Chapter 10

advertisement

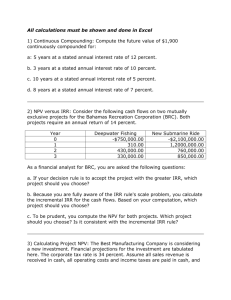

Chapter 10 Cash Flow Estimation and Risk Topics in Capital Budgeting © 2000 South-Western College Publishing CAPITAL BUDGETING: TWO PROCESSES • Estimate Incremental Cash Flows Associated with Every Project Difficult, subjective and sometimes arbitrary Takes judgment and experience • Evaluate Estimates Using Techniques Like NPV and IRR Straightforward given cash flow estimates Little ambiguity or risk of error TM 10-1 THE GENERAL APPROACH TO CASH FLOW ESTIMATION Some Helpful Hints •Think through the events a project will bring about, and write down the future financial implications of each •Forecasts for new ventures tend to be the most complex Pre-startup, the initial outlay: Enumerate pre-start expenses after tax and all assets that must be purchased. Sales Forecast Forecast incremental units over time in spreadsheet form Extend by prices for revenues TM 10-2 Slide 1 of 3 Cost of Sales and Expenses: Base costs and expenses on some assumed relationship with forecast incremental revenues Assets: Plan new assets whenever they're expected to be acquired Include working capital Depreciation: Plan depreciation for new assets It's a non-cash item but impacts taxes Taxes and Earnings Summarize tax deductible items in each period to calculate the project's impact on taxes and earnings Treat incremental taxes like any other cash flow item TM 10-2 Slide 2 of 3 Expansion projects Require the same elements as new ventures but generally fewer and simpler Replacement projects Generally save cost without generating new revenue Savings are planned over future periods along with required assets The Typical Pattern Outflows first followed by inflows Initial outlay is generally large Some subsequent outflows are fairly common (E. g., early losses in a new venture) TM 10-2 Slide 3 of 3 Project Cash Flows are Incremental In addition to and at least conceptually separate from the existing business Ignore Sunk Costs Money already spent is not part of the decision Only future costs matter Opportunity Cost Some resources that seem to be free aren't The cost of any resource is whatever has to be given up for it Value in the next best use An idle resource is only free if it has no market value Impacts on Other Parts of the Company Lost sales Economies of scale Overhead Levels Large incremental projects may require incremental overhead support E.g., personnel, accounting TM 10-3 Slide 1 of 2 Taxes Improved profitability means incremental taxes All bottom line period cash flows should be net of taxes Cash vs. Accounting Results Managers are interested in the net income impact of projects as well as cash flow based capital budgeting results Calculate accounting results for their information Working Capital Incremental sales normally require incremental receivables and inventories (partially offset by payables) which need to be funded with cash Ignore Financing Costs The NPV and IRR techniques take care of financing Old Equipment Sold Off Include cash proceeds less taxes TM 10-3 Slide 2 of 2 ACCURACY AND ESTIMATES Estimating the future is generally difficult and imprecise However Capital budgeting projects usually come with built-in biases The people doing the technical estimating are usually proposing the project and have a self-interest in its approval Therefore The elements contributing to the final cash flows tend to be too optimistic This does not imply deception Biases are often honest differences of opinion based on point of view and priorities TM 10-9 ESTIMATING CASH FLOWS FOR REPLACEMENT PROJECTS Usually simpler but identifying what is incremental can be tricky Example 10-2: HARRINGTON METALS, INC. REPLACEMENT STAMPING MACHINE Old Machine: Purchased five years ago for $80,000 8 yr straight line depreciation Performs poorly: High maintenance cost Excessive down-time Poor quality output Market value is $45,000 3 operators @ $25,000 Proposed Machine: Costs $150,000 Five-year straight line depreciation 2 operators @ $25,000 One year full warranty TM 10-10 Slide 1 of 2 OLD MACHINE'S DOWN-TIME AND MAINTENANCE COST Year Hours Down Maintenance Exp ($000) 1 2 40 60 In Warranty $10 3 100 4 130 _5_ 128 $35 $42 $45 Down-time is subjectively estimated to cost $500 per hour PROPOSED MACHINE'S MANUFACTURER CLAIMS Down-time per year 30 hours Maintenance cost per year $15,000 Higher quality output will increase sales TWO KINDS OF CASH FLOW ESTIMATE Subjective Objective Note: The tax rate is 34% TM 10-10 Slide 2 of 2 SUBJECTIVE ESTIMATES of Subsequent Cash Flows The issues are the differences in cost or benefit due to: • Maintenance Expense • Downtime • Product Quality Assumptions must be made about: • • • • Whether the old machine will get worse or stay as is Whether the proposed machine will live up to its claims What value to place on an hour of downtime How to handle the quality issue: Measuring quality Estimating improvement Valuing improvement The analyst must be impartial and keep peoples' biases in mind TM 10-12 Slide 1 of 2 MAINTENANCE COST($000) Assume maintenance on the old machine stays at $45,000 and the proposed machine performs as promised Year OLD Machine 1 $45.0 2 3 4 $45.0 $45.0 $45.0 $45.0 NEW Machine In Wrnty $15.0 $15.0 $15.0 $15.0 Savings $45.0 $30.0 $30.0 $30.0 $30.0 5 DOWNTIME Assume 100 hours of downtime per year are saved arbitrarily valued at $200 per hour Assume no value for improvement in product quality TM 10-12 Slide 2 of 2 RISK IN CAPITAL BUDGETING •Cash flow estimates are risky and can be thought of as random variables •Conceptually similar to the return on an investment •Each future cash flow is a separate random variable with its own probability distribution •The risk associated with a particular flow is related to the variance of its probability distribution TM 10-14 Slide 1 of 2 Prob (Ci) Variance (risk) Ci Expected Value Figure 10-1 The Probability Distribution of A Future Cash Flow as a Random Variable TM 10-14 Slide 2 of 2 Cash Flows as random variables imply project NPV's and IRR's are also random variables with their own probability distributions Project Cash Flows ... C0 C1 C2 Cn Time Probabilistic Cash Flows Lead To Probabilistic NPV and IRR NPV IRR Figure 10-2 Risk in Estimated Cash Flows Hence NPV's and IRR's also have most likely values but will probably turn out somewhat differently depending on the variances of the distributions TM 10-15 THE IMPORTANCE OF RISK IN CAPITAL BUDGETING Ignoring the possibility that NPV or IRR can turn out to be other than expected means there's a good chance of making wrong decisions Example NPVA NPVB $12M Figure 10-2 $13M Project NPV's Reflecting Risky Cash Flows • NPVB has a higher expected value than NPVA, but is much more risky Standard capital budgeting techniques will invariably choose B over A but there's a good chance the actual NPVB < NPVA • If that happens the wrong decision may cost millions. •The principle of risk aversion is applicable • Less risky capital projects are preferred to those with more risk. TM 10-16 Slide 1 of 2 Changing the Nature of the Company A firm that takes on risky projects over time becomes more risky itself which eventually affects its beta and stock price Hence, some consideration of risk should be included in project analysis. TM 10-16 Slide 2 of 2 METHODS OF INCORPORATING RISK SCENARIO/SENSITIVITY ANALYSIS Consider A Range of Possible Outcomes Including Good, Most Likely, and Bad For each cash flow: Prob(Ci) Ci Bad Figure 10-3 Most Likely Good Possible Cash Flows for a Particular Period TM 10-17 Slide 1 of 2 • Calculate NPV and IRR three times using good, bad, and most likely cases for each cash flow • Gives a range of values for NPV and IRR along with the most likely values and a subjective feel for a project's risk • Tests the sensitivity of NPV and IRR to changes in assumptions about cash flows. • However, it does not give a very good notion of the probability distribution of outcomes TM 10-17 Slide 2 of 2 SIMULATION Using the Computer to Build an NPV or IRR Probability Distribution Input the probability distributions for all Ci Draw observations from each and compute NPV or IRR Repeat and display as histogram Approximates the probability distributions of NPV and IRR Number of Observations 600 500 400 300 200 100 NPV -$100 0 $100 $200 $300 Centers of NPV ranges $400 Figure 10-4 Results of Monte Carlo Simulation for IRR TM 10-18 Slide 1 of 2 Drawbacks to Simulation Approach • Cash flow distributions have to be subjectively estimated • Distributions are not generally independent Tend to be correlated: if early flows are low, it's likely that later flows will also be low • There are no decision rules for choosing among projects with respect to risk TM 10-18 Slide 2 of 2 INCORPORATING RISK INTO CAPITAL BUDGETING THE THEORETICAL APPROACH RISK ADJUSTED RATES OF RETURN - CAPM • In both NPV and IRR an interest rate (the cost of capital, k) determines project acceptability • The higher the rate, the less likely is acceptance • Risk aversion implies that Riskier Projects Should Be Less Acceptable • Incorporate risk into capital budgeting using Risk Adjusted Rates in place of the cost of capital in applying NPV and IRR techniques to riskier projects • The cost of capital is the starting point reflecting normal risk for the company CHOOSING RISK ADJUSTED RATES Replacement projects - cost of capital Expansion projects - cost of capital plus 1 to 3% New Venture projects - ??? TM 10-19 ESTIMATING RISK ADJUSTED RATES FOR NEW VENTURES USING CAPM If a project is viewed as a business, a beta common to the field (pure play) may be appropriate for estimating a risk adjusted rate using the SML kX = kRF + (kM - kRF)bX The calculated rate approximates the required return for an equity investment in the project TM 10-20 PROBLEMS WITH THE CAPM APPROACH It is questionable whether the CAPM calculated rate is appropriate because it considers only systematic risk A Project is a Diversification in Two Ways The firm is a collection (portfolio) of projects A new venture simply adds one more and A new venture effectively diversifies the investment portfolios of stockholders into the new line of business This calls for a new look at diversified risk TM 10-21 Slide 1 of 2 Total Risk Risk Diversified Away by Project Portfolio Risk Added To Company Risk Diversified Away by Stockholder's Investment Portfolio Systematic Risk Figure 10-5 Components of Project Risk • Beta is associated with systematic risk, but total risk may be more appropriate in the context of a project • Hence the CAPM rate may be TOO LOW • In Orion example(10-3) this implies the project is probably unacceptable TM 10-21 Slide 2 of 2