Chapter 7

advertisement

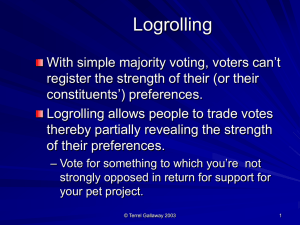

© Terrel Gallaway Data & Charts from US Census unless otherwise noted 1 © Terrel Gallaway Data & Charts from US Census unless otherwise noted 2 © Terrel Gallaway Data & Charts from US Census unless otherwise noted 3 © Terrel Gallaway Data & Charts from US Census unless otherwise noted 4 Child Poverty Source US Census, Joint Center for Poverty Research © Terrel Gallaway Data & Charts from US Census unless otherwise noted 5 © Terrel Gallaway Data & Charts from US Census unless otherwise noted 6 Who is poor? Working & non-working Urban & Rural Blacks Hispanics Single Moms Children © Terrel Gallaway Data & Charts from US Census unless otherwise noted 7 Limits to Poverty Statistics Income measured Looks at annual, not as cash receipts, lifetime income ignores in-kind Most of us are poorer transfers and and richer at some other, imputed point in our lives rent, etc. Units of observation are somewhat ambiguous Often reported as before tax and How do you compare 2 transfers single people to 2 married people to 2 cohabitating people? © Terrel Gallaway Data & Charts from US Census unless otherwise noted 8 Rationales for Income Redistribution: Simple Utilitarianism Assume a additive, utilitarian social welfare function W = U1 + U2 + … + UN Also assume: identical utility functions, diminishing marginal utility of income, total income is not affected by redistribution Then, while taking from a rich person decreases utility and thereby SWF, giving that income to a poor person increases their utility (and SWF) by a greater amount. Poor value the income more and so SWF increases as they get a larger share, see graph © Terrel Gallaway Data & Charts from US Census unless otherwise noted 9 Rationales for Income Redistribution: Rawls Maximin criterion W = min(U1, U2…UN) Goal is to elevate the poorest person Based on John Rawl’s ethical premise that, a person in the original position, behind a veil of ignorance, would choose such a distribution If you didn’t know into what family you’d be born, you’d want to make sure their were no families living on the street eating garbage Departures from perfect equality are okay as long as they elevate the lot of the poorest person Assumes strict risk aversion Help many if it increased inequality? © Terrel Gallaway Data & Charts from US Census unless otherwise noted 10 Rationales for Income Redistribution: Public Good Argument Income redistribution, and acts of charity, can be viewed as public goods e.g. Many people can benefit when housing is provided to the homeless (for reasons including aesthetics, feelings perceptions Rationalesof forguilt, Income Redistribution: of safety, nuisance factor) Simple Utilitarianism Charity is underprovided because of the free rider problem Government can use it’s coercive power to overcome the free rider problem Unlike other arguments, this one rests on Pareto Improvements © Terrel Gallaway Data & Charts from US Census unless otherwise noted 11 Rationales for Income Redistribution: Non-Individualistic Views Some believe inequality per se is a bad thing, something to be minimized Plato argued the income of the rich should be no more than four times that of the poor Rationales for Income Redistribution: Rawls Others desire complete equality Commodity Egalitarianism (e.g. Tobin) argues some specific goods should be available to all. e.g. Basic food, shelter, clothing, education, medical care How much? © Terrel Gallaway Data & Charts from US Census unless otherwise noted 12 Other Issues Relative Price Effects: Government spending on housing for the poor, for example, can raise it’s price, as well as the wages of construction workers. Difficult to measure distributional impact of government expenditures on goods that are consumed jointly (public goods) The poor aren't the only ones helped, and they are not likely helped by the full value of the expenditure Are benefits of roads a function of family size, income, or miles traveled, Is it regressive or progressive? In-kind transfers are often worth less to the recipient than the cost of the good because. A smaller amount of cash may very well do more good because it gives the recipient greater flexibility. © Terrel Gallaway Data & Charts from US Census unless otherwise noted 13 Valuing In-Kind Transfers Transfer lets them buy more of one good (cheese), than at each previous bundle of goods. However, it does not raise the maximum amount of all other goods that can be consumed. This makes the budget constraint kinked Constrains their ability to choose the exact mix that is best for them In-kind transfers are never better than money, money is often better than in-kind transfers. i.e., It is likely that you could increase utility by just as much, or more, but at less expense, by using cash. Greater flexibility. © Terrel Gallaway Data & Charts from US Census unless otherwise noted 14 Valuing In-Kind Transfers © Terrel Gallaway Data & Charts from US Census unless otherwise noted 15 Expenditure Programs © Terrel Gallaway Data & Charts from US Census unless otherwise noted 16 Expenditure Programs Table 8.1 shows that welfare spending is a shared expense between the federal and state/local governments. Subsidized medical care (mainly Medicaid) exceeded $215 billion in 2000. Cash assistance (including the Earned Income Tax Credit) exceeded $91 billion in 2000. © Terrel Gallaway Data & Charts from US Census unless otherwise noted 17 AFDC Started 1935, Gutted 1996 Many argued it decreased work incentives May do so, look at indifference curves &budget constraint flowing from a time endowment. (leisure, income) Kinked, budget constraint, not likely to decrease leisure over horizontal part of BC Welfare dependence 25% of women who received AFDC stayed on it 10 years or more Doesn’t mean they don’t want to work, could mean options remain poor Some argue it hurts the family structure Between 60s & 80s, WF benefits decreased in real terms while the proportion of children not living w/ 2 parents continued to increase No demonstrated connection between WF & family structure (including # of children, there is however links between affluence & small families & between education & small families) © Terrel Gallaway Data & Charts from US Census unless otherwise noted 18