MONOPOLISTIC COMPETITION, OLIGOPOLY, & GAME THEORY

advertisement

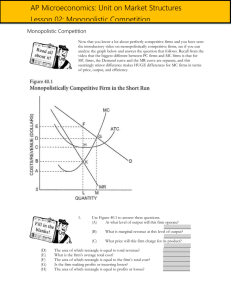

MONOPOLISTIC COMPETITION, OLIGOPOLY, & GAME THEORY MONOPOLISTIC COMPETITION • Firms in monopolistically competitive industry share some of the characteristics of perfect competition market structure: 1. Presence of many firms. 2. Availability of complete information 3. Freedom of exit and entry MONOPOLISTIC COMPETITION • But unlike Firms in perfect competition industry, monopolistically competitive industry firms share one unique characteristic: 1. Products are not homogenous. Each firm produces a product that differs in some slight way from the products of its competitors. MONOPOLISTIC COMPETITION • • But competitor’s products are close substitutes, therefore in this market structure, firms do have real monopoly power. Example of monopolistic competition firms: gas stations, dry-cleaning services, etc. MONOPOLISTIC COMPETITOR’S DEMAND CURVE • • Due to the presence of substitutes for monopolistic firm’s products, but not perfect substitutes Demand curve is downward sloping. REVENUE CURVES FOR MONOPOLISTIC FIRM • • • Monopolistic firms are assumed to maximize their profits. So, the relationship between MC and MR determines the optimal quantity of output. Demand curve determines the price at which output will be sold. REVENUE CURVES FOR MONOPOLISTIC FIRM • • • Because product differentiation, a monopolistic firm could alter the price of its product to affect the quantity of output sold. But the price alteration is limited by the existence of close substitutes. So, monopolistic firm price P>MR REVENUE CURVES FOR MONOPOLISTIC FIRM • • • A firm’s demand curve is equivalent to its AR curve. Monopolistic firm’s demand curve is downward-sloping, the MR curve lies below it. Remember: When the average is falling, the marginal is below the average. PRICE AND MARGINAL COST • • • • As seen, monopolistic firm’s price, P>MR. Monopolistic firm produces output at which MR=MC Thus, monopolistic firm must produce at a level of output at which P>MC. Monopolistic firm does not exhibit resource allocative efficiency (P≠MC). SHORT-RUN PROFIT MAXIMIZATION • Profit-Maximizing Output: Additions to firm’s profit are positive as long as the MR received from the sale of an additional unit of output exceeds the MC incurred in producing that unit. SHORT-RUN PROFIT MAXIMIZATION • Profit-Maximization price: The MR curve used to determine profit maximizing output is based on the firm’s demand curve. MR captures the firm’s revenues of selling various levels of output at the corresponding prices on the demand curve. Thus, to find the equilibrium price, find the point on the demand curve directly above the profit-maximizing output. LONG-RUN PROFIT MAXIMIZATION • • • Effects of entry on the monopolistic firm: as new firms enter, the demand curves for existing firms shift inward Given the relationship between MR and Demand, MR also shifts inward Thus, the inward shift in the Demand results in lower levels of AR, which leads to a profit declines. LONG-RUN PROFIT MAXIMIZATION LONGT-RUN PROFIT MAXIMIZATION CHARACTERISTICS • Excess Capacity Theorem: profit maximizing output is at the point of tangency between Demand curve and AC. This level output is to the left of the output level corresponding to minimum AC. The difference between these two output levels is known as excess capacity. EXCESS CAPACITY OLIGOPOLY • • • • Few sellers and many buyers Firms produce either homogenous, or differentiated products There are barriers to entry Concentration ratio: the percentage of industry sales accounted for by x number of firms in the industry. Note, high concentration implies few sellers. OLIGOPOLY • • • • Few sellers and many buyers Firms produce either homogenous, or differentiated products There are barriers to entry Concentration ratio: the percentage of industry sales accounted for by x number of firms in the industry. Note, high concentration implies few sellers. PRICE AND OUTPUT UNDER OLIGOPOLY • • • Cartel Theory Kinked Demand Curve Theory Price Leadership Theory. THE CARTEL THEORY • • • A cartel exists when collusive behavior between oligopolists takes the form of written agreements or other formal arrangements regarding output price and quantity. So doing, oligopolists act as if there were only one firm in the industry. Thus, a cartel can reduce output and increase price in an effort to increase joint profits. THE CARTEL THEORY The Benefits of Being Members of a Cartel We assume the industry is in long-run equilibrium, producing Q1, and charging P1. There are no profits. A reduction in output to QC through the formation of a cartel raises price to PC and brings profits of CPCAB THE CARTEL THEORY • Problems with cartel: 1. Formation: each potential member has an incentive to be a free rider. 2. Formulation of Cartel Policy: there may be as many policy proposals as there cartel members. 3. Entry: high profits provide incentives for new suppliers to join the Cartel. The Cartel is likely to break up if new members enter. 4. Cheating: Cartel members have incentive to cheat on the agreement THE CARTEL THEORY THE KINKED DEMAND CURVE THEORY The key behavioral assumption is that if a single firm lowers price, other firms will do likewise, but if a single firm raises price, other firms will not follow suit. The Kinked Demand Curve Theory Observations About Kinked Demand Theory • Prices are “sticky” if oligopolistic firms face kinked demand curves. • The kinked demand curve posits that prices in oligopoly will be less flexible than in other market structures. Price Leadership Theory • One firm in the industry, called the dominant firm, determines price and all other firms take this price as given. • The dominant firm sets the price that maximizes its profits, and all other firms take this price as given. • All other firms are seen as price takers. They will equate price with their respective marginal costs. THE PRICE LEADERSHIP THEORY Game Theory • Is a mathematical technique used to analyze the behavior of decision makers who: 1. Try to reach an optimal position through game playing or the use of strategic behavior. 2. Are fully aware of the interactive nature of the process at hand. 3. Anticipate the moves of other decision makers. Prisoner’s Dilemma Cartels and Prisoner’s Dilemma Theory of Contestable Markets • There is easy entry into the market and costless exit from the market. • New firms entering the market can produce the product at the same cost as existing firms. • Firms exiting the market can easily dispose of their fixed assets by selling them elsewhere.