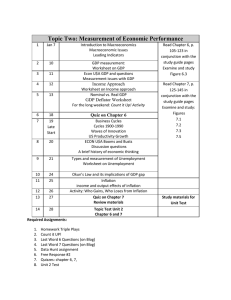

Chapter 10 Aggregate Expenditures Changes in Equilibrium GDP and the Multiplier

advertisement

Chapter 10 Aggregate Expenditures Changes in Equilibrium GDP and the Multiplier o In the private closed economy, the equilibrium GDP will change in response to changes in either the investment schedule or the consumption schedule o Changes in investment schedule are main source of instability The Multiplier Effect o A change in a component of aggregate expenditures leads to a larger change in equilibrium GDP o Determines how much larger than change will be o Change in real GDP/ initial change in spending o Change in GDP = Multiplier X initial change in spending o Works in both directions o Caused by changes in C, G, I, X Rationale o The economy supports repetitive continuous flows of expenditures and income through which dollars spent are received by income to be spent and become income Multiplier and Marginal Propensities o The MPS determines the cumulative respending effects of any initial change in spending and therefore determines multiplier o MPS and multiplier are inversely related o The smaller the fraction of any change in income saved, the greater the respending at each round, therefore the greater the multiplier o M = 1/MPS o M = 1/ 1-MPC Significance of the Multiplier o That a small change in the investment plans of businesses or in the consumption and saving plans of households can trigger a larger change in the equilibrium GDP International Trade and Equilibrium Output o Exports create domestic production, income and employment for a nation o Added as a component of each nation’s aggregate expenditures o Imports reduces domestic production o C + I + (X-M) o Net export > 0 increase aggregate expenditures and GDP beyond what they would be in a closed economy o Net export < 0 reduce aggregate expenditures and GDP below what they would be in a closed economy Public Sector o Adding government spending and taxes to the model o Assumptions o Levels of investment and net exports are independent of the level of GDP o Government purchases neither depress nor stimulate private spending o Government net tax revenues derived entirely from personal income o A fixed amount of taxes is collected o Price level is constant o Government purchases o Increases in public spending, like increase in private spending shift the aggregate expenditures schedule upward and result in a higher equilibrium GDP o Government Taxation o Lump sum tax Which is a tax of a constant amount or more precisely a tax yielding the same amount of tax revenue at each level of GDP Taxes cause disposable income to fall short of GDP by the amount of the taxes. This decline of DI reduces both consumption and saving at each level of GDP The MPC and the MPS determine the declines in C and S Increases in taxes lower the aggregate expenditures schedule and reduce the equilibrium GDP Balanced Budget Multiplier o Equal increases in government spending and in taxation increase the equilibrium GEP o If G and T are each increased by a particular amount, the equilibrium level of real output will rise by the same amount o Government spending has a direct and unadulterated impact on aggregate expenditures o Change in taxes affects aggregate expenditures indirectly by changing disposable income and thereby changing consumption o Equal increases in G and T expand GDP by an amount equal to those increases Equilibrium VS Full-Employment GDP o Recessionary GAP o Is the amount by which aggregate expenditure at the full employment GDP fall short of those required to achieve the full employment GDP o Inflationary GAP o Is the amount by which an economy’s aggregate expenditures at the full employment GDP exceed those just necessary to achieve the full employment GDP