Document

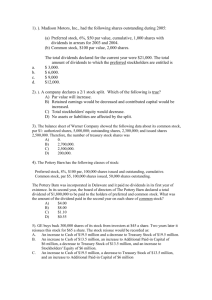

advertisement

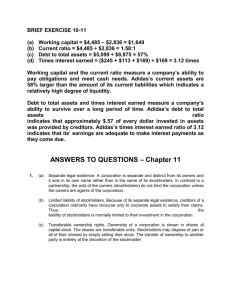

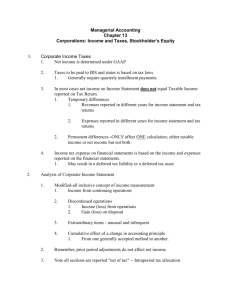

CHAPTER 24 CORPORATE STOCK AND EARNINGS ISSUES 1 Chapter Overview What are the rights of a corporation’s stockholders? What is important for an external users to know about a corporation’s capital stock transactions? What are the characteristics of a corporation’s treasury stock, and how does it record and report this stock? What are compensatory stock options, and how does a corporation report them? 2 Chapter Overview How does a corporation report its results from discontinued operations and extraordinary items? How does a corporation compute and report its earnings per share? What kind of dividends can a corporation distribute, and what are their characteristics? How and why does a corporation report the changes in its stockholders’ equity? 3 Corporate Capital Structure Recall from Chapter 10 that the owners’ equity section for a corporation is called stockholders’ equity, because stockholders are the owners. Contributed capital is the total investment made by stockholders Net income each year becomes part of retained earnings Retained earnings reports the corporation’s total lifetime reinvested net income not distributed to stockholders as dividends. 4 Capital Stock and Legal Capital Capital stock is the ownership unit in a corporation. Stockholders (or shareholders) are the owners of a corporation and their evidence of ownership is a stock certificate. A stock certificate is a serially numbered legal document that indicates the number of shares of capital stock owned by the stockholder, as well as other information. 5 Stockholders’ Rights Shares of stock are transferable between individuals stockholders or other investors. The owners of a corporation may be a diverse set of stockholders who are not involved in its management. Because of the separation of ownership and management, each stockholder may have certain rights of ownership. 6 Stockholders’ Rights A stockholder usually has the right to attend and vote at stockholders’ meetings in setting and approving major policies and actions of the corporation. A stockholder usually has the right to vote in the election of the board of directors, the group of individuals with the fiduciary responsibility to the stockholders. A stockholder is entitled to share in net income of the corporation, provided the board of directors authorizes the payment of dividends. 7 Stockholders’ Rights A stockholder has the right to purchase additional capital stock if it is issued – a right know as preemptive right, a right to maintain a proportionate (pro rata) share of additional capital stock if it is issued. A stockholders is entitled to share in the distribution of the corporation’s assets if it is liquidated and creditors have been paid. 8 Legal Capital Legal capital is the amount of stockholders’ equity that a corporation cannot distribute; it is the minimum which must be maintained to protect the interest of creditors. Legal capital is the minimum monetary amount per share of common stock issued, called par value. Additional PIC represents the difference between the market value (selling price) of the stock issued and the par value or amount attributable to legal capital. 9 Classes of Capital Stock Corporations may issue two (or more) classes of capital stock: common stock and preferred stock. Common stock is the basic ownership unit in the corporation that contains shareholders’ rights (voting, etc.) In exchange for giving up basic shareholders’ right that exist in common stock, preferred stock has a stated dividend rate and preferential dividend and liquidation rights 10 Capital Stock Transactions Authorized capital stock is the number of shares of capital stock that a corporation may legally issue. Issued capital stock is the number of shares of capital stock that a corporation has legally issued to its shareholders as of the balance sheet date. Outstanding capital stock is the number of shares the corporation has issued to stockholders and that the stockholders still hold as of a specified date. 11 Stockholders’ Equity Section of the Balance Sheet: Preferred Stock Stockholders Equity Contributed capital Preferred stock, $100 par, 2000 shares authorized, 600 shares issued and outstanding $ 60,000 Additional paid in capital on preferred stock $ 72,000 Common stock, $10 par. 30,000 shares authorized, The preferred stock has a stated par value of 9,000 shares issued and outstanding $ 90,000 $100 per share. 2,000 shares have been legally The excess of the selling price of Additional paid in capital on common stock $ 43,000 authorized for issue but only 600 shares have the preferred over the par value contributed capital 265,000 been soldTotal to and are in the hands of investors was $72,000$(total average selling (outstanding). par value recorded in the RetainedThe earnings $ 173,000 price was $60,000 + $72,000/600 accounts is the legal capital (600Equity shares X Total Stockholders' 438,000 shares,$or $220 share). $100/share = $60,000). 12 Stockholders’ Equity Section of the Balance Sheet: Common Stock The common stock hasStockholders a stated par value of $10 per share; Equity 30,000 shares have been legally authorized for issue but only Contributed capital 9,000 have been sold to and are currently in the hands of stock, $100 shares authorized, investorsPreferred (outstanding). The par par, value2000 recorded in the accounts and outstanding $ 60,000 is the600 legalshares capitalissued (9,000 shares X $10/share = $90,000). Additional paid in capital on preferred stock $ 72,000 Common stock, $10 par. 30,000 shares authorized, 9,000 shares issued and outstanding $ 90,000 Additional paid in capital on common stock $ 43,000 Total contributed capital $ 265,000 The excess of the selling price of the Retained earnings $ 173,000 common over the par value was $43,000 Total Stockholders' Equity (total average selling price $ 438,000 was $90,000 + $43,000/9000 shares, or $14.77 share). 13 Issuance of Stock for Cash If Unlimited Decadence issues 3,000 shares of its $3 par common stock for $20 per share, how is this recorded? The excess over par value of the stock is recorded in a separate account called “Additional Paid-in-Capital: 3,000 shares X $17 per share The total cash received: 3,000 shares X $20/share Only the par value of the stock is recorded in the stock account: 3,000 shares X $3 per share 14 Noncash Issuance of Stock If Unlimited Decadence issues 1,000 shares of its $3 par common stock in exchange for a patent when the stock is selling for $18 per share, how is this recorded? The total cost of the patent is equal to the market value of the stock issued or the value of the assets received, whichever is more reliable; generally if stock The excess is traded, the asset will be recorded at the market price. over par value of the stock The par value of the stock 15 Preferred Stock Convertible preferred stock is preferred stock that is exchangeable into common stock at the option of the individual stockholder. Callable preferred stock is stock that the corporation may recall (or retire) at its option. Redeemable preferred stock is stock that is subject to a mandatory retirement date at a specified maturity date and price, at the option of the owner. 16 Treasury Stock Treasury stock is a corporation’s own capital stock that (1) stockholders fully paid for and the corporation issued, and (2) the corporation later reacquired, and (3) the corporation currently holds. Treasury stock is not an asset of the corporation because a corporation cannot “own itself.” Rather, when treasury stock is purchased, it reduces the amount of stock outstanding and reduces the total amount of stockholders’ equity. If there is a difference between the number of shares a company has issued and the number outstanding, the difference is likely due to treasury stock acquired. 17 Treasury Stock Treasury stock may be acquired to have shares available to issue for employee-purchase plans or to issue in conversion of convertible preferred stock. Some companies acquire treasury stock to use for the acquisition of other companies, or to reduce the number of shares outstanding, increasing earnings per share and helping to maintain the market price of the stock. Other companies may acquire treasury stock as a defense against hostile takeovers 18 Acquisition of Treasury Stock Suppose Duong Corporation previously issued 5,000 shares of $10 par value common stock for $12 per share and has Retained Earnings of $35,000. The corporation reacquires 400 of its common shares at $14 per share. How is this recorded? The total cash paid to acquire the treasury shares ($14 X 400 = $5,600) Before the treasury shares were acquired, there were 5,000 shares outstanding; now there are only 4,600 shares outstanding and 400 are held in treasury for reissue at another time. Total SE now equals $50,000+$10,000+$35,000-$5,600 = $89,400. 19 Reissue of Treasury Stock Suppose Duong Corporation now reissues 300 shares of the treasury stock for $15 per share. Recall that the treasury shares were originally purchased for $14 per share. How is this recorded? The total cash received when the shares were reissued $15 X 300 = $4,500 The total cost of the treasury stock reissued was $14 X 300 = $4,200 Duong received $1 more/share on reissue than the stock originally cost, so their additional paid-in-capital increases for this amount $1 X 300 shares = $300 20 Stock Options Another way a corporation can issue stock is through stock options. A corporation’s compensatory stock options are intended to provide additional compensation to employees in exchange for their services. Under a compensatory stock option plan, employees receive options to buy shares of the corporation’s common stock at a fixed price for a certain period of time. 21 Stock Options Compensatory stock options are designed to encourage employees to make decisions that cause the market price of the stock to increase, thereby providing benefit to all of the stockholders. These type of plans are particularly popular in “start-up” companies, as well as high-technology and bio-technology companies where there is usually not sufficient cash to pay high salaries to attract the best employees. Under GAAP, corporation’s that issue stock options do not have to currently report an expense on the income statement even though the options are compensatory in nature. 22 Stock Options When an employee exercises an option, say for 10,000 shares at a price of $20 per share (when the market price of the stock is $100 per share), the employee pays the company only $200,000. The company increases its cash and its stockholders equity as if it had sold stock on the open market, except that the increase is only $200,000 (not $1 million which would have been the price received on the open market). This is an opportunity cost of $800,000 to the corporation and an $800,000 windfall to the employee. 23 Stock Options The GAAP treatment of stock options is highly controversial, particularly with the corporate scandals which have arisen in the last several years. A corporation must disclose in the notes to its financial statement the amount that its net income would be if it had included the expense of the stock options it grants. As an example, Microsoft reports in 2001 that its net income would have been $2.262 million less if stock options had been included as an expense. This would have reduced reported net income by almost 31%! 24 Corporate Income Statement Corporate income statements present information in three different sections. Earnings from continuing operations is shown in the first section. If applicable, earnings from nonrecurring activities is shown second. Lastly, a company reports its earnings per share of common stock for each of the major components of earnings. 25 Income from Continuing Operations $ 100,000 $ 60,000 $ 40,000 $ 20,000 $ 20,000 Profit from the company’s basic operating business Sales Cost of goods sold Gross profit Operating expenses Exhibit income10-6 Operating Nonoperating items Other revenues (expenses): $ 10,000 Interest income Loss on sale of equipment $ (5,000) $ 5,000 Taxes on continuing operations Income from continuing operations before tax Income tax expense Income from continuing operations Operating results of a company’s ongoing operations $ 25,000 $ 10,000 $ 15,000 26 Income Statement for Unlimited Decadence Corporation Exhibit 24-1 27 Results of Discontinued Operations Many corporations, sometimes called conglomerates, have several major divisions (components) that sell different products or services. A corporation occasionally sells one of these components called a “sale of a discontinued component.” Examples include the sale by a communications company of all of its radio stations or the sale by a food distributor of its wholesale supermarket division. 28 Results of Discontinued Operations Since these sales are not usual, they are important events that need to be highlighted for financial statement users. For this reason, a corporations reports certain information about the sale separately on its income statement in a section called results from discontinued operations. This section is below income from continuing operations. This allows users to assess the impact of the sale on the company earnings. 29 Extraordinary Gains and Losses Sometimes an event or transaction causes an extraordinary gain or loss for a corporation. An extraordinary item is an event that is (1) unusual in nature and, (2) infrequent in occurrence. Examples of events that are likely to be extraordinary items are earthquakes, tornados, floods, expropriation of assets by a foreign country, or prohibitions under newly enacted law. 30 Extraordinary Gains and Losses Like discontinued operations, extraordinary gains and losses are required to be highlighted in a separate section of the income statement. Extraordinary items fall below continuing operations and discontinued operations (if applicable). Like discontinued operations, a corporation reports extraordinary items separately so external users can assess the impact on earnings. 31 Earnings Per Share (EPS) Since a corporation earns its net income over an entire year, it relates the earnings to the weighted average number of common shares outstanding during the year. EPS is widely used to predict a corporation’s future earnings, dividends and stock market price. This ratio is so important that GAAP requires it to be included on the income statement and to be computed for the major components of earnings. Net income – Preferred Dividends Weighted Average Number of Common Shares Outstanding 32 Weighted Average Common Shares Assume Unlimited Decadence had 1,200,000 shares of common stock outstanding during all of 2005. However, on August 1, 2005, it issued an additional 240,000 common shares so that it had a total of 1,440,000 shares outstanding at the end of the year. How would the weighted average number of shares be computed? Months Shares Are Outstanding January-December August-December Total Shares Outstanding 1,200,000 240,000 X Fraction of Year Outstanding 12/12 5/12 This would be the denominator in the EPS calculation for 2005 = Weighted Average 1,200,000 100,000 1,300,000 33 Earnings Per Share (EPS) Using Exhibit 24-1, Unlimited Decadence’s basic earnings per share for income from continuing operations is computed as follows: Net income – Preferred Dividends Weighted Average Number of Common Shares Outstanding $4,800 - $690 1,300 = $3.16 per share For every share of common stock owned in Unlimited Decadence, stockholders earned $3.16 34 Price Earnings (PE) Ratio Since one of the important results of a corporation’s performance is the market price of its common stock, another important and widely used financial ratio is the price/earnings (PE) ratio. This ratio indicates how much investors are willing to pay per dollar of current earnings. Market Price Per Share Earnings Per Share 35 Price Earnings (PE) Ratio A higher PE ratio is thought to mean that investors are optimistic about the future and that the corporation has better prospects for future growth. For example, at the time of writing this book, the PE ratio for Pepsi was 27 times earnings and Coca-Cola was 32 times earnings. This means that investors were willing to pay 27 times as much for the stock of Pepsi and 32 times as much for the stock of Coca-Coca as each company had reflected in current earnings. In general, the marketplace viewed Coca-Coca as having better prospects for the future. 36 Cash Dividends A corporation must meet legal requirements and have enough cash available to pay dividends. In addition, the board of directors is responsible for setting a corporation’s dividend policy. In setting the dividend, a board of directors determines the amount and timing of the dividends, considering legal requirements, compliance with contractual agreements, and the financial well-being of the corporation. The payment of dividends should be in the financial long- and short-term interests of the corporation and its stockholders. 37 Cash Dividends Three dates are significant for a cash dividend (or any type of dividend). The date of declaration is the date the board of directors declares that a dividend will be paid. The corporation becomes legally liable to pay it on this date. The date of record is the date that is used to determine which investors own stock in the corporation and will be entitled to the dividend. The date of payment is the date the corporation mails the dividend checks to the investors who were owners on the date of record. 38 Recording a Cash Dividend Assume on November 15, 2004, Unlimited Decadence declares a 60 cent per-share dividend on its 1,200,000 outstanding common shares. The dividend is payable on December 29, 2004 to stockholders of record as of December 15, 2004. How much is the dividend and how is it recorded? 60 cents X 1,200,000 = $720,000 dividend to be paid; liability accrued on the declaration date Assets = Retained Earnings is decreased on the date of declaration Liabilities + Stockholders’ Equity +$720,000 Dividends Payable) -$720,000 (Retained Earnings) 39 Payment of a Cash Dividend Previously Declared When Unlimited Decadence pays the $720,000, the liability is liquidated. How is it recorded? Assets -$720,000 (Cash) = Liabilities + Stockholders’ Equity -$720,000 Dividends Payable) 40 Cash Dividends on Preferred Stock Holders of preferred stock have preference as to dividends. This means that their dividend must be paid before anything can be paid common stockholders. It does not mean that the dividend is guaranteed. A corporation issues preferred stock with a par value and expresses the dividend as a percentage of this value. For example, preferred stock that is issued with a $50 par value and pays 10% means that a dividend of $5 per share is paid ($50 X 10%). The total preferred dividend is equal to the dividend per share times the number of preferred shares that are outstanding when the dividend is declared. 41 Cumulative Preferred Stock Holders of cumulative preferred stock have preference as to dividends and the right to received all prior, unpaid dividends once a dividend is declared payable by the Board of Directors. Most preferred stock is cumulative. All cumulative preferred stock dividends must be paid before any dividend can be paid on common stock. The total cumulative preferred dividend is equal to the dividend per share X the number of preferred shares X the number of outstanding years when the dividend is declared. 42 Stock Dividends Occasionally, a corporation may declare and distribute a stock dividend. A stock dividend is a proportional (pro rata) distribution of additional shares of a corporation’s own stock to stockholders instead of paying cash. For example, assume a corporation has 10,000 shares of stock outstanding and one shareholder owns 2,000 shares. If a 10% stock dividend is declared, the corporation will now have 11,000 shares outstanding (10,000 x 1.10) and the stockholder will now own 2,200 shares (2,000 x 1.10). 43 Small Stock Dividends For reporting purposes, GAAP distinguishes between small and large stock dividends. Small stock dividends are assumed to have no significant affect on the stock market price of outstanding shares. A small stock dividend is 20% or less of the previously outstanding common shares. When a small stock dividend is declared, a company reduces retained earnings for the current market value of the dividend and increases its contributed capital by a like amount, resulting in no net change to stockholders’ equity. 44 Payment of a Small Stock Dividend Assume Crabtree Corporation declares and issues a 10% stock dividend. Before the dividend, Crabtree has 10,000 shares of its $10 par common stock outstanding. The common stock is selling for $19 per share, so the 1,000 share stock dividend (10,000 X 10%) has a current market value of $19,000 (1,000 shares X $19). 11,000 shares of common stock are outstanding after the stock dividend. How does this affect stockholders’ equity? The par value of new shares issued (1,000 shares @ $10 par value) Excess over par value of new Contributed capital: Common stock shares issued (1,000 shares @ Additional PIC $9) Total contributed capital Retained earnings Total Stockholders' Equity 11,000 shares @ $10 par value) Before Stock Dividend $ $ $ $ $ 100,000 70,000 170,000 140,000 310,000 After Stock Dividend Change + + - $ 10,000 $ 9,000 $ 19,000 $ 19,000 $ - = = = = = $ $ $ $ $ 110,000 79,000 189,000 121,000 45 310,000 Large Stock Dividends and Stock Splits Sometimes the market price of a corporation’s common stock increases to the point where it is not as attractive to certain investors. To reduce the market price so that it falls within the trading range of most investors, a corporation may authorize a large stock dividend or a stock split. Unlike a small stock dividend, a large stock dividend is recorded at its par value not at its market value. 46 Payment of a Large Stock Dividend Assume Crabtree Corporation declares and issues a 100% stock dividend. Before the dividend, Crabtree has 10,000 shares of its $10 par common stock outstanding. The common stock is selling for $19 per share, but the dividend is recorded at its par value (10,000 X $10). 20,000 shares of common stock are outstanding after the dividend. How does this affect stockholders’ equity? The par value of new shares issued (10,000 shares @ $10 par value) Contributed capital: Common stock Additional PIC Total contributed capital Retained earnings Total Stockholders' Equity 20,000 shares @ $10 par value) Before Stock Dividend $ $ $ $ $ 100,000 70,000 170,000 140,000 310,000 Change + - $ 100,000 = = $ 100,000 = $ (100,000) = $ - = After Stock Dividend $ $ $ $ $ 200,000 70,000 270,000 40,000 310,000 47 Comprehensive Income Comprehensive income is a measure of a company’s performance that includes items other than net income from the income statement. Basically, the idea is to give users a better picture of the items that affected stockholders’ equity of the company that may not have been reported in net income. It includes unrealized gains and losses from adjusting to the market value method for investments and other similar items. 48 Statement of Changes in Stockholders’ Equity A statement of stockholders’ equity is a supporting schedule to the stockholders’ equity section of the balance sheet. It bridges the gap between the income statement and balance sheet to identify changes that have occurred during an accounting period that affected stockholders’ equity. External users are interested in this statement because it provides information that may have an impact on the corporation’s risk and financial flexibility. 49 Reporting Changes in Stockholders’ Equity and Ending Stockholders’ Equity 50