Corporate Information Strategy 7/e

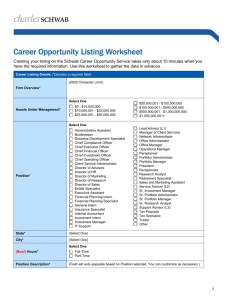

advertisement

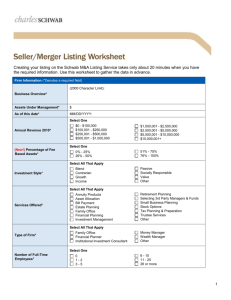

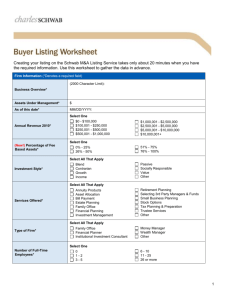

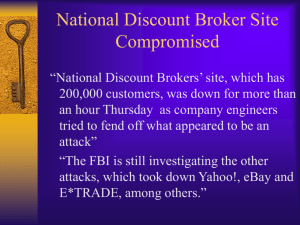

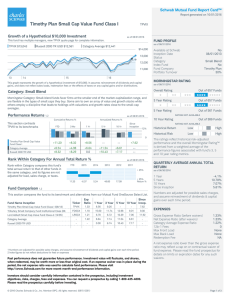

ISM 158 • Lecture 3 • Charles Schwab Case Fig 1.7 Strategic Alignment Model Ideally, all four quadrants align to create value Opportunities • Can IT change basis for competition? • Can IT change balance of power among buyers and supplyers? • Can IT build or reduce barriers to entry? • Can IT increase or decrease switching costs? • Can IT add value to existing products and services or create new ones? Risks • Can emerging technologies disrupt current business models? • Are we too early or too late to exploit IT opportunity? • Does IT lower entry barriers? • Does IT trigger regulatory action? Fig 1.8 Analyzing Disruptive Technologies Fig 1.9 Analyzing Cash Flow Curve Questions Case Overview: Charles Schwab • Decision making under rapidly changing environment • Technology providing large opportunities and risks • Regulatory environment changing at same time Outline for discussion • Background/history of company • Main issues at time of case • Any updates since case? Company History • Discount Broker 1975 – 1994 • Multi-channel online broker 1995-1999 • Strategic Transition 2000-2002 – What are the differences? – What were strengths and weaknesses in each period? Financial Services 1980’s Charles Schwab Discount Broker Case: Charles Schwab Time of case Charles Schwab Charles Schwab US Trust Acquisition Examining the Numbers • Calculating – Return on Assets – Return on Equity – Profit Margins ISMA MEETING TODAY! • Engineering 2, Room 399, 6-7pm • Right next to the elevators • Open to everyone! Even if you’re new to ISMA. • Please turn in member apps if you have one Questions, Survey, Break Student Presentation • Johan Stenberg Between case and now Financial Services Market Today Schwab Private Client US Trust – State Street Extending to other Financial Products Schwab Equity Ratings Research Offerings Schwab Capital Markets 2004 follow up Schwab Personal Choice Still struggled Charles Schwab More Recently • Very strong 2006 • Recent sale of US Trust Announced Stock Price History