hw_4 - Homework Market

advertisement

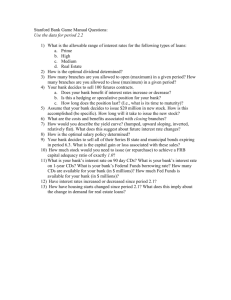

FIN 4310*02*Money and Capital Markets, Spring 2013 Prof. Ananth Narayan Assignment Chapter(s) Group Name Student Name(s) Date HW Assignment # 4 (Chapters 17-20) Banks and Non-Banks 17, 18, 19, 20 Instructions: HW Assignments will be uploaded to Kean Blackboard and must be accessed from there. You must work in groups where assigned (or independently if not assigned to groups) on homework assignments. Points are noted against each question. You are required to submit Home Work assignments electronically on Kean Blackboard using MS-Office or other text editor. You are required to complete your assignments as per the due date indicated by the Professor. Total Points in Assignment: 150 (Points scored will be scaled down to a maximum of 15 towards the final grade) Chapter 17: 1. Managing in Financial Markets (5 points) As a consultant, you have been asked to assess a bank’s sources and uses of funds, and to offer recommendations on how it can restructure its sources and uses of funds to improve its performance. This bank has traditionally focused on attracting funds by offering certificates of deposit (CDs). It offers checking accounts and money market deposit accounts (MMDAs), but it has not advertised these accounts because it has obtained an adequate amount of funds from the CDs. It pays about 3 percentage points more on its CDs than on its money market deposit accounts, but the bank prefers knowing the precise length of time that it can use the deposited funds. (The CDs have a specified maturity whereas the MMDAs do not.) Its cost of funds has historically been higher than that of most banks, but it has not been concerned because its earnings have been relatively high. The bank’s use of funds has historically been focused on local real estate loans to build shopping malls and apartment complexes. The real estate loans have provided a very high return over the last several years. However, the demand for real estate in the local area has slowed. a. Should the bank continue to focus on attracting funds by offering CDs, or should it push its other types of deposits? b. Should the bank continue to focus on real estate loans? If the bank reduces its real estate loans, where should the funds be allocated? c. How will the potential return on the bank’s uses of funds be affected by your restructuring of the asset portfolio? How will the cost of funds be affected by your restructuring of the bank liabilities? 2. TD Bank (10 points) Attached is the 2011 financial statements as disclosed by TD Bank. Review the Consolidated Balance FIN 4310*02*Money and Capital Markets, Spring 2013 Prof. Ananth Narayan HW Assignment # 4 (Chapters 17-20) Sheet data as well as the accompanying footnotes to answer the following questions: TD Bank 2011 Financial Statements.pdf a. Identify at least three sources of funds for the bank as of the end of 2011 b. Identify at least three uses of funds for the bank as of the end of 2011 c. Comment on how similar or different TD Bank is from the summary sources and uses of funds for banks as published by the Federal Reserve (indicated in the textbook and reproduced below): Summary Sources of Funds for all banks Summary Uses of Funds for all banks Chapter 18: 3. Off-Balance Sheet Activities. (3 points) Provide examples of off-balance sheet activities. Why are regulators concerned about them? 4. Value at Risk (3 points) Explain how the value at risk (VaR) method can be used to determine whether a bank has adequate capital. FIN 4310*02*Money and Capital Markets, Spring 2013 Prof. Ananth Narayan HW Assignment # 4 (Chapters 17-20) 5. Impact of SOX on Banks. (3 points) Explain how the Sarbanes-Oxley (SOX) Act improved the transparency of banks. Why might the act have a negative impact on some banks? 6. Managing in Financial Markets (4 points) A bank has asked you to assess various strategies it is considering, and explain how they could affect its regulatory review. Regulatory reviews include an assessment of capital, asset quality, management, earnings, liquidity, and sensitivity to financial market conditions. Many types of strategies can result in more favorable regulatory reviews based on some criteria but less favorable regulatory reviews based on other criteria. The bank is planning to issue more stock, retain more of its earnings, increase its holdings of Treasury securities, and reduce its business loans. The bank has historically been rated favorably by regulators, yet believes that these strategies will result in an even more favorable regulatory assessment. a. Which regulatory criteria will be affected by the bank’s strategies? How? b. Do you believe that the strategies planned by the bank will satisfy shareholders? Is it possible for the bank to use strategies that would satisfy both regulators and shareholders? Explain. Chapter 19: 7. Liquidity. (3 points) Given the liquidity advantage of holding Treasury bills, why do banks hold only a relatively small portion of their assets as T-bills? 8. Managing Interest Rate Risk. (3 points) If a bank expects interest rates to decrease over time, how might it alter the rate sensitivity of its assets and liabilities? 9. Managing Interest Rate Risk. (3 points) Assume that a bank expects to attract most of its funds through short-term CDs and would prefer to use most of its funds to provide long-term loans. How could it follow this strategy and still reduce interest rate risk? 10. Managing Interest Rate Risk. (3 points) If a bank has more rate-sensitive assets than rate-sensitive liabilities, what will happen to its net interest margin during a period of rising interest rates? During a period of declining interest rates? FIN 4310*02*Money and Capital Markets, Spring 2013 Prof. Ananth Narayan HW Assignment # 4 (Chapters 17-20) 11. Managing Risk. (15 points) Use the balance sheet for San Diego Bank in Exhibit A (below and next page) and the industry norms in Exhibit B (page following Exhibit A) to answer the following questions: a. Estimate the gap and determine how San Diego Bank would be affected by an increase in interest rates over time. b. Assess San Diego Bank’s credit risk. Does it appear high or low relative to the industry? Would San Diego Bank perform better or worse than other banks during a recession? c. For any type of bank risk that appears to be higher than the industry, explain how the balance sheet could be restructured to reduce the risk. d. What is San Diego Bank’s Leverage Measure? If San Diego Bank generated $80 Million in after tax profit, what is its ROE? e. Comment on how San Diego Bank compares to the industry regarding use of Leverage. What strategies can you recommend for the bank to improve its ROE? Exhibit A: Balance Sheet for San Diego Bank (in Millions of Dollars) Assets Required reserves $800 Commercial loans Floating-rate None Fixed-rate $7,000 Total Liabilities and Capital Demand deposits $800 NOW accounts $2,500 MMDAs $6,000 $7,000 CDs Consumer loans $5,000 Mortgages Floating-rate None Fixed-rate $2,000 Total Treasury Short-term From 1 to 5 years $9,000 None Total $9,000 Federal funds $500 Long-term bonds $400 $2,000 years FIN 4310*02*Money and Capital Markets, Spring 2013 Prof. Ananth Narayan HW Assignment # 4 (Chapters 17-20) securities Short-term None Long-term $1,000 Total Capital $800 $1,000 Long-term corporate securities High-rated None Moderate-rated $2,000 Total $2,000 Long-term municipal securities High-rated None Moderate-rated $1,700 Total Fixed assets TOTAL ASSETS $1,700 $500 $20,000 TOTAL LIABILITIES AND CAPITAL $20,000 FIN 4310*02*Money and Capital Markets, Spring 2013 Prof. Ananth Narayan HW Assignment # 4 (Chapters 17-20) Exhibit B: Industry Norms in Percentage Terms Assets Liabilities and Capital Required reserves 4% Commercial loans Floating-rate 20% Fixed-rate 11% Total Demand deposits 17% NOW accounts 10% MMDAs 20% 31% CDs Consumer loans 20% Mortgages Short-term 35% From 1 to 5 years 10% Total Floating-rate 7% Fixed-rate 3% Total 45% Long-term bonds 2% Capital 6% 10% Treasury securities Short-term 7% Long-term 8% Total 15% Long-term corporate securities High-rated 3% Moderate-rated 2% Total 5% Long-term municipal securities High-rated 3% Moderate-rated 2% Total Fixed assets TOTAL ASSETS 5% 5% 100% ___ TOTAL LIABILITIES AND CAPITAL 100% FIN 4310*02*Money and Capital Markets, Spring 2013 Prof. Ananth Narayan HW Assignment # 4 (Chapters 17-20) Chapter 20: 12. Interest Income. (3 points) How can gross interest income rise, while the net interest margin remains somewhat stable for a particular bank? 13. Impact on Income. (3 points) If a bank shifts its loan policy to pursue more credit card loans, how will its net interest margin be affected? 14. Analysis of a Bank’s ROA. (3 points) What are some of the more common reasons for a bank to experience a low ROA? 15. Managing in Financial Markets (6 points) As a manager of Hawaii Bank, you anticipate the following information provided to you: Loan loss reserves at end of year = 1 percent of assets Gross interest income over the next year = 9 percent of assets Noninterest expenses over the next year = 3 percent of assets Noninterest income over the next year = 1 percent of assets Gross interest expenses over the next year = 5 percent of assets Tax rate on income = 30 percent Capital ratio (capital/assets) at end of year = 5 percent a. Forecast Hawaii Bank’s net interest margin. b. Forecast Hawaii Bank’s earnings before taxes as a percentage of assets. c. Forecast Hawaii Bank’s earnings after taxes as a percentage of assets. d. Forecast Hawaii Bank’s return on equity. e. Hawaii Bank is considering a shift in its asset structure to reduce its concentration of Treasury bonds and increase its volume of loans to small businesses. Identify each income statement item FIN 4310*02*Money and Capital Markets, Spring 2013 Prof. Ananth Narayan HW Assignment # 4 (Chapters 17-20) that would be affected by this strategy, and explain whether the forecast for that item would increase or decrease as a result. 16. How the Flow of Funds Affects Bank Performance (5 points) In recent years, Carson Company has requested the services listed below from Blazo Financial, a financial conglomerate. These transactions have created a flow of funds between Carson Company and Blazo. a. Classify each service according to how Blazo benefits from the service. advising on possible targets that Carson may acquire, futures contract transactions, options contract transactions, interest rate derivative transactions, loans, line of credit, purchase of short-term CDs, checking account. b. Explain why Blazo’s performance from providing these services to Carson Company and other firms will decline if economic growth is reduced. c. Given the potential impact of slow economic growth on a bank’s performance, do you think that commercial banks would prefer that the Fed use a tight-money policy or a loose-money policy? 17. Forecasting Bank Performance (75 points in total) As an analyst of a medium-sized commercial bank, you have been asked to forecast next year’s performance. In June you were provided with information about the sources and uses of funds for the upcoming year. Answer all questions as laid out in the below attachment. Forecasting Bank Performance Integ Problem.pdf this pdf file is the website beneath this… http://blackboard9.kean.edu/bbcswebdav/pid-77391-dt-content-rid185884_1/courses/13SP_FIN_4310_02/HW4%20Ques%2017.pdf FIN 4310*02*Money and Capital Markets, Spring 2013 Prof. Ananth Narayan SCORING SHEET: Chapter 17 Ques# 1 2 18 3 4 5 6 3 3 3 4 19 7 8 9 10 11 3 3 3 3 15 20 12 13 14 15 16 17 3 3 3 6 5 75 TOTAL Max Points Points awarded 5 10 150 HW Assignment # 4 (Chapters 17-20)