Principles of economics

advertisement

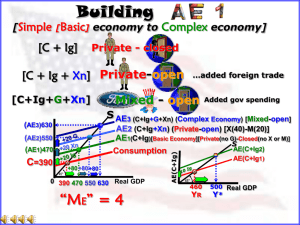

Principles of economics Consumption and investment Business fluctuations and the theory of Aggregate Demand Multiplier model Consumption • Consumption (C) is the largest component of GDP (cca. 2/3 of GDP) and major part of AD • Investment is a part of AD but its accumulation increases K which increases AS • Categories of consumption are: 1. Durables (12% in USA in 2002) 2. Non-durables (29% in USA in 2002) 3. Services (59% in USA in 2002) Saving • Saving (S) is the part of disposable income that is not consumed: Y=C+S Consumption and saving changes as income (Y) changes: • When there is no income some consumption exists (autonomous consumption, c0) • At certain level of income consumers consume exactly how much they earn (break even point: Y = C since S = 0) DI (or Y) S • After that level saving (S) is positive 0 -100 - c0 = 100 300 0 - Y = C when Y = 300 C 100 300 600 100 500 900 200 700 MPC and MPS • Marginal propensity to consume (MPC or c1) is an extra amount of consumption caused by a 1 kn income increase: 𝐶𝑛 − 𝐶𝑛−1 ∆𝐶 𝑀𝑃𝐶𝑛 = = = 𝑐1 𝑌𝑛 − 𝑌𝑛−1 ∆𝑌 200/300 = 0.667 • Marginal propensity to save (MPS) is an extra amount of saving caused by a 1 kn income increase: 𝑆𝑛 − 𝑆𝑛−1 ∆𝑆 𝑀𝑃𝑆𝑛 = = = 𝑠1 DI (or Y) S 𝑌𝑛 − 𝑌𝑛−1 ∆𝑌 0 -100 100/300 = 0.333 C 100 300 0 300 600 100 500 900 200 700 Consumption and saving function • Consumption function shows the relation between the income and the consumption. C(Y) = c0 + c1Y • Saving function shows the relation between the income and the saving. Y = S(Y) + C(Y) = S(Y) + c0 + c1Y → S(Y) = - c0 + (1 - c1)Y where 1 - c1 = s1 C C = f(Y) c0 45° 0 Y S S = f(Y) 0 Y Consumption and saving plot C, S C(Y) 300 S(Y) 100 0 -100 300 Y DI (or Y) S C 0 -100 100 300 0 300 600 100 500 900 200 700 C = 100 + 0.667Y S = -100 + 0.333Y Determinants of consumption • Current disposable income (Y) • Permanent income and the Life-Cycle Model of Consumption • (Permanent income: trend level if income) • Wealth • Other influences Investment • Second major part of income • It affects AD (short-run) since it is its component and AS (long-run)since it increases stocks of capital • Financial investment: sale-purchase (not real investment) • Real investment increases ONLY WHEN CAPITAL IS PRODUCED Determinants of investments • Revenues, which depend on demand for output produced by new investment • Costs (interest rates (i) and taxes (t) ) • Expectations (state of the economy) Increase taxes and deterioration of expectations shifts investment demand curve towards the origin Investment demand curve • Investment demand curve shows the change in the amount of investment when return on investment (interest rate) changes: Id = Investment demand i 0 I • Investment function: 𝐼 = 𝐼 − 𝑏𝑖 (𝐼 = autonomous investment, b = propensity to invest) Business Fluctuations • Expansion: economic growth • Recession: economic decline • Depression is a long-lasting recession (more than a year) • They interchange • Business cycle is an economywide fluctuation in income, outout and employment. Business cycle theories • Exoneous vs. Internal Cycles Exogenous cycles are caused by factors outside of economic system Internal cycles happen are caused by factors within economic system • Demand induced cycles Contraction of aggregate demand causes cycles (Keynesian theory) Aggregate demand (AD) and its components P AD2 AD3 AS AD1 AD4 0 Y At first AD boost increases income, but after a AS kink AD expansion increases only inflation Forecasting business cycles • Forecast of business cycles are made using econometric models • Econometric models are estimated using sets of statistical data with methods developed by econometrics 𝒀 = 𝜷𝟎 + 𝜷𝟏 𝑿𝟏 + ⋯ + 𝜷𝒏 𝑿𝒏 • Time series, cross section data or both (panel data) Aggregate demand segments P C I G X AD 0 q • Consumption (households) • Investment (companies) • Government purchases • Net export AD: movement along and its shift P C I G X • Movement along AD: 0 q Change in the price level • Shift od demand causes: A. POLICY VARIABLES: Change in monetary and fiscal policy shifts demand (expansive f.p. & m.p. causes outward shift) B. EXOGENOUS VARIABLES: Foreign output, asset values, technology advances, etc. AD Exercise 1 a) Find APS, APC, MPS, MPC using the table below: Income 0 10 000 20 000 30 000 40 000 50 000 • • Consumption 6000 12000 18000 24000 30000 36000 APC = C / Y MPC= C / DI Income 0 10 000 20 000 30 000 40 000 50 000 Consumpti on 6000 12000 18000 24000 30000 36000 APS = S / Y MPS= S / DI Saving APC APS MPC -6000 -2000 2000 6000 10 000 14 000 1,2 0,2 0.6 0,9 0,1 0.6 0,8 0,2 0.6 0,75 0,25 0.6 0,72 0,28 0.6 MPS 0.4 0.4 0.4 0.4 0.4 • • • • • b) Express consumption function C = A + MPC*DI C= 6000 + 0,6*DI b) Express saving function S = MPS*DI - A S= 0,4*DI - 6000 Exercise 2 Consumption function in a country is C = 800 + 0.7Y, (Bill. $). a) Find MPC and MPS and draw saving& consumption function C=800 + 0.7Y MPC=0.7 - > MPS= 1-MPC = 1-0.7 =0.3 b) Find annual saving and consumption for the following levels of income: 3000, 4000, 5000, 6000 Y 3000 4000 5000 6000 C 2900 3600 4300 5000 S 100 400 700 1000 APC 0.97 0.90 0.86 0.83 APS 0.03 0.10 0.14 0.17 Multiplier model • Multiplier model explains how shocks in exogenous expenditures (investment, taxes, government spending, foreign trade, household spending) affect output and employment. • Assumption: 1. wages are fixed 2. prices are fixed 3. there is available unemployed labour force • The multiplier is the impact of a 1 HRK change in exogenous expenditures on total output. I = S output determination • DI = C + S • Savings are invested → S = I • Let us assume investments are exogenous S,I 𝑆 = −c0 + 1 − c1 Y I = const. 0 Y • The intersection of I and S determines equilibrium GDP toward which national income will gravitate • If S > I consumption is too small, invetories fill up and companies sack workers. Output falls and the equilibrium is obtained. Total expenditure approach in output determination TE C + I = TE C c0+I c0 45° 0 Y* Y • Intercept of TE and 45° line shows the equilibrium output Investment multiplier 𝑌 𝑆 𝐶 𝑌 𝑌 = = = = − 𝐶 + 𝑆 𝐼 𝑐0 + 𝑐1 𝑌 𝑐0 + 𝑐1 𝑌 + 𝐼 𝑐1𝑌 = 𝑐0 + 𝐼 |: (1 − 𝑐1) 𝑐0 𝐼 𝑌 = + 1 − 𝑐1 1 − 𝑐1 1 1 Δ𝑌 = ∆𝐼 = ∆𝐼 1 − 𝑐1 𝑀𝑃𝑆 Equilibrium output and the multiplier TE Y = 𝑐0 + 𝑐1𝑌 + 𝐼 C = 𝑐0 + 𝑐1𝑌 ΔI C0+I ΔY YN = potential output c0 0 45° Y S 𝑆 = −c0 + 1 − c1 Y 𝐼 0 Y TE Y = 𝑐0 + 𝑐1𝑌 + 𝐼 C = 𝑐0 + 𝑐1𝑌 C0+I YN = potential output c0 0 45° Y 𝐴𝑆 P 𝐴𝐷: 0 investment demand 𝐴𝐷′: non 0 investment demand 𝐴𝐷 0 𝐴𝐷′ Y Investment, government spending and tax multiplier 𝑌 𝑆 𝐶 𝑌 𝑌 = = = = − 𝐶+𝐺+ 𝑆 𝐼 𝑐0 + 𝑐1 (𝑌 − 𝑇) 𝑐0 + 𝑐1 𝑌 − 𝑇 + 𝐺 + 𝐼 𝑐1 𝑌 = 𝑐0 − 𝑐1 𝑇 + 𝐺 + 𝐼 |: (1 − 𝑐1 ) 𝑐0 𝑐1 𝐺 𝐼 𝑌 = − 𝑇+ + 1 − 𝑐1 1 − 𝑐1 1 − 𝑐1 1 − 𝑐1 𝑐1 1 1 Δ𝑌 = − ∆𝑇 + ∆𝐺 + ∆𝐼 1 − 𝑐1 1 − 𝑐1 1 − 𝑐1 Taxes multiplier Government expenditure multiplier Investment multiplier Haavelm theorem • Let us assume G = T (leveled budget). Let taxes be increased by 1 HRK and as a result a government spending increased by 1 HRK. GDP will increase by 1 HRK. • Proof: 𝑐1 1 Δ𝑌 = − ∆𝑇 + ∆𝐺 1 − 𝑐1 1 − 𝑐1 Δ𝑌 = − 𝑐1 1 1−𝑐1 + 1 1 1 − 𝑐1 = 1− 𝑐1 1 − 𝑐1 Total effect is positive. =1 Exercise 1 • Find investment multiplier if an increase in GDP by $ Mill. 180 was caused by the investment increase of $ Mill. 120. Also find MPC and MPS. solution • k = Δ BDP / Δ I • k = 180 / 120 = 1.5 • k = 1 / MPS • MPS = 1 / k = 1 / 1.5 = 0,67 • MPC = 1 – MPS = 0.33 Exercise 2 • Consumption function is C = 10 + 0.5*Y, while investments are $Mill. 20. – a) Find the equilibrium level of income. – b) Find value of the investment multiplier. a) • • • • • • • • Equilibrium: S = I S = MPS*Y – c0 MPS = 1 – 0.5 MPS = 0.5 S = 0.5*DI – 10 0.5*DI – 10 = I 0.5*DI – 10 = 20 Y =60 mil $ b) • • • • Multiplier k = 1 / MPS k = 1 / 0.5 k=2 Exercise 3 • Autonomuos consumption is 50 Billion HRK. Citizens save 25% of their income at all levels of income. Government spending is 35 Bill. HRK and investment is 15 Bill. HRK. a) Find the equilibrium level of output b) Government decides to increase its spending by 5 Bill. HRK in order to fight recession, but also raises taxes by 5 Bill. HRK. Investment fell further down by 1 Bill. HRK. Find all multipliers and the total effect. a) C = 50 + 0.75Y, I = S Y = 50 + 0.75Y + 35 + 15 0.25Y = 100 Y = 400 Bill. HRK C = 50 + 300 = 350 b) 𝑐1 1 1 Δ𝑌 = − ∆𝑇 + ∆𝐺 + ∆𝐼 1 − 𝑐1 1 − 𝑐1 1 − 𝑐1 Δ𝑌 = −3∆𝑇 + 4∆𝐺 + 4∆𝐼 kg = kI = 4, kt = 3 Δ𝑌 = −3×5 + 4×5 – 4×1 = 1 Bill. HRK