Syllabus_FIN 331_2013-2014 first term

advertisement

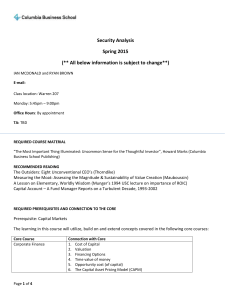

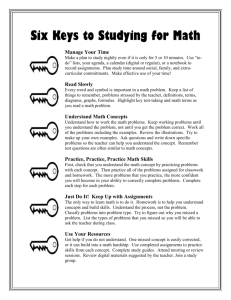

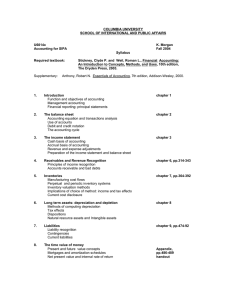

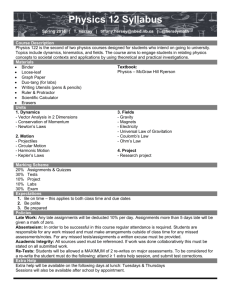

King Abdulaziz University Faculty of Economics & Administration Department of Finance FIN 331: Foundations of Investments Spring 2013/14 Prerequisite: Credits: FIN 331 3 Lectures hours: Course level: 3 hours per week Intermediate Instructor: Dr. Nesma Heshmat E-mail: nheshmat@kau.edu.sa Office: 2221 Office Hours: Sun. Tue. Thu 12-1 Mon .Wed 11-12:30 COURSE DISCRETION The course is a rigorous, quantitative introduction to financial market structure and financial asset valuation. First, we describe the investment environment, financial markets, and instruments. Second, we examine the risk-return tradeoff, optimal portfolio selection, asset pricing models, and market efficiency. Third, we explore theoretical and applied methodologies for stock analysis and valuation. Finally we provide an introduction to derivatives securities. COURSE OBJECTIVES The main objectives of this course are to: 1. Provide students with deeper understanding of concepts related to investment analysis and portfolio theory. 2. Equip students with techniques of investment analysis. 3. Expose students to the investment environment, locally and internationally. LEARNING OUTCOMES Upon completion of this course student should be able to: 1. Comprehend the fundamental concepts of investment theory and financial markets. 2. Understand the theory necessary to manage and analyze investments and risk effectively. 3. Construct efficient portfolios. 4. Construct and use the security market line. 5. Apply research, analytical, and writing skills through formal case studies and assignments. COURSE MATERIAL Required Text Bodie, Z., Kane, A., and Marcus, A., 2010, Essentials of Investments, 8th edition, McGraw-Hill. An important complement to class work is following the financial news. There are several sources of information on the internet such as Bloomberg, Reuters and Yahoo Finance. Supplementary (but optional) Texts Jordan & Miller, Fundamentals of Investment, 4rd Edition ,2008 (McGraw-Hill) 1 COURSE GRADING Your course grade will reflect your performance on midterm and final exams, assignments, and class participation, with weights determined as follows: Quiz 10% Tuesday 3/12/1434 - 8/10/2013 First Exam 20% Tuesday 23/1/1434 - 26/11/2013 Midterm Exam 20% Thursday 16/2/1434 - 19/12/2013 Final Exam 40% Assignments and Class Participation 10% IMPORTANT NOTE If a midterm exam is not completed, the mark assigned to the missed component will be zero except in the case of a valid excuse (illness, death of a close family member, etc.). In the case of a valid excuse the marks associated with the missed component will be re-assigned to the final exam. In every aspect of the course, students are required to adhere to the standards of conduct in the King Abdulaziz University Honor Code CLASSROOM USE Students should conduct themselves professionally at all times. Class starts promptly at the time indicated on your schedule. It is the student’s responsibility to obtain handouts, notes, and assignments from any missed days. Students are expected to follow the college’s acceptable use policy while in the class. HOW TO STUDY FOR THIS COURSE: Spend some time on the course every day, whether you have class or not Take good notes in class and review them frequently, comparing them to corresponding material in the text Read the chapter in the textbook (prior to it's being covered in class) Answer and study the questions in the text Do homework assignments as soon as possible after they have been assigned Pay attention to the solutions (i.e., the solution processes), not just the answers Topic Introduction to the Investment Environment Financial Markets, Trading Mechanisms, and IPOs Readings Chapter 1:1.1-1.8 Chapters 2 & 3: 2.1-2.4 & 3.1-3.3, 3.5-3.7 Mutual Funds Chapter 4 (optional) Introduction to Portfolio Selection & Efficient Chapters 5 & 6:5.1-5.5 & 6.1-6.6 Diversification Asset Pricing Models Chapter 7: 7.1-7.3 Arbitrage Pricing Chapter 7: 7.4-7.5 Market Efficiency Chapter 8 Equity Valuation Chapter 13: 13.1-13.5 Options Chapter 15: 15.1-15.2 Note: The above course outline is tentative and may be subject to change as class progresses. 2