see presentation - Clean Slate Ltd

advertisement

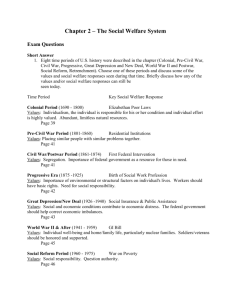

Welfare Network UNDERSTAND WELFARE REFORM Michael Fothergill michael.fothergill@crisis.org.uk 020 7426 8504 THE WORK PROGRAMME Work Programme was introduced in June 2011 Delivered by a Framework of 18 Prime Contractors – one ‘Lot’ for Gloucestershire, Wiltshire and west of England with one Contract Package Area (CPA 12), and 2 Prime Contractors Prime Contractors – CPA 12 JHP Group 22% self delivery, and Rehab Job Fit 0% self delivery ~ managing agent Sub-contracts ~ 1ST tier ‘end to end’ - 20 organisations, 2nd tier spot purchase/ specialist intervention – 46 organisations – unusual split due to status of Primes Actual contracts forecast prices to 1st April 2016 ~ JHP Group ~ £43.7m, and Rehab Job Fit ~ £54.8m The Employment Related Support Services Framework can include consortia bids, ESF contracts, and any other employment related support service contracts (15 in the West Midlands) ESF and the Work Programme ~ IB/IS voluntary programme = £66 million / Families with Multiple Problems = £200 million Benefit forecast - £190 billion in 2011/12 WELFARE REFORM ‘THE WORK PROGRAMME’ Attachment fee / job outcome fee / sustainment fee – maximum £13529, minimum £3996 £15,000 £14,000 £9,429 £13,000 £12,000 Sustainment payments £11,000 £10,000 £9,000 £8,000 Job outcome payment £5,327 £7,000 £4,859 £4,405 £6,000 £5,000 £2,994 £2,396 £4,000 £2,007 Attachment fee £3,000 £2,000 £1,200 £1,200 £1,200 £1,000 £0 £400 1. JSA 25+ £400 2. JSA 18-24 £400 4. JSA seriously disadvantaged £1,200 £400 3. JSA Ex-IB £1,200 £600 6. ESA Flow £3,500 £600 7. ESA Ex-IB £1,000 £400 5. ESA volunteers WELFARE REFORM WELFARE BENEFITS PROPOSALS The White Paper 11 November 2010 – Welfare Reform Bill February 2011 LHA rates will be subject to caps ranging from £250 per week for a 1 bedroom property to £400 per week for a 4 bedroom property – new claims April 2011, existing claims January 2012 Shared Accommodation Rate extended to 35 year olds – exemptions for people who have lived in a hostel for 3 months / ex-offenders ~ serious risk to the public HB on a property that is deemed bigger than their needs – already applies to the PRS Excess payments of up to £15 to claimants of Local Housing Allowance (LHA) where contractual rent is lower than the rate of LHA will be scrapped Discretionary housing payment (DHP) budget to rise (From 2012, Estimated additional expenditure: £10 million in 2011 and £40 million thereafter) Social housing rents will increase for new tenants to 80% of the market rental value – 150,000 new homes over 4 years/ limiting social tenancies depending on financial capacity (2 year review) LHA Transition Fund - £4 million boost for innovative projects to support HB reforms 2011/12 ~ liaison between tenants and landlords - £15m for the next three years post 2011/12 WELFARE REFORM WELFARE BENEFITS PROPOSALS The White Paper 11 November 2010 – Welfare Reform Bill February 2011 The Social Fund to be abolished in April 2013 – Crisis Loans and Community Care Grants budgets to be administered by local authorities (social services) Budgeting Loans budget will stay with DWP and form part of the Universal Credit Cap of £500 per week on benefits for families - £26,000 per year Cap of £350 per week on benefits for single people - £18,200 per year Conditionality – refusal to take up job offer – 1st up to 3 months, 2nd up to 6 months, 3rd up to 3 years (housing costs will not be sanctioned) ‘Conditionality threshold’ – will be removed when a certain number of hours of work being undertaken (amount earned at NMW rather than hours worked) DLA to Personal Independence Payment (PIP) – 2013/14 – 6 month not 3 month waiting time (trial WCAs – Atos Healthcare and G4S) Linking rules for ESA, IB/IS clients abolished from January 2011 Joint conditionality for couples without children Introduction of the ‘claimant commitment’ WELFARE REFORM WELFARE BENEFITS PROPOSALS The White Paper 11 November 2010 – Welfare Reform Bill February 2011 Higher earnings disregards for people with children and people with disabilities – not single people = Couple £3000 + £2700 per child, lone parent £5000 and £2700 per child, disabled people £7000 Universal Credit will not replace non-means tested benefits – JSA, ESA, DLA, CHB, SSP, SMP, MA and IIDB The Enterprise Allowance Monthly payments of the Universal credit? Universal Credit will be implemented by Oct 2013, with migration of old cases taking place between April 2014 to October 2017 All administered by DWP Passported benefits Legal Aid (debt, employment, benefits – not homelessness, mental health, asylum seekers) Official error overpayments WELFARE REFORM WELFARE BENEFITS PROPOSALS ~ 21st Century Welfare A Universal Credit: this combines elements of the current income-related benefits and Tax Credits systems (thus subsuming the tax credit system). There would be additional payments, reflecting circumstances (including children, housing and disability). Universal Credit would be delivered through a new system which would use up-to-date earnings information from employers to calculate Universal Credit on a household basis – 31 benefits into one ! To be implemented over the next two terms of Parliament by October 2013 Real time payment system Will keep up to 35% of their extra income until