Chapter 6

advertisement

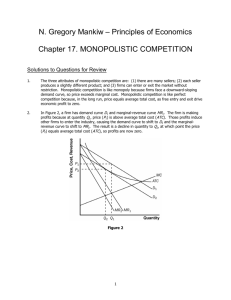

Chapter 6 COMPETITIVE MARKETS 1. Competitive Markets The invisible hand of Adam Smith describes how an economy works when there is competition among sellers and competition among buyers. The greatest degree of competition exists when no single buyer or seller has any control over price. 1.1 Perfect Competition In perfect competition, the seller has absolutely no control over price; each individual seller faces so much competition from other sellers that the market price is taken as given. (Perfect competition is a market with many sellers, perfect information, a homogeneous product, and freedom of entry.) When the price is given to the individual seller by the market, the seller is said to be a price taker. (The price taker has no control over the price.) Price Taking and High Liquid Markets: Exxonmobil Ex. 1.1 Perfect Competition cont Characteristics of perfect competition resulting in price taking: 1. 2. 3. 4. 5. The product’s price is the same for each buyer and seller. The product is homogeneous—one seller’s product cannot be distinguished from another’s. Buyers and sellers have perfect information about prices and product qualities. There are a large number of buyers and sellers. There is complete freedom of entry into and exit from the industry. 1.2 Monopolistic Competition Monopolistic competition is a highly competitive market that has all the characteristics of perfect competition except for price uniformity (Characteristic 1) and product homogeneity (Characteristic 2). Monopolistic competition allows each firm to have a slightly differentiated product because of such factors as location and costs of information. Differentiation can be on the basis of location, price, speed of service, or variety of styles or colors. 2. The Firm and the Market: Perfect Competition In perfect competition, all firms in the industry sell a homogeneous, or identical, product. No firm has an advantage over other forms in terms of quality, location or other product features. No rational buyer will buy from Firm A if it charges a higher price than Firm B. In a perfect competitive market, buyers would know if Firm B’s price was lower than Firm A’s price. 2. The Firm and the Market: Perfect Competition - cont The Demand Curve Facing the Perfectly Competitive Firm Example The demand curve facing the perfectly competitive firm is horizontal, or perfectly elastic, at the market price. If the price-taking firm can sell all it wants at the going market price, what prevents a single firm from supplying the entire market? Costs. 3. The Competitive Firm in the Short Run In a perfectly competitive market, marginal cost plays a major role in determining the supply curve, which shows how much the firm is willing to supply at different prices. The firm’s supply behavior is the outcome of three factors: Its marginal curve; The horizontal demand curve facing the firm; The desire to maximize profits or minimize losses. 3.1 Marginal Revenue Marginal revenue (MR) is the increase in revenue brought about by increasing output or sales by one unit. If MR exceeds MC, and extra unit of output adds more to revenues than to cost. Thus, MR > MC implies that the profits of the firm can be increased, or its losses reduced, by producing one more unit of output. 3.1 Marginal Revenue cont Firms will look at the relationship between MR and MC in making decisions about how much output to produce. In the case of a perfect competitive firm, marginal revenues is simply the market price. MR = Price (P) 4. The Short-Run Supply Curve In the short run, the firm’s objective is to maximize profits or, if necessary, to minimize losses. Once the market price is set: the following outcomes: The firm makes economic profits. The economic profit is zero. The firm stays in business but produces at a loss. The firm shuts down temporarily and hopes for the price to rise. 4. The Short-Run Supply Curve – cont. Prices effect output decisions: At very low prices, the firm may have to shut down. At higher prices, it produces a positive amount of output. The quantity supplied at each price is simply the firm’s profit-maximizing output or its loss-minimizing output. 4. The Short-Run Supply Curve – cont. Output will be pushed up to P = MC Perfectly competitive firm, profitmaximizing level P = MC Any output short of P = MC; too little is produced. Any output P < MC; too much is produced. Competitive firms adjust output to P = MC 4. The Short-Run Supply Curve – cont. The Profit-Maximizing Firm Example If the price exceeds minimum ATC, the firm can make an economic profit. 4. The Short-Run Supply Curve – cont. The Profitable Firm: Perfectly profitable firms choose that level of output where P = MC, provided price is greater than the minimum level of AVC. The Loss-Minimizing Firm: The market price is not high enough for the firm to make an economic profit. The Loss-Minimizing Firm Example The Shutdown case: The shutdown rule: If the firm’s price at all levels of output is less than AVC, it minimizes its losses by shutting down. 4.1 The Industry Supply Curve The supply curve shows the output that competitive firms are prepared to supply at each price. The profit-maximizing level of output increases as the price increases. In the short run, the market supply is the horizontal summation of the supply curves of each firm, which in turn are their MC curves above minimum AVC. 4.2 Short-Run Equilibrium The market equilibrium is achieved when the market price equates the market supply with the market demand. Short-Run Equilibrium Example 5. Long Run Adjustments The effect of economic profits on perfectly competitive industries is felt primarily in the long run, when new firms can enter the industry and established firms can exit. As competitive firms respond to economic profits and losses, the industry short run supply schedule shifts and prices change. 5.1 Economic Profit Attracts Resources Economic profits equal revenues minus opportunity costs. Opportunity costs are the best alternatives sacrificed by the business firm when it engages in production. E.g. The best return that could be earned by the owner if the owner’s money capital, labor, and managerial time had been used elsewhere. Economic losses are incurred when the return to the resources used in the business firm is less than the normal return they could earn in the next-best alternative. 5.1 Economic Profit Attracts Resources – cont. When economic profits are zero, the business firm is earning a normal profit. A normal profit requires a normal competitive return on the resources used in the firm. If economic profits continue, new firms enter the industry. If there are economic losses, some will exit from the industry. Long-run equilibrium occurs when firms no longer wish to enter or leave the industry. 5.2 Entry and Exit When economic profits are being made in one industry, the resources used in that industry are being used more profitable than in other industries. Why? The returns in other industries are part of the opportunity costs of doing business in the first industry. New firms will be attracted to the more successful industry and away from others. 5.2 Entry and Exit – cont. When economic losses are being made, the resources used in that industry are being used less profitable than in other industries. At any given time, there are sunset industries experiencing economic losses and sunrise industries earning economic profits. 5.3 Characteristics of Long-Run Equilibrium Long-Run Equilibrium: Adjustments That Eliminate Economic Profits Example The industry is brought to a long-run equilibrium by entry in response to economic profits and exit due to losses. Characteristics of long-run equilibrium: The firm operates at an efficient scale of operation. When P = MC and P = ATC at the long-run equilibrium output, and when MC intersects ATC at its minimum point, the perfectly competitive firm is producing at the lowest average cost in the long run. 6. Efficiency and Monopolistic Competition There is basis for distinguishing between the goods and services of different sellers, even though there may be a large number of sellers and freedom of entry. Product distinctions may be based on: The physical attributes of the product (one pair of shoes is slightly different from other shoes); Location (one dry cleaner is located more conveniently than another); Type of service (one film developer takes one hour, the other one day); Imagined differences (one brand of aspirin may be perceived as being more effective than another). 6. Efficiency and Monopolistic Competition – cont. Monopolistic Competition versus Perfect Competition Example The perfectly competitive firm faces a horizontal demand curve. The entry and exit of other firms ensures that economic profits (and losses) will eventually disappear, and that the perfectly competitive firm will operate at minimum efficient scale (minimum ATC) with a zero economic profit. 6. Efficiency and Monopolistic Competition – cont. Although monopolistic competitive industries also tend toward a normal, or zero, economic profit in the long run: They do not operate like their perfectly competitive counterparts at minimum efficient scale of operation. They tend to underutilize capacity by operating below minimum efficient scale. Freedom of entry causes monopolistic competitive industries to more closely resemble perfect competition in the very long run. 7. Policies to Promote Competition Competitive industries produce output at minimum efficient scale. The entry and exit of firms push prices down to yield only normal profits of firms. (Economists have praised the virtues of competition). There are a number of policies that can be pursued to increase the level of competition. 7.1 Removal of Trade Barriers Countries can protest domestic firms by imposing tariffs and other restrictions on foreign competitors. As these restrictions are removed: there are more suppliers to the domestic market, competing more effectively with domestic firms; it reduces prices to consumers and lowers costs of production. Are Mexican Trucks Unsafe? Example 7.2 Deregulation Deregulation is the elimination of government controls over a firm’s prices, quantity and quality of service. The argument for deregulation is that , where the potential for competition exists, it is better to have professional managers make decisions about prices, fares, and services rather than government bureaucrats. Deregulation has increased competition (Banks, airlines and TV viewers example) Deregulation has also revealed the consequences of competition. Competition creates winners and losers. 7.3 Antitrust Laws Antitrust laws can set the legal rules of the game for businesses. They can: forbid certain types of anticompetitive behavior (price fixing); prohibit specific forms of markets (market with only one supplier); prevent mergers and other acts that restrict competition. 7.4 Reducing Licensing Restrictions and Work Rules Licensing agencies can lessen competition by restricting entry into a business. Unions determine which individuals can perform what tasks (plumbers cannot turn a screw or hammer a nail). Licensing agencies determine who can be a truck driver, manicurist, or taxi driver. Eliminating unneeded licensing restrictions and work rules can help bolster competition.