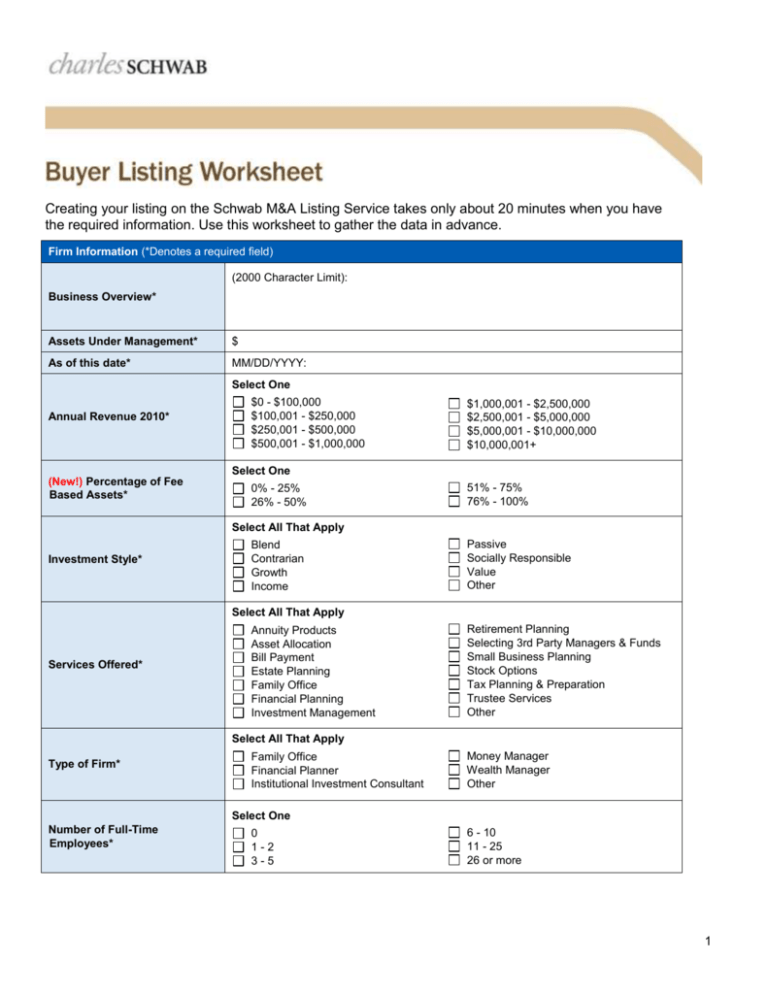

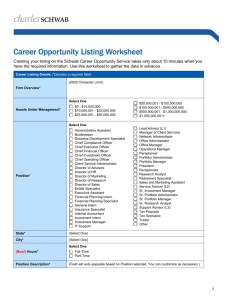

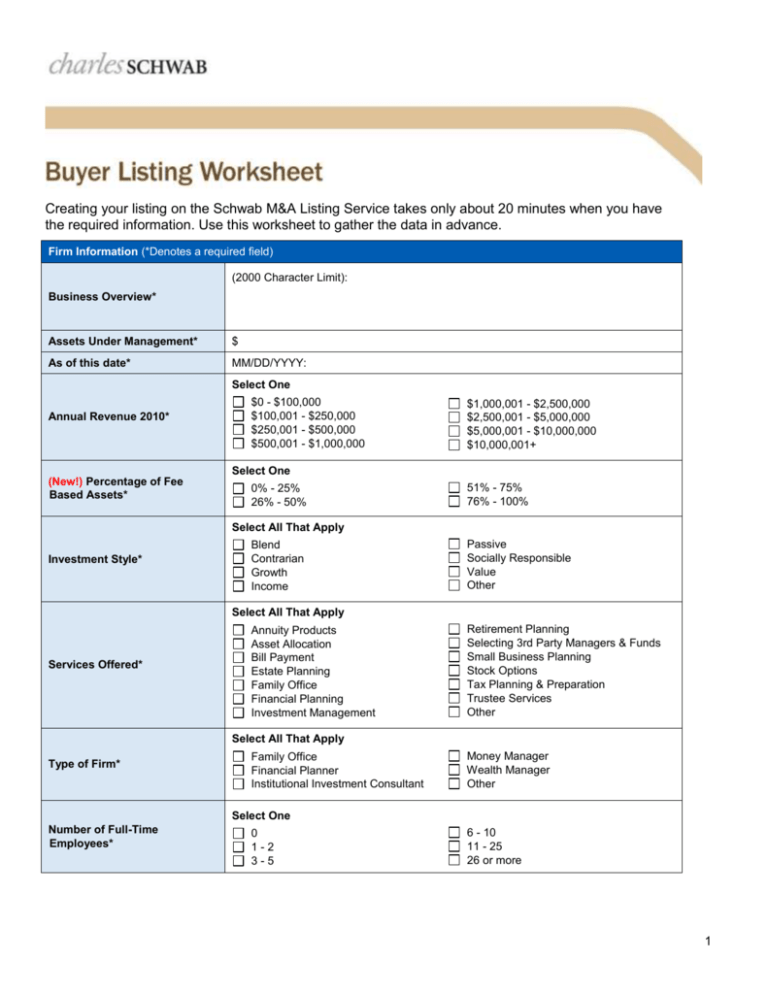

Creating your listing on the Schwab M&A Listing Service takes only about 20 minutes when you have

the required information. Use this worksheet to gather the data in advance.

Firm Information (*Denotes a required field)

(2000 Character Limit):

Business Overview*

Assets Under Management*

$

As of this date*

MM/DD/YYYY:

Select One

Annual Revenue 2010*

$0 - $100,000

$100,001 - $250,000

$250,001 - $500,000

$500,001 - $1,000,000

$1,000,001 - $2,500,000

$2,500,001 - $5,000,000

$5,000,001 - $10,000,000

$10,000,001+

Select One

(New!) Percentage of Fee

Based Assets*

0% - 25%

26% - 50%

51% - 75%

76% - 100%

Select All That Apply

Investment Style*

Blend

Contrarian

Growth

Income

Passive

Socially Responsible

Value

Other

Select All That Apply

Services Offered*

Annuity Products

Asset Allocation

Bill Payment

Estate Planning

Family Office

Financial Planning

Investment Management

Retirement Planning

Selecting 3rd Party Managers & Funds

Small Business Planning

Stock Options

Tax Planning & Preparation

Trustee Services

Other

Select All That Apply

Type of Firm*

Family Office

Financial Planner

Institutional Investment Consultant

Money Manager

Wealth Manager

Other

Select One

Number of Full-Time

Employees*

0

1-2

3-5

6 - 10

11 - 25

26 or more

1

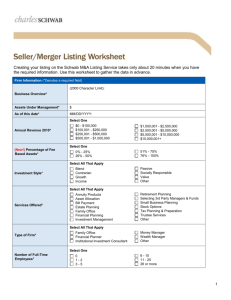

Select One

Number of Part-Time

Employees*

0

1-2

3-5

6 - 10

11 - 25

26 or more

Select One

Number of Principals*

1

2

3

4

5

6

7

8

9

10 or more

Select One

Years in Operation*

0-5

6 - 10

11 - 25

26 or more

Select One

Number of Offices*

(New!) Office Location(s)*

0

1

2

3

4

5 or more

(Select All States That Apply)

Select One

Errors & Omissions Insurance*

Yes

No

Select All That Apply

Licenses Held by Owners and

Employees*

Series 3

Series 4

Series 6

Series 7

Series 9

Series 10

Series 11

Series 14

Series 23

Series 24

Series 26

Series 27

Series 30

Series 31

Series 51

Series 53

Series 55

Series 62

Series 63

Series 65

Series 66

Series 87

Insurance

Other

None

Select All That Apply

Designations Held by Owners

and Employees*

AAMS

AWMA

CFA

CFP

CMFC

CPA

CRPC

CRPS

CTFA

MBA

MPA

PFS

Other

None

Select One

Average Client Relationship

Size*

$0 - $100,000

$100,001 - $250,000

$250,001 - $500,000

$500,001 - $1,000,000

$1,000,001 - $2,000,000

$2,000,001 - $5,000,000

$5,000,001 - $10,000,000

$10,000,001+

2

Select One

(New!) Minimum Client

Relationship Size*

$500,001 - $1,000,000

$1,000,001 - $2,000,000

$2,000,001+

$0 - $100,000

$100,001 - $250,000

$250,001 - $500,000

Number of Client

Relationships*

Select All That Apply

(New!) Target Clientele*

Doctors

Heirs

Lottery Winners

Physicians

Retirees

Other

Attorneys

Business Owners

Entrepreneurs

Executives

Dentists

Divorcees

Investment Vehicles* (Total 100%)

Individual Securities

Mutual Funds

Separate Accounts

Totals

Equities

%

+

%

+

%

=

%

Fixed Income

%

+

%

+

%

=

%

(New!) ETFs

Alternative

%

Investments†

%

Cash/Money Market

%

Other

%

†Alternative

Investments include hedge funds, private equity funds, managed funds, managed futures, commodities and other

investment instruments.

Buyer Listing Details (*Denotes a required field)

(New!) We are interested in

completing a transaction

within*

Select One

6 - 12 months

1 - 2 years

2 - 5 years

5+ years

Select All That Apply

Price Range

(New!) Cash Willing to Offer at

Closing

$0 - $100,000

$100,001 - $250,000

$250,001 - $500,000

$500,001 - $1,000,000

$1,000,001 - $5,000,000

$5,000,001 - $10,000,000

$10,000,001+

Select All That Apply

0% - 25%

26% - 50%

51% - 75%

76% - 100%

Select the information about the business you wish to purchase.

Select All That Apply

Assets Under Management*

$0 - $10,000,000

$10,000,001 - $25,000,000

$25,000,001 - $50,000,000

$50,000,001 - $100,000,000

$100,000,001 - $500,000,000

$500,000,001 - $1,000,000,000

$1,000,000,001+

3

Select All That Apply

Annual Revenue*

(New!) Percentage of Fee

Based Assets

$0 - $100,000

$100,001 - $250,000

$250,001 - $500,000

$500,001 - $1,000,000

Select All That Apply

0% - 25%

26% - 50%

Select All That Apply

Target Average Revenue bps

on Assets

$1,000,001 - $2,500,000

$2,500,001 - $5,000,000

$5,000,001 - $10,000,000

$10,000,001+

0 - 25

26 - 50

51 - 100

51% - 75%

76% - 100%

101 - 200

201 - 500

501+

Select All That Apply

Investment Style*

Blend

Contrarian

Growth

Income

Passive

Socially Responsible

Value

Other

Select All That Apply

Services Offered*

Annuity Products

Asset Allocation

Bill Payment

Estate Planning

Family Office

Financial Planning

Investment Management

Retirement Planning

Selecting 3rd Party Managers & Funds

Small Business Planning

Stock Options

Tax Planning & Preparation

Trustee Services

Other

Select All That Apply

Type of Firm*

Family Office

Financial Planner

Institutional Investment Consultant

Money Manager

Wealth Manager

Other

Select One

Minimum Years in Operation*

0-5

6 - 10

11 - 25

26 or more

Select One

Errors & Omissions Insurance*

Yes

No

4

Select All That Apply

Licenses Held by Owners and

Employees

Series 3

Series 4

Series 6

Series 7

Series 9

Series 10

Series 11

Series 14

Series 23

Series 24

Series 26

Series 27

Series 30

Series 31

Series 51

Series 53

Series 55

Series 62

Series 63

Series 65

Series 66

Series 87

Insurance

Other

None

Select All That Apply

Designations Held by Owners

and Employees

AAMS

AWMA

CFA

CFP

CMFC

CPA

CRPC

CRPS

CTFA

MBA

MPA

PFS

Other

None

Select All That Apply

(New!) Average Client

Relationship Size*

$0 - $100,000

$100,001 - $250,000

$250,001 - $500,000

$500,001 - $1,000,000

$1,000,001 - $2,000,000

$2,000,001 - $5,000,000

$5,000,001 - $10,000,000

$10,000,001+

Select All That Apply

Minimum Client Relationship

Size*

$0 - $100,000

$100,001 - $250,000

$250,001 - $500,000

$500,001 - $1,000,000

$1,000,001 - $2,000,000

$2,000,001+

Select All That Apply

Investment Vehicles*

Alternative Investments

Cash/Money Market

Equities

ETFs

Fixed Income

Other

Asset Based Fee Revenue

Commissioned Sales Revenue

Select One

Select One

Yes

No

Yes

No

Sources of Revenue

Hourly Revenue

Other Revenue

Select One

Yes

No

Select One

Yes

No

For institutional use only. ©2011 Charles Schwab & Co., Inc. ("Schwab"). Member SIPC. All Rights Reserved. Schwab Advisor Services™

(formerly Schwab Institutional®) serves independent investment advisors and includes the custody, trading and support services of Schwab.

Independent investment advisors are not owned by, affiliated with or supervised by Schwab. IAN MKT61827 (0511-2634)

5