Capital Budgeting

advertisement

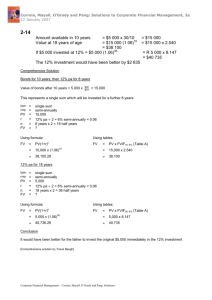

CHAPTER 8 CAPITAL BUDGETING Objectives Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 At the end of the chapter, you should be able to; Understand the importance of the capital budgeting decision Understand why only cash flows matter Define the types of investment projects Apply the methods used to evaluate capital projects Set out the advantages and disadvantages of each method Understand why the Internal rate of return may result in a firm choosing the wrong project Calculate a project’s modified internal rate of return Understand the relationship of Economic Value Added (EVA) and net present value Determine the relevant cash flows to be included in the analysis Include taxation and tax allowances and in the project cash flows Understand the role of Post-audits in capital budgeting Use Excel spreadsheets to solve applied Capital Budgeting problems 2 Outline Types of Projects Capital Budgeting Methods Net Present Value Internal Rate of Return Payback and Discounted Payback Accounting Rate of Return Profitability Index (PV Index or Benefit-Cost Ratio) Project Cash Flows Estimating future cash flows Taxation Some Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 rules Post-Audits 3 The Balance Sheet (Statement of Financial Position) Why did Wesfarmers invest in these assets? Capital Budgeting Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 4 Why is the Capital Budgeting decision so important for the firm? The Balance Sheet Tactical and Strategic Investments Consequences of Investment and non-investment Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 The Balance Sheet includes past capital budgeting decisions. Over capacity resulting in high overheads Under-capacity resulting in loss of market share High operating costs Loss of Flexibility - a large investment results in a company losing the option to invest. Microsoft & Netscape - Microsoft had to change from stand alone systems due to impact of the Internet Timing Columbus steel plant The focus should also be on Project Creation 5 TYPES OF INVESTMENT PROJECTS Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 Replacement decisions Expansion : existing product lines Expansion : new product lines Other (IT, Pollution control, Corporate social investment) Mutually Exclusive vs. Independent Projects Divisible and non-divisible projects 6 Why use Cash Flows ? Future benefits of the project Only use Cash flows, not earnings Accounting Earnings vs. Cash Flows Accounting is based on the Matching Concept Cost and Depreciation Taxation - GAAP & Inventory Valuation Tax is a cash flow and taxable income is based on the Accrual Accounting Model Accounting does not record opportunity costs; in Capital Budgeting we include cash flows foregone. Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 Performance Appraisal Yet if Accounting results are used to measure management performance, then Accounting may be relevant 7 Corporate Social & Infrastructural Investments Types of “non-economic” projects Environment Human Resources Small Business Community Investments Information Technology Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 The relevance of DCF techniques Materiality of Investments References to Annual Financial Statements 8 Capital Budgeting Techniques Net Present Value (NPV) Internal Rate of Return (IRR) Payback Period and Discounted Payback Accounting Rate of Return Profitability Index (Benefitcost ratio) Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 9 Net Present Value (NPV) NPV = Future Cash flows discounted at the cost of capital less the Cost of the Project If NPV > 0, accept the project If NPV < 0, reject the project NPV Analysis - 2 year project Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 Cost of Capital 20% Year 0 1 2 Cash Flows PV Factor 1/(1+r)t Present Values (10,000) 1.0000 (10,000) 8,000 0.8333 6,667 6,000 0.6944 4,167 NPV 833 10 Internal Rate of Return (IRR) Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 IRR = Discount rate which makes the Present value of the Project’s Future Cash flows equal to the cost of the Project. Year 0 1 2 Cash Flows t PV Factor 1/(1+r) Present Values (10,000) 1.0000 (10,000) 8,000 0.7863 6,290 6,000 0.6183 3,710 IRR NPV 27.2% 0 10,000 11 NPV Profile How will NPV change with a change in the discount rate? NPV Profile 5,000 4,000 NPV 3,000 IRR 2,000 1,000 0 0% -1,000 -2,000 3% 6% 9% 12 % 15 % 18 % 21 % 24 % 27 % 30 % 33 % 36 % 39 % Discount rate NPV Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 12 NPV or IRR? If we analyse the NPV Profile, a project with a positive NPV will also have an IRR to the right of the cost of capital. So the IRR and the NPV methods will give the same answer. Is this always so? Assume Project A and B are alternative one year investments. A firm can only select either A or B. Year 0 Project A Project B (10,000) (1,000) NPV Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 Cost of Capital Project A Project B 1 11,800 1,400 IRR 10% 727 273 18% 40% 13 NPV or IRR? Project A results in a higher NPV and Project B results in a higher IRR. Which project should be accepted? Always select the project with the higher NPV. Why? The difference in costs should not affect the decision unless the company is subject to capital rationing. If markets are efficient, the company should be able to always raise finance at its cost of capital. Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 14 What is wrong with IRR? There could be more than one IRR for non-conventional projects. Year 0 Project I 1 (200) Cost of Capital 2 1,000 (1,000) 14% NPV IRR IRR (92) 38% 262% NPV Profile of Non-conventional Project 50.00 440% 418% 396% 374% 352% 330% 308% 286% 264% 242% 220% 198% 176% 154% 132% 110% 88% 66% 44% 22% 0% - (50.00) (100.00) NPV (150.00) Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 (200.00) (250.00) 15 Payback Method Projects are evaluated according to the number of years that it takes to recover the cost of the investment from the cash flows generated by the project. The firm sets a required payback period, say 3 years. Only projects with payback periods of less than 3 years are accepted. Year Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 0 Project I Project J (12,000) (12,000) Payback I Payback J 2.33 3.25 1 4,000 2,000 2 6,000 4,000 3 6,000 4,000 4 1,000 8,000 16 What are the advantages and disadvantages of Payback? Advantages Simple to calculate and understand Widely used in practice Risk indicator Disadvantages Ignores cash flows after the payback Ignores time value of money Bias against long term projects Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 17 Discounted Payback Discounted Payback = time it takes so that the PV of the project’s cash flows equals the cost of the project. Year Project I Project J Cost of Capital 0 (12,000) (12,000) 1 4,000 2,000 2 6,000 4,000 3 6,000 4,000 4 1,000 8,000 r = 15% t Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 If we discount each year by multiplying the cash flow by 1/1+r) , then the present values of each year's cash flows are as follows; Project I (12,000) 3,478 4,537 3,945 572 Cumulative 11,960 Project J (12,000) 1,739 3,025 2,630 4,574 Cumulative 11,968 The discounted payback of I is very close to 3 years and the discounted 18 payback of J is very close to 4 years Accounting Rate of Return Accounting Rate of Return = Net Income/Average book value. The average book value if the residual value is zero, will be Cost/2 Net income is after depreciation. Advantages and disadvantages of ARR Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 19 Profitability Index (Benefit-Cost Ratio) A project’s PI measures the return of a project relative to cost PI = Present Value/Cost If PI > 1 = Accept the project If PI < 1 = Reject the project As NPV = PV - Cost, a PI greater than 1 means a positive NPV. When should we use the PI? If there is capital rationing and we wish to maximise returns relative to the costs of a projects. Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 20 Economic Value Added (EVA) How do we use EVA to evaluate projects? EVA = Net operating profit after tax (Invested Capital x Cost of Capital) Value of Project = Investment + PV of future EVAs PV of future EVAs = project’s NPV EVA Net Book Value 0 1,100,000 EBIT (1-t) Capital charge (Opening Book value x WACC) EVA Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 PV of EVAs = NPV 1 2 880,000 660,000 56,000 -165,000 -109,000 161,000 -132,000 29,000 3 440,000 161,000 -99,000 62,000 4 220,000 161,000 -66,000 95,000 5 161,000 -33,000 128,000 85,867 21 Cash flows Estimation of future cash flows After tax cash flows, therefore need to consider the tax issues Beginning-of-project cash flows Cost of project = cash outflow What about depreciation? Sale of existing equipment? Working capital requirements? Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 22 Tax Effects - Introduction Depreciation deduction Deduction from taxable income Adjustable Value [undeducted cost] Cost less depreciation deductions to date Effect on Cash Flow Net operating income x (1-tax rate) Deduction x tax rate Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 23 Depreciation Methods Diminishing Value method =Opening value x 150%/Asset’s effective life Prime Cost method =Cost x 100%/Asset’s effective life Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 24 Balancing Adjustments Balancing adjustment = selling price – adjustable value If selling price > adjustable value, then this an assessable balancing adjustment. Add to income. If selling price < adjustable value, then the difference is a deductible balancing adjustment. Deduct from taxable income. Capital gains do not apply to depreciating assets – the difference between selling price and the undeducted cost ( adjustable value) is a balancing adjustment. Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 25 Depreciation rates for Tax purposes Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 The ATO has issued recommended effective economic lives for various categories of assets Effective life = number of years that company can use the asset for a taxable purpose. Examples: Computers – 4 yrs, forklifts – 11 yrs pumps – 20 yrs, trucks (heavy haulage) – 5 yrs, lathes – 10 yrs Patent = 20 years 26 Capital Gains Tax Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 Companies are subject to Capital Gains Tax on the the disposal of fixed assets. If the sales price > cost, the difference will be subject to CGT if the asset is NOT a depreciating asset. CGT = Selling price – base cost. CGT may apply on the sale of land and other nondepreciating assets. No inflation indexation, so inflationary gains may be subject to tax. 27 The effect of depreciation on cash flow Example: Cost = $800 000. Prime cost depreciation of 20% per year. What is the effect on cash flow? Taxation Net operating income Less: decline in value (depreciation) Assessable income Tax charge - 300,000 160,000 [800000 x 0.20] 140,000 42,000 [140000 x 0.30] The net cash flows would be determined as follows: Net operating cash flow Less: taxation Net Cash flow Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 - 300,000 42,000 258,000 28 Relevant revenues & costs - some rules. Only include Incremental cash flows Use future after-tax cash flows Ignore Sunk costs Opportunity costs - foregone cash flows Include the negative and positive effects of new product lines on existing lines Evaluate all alternatives Ignore all Allocated costs Ignore Financing charges, as this would amount to double counting. Working capital Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 Net incremental Changes, not levels Separate accounting from cash flows Separation of the financing from the investment decision 29 Working Capital Income Statement S A L ES Expense 10000000 CO S T O F S A L E S 4500000 O P E N IN G S TO C K 0 P URCHA S E S C L O S IN G S TO C K G RO S S PRO F IT 6000000 -1 5 0 0 0 0 0 5500000 Cash out flow Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 30 Working Capital Investment in working capital changes accounting earnings to cash flows From Accounting Year 0 1 2 Sales 12,000.00 12,000.00 Cost of Sales Opening inventory Purchases Closing inventory -8,000.00 -9,600.00 1,600.00 -8,000.00 -1,600.00 -8,000.00 1,600.00 4,000.00 4,000.00 12,000.00 -8,000.00 12,000.00 -8,000.00 4,000.00 4,000.00 Gross profit To Cash flows Sales Cost of sales Investment in inventory* Investment in debtors# -1,600.00 -2,000.00 -3,600.00 Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 * The investment in inventory is assumed to take place at the beginning of the project. # The investment in debtors will occur in the first 60 days but is assumed to take place at the beginning of the project. 31 Inventory Sometimes future inventory levels are stated as a percentage of sales. The cash flows are represented as changes in the inventory levels. Inventory as a percentage of Sales 1 Sales Inventory Cash flow Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 R000s 10% 2 3 15,000 18,000 9,000 1,500 1,800 900 (1,500) (300) 900 32 Post Audits What are post audits? Formal assessment and comparison of actual returns achieved for specific projects as compared to projected returns. Advantages Lessons for management. Identify critical factors and ensures focus on achieving projected cash flows Disadvantages Sponsors may reduce investments due to personal risks Difficulties in separation of project cash flows from other business investments Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 33 Modified Internal rate of Return (MIRR) Year Project E Project F E F Cost of Capital IRR IRR 0 1 2 -100.00 -100.00 20.00 80.00 20.00 50.00 3 Total 100.00 140.00 10.00 140.00 14.2% 26.0% 10.0% If we compare IRRs than the second project is much more attractive and would be selected. However, comparing IRRs may overstate the return as the IRR method assumes reinvestment at the IRR. This may be an unreasonable assumption. Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 34 MIRR What happens if we assume that cashflows are reinvested at the cost of capital? Reinvestment at Cost of Capital Project E 0 1 2 3 -100.00 20.00 20.00 100.00 24.20 22.00 146.20 80.00 50.00 10.00 96.80 55.00 161.80 0 0 0 0 146.20 161.80 -100.00 Project F -100.00 -100.00 Project E Project F E F Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 -100.00 -100.00 MIRR MIRR 13.5% 17.4% If we assume reinvestment at the cost of capital, then the relative return of the second project is reduced significantly. As this project has significant cash flows early on, changing the reinvestment assumption can make a large difference to the expected return. 35 Modified Internal Rate of Return (MIRR) Correia, Mayall, O’Grady & Pang Copyright Skystone ©2005 NPV - assumes reinvestment at the cost of capital IRR - assumes reinvestment at the IRR MIRR - Assume a reinvestment rate until end of project MIRR = Rate that causes PV of the terminal value to equal PV of cash outflows 36