks often resist building up too much capital because it

lowers the return on equity (ROE). Stated another way,

the more leverage the bank, the more ROE is magnified.

Capital is usually approx. 6-12% of assets but it really

depends on risk-based capital requirement and size of bank

Primary capital (stock & RE) is of higher quality than

secondary capital (subordinated notes & bonds)

Copyright© 2002 Thomson Publishing. All rights reserved.

Bank Capital Regulation

A major reason banks failed during the financial

crisis because of inadequate capital.

Basel III (or the Third Basel Accord) is a global

regulatory standard on bank capital adequacy, stress

testing, and market liquidity risk agreed upon by the

members of the Basel Committee on Banking

Supervision in 2010–11, and scheduled to be

introduced from 2013 until 2018. (Basel is a town in

Switzerland where they meet.) Basel III strengthens

bank capital and introduces new regs on liquidity and

leverage.

Copyright© 2002 Thomson Publishing. All rights reserved.

Uses of Funds

(left hand side of balance sheet)

Source: Federal Reserve

Copyright© 2002 Thomson Publishing. All rights reserved.

Uses of Funds by Banks

Cash and “due from” balances at institutions

Currency/coin provided via banks

Reserve requirements imposed by Fed

Due from Fed and vault cash count as reserves

Hold cash and due from balances to maintain

liquidity and accommodate withdrawal requests by

depositors

Copyright© 2002 Thomson Publishing. All rights reserved.

Uses of Funds by Banks

Bank Loans (59% of assets)

Types of business loans

Working capital loans (business operating cycle)

Term loans

Purchasing fixed assets

Protective covenants & conditions

Informal line of credit (bank not obligated to lend)

Revolving credit loan (bank obligated)

Copyright© 2002 Thomson Publishing. All rights reserved.

Uses of Funds by Banks: Volume of

Small Business Loans

Copyright© 2002 Thomson Publishing. All rights reserved.

Uses of Funds by Banks

Bank Loans

Loan participations (syndicates)

Sometimes large firms seek to borrow more money

than an individual bank can provide

Lead bank will organize the syndicate

Loans supporting leveraged buyouts

Banks charge a high loan rate

Monitored by bank regulators

Highly-leveraged transactions (HLTs) where debt ratio

> 75%.

Copyright© 2002 Thomson Publishing. All rights reserved.

Uses of Funds by Banks

Bank Loans

Collateral requirements on business loans

Types of consumer loans

Increasingly accepting intangible assets

Important to service-oriented firms which have few hard assets

Increased lending risk with service businesses--telecomm

Installment loans (cars, furniture, etc.)

Credit cards

Usury laws

Real estate loans

Copyright© 2002 Thomson Publishing. All rights reserved.

Bank Prime Rate Over Time

Theoretically, the prime rate is the rate charged to most creditworthy customers.

WSJ does a regular survey of the 30 largest banks and average their best rates to get

the WSJ prime rate. In reality, this rate moves in tandem with Fed funds rate,

usually 300 bp above the upper Fed target rate. The prime rate is the base of most

short-term consumer rates, such as on credit cards and auto loans.

http://www.bankrate.com/rates/interest-rates/wall-street-prime-rate.aspx

Copyright© 2002 Thomson Publishing. All rights reserved.

Uses of Funds by Banks

Investment securities (bank income and

liquidity)

Treasury securities

Government agency securities

Corporate and municipal securities

Investment grade only

Federal funds sold

Copyright© 2002 Thomson Publishing. All rights reserved.

Uses of Funds by Banks

Repurchase agreements

Eurodollar loans

Branches of U.S. banks located outside of the U.S.

Foreign-owned banks

Fixed assets

Office buildings

Land

Copyright© 2002 Thomson Publishing. All rights reserved.

How Banks Finance Economic Growth

Copyright© 2002 Thomson Publishing. All rights reserved.

Off-Balance Sheet Activities

Loan commitments

Obligation of bank to provide a specified loan

amount to a particular business upon request

Banks earn fee income for risk assumed

Standby letters of credit (SLC)

Backs a customer’s obligation to a third party

Banks earn fee income

Copyright© 2002 Thomson Publishing. All rights reserved.

Off-Balance Sheet Activities

Forward contracts in foreign currency

Agreement between a customer and bank to

exchange one currency for another on a particular

future date at a specified exchange rate

Allows customers to hedge their exchange-rate

risk

Copyright© 2002 Thomson Publishing. All rights reserved.

Off-Balance Sheet Activities

Interest rate swap contracts

Two parties agree to periodically exchange

interest payments on a specified notional amount

of principal

Banks serve as intermediaries or dealer and/or

guarantor for a fee

Credit default swap contacts

Privately negotiated contracts to protect investors

against the risk of default on debt securities

Copyright© 2002 Thomson Publishing. All rights reserved.

Baker Boyer Bank

In the 1800s, Walla Walla was the largest city in the Northwest

and the financial and cultural center of the NW region (and it

almost became the state capitol).

Baker Boyer Bank (BBB) was founded in 1869, twenty years

before Washington became a state. The bank really started as a

mercantile store where gold miners would keep their gold in the

store’s safe. As much as $40,000 in gold would be left in the

safe for more than a year, and though it wasn't common to give

or ask for receipts, no losses were ever suffered.

At one point in 1911, the BBB building was the tallest building

west of the Mississippi River.

During the banking crisis of the 1930s, most banks were forced

to close, at least temporarily. But BBB was determined to

remain open, even though it had been ordered closed. BBB

allowed customers to use the back door of the bank until banks

were allowed to reopen.

BBB is still partly owned by the families of the original

founders, Dorsey Baker and John Boyer. Today the CEO is the

great-great-granddaughter of Dorsey Baker.

BBB remains a community bank with 8 branches in WW, TriCities, Milton-Freewater, and Yakima

1911, tallest building west of the

Miss. River

Megan Clubb,

CEO

Copyright© 2002 Thomson Publishing. All rights reserved.

Banner Bank

Banner Bank (BB) started in the 1890 (one year

after Washington gained statehood and two years

before the founding of WWU).

For most of its history, it was known as First

Washington Bank and remained a small,

community-based bank in Eastern Washington.

In 1995, the bank did an IPO and become a public

company traded on the Nasdaq (ticker of BANR).

Since then, the bank has pursued a path of

tremendous growth through mergers/acquisitions.

Today it has expanded to 204 branches in 59

counties throughout WA, OR, ID and UT.

In 2000, the bank changed its name to Banner

Bank.

WW Headquarters

Bank in Boise

Copyright© 2002 Thomson Publishing. All rights reserved.