Consumption is reduced by the MPC of the tax

advertisement

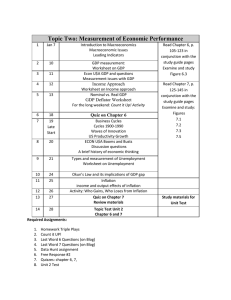

HOMEWORK PROBLEMS 9, 10, 12, 13 page 185 Chapter 9 #9 page 185 REAL DOMESTIC OUT PUT = DI AE, EXPORTS PRIVATE CLOSED ECONOMY IMPORTS $200 $240 $20 $30 250 280 20 30 300 320 20 30 350 360 20 30 400 400 20 30 450 440 20 30 500 480 20 30 550 520 20 30 NET EXPORTS AE, PRIVATE OPEN ECONOMY Chapter 9 #10 page 185 GDP C $100 $120 200 200 300 280 400 360 400 500 440 300 600 520 200 700 700 AE 600 600 500 100 C 45◦ 100 200 300 400 500 600 700 GDP = DI A. Graph the consumption schedule and determine the MPC. B. Assume that a lump-sum tax is imposed such that the government collects $10 billion in taxes at all levels of GDP. Graph the resulting consumption schedule, and compare the MPC and the multiplier with those of the pretax consumption schedule. Consumption is reduced by the MPC of the tax Chapter 9 #10 page 185 Consumption after Tax GDP C TAX $100 $120 $10 $112 200 200 10 $192 300 280 10 $272 400 360 10 $352 500 440 10 $432 600 520 10 $512 700 600 10 $592 Equilibrium GDP is reduced by $40. Consumption is reduced by $8 and the multiplier is 5. The new equilibrium GDP is $160. Chapter 9 #12 page 185 REAL DOM REAL DOM. OUTPUT =DI AE, PRIVATE CLOSED ECONOM Y EXPORTS IMPORTS NET EXPORTS GOV’T EXPEND. TAXES AE, OPEN ECONOM Y 200 240 $20 $30 $-10 $20 $20 250 250 280 20 30 -10 20 20 290 300 320 20 30 -10 20 20 330 350 360 20 30 -10 20 20 370 400 400 20 30 -10 20 20 410 450 440 20 30 -10 20 20 430 500 480 20 30 -10 20 20 490 550 520 20 30 -10 20 20 530 The increase in government spending of $20 increases Equilibrium GDP by $100. $20 X 5 (the multiplier) = 100. What is the result if the government plans to tax and spend $20 at each level of GDP? ANSWER: GDP increases by the amount of the change in spending ($20). The increase in taxes reduces consumption by the MPC of the tax. (20 X MPC (.8) = 16). 16 x 5 (the multiplier) = 80. Equilibrium GDP is reduced by $80. The net result in the increase in taxes and the equal increase in spending is and increase in Equilibrium GDP by the amount of the change in spending ($20). Chapter 9 #13 page 185 POSSIBLE LEVELS OF EMPLOYMENT, MILLIONS REAL DOMESTIC OUTPUT If full employment in this economy is 130 million, will there be an inflationary expenditure gap or a recessionary expenditure gap? RECESSIONARY AE 90 $500 $520 100 550 560 110 600 600 120 650 640 130 700 680 What will be the consequence of this Employment will be 20 million gap? less than at full employment. By how much would AE in column 3 have to change at each level of GDP to eliminate the inflationary expenditure gap or the recessionary AE gap? Explain $20 What is the multiplier in this example? 5 Will there be an inflationary expenditure gap or a recessionary INFLATIONARY expenditure gap if the full-employment level of output is $500 billion? DEMAND-PULL INFLATION (higher prices, no Explain the consequences. increase in output) By how much would AE in column 3 have to change at each level of GDP to eliminate the gap? What is the multiplier? 5 $20