discuss12

advertisement

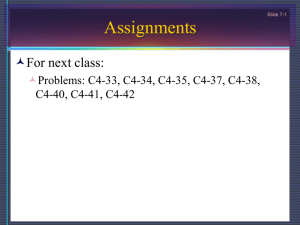

Agenda 4/26 BA 128A • • • • • Questions from lecture Hand in project Review Ch4, Ch9 Assignment C4-29,37 Additional C4-36,40, C9-28 Chapter 4 - current E&P • Calculating current earnings and profits – start with taxable income or NOL – always remember to deduct current federal income taxes Permanent differences – plus income excluded from taxable income but included in E&P • life insurance proceeds, tax-exempt interest income – plus deductions that reduce taxable income but not allowed in E&P • dividends-received deduction • NOL, charitable contribution, capital loss carryover Current E&P calculation – minus expenses and losses not deductible in taxable but allowed in E&P • federal income taxes • excess capital loss not allowed • excess charitable contributions • non deductible fines and penalties etc. Temporary difference – plus income deferred to a later year when computing taxable income but included in E&P in current year • installment sales, like-kind exchanges – plus or minus income and deductions items that is recomputed for E&P • depreciation - ADS for MACRS • LT contracts - % of completion for E&P • depletion - cost depletion, IDC capitalized and amortized Non-liquidating distributions • Dividend - distribution made out of corporation’s E&P • Property as contribution - $, securities of other corporation, and any other property except stock, stock right of distributing corporation • if distributions > E&P - > return of capital, reduce ownership basis • if distributions> ownership basis, excess treated as gain of sale of stock - capital gain Non-liquidating distributions • Distributions net against current E&P first and then accumulated E&P • Distributions come from current E&P as long as the amount < current E&P even though accumulated E&P is in deficit • if distributions made during the year exceed current E&P, current E&P is allocated to those distributions on a pro-rata basia regardless of when the distributions are made, distributions in excess of current will be deducted from accumulated E&P in chronological order Property Distributions- tax consequences to SH • Amount of distribution to shareholder is the property’s FMV, value determined at date of distribution, distribution amount reduced by any liability assumed by shareholder • Basis to shareholders is the FMV (regardless of liability assumed) • Distribution is dividend to the extent of the corp’s E&P Property Distributions- tax consequences to corp • Corporation must recognized gain on distributed property that has appreciated in value • Property’s FMV must be at least the amount of liability assumed by shareholder • Does not recognized loss on distributed property Effect on E&P of corporation • gain recognized by distributed property increase E&P • Tax on the taxable gain on distributed property decrease E&P • Property’s adjusted basis/FMV reduce E&P (if adjMusted basis >= to FMV, reduce E&P with adjusted basis, else reduce E&P with FMV Constructive Dividends • • • • • • Indirect payment to shareholder without formal declaration Likely arise in closely held corporation Loans to shareholders Excessive compensation Excessive compensation for the use of SH’s property Corporate payments for the SH’s benefits e.g. travel expenses • Bargain purchase of corporate property • SH use of corporate property Stock dividends and rights • Stock dividend – tax free – basis allocated between old and new shares – if stocks identical, dividing basis by old + new number of shares – if stocks not identical, use relative FMV to allocate • Stock rights – tax free unless SH’s proportionate interests is/may be changed – stock rights value <15% of stock, basis of rights is zero unless election is made – allocation is made using relative FMV of stock rights and stock Chapter 9 - formation of partnerships • Types of partnerships – general partnerships – limited partnerships – LLC - taxed as partnerships but with limited liability – LLP - similar - more for professional organizations – check the box regulations – electing large partnerships - simplified reporting arrangement Partnership profits and losses • Partnerships - tax reporting entity • partner reports his/her share of income from partnership from the partnership return • partnership has its own tax year and accounting methods • partnership income can office personal losses of individual partners • Partner’s Basis – contribution increase a partner’s basis in the partnership – liability assumed by the partner also increase his/her basis – gain increase partner’s basis – loss decrease partner’s basis until the basis =0 – partner’s personal liabilities assumed by partnership decreases the partner’s basis – partnership distributions are tax free Contribution of property to partnerships • No gain or loss recognized for the partner and partnership if property is cash, tangible and intangible property, services - need to recognized gain • if personal liabilities assumed by partnership exceed basis in partnership, recognize gain • partnership basis of property contributed = partner’s basis before the transfer • Unrealized receivables, basis = 0 • holding period includes the transferor’s holding period • character of gain also transfers over • depreciation recapture also transfers over • apply the same rules after formation of partnership Partnership-reporting of income • Separately stated items and ordinary income/loss • Separately stated items are a list of deductions not deductible in the partnership income calculation but deductible for individuals (partners). – Foreign income taxes paid, charitable contributions, NOL carryovers and carrybacks etc.. – These items are deducted later on in partners’ individual return • Ordinary income are things such as gross profit on sales, administrative expenses, salaries and etc. Partnership’s distributive share • Depends on partnership agreement, profits and losses share may be different • Varying interest rule - if partnership interest % changes during the year, income and loss allocation is prorated between the different days of ownership and interest % • Special allocations – pre-contribution gain or losses for contribution to partnership after 3/31/1984 – gain/loss at the time of contribution allocated solely to the SH who contributed the property – other special allocations allowed if criteria is met for substantial economic effect - appropriate decrease/increase in capital account of partner and partners will make up negative capital balance - see C9-19