7 Uncle Sam Takes a Bite

advertisement

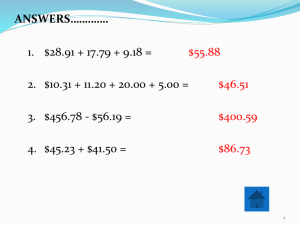

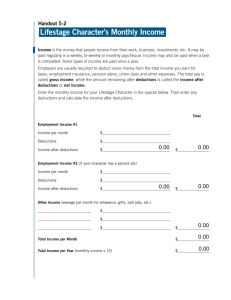

Uncle Sam Takes a Bite – 1 It's exciting to receive your first paycheck. But for many young people, that first rush of excitement soon yields to disappointment. They quickly realize the money they earned is not the same as the money they received. Uncle Sam and a lot of others have taken a bite out of that paycheck. GROSS PAY Gross pay is the total amount of money a worker earns before any deductions are made. For example, many employees are paid at an hourly rate. In the case of an hourly employee, the record of hours worked in a week is multiplied by the employee's hourly rate of pay. This results in the employee's weekly gross pay. Gross means large, thick, or whole originally. 40 hours x $10 an hour = $400 a week Gross pay = $400 a week Similar calculations are made to determine the gross pay of employees who receive a bi-weekly (every two weeks), monthly, or an annual (every year) salary. NET PAY The amount left after all deductions are taken out of the gross pay is the net pay. This is the actual amount of an employee's paycheck. Net pay is often called take-home pay because it is the amount of money an employee actually receives on payday. You can remember the difference by thinking of a net: What you catch in it is what you keep. Gross pay – Deductions = Net pay REQUIRED (MANDATORY) DEDUCTIONS Federal income tax, state income tax, local taxes, and FICA are among the required deductions taken from an employee's paycheck. FICA is the abbreviation for the Federal Insurance Contributions Act. FICA provides for a federal system of old-age, survivors, disability, and hospital insurance. The old-age, survivors, and disability portion is paid by the Social Security tax. The hospital insurance portion is paid by the Medicare tax. The actual amount deducted from a paycheck for federal, state, and local income taxes is determined by reference to tax tables provided by the various levels of government. Employees complete the W-4 Form (Employee's Withholding Allowance Certificate) when they are hired. The W-4 is an Internal Revenue Service (IRS) form you complete 1 to let your employer know how much money to withhold from your paycheck for federal taxes. The amount of federal and state income tax withheld will be determined from the allowances declared in the W-4 Form as well as the employee’s income. The amount withheld for Social Security is 6.2 percent of income earned up to $118,500 (2015) and the amount withheld for Medicare is 1.45 percent of income earned without limit. Accurately completing your W-4 can ensure you don't have a big balance due at tax time. It can also prevent you from overpaying your taxes, putting more money in your pocket during the year. This form tells the employer the number of allowances the employee wishes to claim. For example, an employee is able to claim allowances for himself or herself, a spouse, and children under 21 years of age whom the employee supports. The more allowances an employee claims, the less money withheld from the employee's paycheck. OPTIONAL (VOLUNTARY) DEDUCTIONS In addition to mandatory deductions (federal and state taxes and FICA, shown in the table below), there are two types of optional (voluntary) deductions: before-tax and after-tax deductions. Before-tax deductions are deductions not subject to Federal and State income tax withholding, a good example is the 401(k) plan. By having beforetax deductions, you will have taxable income reduced and owe few taxes. After-tax deductions include various employee benefits that employers may take money directly out of employees’ paychecks (deductions). Benefits vary by industry, by business, and by the status of the employee in the firm. Benefits may include such things as life 2 insurance, disability insurance, medical insurance, dental insurance, retirement savings plans, and profit-sharing. Other after-tax deductions include union dues and others (shown in the second table below). 3 All these amounts – pays and deductions – are clearly shown on your paycheck. Usually your pay stub will list what you have made since the last check (current pay) and what you have made for the year to date (YTD). 1. How much money have you earned all year before deductions? 2. How much net pay have you earned for this check only? 234.99 3. How many hours did you work for this check? 4. How much were you paid per hour? 1560 40 6.5 5. How much has been deducted for Medicare for the year? 22.62 6. What was the total amount of your deductions this period? 25.01 YTD?403.19 7. What amount has been available for your financial objectives YTD? 1156.81 8. How many pay checks have you received so far this year? 9. What’s the tax rate of your social security tax? 6 (1560 ÷260) 6.5% (=16.12/260) 4