Financial Investigation Strategy for the Period from 2015 through 2016

advertisement

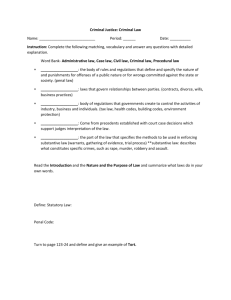

Proposal Pursuant to Article 45, Paragraph 1 of the Law on Government (“Official Gazette of the Republic of Serbia”, No. 55/05, 71/05 – correction, 101/07, 65/08, 16/11, 68/12 – CC, 72/12, 7/14 – CC and 44/14), the Government adopts the following: Financial Investigation Strategy for the Period from 2015 through 2016 Financial investigations are one of the Republic of Serbia’s priorities relating to combating corruption, money laundering and financial crimes. Adoption of a mid-term strategy to improve financial investigations overall, means achieving one of the objectives anticipated in the National Anti-Corruption Strategy for the period 2013-2018. The Republic of Serbia needs an efficient and proactive tool to investigate and prosecute financial crimes because gaining assets is the underlying reason for and motivation behind most such criminal offenses. Forfeiture of assets that have resulted from a criminal offense supports the rule of law and the moral principle that no one can benefit from a criminal offense. The police and prosecution authorities in Serbia have had some success in this area, but their results need to be improved. A financial investigation, according to the Criminal Procedure Code (“Official Gazette of the Republic of Serbia”, No. 72/11, 101/11, 121/12, 32/13, 45/13 and 55/14) is somewhat narrower than what has been defined by the comparative legal theory which includes in a financial investigation money flow investigations which are carried out in parallel with criminal investigations, with the objective to discover assets gained by a criminal offense, identify assets which can be seized and temporarily secure property to enable its subsequent confiscation. Also, The Criminal Procedure Code prescribes special evidentiary actions which help tracing the assets gained by a criminal offense. The term “financial investigation” within the meaning of the Strategy has been made consistent with Recommendation No. 30 provided by the Financial Action Task Force (hereinafter: the FATF); it implies an enquiry into the financial affairs related to a criminal activity with a view to: identifying the extent of criminal networks, that is, the scale of criminality, identifying and tracing the proceeds of crime, terrorist funds or any other assets that are, or may become, subject to confiscation; and developing evidence which can be used in criminal proceedings The main objective of a financial investigation is to identify and document money flow during criminal activities, that is, to discover where the money comes from (origin), how it is transformed, used and where it flows. The connection between the origin of money, beneficiaries, the moment when the money is received and the place where it is deposited can provide information about criminal activities and evidence about the committed criminal offense. In its efforts to combat economic crimes, Serbia has to date undertaken certain measures: trainings on integrated financial investigations have been conducted, the Law on Seizure and Confiscation of Proceeds of Crime has been adopted; the Directorate for Management of Seized and Confiscated Assets has been formed; a special financial intelligence unit has been formed within the Ministry of the Interior; special anti-corruption departments have been formed within the Republic Public Prosecutor’s Office and Appellate and High Public Prosecutor’s Offices; the Law on Criminal Liability of Legal Entities has been adopted, as well as the Law on International Legal Aid on Criminal Matters, but with insufficient effects and outcome, or rather, cases disposed. Studies carried out in the previous period identified the following weaknesses in the Serbian system of financial investigations: A financial investigation is mostly initiated after the criminal charges have been filed; Any delay of a financial investigation increases the risk that the assets will be taken out of the country; Obsolete models of communication between public prosecutors and the police; Lack of cooperation between institutions with information relevant for financial investigations and the police and public prosecutors; Lack of specialized trainings of police officers and judicial officers; Lack of forensic accountants as a special category of experts; Lack of a proactive approach on the part of the police and public prosecutors; The Financial Investigation Strategy represents a document that comprehensively addresses the problem of financial crime, rather than leaving everything to the law enforcement and prosecution authorities; it implies connections between a wide circle of government authorities, that cooperate and exchange information received and processed by specialized police departments and public prosecutors’ offices and efficiently and proactively identify and prosecute financial criminal offenders, which is an approach used for the first time in the Republic of Serbia. The strategy is a short-term projection for the period 2015-2016. Three sections comprise the strategy document: the introduction which defines the general goal of the Strategy and lists relevant international instruments and forms of international cooperation; its central section which presents the reform of systems responsible for financial investigations; and its third section which describes implementation and oversight over the implementation of the Strategy. 1 I Introduction 1. General Goal The general goal of the Strategy is to enable efficient and effective financial investigations so as to keep track of money flows and assets and have proactive identification of criminal offenses; the efficient cooperation of relevant agencies responsible for collecting data and conducting financial investigations; advanced trainings of judicial officers and civil servants who handle financial investigations; and prevent shifting of unlawfully gained funds into lawful business flows. The purpose of the Strategy is to enable strategic planning and managing the reform of systems responsible for financial investigations. The Financial Investigations Strategy anticipates a proactive and continuous fight against systemic corruption, white-collar crime and financial crime, money laundering and the financing of terrorism which have a serious impact on the political and economic stability of the country, national security, democracy and the rule of law. The Republic of Serbia’s Government, by adopting this Strategy, has decided to improve the system of financial investigations with the aim to protect society from crime and its consequences, through improved cooperation of relevant agencies, by introducing new profiles of experts and by continuous training of all participants in criminal proceedings; in particular government authorities that work closely with law enforcement and prosecution authorities and that handle information important for financial investigations on a daily basis. The final outcome of the Strategy is a modern system of financial investigations as part of a developed and efficient judiciary which successfully responds to crime and undertakes proactive investigations of financial crimes, that is, economic crime. Introduction of a modern system of financial investigations will increase citizens’ trust in the police (executive power) and the judiciary because of efficient prosecution and adjudication and confiscation of assets resulting from criminal offenses; a clear message that crime doesn’t pay. Efficiently gathered, usable evidence by the police for the public prosecutors should result in relatively quick convictions in criminal proceedings. 2. International Instruments International conventions like: The United Nations Convention Against Illicit Traffic in Narcotic Drugs and Psychotropic Substances (“Official Gazette of the SFRY – International Treaties”, No. 14/90); The Council of Europe Convention on Laundering, Search, Seizure and 2 Confiscation of the Proceeds of Crime (“Official Gazette of the SRY”, No. 7/02 – International Treaties); The Criminal Law Convention on Corruption (“Official Gazette of the RoS”, No. 2/02-International Treaties and “Official Gazette of the Serbia and Montenegro State Union” No. 18/05 - International Treaties); The UN Convention against Transnational Organized Crime (“Official Gazette of the SRY” No. 6/01-International Treaties); The UN Convention against Corruption (“Official Gazette of the SMN”, No. 12/05 International Treaties); The Convention on Laundering, Search, Seizure and Confiscation of Proceeds of Crime and on the Financing of Terrorism (“Official Gazette of the RoS”, No. 19/09- International Treaties), anticipate or demand legal mechanisms or financial investigative actions to be in place in order to make gathering evidence easier. The Council of Europe in its Recommendation on Simultaneous Investigations, dated April 25, 2002, has recognized the necessity to improve investigative measures aimed at combating organized crime, the need to have simultaneous investigations of drug trafficking by criminal organizations and their finances and identify the assets of criminal organizations. The framework decision, EU 2007/845/JNA, regulates the cooperation of financial institutions responsible for this area, that is, Asset Recovery Offices – AROs. According to the decision, each of the member countries needs to establish a financial intelligence unit, that is, asset recovery offices which would be responsible for simplifying, tracing and identifying assets that have resulted from a criminal offense or other unlawful actions which could be subject to court measures to secure them, and subject them to seizure and confiscation within criminal or civil proceedings in line with the national law of the member country. In its latest recommendations FATF strongly recommends conducting proactive parallel investigations of money laundering, predicate offenses and the financing of terrorism, including criminal offenses committed in other countries. Relevant agencies are asked to quickly identify, trace and initiate freezing and confiscation of assets that have resulted from a criminal offense. A set of 40 new, revised FATF recommendations expands the authority of law enforcement agencies and investigation authorities – the list of special investigative techniques has been expanded to include – controlled delivery, undercover investigations and communication interception accessing computer systems. The use of multidisciplinary investigation groups is recommended as well as investigations in cooperation with other countries. The European acquis in the area of criminal law is based on the principle of mutual recognition of judgments, and considering that the criminal law of the European Union is mostly developed to protect financial interests, a significant number of decisions and directives have been passed to date, as follows: Framework Decision 2005/212/JHA on Confiscation of Crime-Related Proceeds Instrumentalities and Property; Framework Decision 2003/577/ЈHА on the Execution in the European Union of Orders Freezing Property or Evidence; Framework Decision 2006/783/ЈHА on the Application of the Principle of Mutual Recognition to Confiscation Orders; Framework Decision 2001/500/ЈHА on Money Laundering, the Identification, Tracing, Freezing, Seizure and Confiscation of Instrumentalities and Proceeds of Crime; Framework Decision 2005/214/ЈHА оn the Application of the Principle of Mutual Recognition of Financial Penalties; and Framework Decision 2014/42/ЕУ оn the Freezing and Confiscation of Instrumentalities and Proceeds of Crime in the European Union. In the process of harmonization 3 of the Republic of Serbia law with the EU acquis, all relevant instruments will become part of the Serbian legal system. 3. International Cooperation a) INTERPOL Interpol is the International Criminal Police Organization, which included the Republic of Serbia in its membership in 2011. Interpol’s mission is to enable police cooperation at the international level and to support all organizations, bodies and agencies aiming at preventing and combating crime at the international level. In its resolutions (AGN/52/RES/8, of 1983; AGN/57/ RES/8, of 1988; AGN/66/RES/17, of 1997, Interpol called on all member countries to focus their investigations on identification, tracing and recovering unlawfully gained assets of criminal organizations. Those resolutions also call on their members to improve the exchange of information in that area and instruct its country members’ governments to adopt laws that will enable access to financial records and confiscation of proceeds of crime. As part of the efforts of the international police community to fight against organized crime a special branch within the police department of Interpol’s General Secretariat, called FOPAC, was established by the General Assembly of Interpol in 1983. The General Secretariat of Interpol and FOPAC, as its special branch, closely cooperate with other international organizations with the aim to build awareness about the need to use financial investigative techniques in the fight against organized and other forms of crime. b) EUROPOL Europol is the law enforcement and criminal intelligence agency of the European Union which became fully operational in 1992. Although Serbia is not an EU member it became member of a consolidated information system used by Europol in April 2012 after having signed a Strategic Cooperation Agreement. The main objective of Europol is to establish close cooperation of member countries and thus enable them to jointly combat organized crime, and in particular drug trafficking, human trafficking, child pornography, money counterfeiting and sale of radioactive and nuclear substances. c) Financial Action Task Force - FATF FATF was established during the G-7 Summit in Paris in 1989 as a coordinated international response to money laundering stemming from drug trafficking at the international level. The FATF is an inter-governmental body which sets standards, develops and promotes policy for combating money laundering and the financing of terrorism. Based on the efforts of the Financial Action Task Force in April 1990, the first forty recommendations were adopted as a framework for combating money laundering and recovery of assets that have resulted from crime at the national and international levels. The forty recommendations comprise a flexible 4 framework which enables countries interested in its implementation to accommodate it to their economic, social and political circumstances. The forty recommendations have been amended and supplemented several times, and most recently in 2012. d) Committee of Experts on the Evaluation of Anti-Money Laundering Measures and the Financing of Terrorism (MONEYVAL) MONEYVAL was established in 1987 with the aim to introduce efficient systems to counter money laundering and the financing of terrorism in the member countries. MONEYVAL evaluates whether its member countries adhere to appropriate standards concerning combating money laundering and the financing of terrorism. The Republic of Serbia is a member of this committee of the Council of Europe. Activities of this committee of the Council of Europe concern evaluation whether its members adhere to appropriate standards relating to combating money laundering, recovery of assets gained by crime and the financing of terrorism. e) Egmont Group The basic goal of this group is to provide a forum for financial intelligence units in order to improve the cooperation in the fight against money laundering and the financing of terrorism and communication between different countries. The forms of cooperation include: proliferation of systems for the exchange of financial intelligence information; training of personnel employed by those organizations; and enabling better cooperation between FIUs by applying new technological solutions. f) Group of States against Corruption - GREKO GREKO is a committee of the Council of Europe established with the aim to build capacities of its members to combat corruption by monitoring whether the countries adhere to their obligations concerning this area. The process of anti-corruption capacity building is a flexible and efficient evaluation system of anti-corruption measures. Groups of experts handle evaluation, and based on the obtained results, propose concrete measures (legal, organizational and educational measures) of improvement of the anti-corruption system. The second round of evaluation which pertains to proceeds of corruption is particularly important for financial investigations. The Republic of Serbia is a member of this committee of the Council of Europe. GREKO is, in particular, responsible to monitor whether the member countries adhere to the adopted anti-corruption principles and whether to implement measures anticipated by the Council of Europe’s legal instruments as follows: the Criminal Law Convention on Corruption; the Civil Law Convention on Corruption (“Official Gazette of the RoS” No. 102/07 – International Treaties); and Recommendation (R 10) on the Rules of Conduct for Civil Servants, adopted in 2000. 5 The Republic of Serbia has been included in cooperation with the above mentioned international institutions and bodies, both in the area of cooperation and improvement and harmonization of the legal and institutional framework. The Republic of Serbia will continue to improve its international and regional cooperation and harmonize its regulations with recommendations and standards of international institutions and bodies in the future. II REFORM OF SYSTEMS RESPONSIBLE FOR FINANCIAL INVESTIGATIONS The Strategy includes three basic sections with 12 objectives. Each objective is further broken down into measures which need to be taken in order for the Republic of Serbia to establish an efficient system of financial criminal investigations. Training is a separate pillar which cuts across the entire Strategy, its objectives and measures, and all three of its pillars. Financial Crimes Investigation Strategy TRAINING EFFECTIVE JUDICIARY AND PROCECUTION AUTHORITIES • Established efficient organization of public prosecutor's offices and courts •Capacities of judicial officers to handle financial investigations built •Trained judicial officers in the area of financial investigations • Established efficient organizations within the Ministry of the Interior •Trained police officers ESTABLISHED IMPROVED COOPERATION • Established efficient horizontal and vertical cooperation of the police, public prosecutors and courts and other government agencies and institutions, regulatory and oversight bodies through liaison officers •Established improved cooperation by means of task forces • Established improved international cooperation • Training on how to improve cooperation FORENSIC ACCOUNTING • Formation of forensic accounting offices within public prosecutor's offices • Providing forensic accounting offices within public prosecutor's offices with human , material and technical resources • Trained public prosecutors in forensic accounting 6 – Public Prosecutor’s Offices Criminal Police – Left: Business Registers Agency, Central Securities Depository, Privatization Agency, State Audit Institution, Center: Administration for the Prevention of Money Laundering, Tax Administration, Tax Police, Customs Administration, National Bank of Serbia Right: Cadastre, Anti-Corruption Agency, Pension Fund, Property Directorate 1. Effective Judiciary and Prosecution Authorities Description of the Situation The Prosecutor’s Office for Organized Crime has been active since 2003. The authority and activities of the Prosecutor’s Office for Organized Crime in Serbia have been regulated by the Law on the Organization and Competences of the State Organs in Combating Organized Crime, Corruption and Aggravated Offences (“Official Gazette of the RoS”, No. 42/02, 27/03, 39/03, 67/03, 29/04, 58/04, 45/05, 61/05, 72/09, 72/11, 101/11 and 32/13 and the Law on Public Prosecution (“Official Gazette of the RoS”, No. 116/08, 104/09, 101/10, 78/11, 101/11, 38/2012, CC, 121/12, 101/13, 111/14 – CC and 117/14. 7 In addition to forming the Prosecutor’s Office for Organized Crime, public prosecution specialized in prosecution of corruption, and in 2008 the Anti-Corruption Department was formed in the Republic Public Prosecutor’s Office; and anti-corruption and money laundering departments were established in other public prosecutor’s offices of general jurisdiction in 2010 (in the Appellate and the Higher Public Prosecutor’s Offices). The Prosecutor’s Office for Organized Crime files charges with the Special Department of the Higher Court in Belgrade while all other public prosecutor’s offices file charges with higher courts, that is, prosecute offenses that fall under their jurisdiction in line with law that regulates territorial organization of courts and public prosecutor’s offices. The Counter-Organized Crime Service (COCS), the Criminal Police Administrations (CPA) and the Criminal Police Department (CPA) handle the most difficult cases of financial crimes, crimes against duty and criminal offenses with elements of corruption; they do so in cooperation with regional police stations, and such form of assistance is coordinated by the relevant regional police administrations. The Financial Intelligence Unit is an integral part of the Counter-Organized Crime Service and the unit itself is comprised of the Department of Financial Investigations of Organized Crime and the Department of Planning and Coordination of Financial Investigations. In order to have efficient financial investigations, capacity building of public prosecutors needs to be followed by efforts to increase the resources of the Financial Intelligence Unit. Given the complex internal structure of the police, horizontal and vertical coordination of relevant organizational units is a challenge. Coordination of the police and public prosecutors towards efficient identification and prosecution of offenders who committed this type of offenses is yet another challenge. The above described organizational structure of the police and the public prosecutor’s offices yields partially successful results in practice. In order to achieve full efficiency, the legal and institutional framework of the judiciary and prosecution authorities needs to be improved, as well as the capacity and skills of public prosecutors and deputy public prosecutors (hereinafter: public prosecutors) and police officers. The prosecutor’s offices see financial investigations solely as a mechanism for asset recovery or asset confiscation which is a quite narrow understanding of them. According to the Screening Report for Chapter 23: “Serbia needs to implement recommendations of the FATF – Financial Action Task Force with special emphasis on capacity building for the implementation of complex financial investigations in parallel with criminal investigations, through specialized units within the police (both on the central and local levels), employing and training experts and introduction of modern investigative techniques“. The legal framework is wide enough to enable parallel financial investigations from the moment when suspicion arises that a criminal offense that has resulted in proceeds has been committed. Also, in the course of a financial investigation when assets are compared to legal sources of income, assets in Serbia, or neighboring countries, are taken into consideration while financial flows and taking those assets outside of the country are not. 8 Law enforcement authorities’ and judicial officers’ current understanding of financial investigations need to change and be consistent with the definition of this term provided in the Strategy. Advanced tools anticipated in this Strategy and trainings organized in the Judicial Academy or the Academy of Criminalistic and Police Studies can be used to change their understanding of the term “financial investigation” and make them be more proactive in their work. All the advanced tools and techniques that can be used to combat financial crime, a new internal structure of the police, public prosecutor’s offices, the courts, the manner of cooperation of the police and prosecutors, the Tax Administration, the Administration for Prevention of Money Laundering and the Financing of Terrorism and other government authorities, as well as forensic accounting, must be regulated by a new law on the organization and the authority of government bodies in combating organized crime, corruption and other particularly grave criminal offences. Such a law will provide regulatory solutions to all matters of organizational character necessary for an efficient fight against organized crime, financial crime, economic crime, crimes against duty and corruption. As the process of adoption of the new law on organization and authority of government bodies combating organized crime, corruption and other particularly grave criminal offences moves on, it is necessary to re-examine the real authority of the Public Prosecutor’s Office for Organized Crime and make it consistent with the Strategy in order to make it stronger. In order to improve the quality of actions of the judiciary and prosecution authorities, and increase the capacity of public prosecutor’s offices and concentrate in them the knowledge and the best human and material resources, a department should be formed within the Higher Prosecutor’s Offices in Belgrade, Novi Sad, Kragujevac and Nis to prosecute only for those criminal offences which include forms of financial crimes. Hence, the Public Prosecutor’s Office for Organized Crime would still handle the most serious forms of financial crimes, while the said, Higher Prosecutor’s Offices would prosecute those forms of financial crimes which do not fall under the jurisdiction of the Public Prosecutor’s Office for Organized Crime. This would allow us to have a central office to handle the most serious forms of financial crimes for the entire Republic of Serbia – that would be the Public Prosecutor’s Office for Organized Crime, while the Higher Prosecutor’s Office in Belgrade, Novi Sad, Kragujevac and Niš would be regional centers that prosecute less serious forms of financial crimes. The said special departments would bring cases before special units of the Higher Courts in Belgrade, Novi Sad, Kragujevac and Nis just like the Public Prosecutor’s Office for Organized Crime brings cases before the Special Unit of the Belgrade Higher Court. The authority to prosecute financial crimes, crimes against economy and crimes against duty being divided between the Basic and Higher Prosecutor’s Offices is an issue. The jurisdiction of the Basic or Higher Prosecutor’s Offices, or the Basic and Higher Courts is determined based on the prison sentence prescribed for a particular criminal offence. 9 The situation is that the largest number of criminal offences falls under the jurisdiction of the basic courts, or the basic prosecutor’s offices. Such an approach does not allow us to concentrate knowledge and the best possible human and material resources in one place and act proactively. For that reason, a nomenclature of criminal offences against economy and criminal offences against duty needs to be created where all criminal offenses which are considered financial crimes and corruption will be visibly marked. A new law on the organization and authority of government bodies in combating organized crime, corruption and other particularly grave criminal offences would specify criminal offences included in the nomenclature that fall under the jurisdiction of the higher prosecutor’s offices or the higher courts and which would be handled by special departments in the higher public prosecutor’s offices and courts in Belgrade, Novi Sad, Kragujevac and Niš. Tax criminal offences and other less serious criminal offences against the economy must remain under the jurisdiction of basic public prosecutor’s offices and courts. The basic public prosecutor’s offices and courts will not have special departments to handle tax and other less serious criminal offences against economy but the tools and techniques provided in this Strategy will be available to them for the stated criminal offences. The existing anti-corruption departments in appellate public prosecutor’s offices will be reinforced and will be coordinators of all efforts of the basic and higher public prosecutor’s offices within their territorial jurisdiction in combating financial crimes. Public prosecutors from newly formed departments would work directly with specially selected and trained police officers. Financial investigations must be conducted simultaneously and the most important pieces of evidence connected to those investigations must be gathered at the same time as evidence for thepredicate criminal offense. Financial investigations should both assist in resolving the case and defining and identifying the flow of money and assets. For that reason, police units in Belgrade, Novi Sad, Kragujevac and Niš need to be formed to be compatible with special departments within public prosecutor’s offices. Therefore, the model established by the Public Prosecutor’s Office for Organized Crime and SBPOK would be followed. Establishment of a regional center within the law enforcement authorities, that would be compatible with the prosecutors’ regional center to handle this type of crimes, is anticipated. In order for that to happen, working conditions and resources (infrastructure, administrative support) for the public prosecutors in the special departments of the higher public prosecutor’s offices in Belgrade, Novi Sad, Kragujevac and Niš will need to be assessed in light of the new requirements of financial investigations. The assessment will show in which cases the space in buildings jointly used by various judicial authorities will need to be reorganized so that public prosecutors can have adequate infrastructure. It should also answer the question relating to administrative support that each public prosecutor needs to efficiently prosecute financial crime offenders. Objectives 10 1.1. 1.2. 1.3. 1.4. 1.5. Established efficient organization of public prosecutor’s offices and courts Strengthened capacities of judicial officers concerning financial investigations Completed training of judicial officers in the area of financial investigations Established efficient organizations within the Ministry of the Interior Completed training of police officers 2. Improved Cooperation a) Description of the Situation 1) Cooperation at the National Level The police and the public prosecutor’s offices play a key role in detection of financial crimes. However, a large number of other government authorities come into contact with facts relevant to financial investigations. Lack of cooperation and exchange of information between the police and the public prosecutor’s offices, on the one hand, and with government authorities that may possess information important for the investigation, on the other, impact the success of detection and prosecution of financial criminal offenses. The cooperation between the law enforcement authorities, public prosecutor’s offices and other government authorities, in its current form, is slow and inefficient. An obvious example for this is exchange of information. The police and public prosecutor’s offices need to wait for feedback from other government authorities for long periods of time, and once such information is received it is often poorly processed and tardy, and cannot be used in a financial investigation. Also, on the front end, requests for information filed by the police and prosecutors are often of poor quality in terms of the content. Requests for information filed by the police or public prosecutors must be clear and specific in order for them to receive a quick and specific answer. There is no two way communication between the police, public prosecutors and other government authorities. It rarely happens that the Customs Administration or some other government authority seeks to consult with the public prosecutor’s office or the police when they come across facts that may be relevant for future identification of a financial criminal offence in their daily activities. Everything stated above clearly shows that a proactive approach to financial investigations by the police or public prosecutors or other government authorities is not possible because of the lack of cooperation between them. 11 In order to remove the identified shortcomings, every authority which comes across facts connected to financial crimes, which may be used as evidence in criminal proceedings or lead to evidence, while performing activities within its purview, needs to appoint a liaison officer for contact with the prosecutor’s office and the police. Government authorities that need a liaison officer are as follows: the Administration for the Prevention of Money Laundering, the Tax Administration, the Tax Police, the Customs Administration, the National Bank of Serbia, the Business Registers Agency, the Central Securities Depository, the Privatization Agency, the State Audit Institution, the Cadastre, the Аnti-Corruption Agency, the Pension Fund, the Property Directorate, databases of different ministries, etc. Liaison officers will effectively transfer knowledge and skills of officers working with different authorities. Liaison officers share their knowledge, skills, experience and expertise by taking part directly in the activities of the government authority in which they have been embedded. A liaison officer bridges the gap between the government authority which embedded him/her and the authority in which he/she was embedded. A liaison officer enables authorities to recognize additional ways of cooperation and enables faster exchange of information. Civil servants, designated liaison officers, will have to go through specialized training. Liaison officers will have to become familiar with the purview of the authority assigned to them and the way it operates. Liaison officers of the Tax Administration, the Customs Administration, the Administration for the Prevention of Money Laundering and the Financing of Terrorism, must be continuously embedded in the public prosecutor’s office. Liaison officers don’t have to be exclusively sent to public prosecutor’s offices and the police. It may be the other way around; some police officers may be embedded in some other government authorities. Also, as needed, other government authorities may embed their liaison officers which are not with the police or the public prosecutor’s office. The most complex cases of financial crime require the highest degree of cooperation of government authorities with the police and the prosecutor’s office so as to efficiently manage the investigation and criminal prosecution. If there is a rather complex case which requires the permanent presence of officers of different authorities and a multidisciplinary approach the prosecutor should form an ad hoc task force to handle such a case. There should be a method, designed and adopted, to form such task forces. A task force is led by a public prosecutor and comprised of police officers and officers of other government authorities, depending on the case. The capacities of public prosecutor’s offices need to be reinforced in order for them to be able to manage task forces. Public prosecutors engaged in special departments will have to go through specialized trainings to learn how to manage task forces. A task force is not a tool for daily use; it should be used exclusively for the most difficult criminal cases. Each task force is formed to meet a special objective and its success and results will mostly depend on the skills 12 of the lead person in the task force and his/her ability to manage the group and provide guidance to its members. Inter-agency cooperation must be approached strategically considering that the objective of ad hoc task forces is to enable the exchange of information and skills to support the work in progress in a specific case. International Cooperation Eurojust (the European Union’s Judicial Cooperation Unit) has been established to enable efficient detection and prosecution of organized crime offenders whose criminal activities stretch beyond borders of all of the EU member countries. Eurojust’s basic objectives are: encouraging and improving the cooperation of member countries in the field of investigation and criminal prosecution, improving the cooperation of governments of EU member countries in the field of mutual legal assistance and execution of orders for extradition, efficient investigation and proceedings. In terms of cooperation with Eurojust, Serbia needs to meet a set of conditions, primarily concerning personal data protection, before it can conclude an agreement on cooperation. As regards joint investigation teams, Serbia is a member of the Police Cooperation Convention in South East Europe, which has embraced EU principles. That said, Serbia should rely more on its joint investigation teams formed with other countries of the West Balkans. Joint investigation teams are a useful tool of cooperation with EU member countries. The Framework Decision on simplifying the Exchange of Information and Intelligence between Law Enforcement Authorities of the Member States of the EU - 2006/960/JHA, is crucial for cooperation with EU member states. Pursuant to the EU Framework Decision, a joint investigation team (JIT) is an investigation team formed, based on the agreement between relevant authorities of two or more EU member countries, made with a specific objective and a limited time period for criminal investigation. A joint investigation team is usually formed to investigate the most serious criminal offenses, such as terrorism, trafficking in human beings, drug trafficking, etc. However, the EU recommends using them for criminal offenses which are considered less serious. Objectives 2.1. Established efficient horizontal and vertical cooperation between the police, the public prosecutor’s offices, courts and other government authorities and institutions, regulatory and oversight bodies through liaison officers 13 2.2. Established improved cooperation through task forces 2.3. Established improved international cooperation 2.4. Completed training on established improved cooperation 3. Introducing Forensic Accounting a) Description of the Situation Financial crime is manifested as incorrect financial reporting of companies, stock exchange manipulations with securities and goods, offering bribes to persons responsible to manage public assets with the intention to obtain more favorable contracts, incorrect tax reporting, embezzlements, delivery of counterfeit products, tax evasion, abuses in connection with bankruptcy, abuses of public procurement, privatization, creating secret funds and the financing of terrorism. The above mentioned economic transactions are complicated; therefore public prosecutors’ knowledge and skills do not enable efficient criminal prosecution. For this reason prosecutor’s offices need forensic accountants. Forensic accounting is a multidisciplinary area which combines knowledge of finances, accounting, audit, banking and exchange operations, information systems, and knowledge of the legal framework, the criminal procedure code, the procedures of government institutions, investigation techniques and other financial skills, all that in order to clarify facts and economic transactions for the purpose of criminal proceedings. A forensic accountant should be able to identify criminal activity from the financial standpoint, but he should also be familiar with investigation and evidentiary techniques. Similarly, a forensic accountant must know how to present findings, both orally and in writing, and to have a so-called research mentality. For everything mentioned above, forensic accountants need to assist public prosecutors in finding answers that they cannot provide because of the complexity of the case such as: providing a description or definition of what happened, detecting and identifying the offender, detecting where and when the offense was committed, the scope of damage and providing a description of how the offense was committed. It is clear that answers to those questions can be provided in the criminal proceedings, but the police and the prosecutor’s office cannot act because of a lack of economic knowledge. This is where a forensic accountant is needed to find traces and assist the public prosecutor and the police with their financial investigation and gather as much evidence as possible for the charges. In order to introduce forensic accounting in the public prosecutor’s offices it is necessary to identify several persons with relevant knowledge and skills, willing to handle forensic accounting, primarily as civil servants, in the public prosecutor’s offices. This requires predefined selection criteria, namely, forensic accountants must have previous experience in 14 accounting and/or audit and as part of their preparations for the work in the public prosecutor’s offices they will need to go through specialized training and be certified abroad. After having completed the training they will be obliged to work as civil servants for a certain number of years, which will prevent newly trained experts from leaving. The introduction of forensic accounting is the most complex and most costly element of the Strategy. The Prosecutor’s Office for Organized Crime should have at least two forensic accountants, while departments in the four higher prosecutor’s offices should have minimum of one forensic accountant. b) Objectives 3.1. A forensic accounting service established in the public prosecutor’s offices 3.2. Forensic accounting services in the public prosecutor’s offices provided with human and technical resources 3.3. Basic training of public prosecutors on forensic accounting completed 4. Trainings The challenges of financial crime prosecution stem from its complex phenomena, offenders who pay financial experts to help them create complex transactions and cover the traces of criminal offenses and form secret funds and launder money. Opposite to financial crime offenders are judges and public prosecutors with their law degrees which do not imply knowledge about detection and prosecution methods appropriate for such serious forms of crime. During the last decade in Serbia, a large number of trainings have been organized with the aim to improve the fight against financial crimes. Though quite useful for judicial officers, they failed to meet their basic goal – to leave judicial officers with complete knowledge about this area. The goal hasn’t been met because the trainings were mostly organized ad hoc, for different groups of judges and public prosecutors, without any previous training needs assessment and without any comprehensive training plans prepared ahead of time. In other words, there has been no comprehensive approach in that activity. The Financial Investigations Strategy reflects a comprehensive approach to combating financial crime. Such a comprehensive approach is also needed when it comes to training. All public prosecutors and judges who decide cases included in the nomenclature must go through the complete training anticipated in the future training program of the Judicial Academy. The training program will be based on the previously prepared training needs assessment. The Judicial Academy will be responsible to train public prosecutors and judges from special departments to work on this type of cases. The training for police officers will be prepared and organized in cooperation with the Academy for Criminalistic and Police Studies and the Judicial 15 Academy. Additionally, liaison officers and public prosecutors will need to attend the training on how to manage task forces. 5. Recommendations for Improvement of Financial Investigations In addition to the objectives defined in the Strategy, the attainment of which implies certain obligations, the Strategy specifies some optional recommendations relating to government authorities, the public prosecutor’s offices, to be specific. The purpose of those recommendations is to encourage proactive thinking of government authorities: • Use of Publicly Available Information – It has been recommended to public prosecutors that they use publicly available information. The main sources of such information are the Internet and the mass media. • Use of Databases for Assessment Purposes – Publicly available national and international databases are a significant source of information. They include information from public registers (e.g., registers of companies, tax payers, the statistics office), and can be used as a tool for data analysis. The advantage of those databases is their accessibility. III IMPLEMENTATION AND OVERSIGHT OVER THE STRATEGIC IMPLEMENTATION 1. Strategic Implementation The Strategy will include an Action Plan to shows precisely how the strategic goals will be implemented through concrete measures. The Action Plan includes time limits for the implementation of measures and who will be responsible to implement them. The form of the Action Plan allows measuring progress of the implementation of the Strategy because it includes indicators of success of the measures established and the status of activities, which will make reporting easier. The plan includes estimates of resources needed for the implementation of each measure. The plan also includes sources of finance. 1.1. Oversight over the Implementation of the Strategy and the Action Plan 16 Responsibility for the implementation of objectives and measures defined in the Strategy and the Action plan will be entrusted to the Coordination Body for the Implementation of the Strategy, comprised of four members, heads of the institutions that are crucial for the improvement of financial investigations: the Ministry of Justice, the Ministry of the Interior, the Republic Public Prosecutor’s Office and the Supreme Court of Cassation. Members of the Coordination Body are the Justice Minister, the Minister of the Interior, the Republic Public Prosecutor and the Chief Justice of the Supreme Court of Cassation, as well as their substitutes as proposed by those members. The Ministry of Justice provides administrative, expert and technical assistance to the Coordination Body. 1.2. Reporting on Implementation The Coordination Body reports to the Government every three months. At the end of every calendar year it reports to the National Parliament of the Republic of Serbia about the implementation of the Strategy. The National Parliament reviews the report of the Coordination Body and the report of the relevant parliamentary committee with proposed conclusions and recommendations and passes a decision about the proposal with measures for improvement in this area. IV ACTION PLAN The Action Plan is printed together with the Strategy and represents an integral part of it. V FINAL SECTION This Strategy shall be published in the “Official Gazette of the Republic of Serbia”. 17