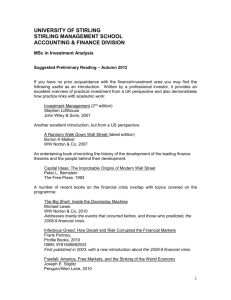

Chapter 12: Risk, Return, and Capital Budgeting

advertisement

Chapter 12 12-1 Fifth Edition Corporate Finance . . Risk, Return, and Capital Budgeting Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Review Item 12-2 Fifth Edition Corporate Finance . . Yahoo is considering building a cafeteria for its employees. At a high discount rate appropriate to Yahoo’s risk, the NPV of the cafeteria is negative. At a low discount rate appropriate to a Wendy’s, the NPV of the cafeteria is positive. Should Yahoo build the cafeteria? Explain briefly. Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Answer 12-3 Fifth Edition Corporate Finance . . Build the cafeteria. The project is safe like a Wendy’s, not risky like an internet service. NPV is market value. The market it not deceived but sees the project for the safe investment that it is. Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Example of beta and NPV 12-4 Fifth Edition Corporate Finance . . Wingmar Inc. has a beta of 2. The Market risk premium is 8.5% The risk-free rate is 4%. Wingmar has a project with cash flows -100, 60, 80. The project is typical of Wingmar’s core business. Should the project be undertaken? Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Answer 12-5 Fifth Edition Corporate Finance . . Part 1. Cost of equity financing. The appropriate discount rate for projects of Wingmar is .04+.085(2)=.21. Part 2. The NPV of the project is 4.2278533. Take the project. Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Chapter 12 Risk, Return, and Capital Budgeting 12-6 Fifth Edition Corporate Finance . . Determinants of the Cost of Equity Capital Estimation of Beta Financial leverage. Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 The Cost of Equity 12-7 Fifth Edition Corporate Finance . . E(rs) = RF + bs x [E(RM) - RF] Business risk 1: Cyclicality of revenues Business risk 2: Operating leverage. Financial Leverage Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Cyclicality 12-8 Fifth Edition Corporate Finance . . Capital goods, consumer durables, construction are cyclical and synchronized with general economic conditions. Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Operating leverage 12-9 Fifth Edition Corporate Finance . . Fixed cost of debt service, leases, employment contracts versus variable costs. High operating leverage means high fixed costs. MRI labs. Low leverage, low fixed cost. Fast food, services. EBIT = earnings before interest and taxes. Assume depreciation = loss of market value. Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Beta Estimation 12-10 Fifth Edition Corporate Finance . . Problems Betas may vary over time. The sample size may be inadequate. Solutions More sophisticated statistical techniques. Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Beta Estimation 12-11 Fifth Edition Corporate Finance . . Problem: Beta for a firm is overly influenced by random factors peculiar to the firm. Solution: Look at average beta estimates of several comparable firms in the industry. Problem: Firms have shouldn’t matter in NPV. financial leverage, which Solution: Adjust as follows. Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Financial leverage means debt 12-12 Fifth Edition Corporate Finance . . Equity beta for the firm’s shares. Debt beta for the firm’s debt. Asset beta for the physical firm. Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 The physical firm (the asset) is a portfolio 12-13 Fifth Edition Corporate Finance . . Ross S = market value of equity (stock) B= “ “ “ debt (bonds) A= “ “ “ asset (firm) Portfolio weights are S XS , SB B XB SB Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Beta of the (physical) firm 12-14 Fifth Edition Corporate Finance . . Beta of a portfolio is the weighted sum of the betas of the components. S B bA bS bB SB SB Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Normally 12-15 Fifth Edition Corporate Finance . . Stock is risky Debt is less risky Asset is in between. Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Weighted Average Cost of Capital 12-16 Fifth Edition Corporate Finance . . S B rW ACC rS (1 TC )rB SB SB Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Chapter 13 Corporate-Financing Decisions and Efficient Capital Markets 12-17 Fifth Edition Corporate Finance . . 13.1 Can Financing Decisions Create Value? 13.2 A Description of Efficient Capital Markets 13.3 The Different Types of Efficiency Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Reaction of Stock Price to New Information in Efficient and Inefficient Markets 12-18 Fifth Edition Corporate Finance Stock Price Overreaction to “good news” with reversion Efficient market response to “good news” -30 . . Ross -20 -10 0 +10 +20 +30 Days before (-) and after (+) announcement Westerfield Jaffe Delayed response to “good news” Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Reaction of Stock Price to New Information in Efficient and Inefficient Markets 12-19 Fifth Edition Stock Price Corporate Finance Overreaction and reversion . . Delayed response Efficient-market response to new information Ross Westerfield Jaffe –30 –20 –10 Irwin/McGraw-Hill 0 +10 +20 +30 Days before (+) and after (-) announcement © The McGraw-Hill Companies, Inc., 1999 Sets of Information relevant to a stock 12-20 Fifth Edition Corporate Finance . . All information Publicly available information Past prices Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Three Forms of Market Efficient Hypothesis 12-21 Fifth Edition Corporate Finance . . Weak Prices reflect information in past prices Random Walk Semi-strong Prices reflect publicly available information Strong Prices reflect all information Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Implications for Corporate Financial Managers 12-22 Fifth Edition Corporate Finance . . Can financial managers “fool” investors? Can financial managers “time” security sales? Are there price pressure effects? Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Some anomalies 12-23 Fifth Edition Corporate Finance . . Monday effects Weekend effects January effects Small firm effects Pre acquisition run-ups Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999 Some explanations 12-24 Fifth Edition Corporate Finance . . Closing positions over the weekend. ditto Tax timing, annual reporting, data mining. Trading with better informed quasi-insiders. Information leaking out bit by bit. Ross Westerfield Jaffe Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999