Common Market Theory - The Economics Network

advertisement

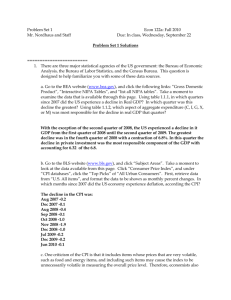

COMMON MARKET THEORY Lecture outline Ref com mkt oct08 Introduction If add free movement of all F of P to CU, result is common market (CM) So far assumed F of P immobile within CU & RoW EU more than a CU This is one theory that underlies the single (internal) market (1) Heckscher - Ohlin (H O) theory Factor price equalisation occurs with free movement of goods, even without factor movements perfect competition assumptions! allocation of resources efficient lab abundant country - lab price low (K price high). Country specialises where it has a factor endowment - raising the price of lab (while scarce K falls in price as demand low) See handout for outline of H-O model CU & factor price equalisation before formation of CU tariffs & other barriers prevented FP equalisation post- CU: move to FP equalisation, but not complete non-traded goods NTBs but, if extend CU thru factor mobility, possibly achieve additional welfare benefits (2) Free factor mobility Assume 1. 1 factor (labour) mobile 2. 2 countries North (N) E.U. & South(S). E.U. S - labour abundant 3. Perfect competition See diagram a) labour force in N = ON LO labour force in S = OS LO Difference in real wage(w)=WnWS real wage (w) w Wn Ws MPL South ON North Lo MPL North South OS b) Emigration S to N = LO L1 Equalisation of real wage = (Wc) Workers in S attracted by higher wages to N c) Welfare gain = area ABC in EU due to reallocation as the MPL (N) > MPL (S) before migration. Thus, increased production in N > fall in production in S as lab is reallocated real wage (w) Wn w B C A Ws MPL South ON North Lo MPL North L1 South OS Relevant today- EU15 v CEECs real wage (w) Wn W c w B D C W c Ws A MPL South ON North Lo MPL North L1 South OS d) Redistribution of rewards - depends where migrant workers live & where their wages are spent Lab remaining in S receive higher real wages, while real wages fall in N If migrant workers reside & spend in N - N’s income rises by LoBCL1 & S’s income falls by LoACL1 If ‘border’ workers live in S, N’s income rises by only BCD & S’s income rises by DCA 3 Capital(K) mobility & labour immobile model N is capital rich, K = On Ko In S, K = OsKo real interest rate (r%) r% B rs A rn C MPk South ON MPk North Y Ko OS Free movement K from N to S (where higher r%) Equilibrium K* (move Ko to K*) R% = ru Likely new investment Welfare gain area ABC real interest rate (r%) r% B rs A ru rn ru C MPk South ON MPk North Y K* Ko OS Tax distortions (+ see case study) Assume (above) no tax or equal tax on K in N & S If tax rates on K differ, investors aim for low tax country IF No tax in S 50% tax on K in N (NO tax harmonisation) MPkN shown by X-Y New equilibrium K1 rather than K* real interest rate (r%) r% B ru rs A X ru D rn C MPk South ON K1 MPk North Y K* Ko OS Welfare loss ADE, compared with optimal allocation BUT, if tax in S > tax in N (not shown) Further K could flow to K rich N Ie. Flow the ‘wrong way’ real interest rate (r%) r% E B ru rs A X ru D rn C MPk South ON K1 MPk North Y K* Ko OS (4) Conclusions 1 EU wage differentials exist not full lab mobility partial welfare gain BYZA capital is more mobile You should research EU wage & interest rate (eg. 10yr bond yields) convergence over the last 20yrs - see Eurostat real wage (w) Wn w B Y W c C D A Z MPL South ON North Lo W c Ws X MPL North L1 South OS 2 Criticise perfect competition would expect dynamic effects of integration to lead to mergers 3 Neglects interaction of K&L 4 Second best 5 Tax distortions 6 Effect of multinationals in the EU?