Chapter 13B

advertisement

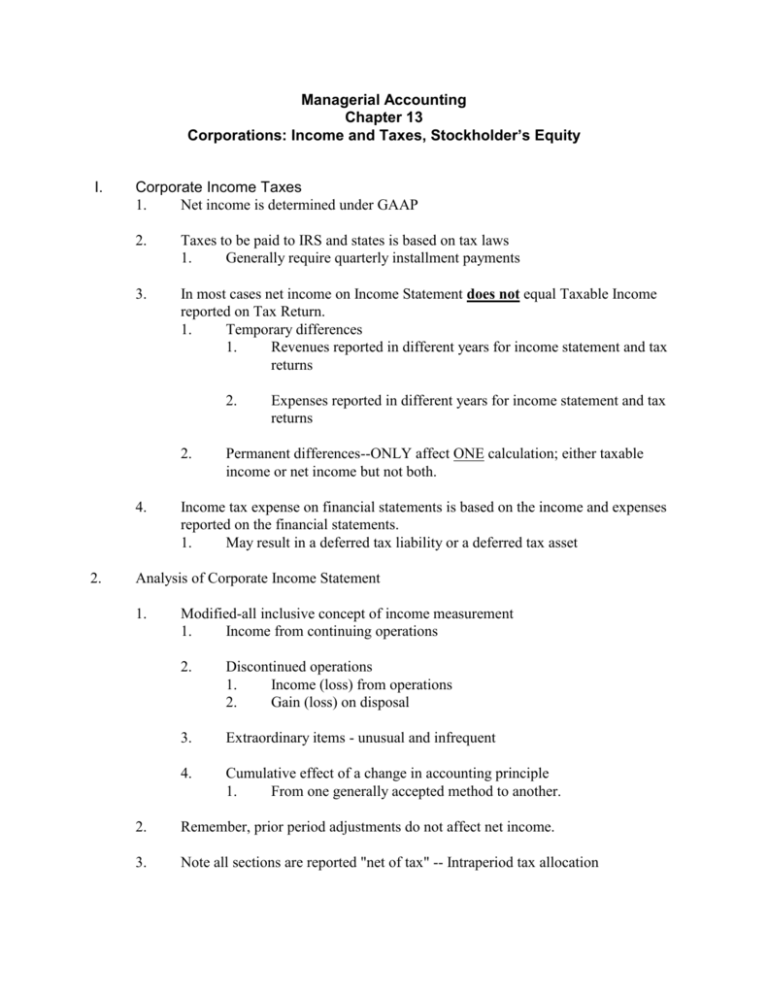

Managerial Accounting Chapter 13 Corporations: Income and Taxes, Stockholder’s Equity I. Corporate Income Taxes 1. Net income is determined under GAAP 2. Taxes to be paid to IRS and states is based on tax laws 1. Generally require quarterly installment payments 3. In most cases net income on Income Statement does not equal Taxable Income reported on Tax Return. 1. Temporary differences 1. Revenues reported in different years for income statement and tax returns 2. 2. 4. 2. Expenses reported in different years for income statement and tax returns Permanent differences--ONLY affect ONE calculation; either taxable income or net income but not both. Income tax expense on financial statements is based on the income and expenses reported on the financial statements. 1. May result in a deferred tax liability or a deferred tax asset Analysis of Corporate Income Statement 1. Modified-all inclusive concept of income measurement 1. Income from continuing operations 2. Discontinued operations 1. Income (loss) from operations 2. Gain (loss) on disposal 3. Extraordinary items - unusual and infrequent 4. Cumulative effect of a change in accounting principle 1. From one generally accepted method to another. 2. Remember, prior period adjustments do not affect net income. 3. Note all sections are reported "net of tax" -- Intraperiod tax allocation 3. Earnings per Share 1. What is net income attributable to each share of common stock 2. Calculation - basic E.P.S. 1. Net income available to common stockholders Weighted average number of shares outstanding 1. Net income available to common stockholders is the net income less preferred dividends. 2. 4. 5. Stock split or stock dividend is treated as if occurred at beginning of year. 3. Computation is more difficult with a complex capital structure -- compute diluted E.P.S. 4. Earnings per share data is reported for each major component in measuring net income. 1. Income from continuing operations. 2. Discontinued operations. 3. Extraordinary items. 4. Cumulative affect of change in accounting principles. Statement of Stockholder’s Equity 1. Shows changes in all components of Stockholder’s Equity 2. Includes changes in retained earnings. 3. Most companies include reporting of comprehensive income in this statement. Computation of Book Value per Share 1. Commonly cited number used in several ratio calculations by investors 2. Represents the equity of the owner of one share of common stock in net assets of corporation (i.e. Average investment for each share) 3. Calculation 1. If only common stock outstanding Total Stockholders Equity / Number of Common shares outstanding 2. If both common and preferred out Total stockholders Equity - Equity allocable to Preferred / number of common shares outstanding