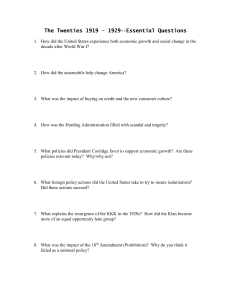

Causes of the Great Depression

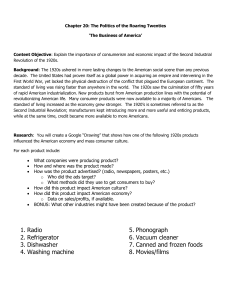

advertisement

Bellringer • • The Harlem Renaissance was • A rebirth of negro spirituals • A rebuilding of New York buildings • An African American cultural movement • A movement of African Americans from the South to Harlem What was the name given to New York City’s song writers during the 1920s, including Irving Berlin? • Tin Pan Alley • Renaissance • Flappers • Harlem Renaissance • • Who was a writer who became a leading voice of the African American experience in the 1920s? • Bessie Smith • Langston Hughes • Louis Armstrong • Duke Ellington How did radio change the lives of Americans in the 1920s? • People were able to listen to up-todate news daily • Music became popular • Commercials helped people to know what businesses were in surrounding communities • Many people entered the entertainment business in the 1920s due to the invention of radio Causes of the Great Depression Causes of the Great Depression • Farmers’ crisis/ Over production -surplus of goods, falling prices • Lower Wages • Under consumption -b/c people were in debt • Credit buying- too much access to easy money • Tariffs -stopped foreign goods from coming into the U.S., but also slowed down foreign trade (exports out of the US) Were the 1920s really “roaring?” • Buying on Credit • People wanted to live the “good life,” which meant indulging themselves with the hottest commodities (i.e. the automobile) • In order to afford these items, people bought them on credit- pay a little now, and pay the rest back later with a low interest rate • Effect: People had a FALSE sense of prosperity Stock Market Speculation • Stocks give the owner the ability to share in the profits if a company does well, or suffer losses if a company does poorly • During the 1920s, the stock market was described as a bull market- in which prices steadily rose (so if you invested, you were sure you were going to make $$) Were the 1920s really “roaring?” • Over-speculation of stock market • The stock market seemed like such an easy way to make money • That is when OVER-speculation occurred. Everyone bought stocks at low prices, even if they could not afford the low prices • Stock prices did NOT reflect the true success of the business • You could take out a loan to buy stock (MARGIN!) • People who bought stocks on margin risked losing a lot of money (that they didn’t have) if the prices of stocks went down. Underconsumption • Few consumers had the money to purchase goods • Under-consumption led to lower prices which resulted in the loss of money for farmers and manufacturers Overproduction Farmers Overproduce: -The wide spread switch from horse-drawn to mechanized farm equipment allowed farmers to increase their production of crops -Overproduction led to major price reductions, causing farmers to lose money and the ability to pay back farm loans Scenario • You are a farmer; the year is 1927. You are bitter because your family has not shared in the urban prosperity that you have been hearing about. Your expenses for farm machinery are increasing at the same time agricultural prices (and your income) are dropping. You have watched the value of stocks continue to increase. You not only want to be able to feed your family, but you want to be wealthy enough to buy a car one day. If you buy a stock that rises in price, you may be able to accomplish all of these goals. You have heard about the successes of the radio maker, RCA and you want to invest, however, you cannot afford the full price of the stock. What will you do? Scenario (Cont) • You buy 5 shares of RCA. You took out a loan from a local bank, and each share should cost you $10. But, since you are paying on margin, you only have to pay $10 immediately, and you will owe the bank $40. You run to make your purchase, and you continue to check the value of your stock. • A week later, each share of RCA is valued at $12. • The stock continues to rise, and you almost made back the original money that you had borrowed (you still owed interest), and the price of RCA dropped slightly. What will you do? Scenario (Cont) • Good for you if you held on, the price of RCA is up to $50 a share! You felt relieved! Maybe you would be able to afford that car by 1929. • Then, in September of 1929, prices began to fall again. You figured the prices would again rise, so you held on to your stock. • On Thursday October 24th, your stock took a huge plunge. It went from $35 dollars a share to $18 dollars a share (in one day!). You don’t know what to do. You begin to panic, but you still hold on. • The next day, your stock dropped even further, to $11. What will you do? The Stock Market Crash of 1929 • October 24th- Black Thursday, when stock prices plunged and people panicked and pulled out their investments (sold their shares) • Oct. 29th- Black Tuesday- when the “bottom fell out of the market”- prices dropped to an all time low • As the prices dropped, people panicked and continued to sell, causing the prices to drop even further • People who bought stock on margin could not pay back the investors Stock Market Crash • Banks who had loaned all of the money to buy on margin could not get their money back • This resulted in bank failures • While the crash of the stock market was NOT the only cause of the Great Depression, it was a major blow to the economy, and it made it impossible for the American and world economy to revive itself