What causes shifts in the production possibilities frontier (PPF

advertisement

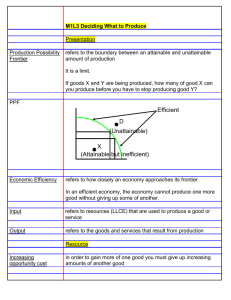

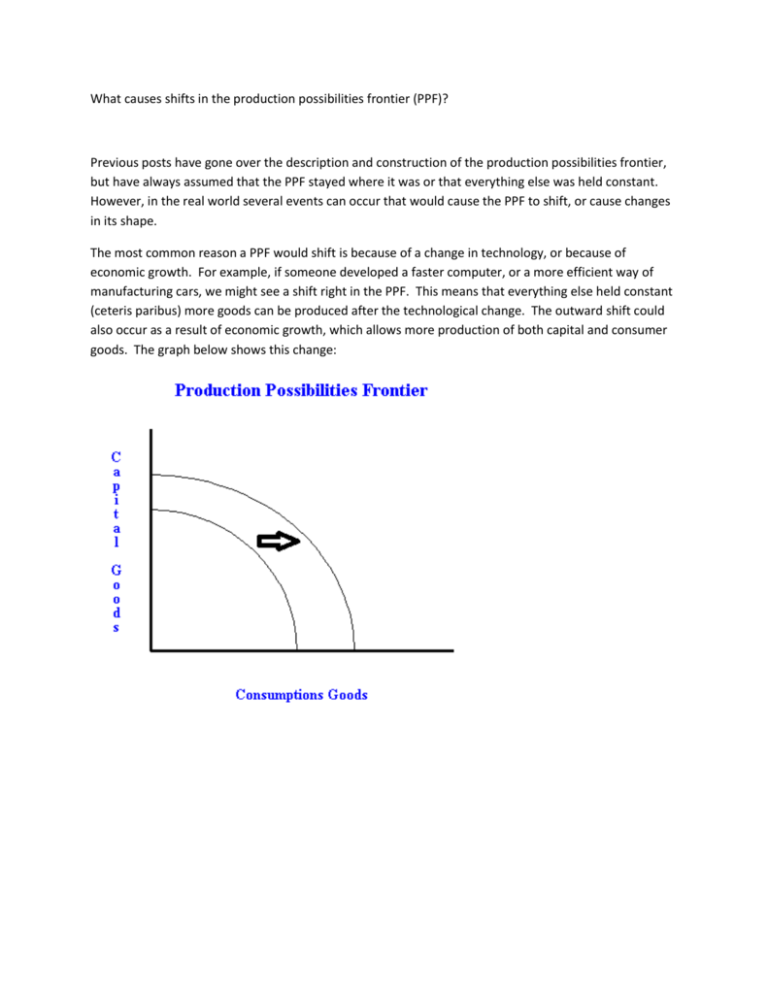

What causes shifts in the production possibilities frontier (PPF)? Previous posts have gone over the description and construction of the production possibilities frontier, but have always assumed that the PPF stayed where it was or that everything else was held constant. However, in the real world several events can occur that would cause the PPF to shift, or cause changes in its shape. The most common reason a PPF would shift is because of a change in technology, or because of economic growth. For example, if someone developed a faster computer, or a more efficient way of manufacturing cars, we might see a shift right in the PPF. This means that everything else held constant (ceteris paribus) more goods can be produced after the technological change. The outward shift could also occur as a result of economic growth, which allows more production of both capital and consumer goods. The graph below shows this change: It is also possible for a natural disaster to hit which destroys some of the inputs in the production process. Imagine if a hurricane took out a factory, then we would see lower production in the economy as a result. This would be shown as follows, in the PPF graph: Likewise, if capital grows over time, then we could see the PPF curve shift out (representing higher possibilities for production: Finally, we could add some dynamics into the shifting process by allowing a choice in capital goods, or consumption goods to affect how much the PPF shifts out. For example, if we choose to produce at point A, then we will have a relatively low amount of consumption goods (pizza, clothes, parties, etc.) and a high amount of capital goods (roads, factories, schools and training), and this will cause the PPF curve to shift out quite a bit. However if we choose to produce at point B, everyone will be happy because they will have a lot of consumption (which gives us utility and thus makes us happy), but in the future we won't have as many capital goods, so the PPF doesn't shift out quite as far. Point A shows a choice high in capital goods, which leads to large growth. Point B shows a choice high in consumption goods, which leads to small growth. Some believe that the United States is at a point closer to B than A right now because of the small investment we are seeing in capital goods. Most people in the United States have a very small savings rate, and spend most of their money on food, entertainment, clothes, and other goods that need to be replaced every year. However, when more money is saved, banks can use that money to invest in larger businesses or houses, which would be around for a long time and would increase our PPF by more.