stress-testing models

advertisement

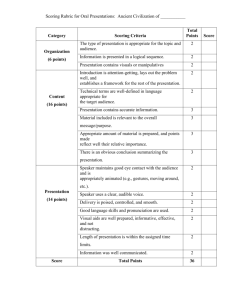

JJ Mois Année SMILOVICE Jan Neckař Dana Chromíková B2 - CONCEPT EXPECTED LOSS Basel II concept differs two types of loss: UNEXPECTED LOSS LOSSES IN TIME 8% 7% 6% loss 5% Unexpected loss 4% 3% 2% Expected loss 1% 0% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Frequency Years 2 Scoring Unit (SCOR) April 2008 B2 - CONCEPT BASEL II CONCEPT – distribution of the losses CAPITAL RESERVES MAINTENANCE STRESS TESTING FREQUENCY Creation of Provisions Covered by SRC VALUE AT RISK Probability 99,9% Probability 0,1% LOSS 3 Scoring Unit (SCOR) April 2008 B2 - CONCEPT EXPECTED LOSS EL = PD * LGD * EAD PD – probability of default - estimation of probability then client is longer than 90 days delayed with payments, insolvency, … LGD – loss given default - estimation of the resulting economic loss after the recovery process - conditional estimation in case of client is in default EAD – exposure at default - conditional estimation of exposures in case of client is in default - average drawing at default is higher than outside default EL = PD*E(loss|default) + (1-PD)*E(loss|nedefault) = PD * LGD * EAD 4 Scoring Unit (SCOR) April 2008 B2 - CONCEPT UNEXPECTED LOSS – CAPITAL REQUIREMENT Tier1 + Tier2 ≥ 8% * Σ RW * EAD & Tier1 ≥ Tier2 R 1 1 M 2,5 bPD RW LGD N GPD G0,999 PD 12,50 Scaling Factor 1 R 1 1,5 b PD 1 R N(x) – distribution function of normalized normal distribution of random quantity G(x) – inversion function to distribution function of normalized normal distribution Scaling factor – according to direction of ČNB is equal to 1,06 Maturity (M) – Average maturity of the expected cash-flows (repayments) Factor of maturity 2 b(PD) 0,11852 - 0,05478 ln PD Correlation factor R for retail exposures (excl. Mortgages = 0,15, qualifying revolving = 0,04): 1 e 35PD 1 e 35PD R 0,03 0,16 1 35 1 e 35 1 e Correlation factor for non-retail exposures: 1 e 50PD 1 e 50PD max(min( S ,50),5) 5 R 0,12 0,24 1 0,04 1 50 1 e 50 1 e 45 S – Annual sales for the consolidated group (million EUR) 5 Scoring Unit (SCOR) April 2008 B2 - CONCEPT UNEXPECTED LOSS – CAPITAL REQUIREMENT 6 Scoring Unit (SCOR) April 2008 STRESS-TESTING Behavior under stress is not easy to predict 7 Scoring Unit (SCOR) April 2008 STRESS-TESTING LOSSES IN TIME 16% 14% BASELINE 12% DEPRESSION loss 10% 8% 6% 4% 2% 0% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Frequency Years 8 Scoring Unit (SCOR) April 2008 STRESS-TESTING STRESSED CHARACTERISTICS STRESS-TESTING MODELS STRESS SCENARIOS ECONOMETRIC MODEL 9 Scoring Unit (SCOR) April 2008 STRESS-TESTING ECONOMETRIC MODEL & STRESS-TESTING SCENARIOS Econometric model predicts the macroeconomic characteristic as: GDP unemployment interest rates inflation / deflation price of oil … These models have usually 50 – 100 formulas and above 200 parameters There are several various of predictions, called as scenarios: baseline depression deep depression high inflation … The most probable scenario is selected for development of the model. 10 Scoring Unit (SCOR) April 2008 STRESS-TESTING STRESS-TESTING MODELS Stress testing = a way how to measure risk of extreme but realistic events Modeled via scenarios for macroeconomics characteristics We assume that portfolio depends on macroeconomic situation and we need to find relation between stressed variable (PD, LGD, CCF) and macroeconomic characteristics: Example for stressing PD: PDt = f (Mt1) t ≥ t1, f (Mt1) function of macroeconomic characteristics Two type of models: Logistic regression Factor model based on Merton’s model 11 Scoring Unit (SCOR) April 2008 STRESS-TESTING STRESS-TESTING MODELS Logistic regression EY 1 k 1 exp( i X i ) i 0 Y is explained variable (indicator of default), EY is probability of default X ( X 1 ,..., X k ) is vector of explanatory variables (macro-economic indicators). Main advantages of this model: Basic statistical model used for modelling 0-1 variable with good mathematical properties 12 Scoring Unit (SCOR) April 2008 STRESS-TESTING Factor model based on Merton’s model STRESS-TESTING MODELS Rit Ft 1 U it Where Rit is logarithmic change of client’s asset Ft is systematic factor U it is specific factor Ait Rit log Ai (t 1) Ft N (0,1) U it N (0,1) cor ( Rit , R jt ) cor ( Rit , Ft ) 13 Scoring Unit (SCOR) April 2008 STRESS-TESTING Factor model based on Merton’s model STRESS-TESTING MODELS P(Yit 1) P( Rit C ) Yit J 1 in case of default C 0 j x jt 0 in case of non-default j 1 Probability of default PDit P(Yit 1) P( Rit C ) J J j 1 j 1 P( Ft 1 U it 0 j x jt ) ( 0 j x jt ) 14 Scoring Unit (SCOR) April 2008 STRESS-TESTING STRESS-TESTING MODELS Factor model based on Merton’s model Conditional probability of default: J 0 j x jt f t j 1 PDit ( f t ) P(Yit 1 | Ft f t ) PU it 1 Likelihood function derivated from binomial distribution of default rate: J 0 j x jt f t T n j 1 l ( 0 ,..., J , ) log t 1 t 1 d t 15 Scoring Unit (SCOR) dt J 0 j x jt f t j 1 1 1 nt d t ( f t )df t April 2008