Understanding Credit Reports and Scores

advertisement

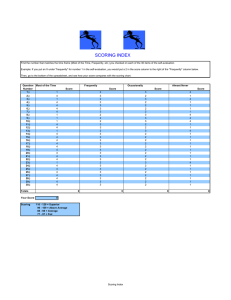

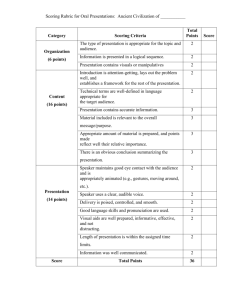

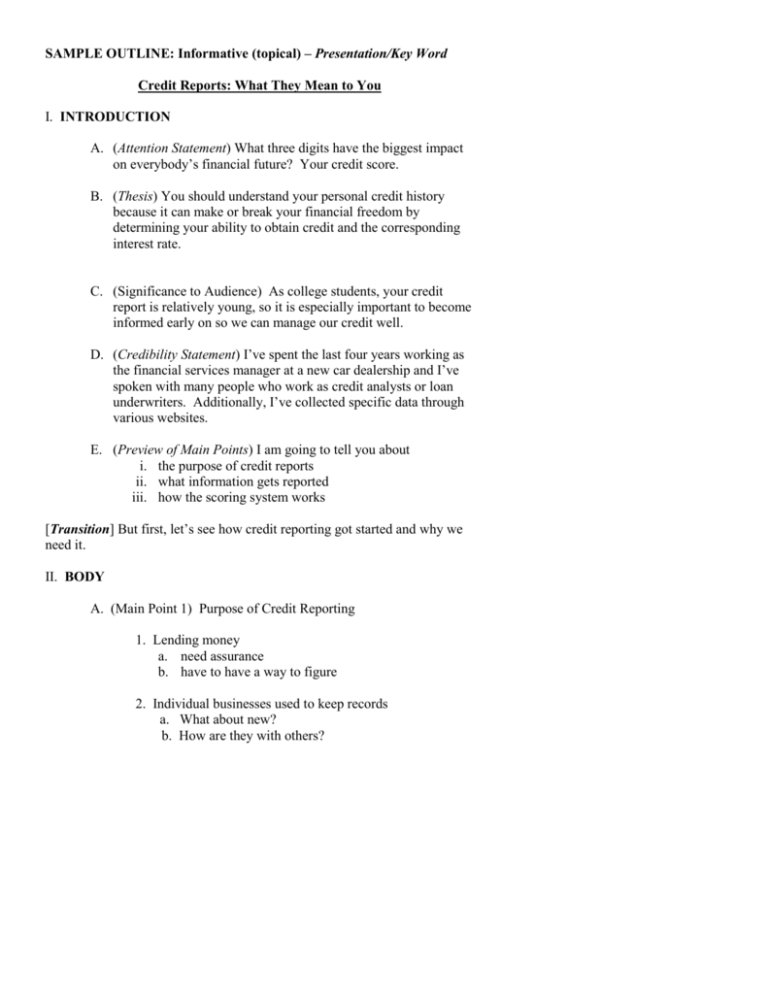

SAMPLE OUTLINE: Informative (topical) – Presentation/Key Word Credit Reports: What They Mean to You I. INTRODUCTION A. (Attention Statement) What three digits have the biggest impact on everybody’s financial future? Your credit score. B. (Thesis) You should understand your personal credit history because it can make or break your financial freedom by determining your ability to obtain credit and the corresponding interest rate. C. (Significance to Audience) As college students, your credit report is relatively young, so it is especially important to become informed early on so we can manage our credit well. D. (Credibility Statement) I’ve spent the last four years working as the financial services manager at a new car dealership and I’ve spoken with many people who work as credit analysts or loan underwriters. Additionally, I’ve collected specific data through various websites. E. (Preview of Main Points) I am going to tell you about i. the purpose of credit reports ii. what information gets reported iii. how the scoring system works [Transition] But first, let’s see how credit reporting got started and why we need it. II. BODY A. (Main Point 1) Purpose of Credit Reporting 1. Lending money a. need assurance b. have to have a way to figure 2. Individual businesses used to keep records a. What about new? b. How are they with others? 3. According to Lee Ann Obringer, a staff writer for HowStuffWorks.com, the first third-party credit reporting agencies were established in the 1830’s. a. The three major today i. Transunion ii. Experian iii. Equifax [Transition] Now that we know how these companies got started, let’s talk about exactly what information they report about you. B. (Main Point 2) The Information on a Credit Report 1. Variety of sources a. merchants – lenders – employers – landlords – courts 2. Start with personal identifying information a. name – addresses – social security – date of birth – employment info 3. Next, public records section -- tax liens - civil judgments – bankruptcies - court ordered liabilities. 4. Then, the lengthiest -- credit history a. credit cards - charge accounts - lines of credit – secured loans - car loans – mortgages i. both paid and unpaid, as well as late payment. 5. Then report inquiries -who has viewed in the last two years. 6. Finally, consumer statements i. prior fraud victim ii. currently being disputed. 7. Doesn’t include bank account, race, religion, health records, criminal records, income, or driving records. [Transition] Now that you know what comprises a report, let’s see how all this information gets turned into a three digit score. C. (Main Point 3) How the Scoring System Works 1. According to a recent survey conducted by HSBC, 7 in 10 consumers don’t know their credit score and nearly 50% don’t know what comprises the score. 2. Developed - Fair Isaac Company 1981. a. By 1991, all three major --credit risk scoring -each company with its own variations. 3. Also known as fico scores range 300 and 850. i. higher, the lesser the credit risk. ii. 600s average iii. higher than 720 very good. 4. payment history - 35% a. debt - 30%. b. length of history - 15% c. new credit - 10%. d. other factors - mix of credit types - 10%, but slight effects [Transition] Knowing your score and how it’s determined is very important so that you can keep tabs on the accuracy of that information. III. CONCLUSION A. (Review of main points) I hope that I’ve been able to inform or at least clarify the purpose of credit reports, the information included, and what comprises a credit score. B. (Re-state Thesis) You should understand your personal credit history because it can have a major impact on your borrowing privileges. C. (Dynamic Closure) So if you’re interested in getting the best jobs, the nicest homes, and saving thousands of dollars, treat your credit like a best friend, because you’ll be together forever.