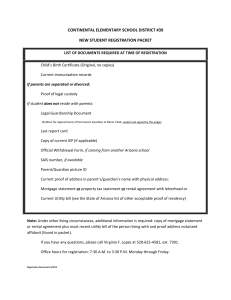

Carl Kinney - National Association of Realtors

advertisement

National Association of Realtors® Regional Housing Opportunity Summit Carl Kinney, Programs Administrator Arizona Housing Finance Authority Median Sale Price of Single Family Homes in Phoenix-Metro Region Since 1990 240,000 Data released by the Arizona Real Estate Center at ASU for July 2005 show a 97% increase in the median resale price of a home since 2000. 225,000 210,000 195,000 165,000 150,000 135,000 120,000 105,000 90,000 75,000 05 Q tr 04 2n d 20 03 20 02 20 01 20 00 20 99 19 98 19 97 19 96 19 95 19 94 19 93 19 92 19 91 19 90 60,000 19 Price 180,000 Year Resale Arizona Real Estate Center – A.S.U. New Source: National Association of Realtors and HUD Homeownership ADOH and the AzHFA provide several different avenues to promote homeownership in the state. •Homes for Arizonans Initiative •New Home Development •Rehabilitation and Emergency Repair Homes for Arizonans • Combines several funding sources including Mortgage Revenue Bond financing (MRB) from the Arizona Housing Finance Authority, funding from the state Housing Trust Fund, and individual federal tax credits from the Mortgage Credit Certificate Program (MCC) to provide: – Mortgage financing (MRB) – Downpayment and closing cost assistance – Federal income tax credits for individuals (MCC) Homes for Arizonans Options Down Payment and Closing Cost Assistance • If buyer is above 80% AMI, must be used in combination with our MRB or MCC • Adjusted assistance depending on buyer’s income – 81% AMI or above up to 5% of purchase price – 60-80% AMI up to 10% of purchase price – below 60% AMI up to 15% of purchase price • Maximum of $20,000 in assistance First Time Homebuyer Assistance in Rural Arizona Downpayment and Closing Cost Assistance • 369 households assisted Low Interest Mortgages (Mortgage Revenue Bond) • First $10 Million issue by Authority is fully reserved • New $15 Million issue made available in September Federal Tax Credits (Mortgage Credit Certificate) • Original $10 Million issue nearing completion • New $15 Million issue available January 2006 Homeownership Development • Maximum of $30,000 per unit • Maximum per project $750,000 • Uses – – – – Infrastructure New Construction Acquisition/Rehab Homebuyer Subsidies Rehabilitation • Maximum of $750,00 per project • After-rehab value limited to FHA 203(b) limits Emergency Repairs • Maximum per unit $10,000 – Minimum $1,000 per unit • Maximum per project $500,000 Homeownership • New Home Development – Constructed 67 new owner-occupied homes in Flagstaff, Cave Creek, San Luis, El Mirage, Pima County/Tucson, Douglas, Yuma, Phoenix , Verde Valley, and Prescott. • Rehabilitation and Emergency Repair – Rehabilitated 231 owner-occupied homes. – Emergency Repair of 516 owner-occupied homes. Rental Housing • ADOH provides several financial tools to non-profit and for-profit housing developers to assist with the development and rehabilitation of affordable rental homes and transitional housing facilities for individuals earning less than 60% of area median income, adjusted for household size. • ADOH also provides financial assistance for the development and rehabilitation of emergency shelters to assist persons who are homeless or otherwise in crisis, including victims of domestic violence. Rental Housing • ADOH allocates Federal Tax Credits – $10.6 Million in 2005 in 9% Credits – Translates into roughly $127 Million in projects • Allocates 4% Credits for Tax Exempt Bond Projects Low Income Housing Tax Credit Development Yavapai Apache Tribe Middle Verde Rental Housing • New Construction – Constructed 2,264 new affordable rental homes • Rehabilitation – Rehabilitated 1,073 existing rental homes • Emergency Shelters – Constructed emergency shelter space for 501 homeless persons and victims of domestic violence Multi-family Mortgage Revenue Bonds • The Arizona Housing Finance Authority has the Bond issuing jurisdiction for the 13 rural Counties • To be a qualified residential rental project: – 20% or more of the units must be occupied by individuals at or below 50% of area median income, or – 40% or more of the units must be occupied by individuals at or below 60% of area median income Long Term Affordability • Units must remain affordable: – 15 years after the project is 50% occupied, or – Until no tax exempt bond issued is outstanding, or – The date when any Section 8 assistance on the project terminates. Additional Assistance • Applicants for multi-family private activity bond cap may be eligible for other funding – 4% Low Income Housing Tax Credits – May apply for AzHFA Gap Financing for rural areas Arizona Housing Finance Authority • Santa Carolina Apartments groundbreaking • 128 units of affordable housing • Nogales, August 2005 Special Needs • Address the housing needs of populations that have needs beyond the mere fact that their incomes may not support decent and affordable housing opportunities. – HIV/AIDS – Serious mental illnesses – Emotional disturbance or chronic substance abuse problems – Persons and families who are homeless – Victims of domestic violence Special Needs • Homeless Prevention – Prevented 3,806 persons from becoming homeless through eviction prevention or foreclosure assistance • Rural Continuum of Care – The Shelter Plus Care and Supportive Housing Programs provided 1,177 households with rental assistance and other related services • HOPWA – 204 households were provided short-term mortgage, rental, and utility assistance as well as support services Community Revitalization • The Community Revitalization Program provides assistance to communities to address housing and community development issues that contribute to the vitality of a community. • ADOH receives Community Development Block Grant (CDBG) entitlement funds annually from the U.S. Department of Housing and Urban Development (HUD) to fund eligible programs and projects in communities located in the 13 rural counties in the state. Community Revitalization • The rural Councils of Government (COGs) partner with ADOH to assist communities with project administration and technical assistance. • CDBG funds may be utilized to address a wide variety of community needs, including: – Affordable housing Infrastructure projects – Community facilities – Expansion of public services to serve low-income persons. – Creation of new jobs Tribal Outreach • Tribal Liaison • Low Income Housing Tax Credit Awards • Governor’s Tribal Housing Initiative – Housing Trust Fund – Task Force – Community Development Financial Institution Rehabilitation White Mountain Apache Tribe Whiteriver Socialserve.com • The Arizona Department of Housing formed a partnership with a national group called Socialserve.com to bring a convenient and timely new tool to the search for affordable housing. The new service allows those seeking affordable apartments to search the department's portfolio of over 30,000 apartments across the state for vacant affordable units. • Information is available in both English and Spanish, by phone, fax or mail. Contact: www.housingaz.com or 1-877-428-8844 Fund Sources • State Housing Trust Fund – 55% of the proceeds of Unclaimed Property • Federal HOME funds • Federal Community Development Block Grant funds (CDBG) • Federal Low Income Housing Tax Credits (LIHTC) Fund Sources (cont’d) • Federal Housing Opportunities for People with HIV/AIDS (HOPWA) • Federal McKinney Vento Homeless Assistance Funds • Federal Private Activity Bonding Authority FY2005 Accomplishments • Developed 2,264 new affordable rental homes • Rehabilitated 1,073 existing rental homes • Developed 67 single-family homes • Rehabilitated 231 owner-occupied homes • Provided emergency repair to 516 owner-occupied homes • Provided 484 households with assistance in purchasing their first home FY2005 Accomplishments • Prevented homelessness by providing rental eviction and mortgage foreclosure prevention assistance to 21 agencies, assisting 3,806 households • Constructed 501 emergency shelter beds for homeless persons and families • Provided one-time assistance to prevent the closure of 284 emergency shelter beds FY2005 Accomplishments A REMI analysis shows that the work of ADOH and its numerous partners equated to over: • 3,057 jobs • $94.2 million in wages and salaries • $24.3 million in state and local taxes • Economic impact of over $350 million to the Arizona economy For additional information contact: Carl Kinney 602-771-1091 carlk@housingaz.com 1700 W. Washington Street, Suite 210 · Phoenix, Arizona · 85007 www.housingaz.com