Chapter 4

advertisement

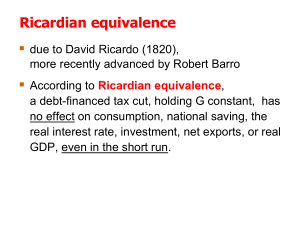

Chapter 4: Consumption, Saving , and Investment Focus: 1) 2) 3) 4) Determinants of consumption, saving, and investment in a closed economy. Inter-temporal trade-off between consumption now and consumption tomorrow. Effects of fiscal policies on consumption, saving, and investment How goods market achieves equilibrium? 1 Consumption 1) 2) 3) 4) The decision to consume is equivalent to decision to save (negative consumption). Main Determinants of Consumption (Saving) Real Rate of Interest Current Income Future Income Wealth 2 The real rate of interest determines the cost of today’s consumption in terms future consumption forgone. Consumption-smoothing motive: The desire to have even (or flat) pattern of consumption over time. We assume that individuals have Consumption-smoothing motive. Marginal Propensity to Consume (MPC): Increase in consumption for a unit increase in income. 3 The Substitution Effect of the Real Rate of Interest: The tendency to reduce the current consumption when the real rate of interest rises. The Income Effect of the Real Rate of Interest: The tendency to increase the current consumption when the real rate of interest rises. These two effects have opposite effect on the current consumption of a saver. In the case of a borrower, these two effects reinforce each other and reduce the current consumption. 4 Any change in current taxes, holding current and future government expenditure constant, does not affect desired consumption and saving. This is called the Ricardian Equivalence Proposition. The Ricardian Equivalence Proposition holds only when consumers take into account offsetting changes in future taxes. In the case this assumption does not hold, higher current taxes reduces desired current consumption and increases the desired saving. Any increase in the government expenditure (G) reduces the desired level of consumption and saving. 5 Investment While making investment firms compare the cost of making investment (real rate of interest + depreciation) with the benefit of investment (expected MPK). Desired capital stock – Amount of capital that maximizes the expected profit. User Cost of Capital = real rate of interest + depreciation The desired stock of capital is determined by the condition: 6 User cost (uc) = Expected MPK (MPKf ) In the case, the government imposes tax on output, the desired capital stock is given by the condition: (1 – tax rate ) MPKf = uc Or, MPKf = (uc/(1-tax rate)) Capital stock and investment satisfy following identity: Net Investment = Gross Investment Depreciation Kt+1 – Kt = It - dkt 7 If the desired capital stock (K*t) is same as the actual capital stock, then we have : It = K*t+1 – Kt + dkt For making investment in inventories and housing as well, one compares the cost of investment with the benefit of investment. 8 Goods Market Equilibrium The equilibrium in goods market is given by the condition that supply of goods and services equals demand for goods and services : Y = Cd + Id + G Or, Y - Cd – G = Id Or, Sd = Id 9