market failures

advertisement

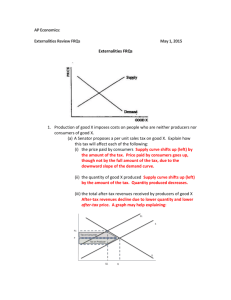

MARKET FAILURES Externalities - markets will not lead to efficiency if actions of producers or consumers affect people other than themselves - when these effects are positive they are external benefits, whenever they are adverse they are external costs Thus the full cost to society (the social cost) of the production of any good or service is the private cost plus and externalities (positive or negative) Four major types of externality 1. External costs of production (MSC > MC) 2. External benefits of production (MSC<MC) 3. External costs of consumption (MSB<MB) 4. External benefits of consumption (MSB>MB) EXTERNALITIES - EXAMPLES 1. External costs of production (MSC > MC) When a chemical firm dumps waste into a river or pollutes the air the community bears costs additional to those borne by the firm 2. External benefits of production (MSC < MC) If a bus company spends money training its bus drivers and some leave each year to join coach and haulage companies these companies costs are reduced as they do not have to train drivers 3. External costs of consumption (MSB < MB) When people use their cars there are costs (negative externalities) with respect to other people e.g. exhaust fumes, noise, congestion etc. This means that the actual level of consumption will be too great from society’s point of view Other examples - noisy radios in public places, smoke from cigarettes and litter EXTERNALITIES - EXAMPLES (con) 4. External benefits of consumption (MSB > MB) When people travel by train rather than by car other people benefit from less congestion, less pollution and fewer accidents on the road Whenever there are external benefits too little will be produced by the market; Whenever there are external costs too much will be produced by the market In short intervention with respect to market forces is justified whenever externalities arise Environmental Problems such as emissions of CO2 gas point to the extremely important implications of negative externalities External costs in production Costs and benefits MSC P MC = S D External cost O Q1 Q2 Social optimum fig Quantity External benefits in production Costs and benefits MC = S MSC External benefit P O D Q1 fig Quantity Q2 Social optimum External costs and benefits in production D P External cost O Q2 Q1 Quantity (a ) External costs MC = S MSC Costs and benefits (£) Costs and benefits (£) MSC MC = S External benefit P O D Q1 Q2 Quantity (b) External benefits Costs and benefits External costs in consumption External cost P D (MB) MU = D MSB O Social optimum Q2 Q1 fig Quantity External benefits in consumption Costs and benefits External benefit P D MSB (MB) MU = D O Q1 fig Quantity Q2 Social optimum External cost P P Costs and benefits (£) Costs and benefits (£) External costs and benefits in consumption External benefit P P MSB MB MB MSB O Q2 Q1 Car miles (a ) External costs O Q1 Q2 Rail miles (b) External benefits PUBLIC GOODS • With some goods and services, the positive externalities are so great that the market (free or imperfect) may not produce at all These are called public goods e.g. lighthouses, street lighting, public service such as police, national security etc Public goods have two important characteristics: non-rivalry and non - excludability Unlike a bar of chocolate, the benefits of street lighting to one individual does not exclude equal benefits to neighbours. So in this sense they are not rivals with respect to obtaining benefits. However money spent by an individual on improving drainage on a road would not exclude benefits to other users. Therefore there would be no incentive for others who would benefit (free riders) to undertake such expenditure MONOPOLY POWER • Even without externalities, a monopoly will fail to produce the socially efficient output • There is what is referred to as a deadweight loss under monopoly consumer and producer surplus Deadweight loss under monopoly MC £ (= S under perfect competition) Monopoly Pm Ppc Consumer surplus Deadweight welfare loss b a Producer surplus AR = D MR O Qpc Qpc fig (b) Industry equilibrium under monopoly Q OTHER MARKET FAILURES • Lack of information and uncertainty - consumers may not be properly informed on prices, aware of quality or perhaps may be unduly influenced by advertising Immobility of factors and time-lags in response Protecting people’s interests - dependents - principal-agent problem Merit and demerit goods Unequal distribution of income GOVERNMENT INTERVENTION • Where a marginal external cost is involved e.g. pollution from an industrial chimney a tax should be imposed (equal to the marginal pollution cost) • If a monopolist makes excessive profits (i.e. supernormal profits) a lump sum tax can be imposed up to the amount of the excess tax • Then if the monopolist is producing less than the cost efficient output a subsidy should be imposed to encourage production up to that level Other methods would involve legal restrictions, regulatory authorities, changes in property rights, provision of information and the direct provision of goods and services Using taxes to correct a market distortion Costs and benefits MSC MC = S Optimum tax = MSC – MC P D MC O Q1 Q2 fig Quantity Using subsidies to correct a market distortion MC = S MSC Costs and benefits MC Optimum subsidy = MC – MSC P O D Q1 fig Quantity Q2 GOVERNMENT INTERVENTION - TAXES AND SUBSIDIES • Used by Gov. to (a) to create greater social efficiency by altering production or consumption (b) to redistribute income Tax should be made equal to marginal external cost (of product or service) and subsidy made equal to marginal external benefit - advantages: can address market imperfections while still allowing market to operate - Disadvantages: impractical to use a range of different taxes and subsidies: can be a lack of knowledge of how to measure external costs and benefits GOVERNMENT INTERVENTION – LAWS AND REGULATIONS • Three types of regulation: - those that prohibit or regulate behaviour that imposes external costs - those that prevent false or misleading information - those that prevent or regulate monopolies and oligopolies Advantages: simple and clear to understand; when dangers are great easier to ban outright than attempt other regulations; easy to take emergency action when required Disadvantages: tend to be a rather blunt instrument - for example if a minimum pollution standard is required to be met by regulation, a firm will have no incentive to improve on that standard REGULATORY BODIES • In most industrial countries “competition policy” is in place to deal with restrictive practices and monopoly practices; here substantial fines (and even prison sentences) can be imposed on offenders • Special regulatory bodies are often put in place in key sectors (with an important public interest) - for example in Ireland there are special regulatory bodies in place with respect to: electricity telecommunications insurance taxis etc. OTHER FORMS OF GOVERNMENT INTERVENTION • Changes in property rights - generally only practical when the number of offenders is few e.g. laws preventing noise from neighbours and even here problems can exist with respect to the costs and effectiveness of litigation - there can also be a question of equity e.g. property owners may strive to limit access to walkways that were formerly treated as rights of way • Provision of information - information on jobs provided by employment centres can facilitate both firms and job seekers OTHER FORMS OF GOVERNMENT INTERVENTION (con) • Direct provision of goods and services - provision of public goods - considerations of social justice - large positive externalities (e.g. free treatment of an infectious disease) - to protect dependants (e.g. provision of primary education) - ignorance (consumers may not realise how much they will benefit from a certain facility DRAWBACKS OF INTERVENTION • When government fixes prices, this can lead to shortages (e.g. rented accommodation) and surpluses (food) • Poor information • Bureaucracy and inefficiency • Lack of market incentives e.g. where subsidies to firms may allow inefficient to survive • Shifts in government policy - may make it difficult for firms to plan efficiently ahead • Lack of freedom for individuals ADVANTAGES OF FREE MARKET • Automatic adjustments • Dynamic advantages of capitalism • A high degree of competition even under monopoly/oligopoly - excessively high profits can encourage others to enter market - competition from closely related industries - threat of foreign competition - countervailing powers - competition for corporate control HEALTH SECTOR Case of Multiple Market Failures - leading to considerable government intervention • Distribution of Income: People may not be able to afford treatment • Uncertainty: Difficulty for people in predicting their future medical needs - to some extent can be dealt with through insurance • Externalities: Health care generates a number of benefits external to the patient (e.g. inoculation against an infectious disease) • Patient Ignorance: - patients may delay seeking treatment until considerable damage is in evidence - the principle agent problem is in evidence • In market system considerable oligopoly likely to exist in terms of provision of health services The Environment: a Case Study • Policy alternatives – charging for use of the environment • emissions charges • user charges • optimum charge = external cost – green taxes and subsidies • use of such taxes around the world – laws and regulations • advantages and disadvantages – education – tradable permits • the European Emissions Trading Scheme • advantages and disadvantages The Environment: a Case Study • How much can we rely on governments? – governments must have the will to protect the environment • depends on attitudes of various interest groups – must be able to identify problems and appropriates solutions – when problems are global: • may require international agreements • governments are likely to be more concerned with their own national interests