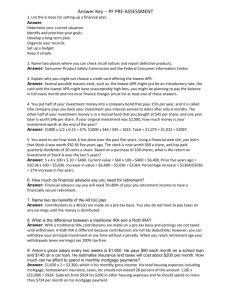

Stock Stock - WordPress.com

advertisement

The Stock Market An Introduction to the Equity Markets What is a Stock Stock • Stock is a share or unit of ownership in a company. • Represents a claim on a company’s assets and earnings • Stock may be publicly traded or privately held • Being a shareholder gives you voting rights attached to the stock • Look up XOM on yahoo finance. Find the top shareholders. Who owns Exxon Mobile? Dividends • Dividends are payments of company profits to shareholders What is the current per share dividend for AT&T? (Symbol: T) What is the current yield? What about Apple? (AAPL) • Why would a company pay a dividend? • Why would they choose not to pay one? Limited Liability Limited Liability. • You as a shareholder are only on the hook for your investment in the company. • It allows you, the shareholder, to be an owner in a company without risking all you own. Different Types of stock Common - shares represent ownership in a company and a claim (dividends) on a portion of profits. Investors get one vote per share to elect the board members, who oversee the major decisions made by management. • has variable dividends that are not guaranteed. Preferred - stock represents some degree of ownership in a company but usually doesn't come with the same voting rights. (This may vary depending on the company.) • investors are usually guaranteed a fixed dividend until the stock is called. • Preferred is ahead of common in liquidation of company assets • Preferred stock may also be callable, meaning the company has the right to buy them back from you at a certain price. Different Classes – maybe issued with different levels of voting rights. Discussion Zone What is a Stock? • What does it represent? What is a dividend? What is dividend yield? What is limited liability? Why is it important? What are the 2 types of stock? • Why are they different? Stock Exchanges A Stock Exchange is a place where stocks are traded. The purpose of a stock exchange is to facilitate the exchange of securities between buyers and sellers, reducing the risks of investing. • Imagine how difficult it would be to sell shares if you had to call around the neighborhood trying to find a buyer. Most famous – NYSE (New York), NASDAQ (over the counter), American Exchange (AMEX) • Over the Counter (OTC) – means no central location or facility. Trades done electronically over the phone or computer. Pink Sheets – Penny Stocks – www.pinksheets.com Primary Vs Secondary primary market - is where securities are created (by means of an IPO). secondary market -investors trade previously-issued securities without the involvement of the issuing-companies. The secondary market is what people are referring to when they talk about the stock market. It is important to understand that the trading of a company's stock does not directly involve that company. Bulls and Bears Bulls – Think the market or stock is going up • The buyers Bears – Think the market or stock is going down • The sellers How Price is determined Bids – A bid is the price that a buyer is willing to buy a stock. Asks – An ask is the price that a seller is willing to sell The trade price is determined when these to prices meet and a trade or exchange occurs Order Types Market – An order where you are willing to take the best bid (if you are selling) or ask (if you are buying). Your order is entitled to execution but not a price. Limit – An order where you set your bid(if you are buying) or ask(if you are selling). You are guaranteed a price, but not order execution Stop – The lowest price (or highest if you are buying) you are willing to let the stock drop to before a market order is entered Stop – Limit - The lowest price (or highest if you are buying) you are willing to let the stock drop to before a limit order is entered Discussion Zone What is an stock exchange? • The most popular? What is the difference between a primary and secondary exchange? Describe a Bull and a Bear. How is price determined? What are the 4 order types? Account Types Non-Qualified – Regular Individual, Joint, or Corporate Account Qualified • Traditional IRA • Roth IRA IRA – Individual Retirement Arrangement Non-Qualified Accounts Fully Taxable Money maybe withdrawn and deposited without limits or penalties Individual Account • One Person Joint Accounts • 2 or more people UTMA – Universal Transfer to Minor Accounts • Custodial accounts for Minors • Must have an Adult as a custodian • In Texas, adult does not have to give up control until Minor is 21 years old Qualified Accounts Tax benefits Limits on contributions based on income Not available to everyone Restrictions and penalties on withdrawals Generally used for retirement purposes IRA – Individual Retirement Arrangement Both require W2 wages to contribute • Contribution limit lesser or 100% of income or $5,000 ($6,000 if over 50) • Penalties for withdrawals if done before age 59 ½. Some exemptions. Traditional IRA • Tax-deferred • Contributions may be tax deductible • Pay taxes on growth when money withdrawn Roth IRA • Tax free – No taxes paid on growth • Contributions are not tax deductible Discussion What are the difference between Qualified and non-Qualified? What is an IRA and how is it helpful for retirement? At what age must a custodian give up control of an account to the Minor in Texas?