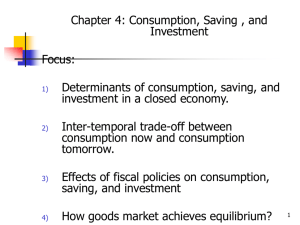

Chapter 9 - Building the Aggregate Expenditures Model

advertisement

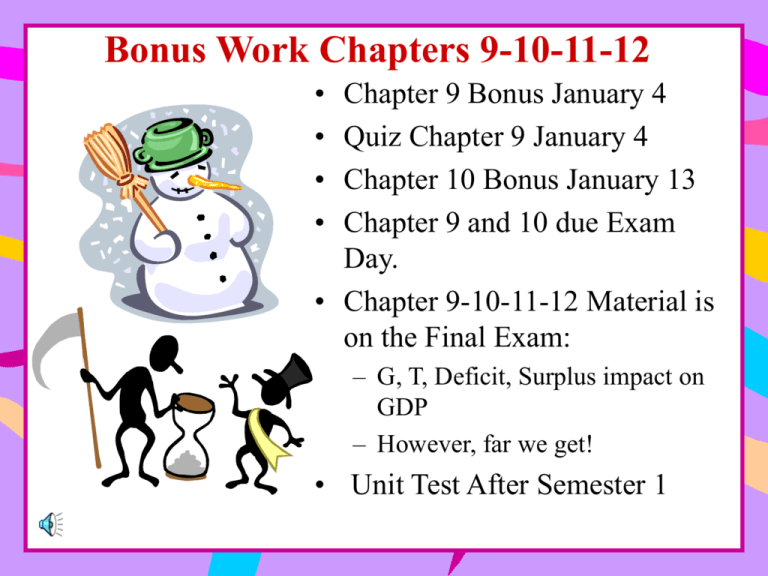

Bonus Work Chapters 9-10-11-12

•

•

•

•

Chapter 9 Bonus January 4

Quiz Chapter 9 January 4

Chapter 10 Bonus January 13

Chapter 9 and 10 due Exam

Day.

• Chapter 9-10-11-12 Material is

on the Final Exam:

– G, T, Deficit, Surplus impact on

GDP

– However, far we get!

• Unit Test After Semester 1

Building the

Aggregate Expenditures

Click to edit

Master title style

Model

CHAPTER NINE

Adam Smith

• Micro Economics

• The Laws of Supply

and Demand

formulated 1776

• Supply shifts outward

because of DIGTS!

• Equilibrium reached

through the invisible

hand of the market!

Wealth is based on the ability to produce goods & services!

David Ricardo Free Trade

1820’s

• Theories on Trade

• Comparative Advantage

• Trade is based on relative

opportunity cost.

• Countries specialize in

production of products

with the lowest

opportunity cost.

Wealth is increased through specialization and trade!

J. B. Say 1830’s

• Supply creates its own

demand!

• If you produce it they will

come!

• Aggregate supply is a vertical

line!

• Demand determines only the

price.

• Aggregate supply should be

increased to improve standard

of living!

Wealth is increased as output increases: “Supply creates Demand!

HISTORICAL BACKGROUND

Classical Economics & Say’s Law

Supply creates its own demand

Two Historical Events Weaken

Say’s Law??!!??

The Great Depression and WWII

John Maynard Keynes – 1930’s

• Father of Keynesian

Economics

• Macro economies may

be fine tuned!

• Fiscal policy may be

used to expand

aggregate demand.

• Aggregate supply is

horizontal not vertical

An absence of Demand makes Supply meaningless!

Simulate Aggregate Demand

Using Fiscal Policy

• Use Expansionary Fiscal

Policy during recessions

and depressions!

• G up

• T down

• TP up

• Deficits acceptable! “In

the long run we’re all

dead!”

Expand or Contract the

Economy by Changing $$$$

• The Federal Reserve

• Expands Money Supply

during recessions

• Contracts Money Supply

during periods of inflation

• Control of interest rate

yields control on RGDP

Milton Friedman 1950’s –

2000’s!

• A limited role for

government!

• No Fiscal or Federal

Reserve interventions

• Simply grow the

money supply at 3-5%

to grow the economy!

Increasing Money Supply will increase NGDP!

MS * V = NGDP

Rational Expectation Theorists

• It’s all Bull S***

because of lags

• People will counter the

planned changes in G,

T, TP, Budget

• Let the economy fix

itself using the

invisible hand of

Adam Smith

HISTORICAL BACKGROUND

Classical Economics & Say’s Law

Supply creates its own demand

The Great Depression and Keynes

1- The Great Depression

HISTORICAL BACKGROUND

Classical Economics & Say’s Law

Supply creates its own demand

The Great Depression and Keynes

1- The Great Depression

2- Keynes and

Keynesian Economics

Keynesian Noble Prize

Keynesian Proof!

•

•

•

•

Prove by Example

Prove by Model – Graphic Technique

Prove by Mathematics – The Multiplier

But before Keynes

– Activity 30

– Activity 31

Key Terminology:

• Fiscal Policy: Changes in Government

Spending and Taxation

• Expansionary Fiscal Policy: G up T down

used to counter a Recessionary Cycle

• Contractionary Fiscal Policy: G down T up

used to counter an Inflationary Cycle

• Discretionary Stabilization: A new law or

program enacted by Congress

• Automatic Stabilization: An existing law or

program used as a counter cyclical tool.

Automatic Stabilizers

Programs in Place that don’t

require new action by Congress

• Unemployment

Compensation

• Progressive Tax Rates

• Welfare, Food Stamps

• Farm Subsidy

Programs

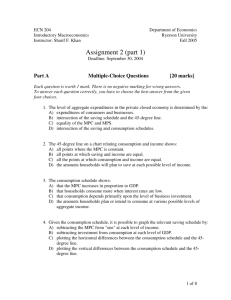

Keynesian Cross/ Aggregate Expenditure Model

C + Ig + Xn + G

(billions of dollars)

C + Ig + Xn + G

C + Ig + Xn

C

Sa+M+T, Ig + X + G

(billions of dollars)

o

45

o

470

510

550

Real domestic product, GDP (billions of dollars)

S+M

Ig + X + G

Ig + X

50

30

0

470

510

550

Real domestic product, GDP (billions of dollars)

Keynesian Economics

Simplifications....

Keynesian Economics

Simplifications....

1- A Closed Economy

Keynesian Economics

Simplifications....

1- A Closed Economy

2- Ignore Government

Keynesian Economics

Simplifications....

1- A Closed Economy

2- Ignore Government

3- All Saving Is Personal

Keynesian Economics

Simplifications....

1- A Closed Economy

2- Ignore Government

3- All Saving Is Personal

4- Net Income Abroad Is

Zero

Recall from chapter 7....

Disposable Income =

Recall from chapter 7....

Disposable Income =

Consumption + Saving

Recall from chapter 7....

Disposable Income =

Consumption + Saving

Households consume most of

their disposable income

Recall from chapter 7....

Disposable Income =

Consumption + Saving

Households consume most of

their disposable income

Consumption & saving are

directly related to income

DI

Consumption + Saving

DI

Consumption + Saving

APC

Consumption / Disposable Income

DI

Consumption + Saving

APC

Consumption / Disposable Income

APS

Saving / Disposable Income

DI

Consumption + Saving

APC

Consumption / Disposable Income

APS

Saving / Disposable Income

MPC

Change in Consumption

Change in Disposable Income

DI

Consumption + Saving

APC

Consumption / Disposable Income

APS

Saving / Disposable Income

MPC

Practice

Activity 20

PG.111

Change in Consumption

Change in Disposable Income

MPS

Change in Saving

Change in Disposable Income

Consumption can exceed income...

Negative saving

Consumption can exceed income...

Negative saving

Income can exceed consumption...

Positive saving

Consumption can exceed income...

Negative saving

Income can exceed consumption...

Positive saving

Income can equal consumption...

Break-even income

Importance of MPC and MPS

• Marginal shows the change in!!

• Given a change in income, how much of it

will go to consumption?

• Using historical data can we see the impact

increases in DI has had on C and MPC??

DI

Consumption + Saving

Basic Idea – The amount of goods and services produced and the

level of employment depend directly upon the level of

total (aggregate) spending.

Keynes’ task is to prove the impact spending and saving

decisions have on output.

He does so by looking at the consumption schedule – the various

amounts households would plan to consume at each of the levels

of disposable income which could exist at some specific time.

Consumption

Graphically presented....

C

o

45

o

Saving

Disposable Income

S

o

Disposable Income

Consumption

Graphically presented....

C

Consumption

schedule

C

45

o

o

Saving

Disposable Income

Saving

schedule

o

S

Disposable Income

S

Graphically presented....

Consumption

SAVING

C

Consumption

schedule

C

45

o

o

Saving

Disposable Income

Saving

schedule

S

SAVING

o

S

Disposable Income

Graphically presented....

Consumption

SAVING

C

DISSAVING

Consumption

schedule

C

45

o

o

Saving

Disposable Income

DISSAVING

Saving

schedule

S

SAVING

o

S

Disposable Income

Graphically presented....

Consumption

SAVING

C

DISSAVING

Consumption

schedule

MPC = Slope of C

C

45

o

o

Disposable Income

Saving

MPS = Slope of S

DISSAVING

Saving

schedule

S

SAVING

o

S

Disposable Income

Graphically presented....

Consumption

SAVING

C

DISSAVING

Consumption

schedule

MPC = Slope of C

C

45

o

o

MPC + MPS = 1

Disposable Income

Saving

MPS = Slope of S

DISSAVING

Saving

schedule

S

SAVING

o

S

Disposable Income

GLOBAL PERSPECTIVE

AVERAGE PROPENSITY TO CONSUME - 1996

.80

Canada

United States

Britain

Germany

France

Netherlands

Japan

Italy

.85

.90

.95

1.00

GLOBAL PERSPECTIVE

AVERAGE PROPENSITY TO CONSUME - 1996

.80

Canada

United States

Britain

Germany

France

Netherlands

Japan

Italy

.85

.90

.95

1.00

.954

.951

.884

.876

.875

.872

.868

.866

Nonincome Determinants

of Consumption & Saving

Nonincome Determinants

of Consumption & Saving

1- Wealth

Real (real estate) and Financial

(stocks) assets.

Nonincome Determinants

of Consumption & Saving

1- Wealth

2- Expectations

Expectations about prices, the future level of your income,

state of the economy, technology.

Nonincome Determinants

of Consumption & Saving

1- Wealth

2- Expectations

3- Consumer Indebtedness

Borrowing allow households to spend more

To a point!! When indebtedness gets abnormally high C down

To pay off loans!! Hope I don’t find myself there!!!!

Nonincome* Determinants

of Consumption & Saving

1- Wealth

2- Expectations

3- Consumer Indebtedness

4- Taxation

T up C & S down! Remember

Fiscal Policy!!!

Shifts & Stability Key Terms:

Consumption

C

C

45

o

o

Saving

Disposable Income

o

S

Disposable Income

Autonomous

Versus

Induced.

AU are

Shifts

Of the C

Schedule.

S Induced are

Movements

Along the C

Schedule.

Shifts & Stability

Consumption

C

C

An

increase in

consumption...

C

C

45

o

o

Saving

Disposable Income

S

o

S

Disposable Income

Shifts & Stability

Consumption

C

C

An

increase in

consumption...

C

C

o

45

o

Saving

Disposable Income

Means

a decrease

in saving

S

S

o

SS

Disposable Income

Shifts & Stability

Consumption

C

C

A

decrease in

consumption...

C

C

o

45

o

Saving

Disposable Income

S

o

S

Disposable Income

Shifts & Stability

Consumption

A

decrease in

consumption...

C

C

o

45

o

Disposable Income

Saving

A change

In

Income is

Movement

Along the

Curve!

C

C

o

S

S

Disposable Income

Means

an increase

S in saving

S

The Paradox of Thrift

• Too much savings hurts the

economy?

• Japanese savings rates in

the 1990’s were among the

highest in the world at

about 40% of DI

• DI = C + S

• Part of their Recession was

>>>>> lack of consumption

Investment???

• Adding the I.

• We need to understand the

impact Investment has on

output as well as what drives

Investment.

• Marginal benefits versus

marginal costs.

• Will it make a profit?

– MEI (marginal efficiency of

investment)

– Interest Rate

• Real Interest rate compared to

expected rate of return on

investment.

INVESTMENT

Expected Rate of Net Profit,

r

INVESTMENT

Expected Rate of Net Profit,

Real Interest Rate,

i

r

INVESTMENT

Expected Rate of Net Profit,

Real Interest Rate,

r

i

Inverse relationship between

Investment and Real Interest

Rate. Invest up to r = i.

interest rate, i (percents), r

MEI

Graphically presented....

16

14

12

10

8

6

4

2

0

5

10

15

20

25

30

35

40

Investment (billions of dollars)

interest rate, i (percents), r

Graphically presented....

16

14

INVESTMENT

DEMAND, MEI

12

10

8

Activity PG. 119

6

4

2

D

0

5

10

15

20

25

30

35

40

Investment (billions of dollars)

SHIFTS IN INVESTMENT DEMAND

Am I an “induced” or “exogenous/autonomous” change?

• Acquisition, Maintenance,

and Operating Costs

Lower costs to operate and maintain equipment shifts I to Right.

SHIFTS IN INVESTMENT DEMAND

Am I an “induced” or “exogenous/autonomous” change?

• Acquisition, Maintenance,

and Operating Costs

• Business Taxes

Lower business taxes shifts I to right

SHIFTS IN INVESTMENT DEMAND

Am I an “induced” or “exogenous/autonomous” change?

• Acquisition, Maintenance,

and Operating Costs

• Business Taxes

• Technological Change

Technological improvement stimulates I shifts to Right

SHIFTS IN INVESTMENT DEMAND

Am I an “induced” or “exogenous/autonomous” change?

• Acquisition, Maintenance,

and Operating Costs

• Business Taxes

• Technological Change

• Stock of Capital Goods on

Hand

When understocked with production facilities and low inventories

I shifts Right.

SHIFTS IN INVESTMENT DEMAND

Am I an “induced” or “exogenous/autonomous” change?

• Acquisition, Maintenance,

•

•

•

•

and Operating Costs

Business Taxes

Technological Change

Stock of Capital Goods on

Hand

Expectations

The more optimistic about political affairs, population growth,

consumer tastes I shifts Right.

1. Rising stock market prices

2. Development of expectations by business that

business taxes will be higher in the future

3. Step-up in the rates at which new products and

production processes are being introduced

4. Business belief that wages may be lower in the

future

5. A mild recession

6. A belief that business is “too good” and the

economy is due for a period of slow growth

7. Rising costs in construction industry

8. A burst in population growth

9. A period of high investment in technology has

created excess inventories

GLOBAL PERSPECTIVE

Gross Investment Expenditures,

% of GDP 1996

40%

30%

20%

10%

0%

South

Korea

Japan Germany France United

States

Canada Mexico

Britain Sweden

GLOBAL PERSPECTIVE

Gross Investment Expenditures,

% of GDP 1996

40%

30%

20%

10%

0%

South

Korea

Japan Germany France United

States

Canada Mexico

Britain Sweden

GLOBAL PERSPECTIVE

Gross Investment Expenditures as a

Percentage of GDP, Selected Nations

d

d

40%

ifts,

30%

ment

and

20%

P

Next

lide

10%

0%

Japan

Mexico

South

Korea

Copyright McGraw-Hill/Irwin, 2002

Canada Germany United United France Sweden

States Kingdom

Source: World Bank

INVESTMENT AND INCOME

AUTONOMOUS INVESTMENT

Desired level of investment based

upon long term profit expectations.

INVESTMENT AND INCOME

AUTONOMOUS INVESTMENT

Desired level of investment based

upon long term profit expectations.

INDUCED INVESTMENT

Level of investment induced by

the level of current income.

illustrated...

Investment (billions of dollars)

The Investment Schedule:

Two Possibilities

60

40

Autonomous

Investment schedule

Ig

20

0

390

410

430

450

470

490

510

530

Real domestic product, GDP (billions of dollars)

Investment (billions of dollars)

The Investment Schedule:

Two Possibilities

60

40

Autonomous

Induced

Investment schedule Investment schedule

I’g

Ig

20

0

390

410

430

450

470

490

510

530

Real domestic product, GDP (billions of dollars)

Investment (billions of dollars)

The Investment Schedule:

Two Possibilities

60

40

Autonomous

Induced

Investment schedule Investment schedule

Planned Investment Unplanned Investment

I’g

Ig

20

0

390

410

430

450

470

490

510

530

Real domestic product, GDP (billions of dollars)

Instability of Investment

Even when interest rates change investment may not. Why?

Instability of Investment

• Durability

Often can patch up and postpone replacement of capital equipment.

Instability of Investment

• Durability

• Irregularity of Innovation

Cannot predict when genius happens, but when it does major

increases in investment.

Instability of Investment

• Durability

• Irregularity of Innovation

• Variability of Profits

Difficult to predict profits with 100% accuracy.

Instability of Investment

• Durability

• Irregularity of Innovation

• Variability of Profits

• Variability of Expectations

Equilibrium GDP:

Expenditures-Output Approach

GDP = C + Ig

Businesses will spend for production

at a certain level expecting to be able

to sell their product for that same

amount of money.

Equilibrium GDP:

Expenditures-Output Approach

GDP = C + Ig

Businesses will spend for production

at a certain level expecting to be able

to sell their product for that same

amount of money.

Planned vs. Unplanned Investment

Equilibrium GDP:

Expenditures-Output Approach

GDP = C + Ig

Equilibrium occurs where the

total output, measured by GDP,

and aggregate expenditures,

C + Ig are equal.

Private spending, C + I g (billions of dollars)

Equilibrium GDP:

Expenditures-Output Approach

C

Equilibrium

C

C

45

o

o

370 390 410 430 450 470 490 510 530 550

Real domestic product, GDP (billions of dollars)

Private spending, C + I g (billions of dollars)

Equilibrium GDP:

Expenditures-Output Approach

(C + I g = GDP)

Equilibrium

C

o

C

C + Ig

C

45

C + Ig

o

370 390 410 430 450 470 490 510 530 550

Real domestic product, GDP (billions of dollars)

Saving and Investment

(billions of dollars)

Equilibrium GDP:

Leakages-Injections Approach

Planned

I g = $20

S=Ig

60

40

20

Unplanned

Inventory

Decrease

Ig

At this level

of GDP

S

Ig

{

0

-5

S

(S = I g = $20)

Equilibrium

370 390 410 430 450 470 490 510 530 550

Real domestic product, GDP

(billions of dollars)

Saving and Investment

(billions of dollars)

Equilibrium GDP:

Leakages-Injections Approach

Planned

I g = $20

S=Ig

60

At this level

of GDP

40

20

(S = I g = $20)

Equilibrium

Ig

0

-5

S

S

{

}

S

370 390 410 430 450 470 490 510 530 550

Real domestic product, GDP

(billions of dollars)

Unplanned

Inventory

Increase

Ig

Investment???

• Leaks and Injections

– Savings = Investment

– Leaks = Injections

– Savings, Imports, Taxes are

leaks out of the circular

flow.

– Investment, Exports,

Government Spending are

injections in to the circular

flow.

Equilibrium GDP

Planned vs. Actual Investment

Equilibrium GDP

Planned vs. Actual Investment

Unintended or Unplanned

Changes in Inventories

Equilibrium GDP

Planned vs. Actual Investment

Unintended or Unplanned

Changes in Inventories

Achieving Equilibrium

Equilibrium GDP

Planned vs. Actual Investment

Unintended or Unplanned

Changes in Inventories

Achieving Equilibrium

Any questions?

• Say’s Law

• Keynesian economics

• consumption schedule

• saving schedule

• break-even income

• average propensity to consume

• average propensity to save

• marginal propensity to consume

• marginal propensity to save

• expected rate of return

• investment demand curve

Copyright McGraw-Hill, Inc.

• investment schedule

• aggregate expenditures-domestic

output approach

• aggregate expenditures schedule

• equilibrium GDP

• 45 degree line

• leakages-injections approach

• leakage

• injection

• planned investment

• actual investment

Next....

Aggregate Expenditures:

The Multiplier, Net Exports,

and Government

Chapter 10