MCL Module: Accounting and Finance AIMS AND OBJECTIVES

advertisement

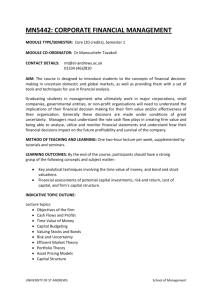

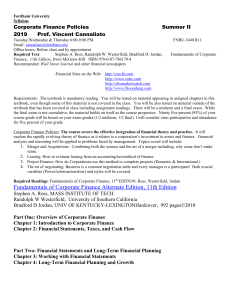

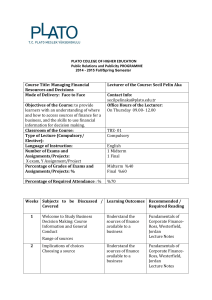

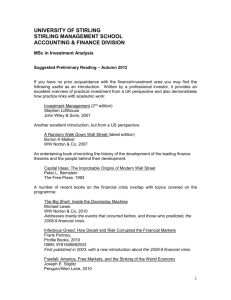

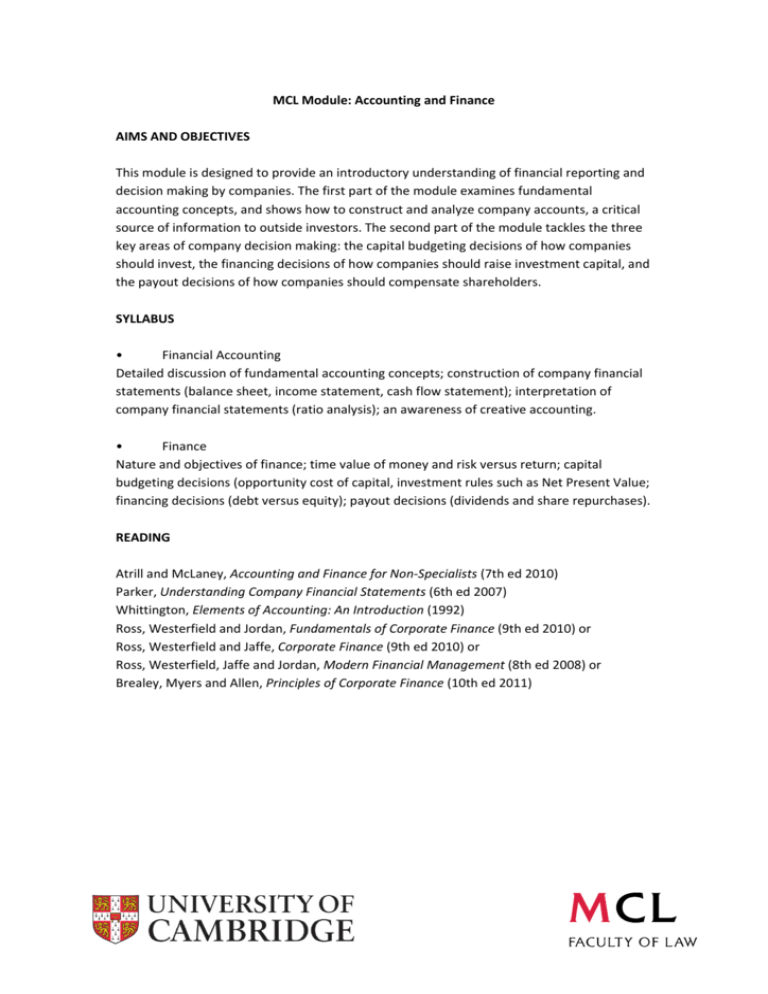

MCL Module: Accounting and Finance AIMS AND OBJECTIVES This module is designed to provide an introductory understanding of financial reporting and decision making by companies. The first part of the module examines fundamental accounting concepts, and shows how to construct and analyze company accounts, a critical source of information to outside investors. The second part of the module tackles the three key areas of company decision making: the capital budgeting decisions of how companies should invest, the financing decisions of how companies should raise investment capital, and the payout decisions of how companies should compensate shareholders. SYLLABUS • Financial Accounting Detailed discussion of fundamental accounting concepts; construction of company financial statements (balance sheet, income statement, cash flow statement); interpretation of company financial statements (ratio analysis); an awareness of creative accounting. • Finance Nature and objectives of finance; time value of money and risk versus return; capital budgeting decisions (opportunity cost of capital, investment rules such as Net Present Value; financing decisions (debt versus equity); payout decisions (dividends and share repurchases). READING Atrill and McLaney, Accounting and Finance for Non‐Specialists (7th ed 2010) Parker, Understanding Company Financial Statements (6th ed 2007) Whittington, Elements of Accounting: An Introduction (1992) Ross, Westerfield and Jordan, Fundamentals of Corporate Finance (9th ed 2010) or Ross, Westerfield and Jaffe, Corporate Finance (9th ed 2010) or Ross, Westerfield, Jaffe and Jordan, Modern Financial Management (8th ed 2008) or Brealey, Myers and Allen, Principles of Corporate Finance (10th ed 2011)