Bad Debts & Doubtful Debts: Accounting Worksheet

advertisement

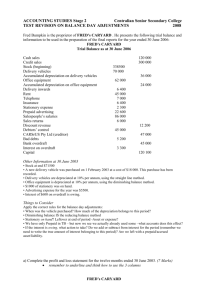

Bad debts Explanation If a business finds it impossible to collect debt then the debt should be ‘written off’ as a bad debt. A bad debt is therefore an expense for the business. MP Ltd sold goods costing £50 to Mr Farnish. Unfortunately Mr Farnish is experiencing financial difficulties and is unable to pay his debt. MP Ltd also sold goods costing £240 to Mr Goldstone. Mr Goldstone paid £200, but is unable to pay the remaining £40. Using white boards, show the affects of these bad debts on the three accounts Example Dr Sales Mr Farnish Account Cr £ £ 50 Dr Bad debts 50 Mr Goldstone Account £ 240 Sales Dr Cr £ 200 40 Cash Bad debts Bad debts Account Dr Mr Farnish Mr Goldstone £ 50 40 90 Cr Profit & Loss a/c Cr £ 90 Provision for bad debts It is impossible to determine with absolute accuracy how much the value of bad debts will be. In order to arrive at a figure of doubtful debts, a business must first consider that some debtors will never be able to pay whilst other might be able to pay a some of the debt. A doubtful debt = not sure if the debt can be repaid A bad debt = the debt will not be repaid Some businesses make an ‘aging schedule’ showing how long the debts have been owing. The longer the debt has been owed the more likely these debts will be turned in to ‘bad debts’ Period debt owing £ % doubtful Allowance 1-4 weeks 5,000 1 50 5-7 weeks 3,000 3 90 8-10 weeks 800 4 32 10-15 weeks 200 5 10 Example At 31 December 2011, the accounts receivable figure after deducting bad debts was £10,000. it is estimated that 2% of the debts (£200) will eventually prove to be bad debts and it is decided to make a provision for these. Profit & Loss Dr Allowance for doubtful debts £ 200 Allowances for doubtful debt £ Cr Dr £ £ Cr Profit & loss 200 Example A business started on 1 January 2007 and its financial year end is 31 December. A table of debtors, the bad debts written off and the estimated doubtful debts at the rate of 2% of debtors at the end of each year, as well as the double entry accounts are below. See worksheet Assessment 1 Hart & Partners started a business on January 1 2009. During its first year of trading the following debts were found to be bad and the business decided to write them off as bad: May 16 Bayley £550 July 31 Carter £223 Nov 9 Roche £467 On 31 December 2009, the schedule of remaining debtors, amounting in total to £26,000, is examined and it is decided to make a provision for doubtful debts of 2%. 1. Show the bad debts account and the provision for doubtful debts account 2. The charge to the profit & loss account 3. The relevant extracts from the balance sheet Assessment 2 Date Total debtors 2007 7000 2008 8000 2009 6000 2010 7000 Profit & Loss Dr / Cr Final figure for Balance sheet The table shows the figure for debtors appearing in a trader’s books. The provision for doubtful debt is to be 1% of debtors. Complete the table indicating the amount to be debited or credited to the profit & loss accounts for the final year ended and the amount for the final figure of debtors to appear in the balance sheet on each date. Questions – In a new business during the year ended 31 December 2013, the following debts are found to be bad, and are written-off on the dates shown: 31 May S.Gill & Son £600 30 Sept H.Black Ltd £400 30 Nov A.Thom £200 On 31 December the schedule of remaining accounts receivable totalling £15,000 is examined and it is decided to make an allowance for doubtful debts of £500. You are required to show: a. The bad debts a/c and the allowance for doubtful debts a/c b. The charge to the income statement c. The relevant extracts from the statement of financial position as at 31 December 2013 Allowance for doubtful debts a/c Bad debts a/c Dec 31 May 31 S.Gill & Son 600 Dec 31 P&L 500 P&L 1,200 Sep 30 H.Black Ltd 400 Nov 30 A.Thom 200 1,200 1,200 Income statement (extract) Sales: COGS Gross Profit Expenses: Bad debts Allowance for doubtful debts ... ... Net Profit Statement of financial position (extract) Fixed Assets: Current Assets: Debtors - £15,000 less allowance for doubtful debt (£500) £14,500 Liabilities Capital employed Question 2 A business had always made an allowance for doubtful debt at the rate of 2% of accounts receivable. On 1 January 2011 the amount for this brought forward from the previous year was £300. During the year to 31 December 2011 the bad debts written-off amounted to £700 On 31 December the accounts receivable balance was £17,000 and the usual allowance for doubtful debt was made (2%) You are required to show: •The dab debts account for the year ended 31 December 2011 •The allowance for doubtful debts account for the year •Extract from the income statement •Extract from the statement of financial position. Bad debts a/c Allowance for doubtful debts a/c Jan 1 bal b/d 300 Dec 31 bal c/d 340 Dec 31 P&L 40 340 340 Homework – 1. finish bad debt work book 2. Draw a bad debt poster on the last 2 pages in the bad debt work book explaining the process of bad debts. Use page 285-294 to help you. Tuesday