LTA_AA Tax Seminar - Queen Mary University of London

advertisement

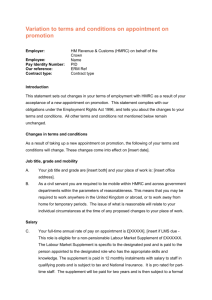

Pensions Taxation – Lifetime Allowance, Annual Allowance (AA) and Tapered Annual Allowance (TAA) Presented By Gary O’Neill Overview of Presentation • • • • • • • • • • • • • What is Lifetime Allowance? How it is calculated Individual Protection 2014 Fixed and Individual Protection 2016 Tax Charge on Exceeding the Lifetime Allowance What is Annual Allowance? How it is calculated? Combining Defined Benefits and Defined Contributions Carry Forward Tax Charge on Exceeding the Annual Allowance Scheme Pays Transitional Arrangements (2015/2016) Tapered Annual Allowance (April 2016) What is Lifetime Allowance • It is a limit on the amount of pension benefit that can be drawn from pension schemes via a lump sum or retirement income without triggering an extra tax charge. • It was introduced in April 2006 (with a limit of £1.5 million) in conjunction with the Annual Allowance (limit of £215,000) and replaced the Pension Earnings Cap (introduced in June 1989). • It is a personal taxation issue (you are responsible for making arrangements to pay or mitigate a Tax Charge). • The current limit is £1.25 million (effective from April 2012) reducing to £1 million with effect from 6 April 2016. • A Tax Charge would apply if the limit is exceeded on retirement. How is Lifetime Allowance calculated? • USS and the NHSPS are Defined Benefit (DB) Schemes. Growth is based on an accrual of service (years and days) and pensionable salary (full time equivalent for Final Salary members, actual salary for Career Revalued Earnings Scheme members). • USS will change to a hybrid Defined Benefit/Defined Contribution scheme from 1 October 2016. • Crystallisation Event is a calculation of your total pension funds (excluding state benefits)at the point of retiring. Includes Defined Benefits, Defined Contribution, Additional Voluntary Contribution and a pension in payment (25 X pension). • Defined Benefit (FS 80th) Example • Pension X 20 + Lump Sum = Lifetime Allowance • £45,000 X 20 + £135,000 (3 X pension) = £1,035,000 • Defined Contributions • Fund value at Retirement £54,000 for example Tax Charge on exceeding the Lifetime Allowance • If deducted from pension – 25% of the excess of Lifetime Allowance is paid to the HMRC and the pension is reduced aligned with the payment. The remaining pension is then subject to income tax at the normal rates. • If deducted from Lump Sum – 55% of the excess of Lifetime Allowance is paid to the HMRC. The remainder is paid as cash. • 1 October 2016 USS Hybrid Arrangement – 55% of the excess of Lifetime Allowance if deducted from the Defined Contribution section. Individual Protection 2014 (IP2014) • Lifetime Allowance was reduced from £1.5 million to £1.25 million from 6 April 2014. • Can be applied for from the HRMC by 5 April 2017. • Lifetime Allowance had to be over £1.25 million on 5 April 2014 to apply for IP2014 • Protection equal to pensions savings on 5 April 2014 up to an overall maximum of £1.5 million. • The excess will be subject to a tax charge. • Can be applied for if you have Enhanced Protection, Fixed Protection or Fixed Protection 2014. IP2014 will remain dormant until you lose your prior protection. • Can continue to contribute to a pension scheme. • Application link – https://online.hmrc.gov.uk/shortforms/form/IP2014?dept-name=subdept-name=&location=36&origin=http://www.hmrc.gov.uk Fixed Protection 2016 (FP2016) and Individual Protection 2016 (IP2016) • • • • • • • To protect against the reduction of Lifetime Allowance to £1 million from 6 April 2016. Fixed Protection 2016 – Can protect up to £1.25 million of LTA but pension accrual (scheme contributions) would stop. Can lose protection if you continue to contribute to a Defined Contribution or Defined Benefits arrangement. Individual Protection 2016 – Protects a personal LTA as at 5 April 2016 (up to £1.25 million) and can continue to contribute to a Defined Contribution or Definded Benefits arrangement. Online applications will not be available until July 2016. An interim FP2016 and IP2016 application arrangement will be available if accessing benefits between 6 April 2016 and July 2016 Recommended that members ask for quotations re. their LTA status as at 5 April 2016 to establish if an application for FP2016 or IP2016 is required and to discontinue contributions (if FP2016). Enhanced Opt Out (USS only) – 2.5% employee contribution allows a member to maintain death and ill health cover. 2.1% employer contribution is deducted for deficit repayment. What is Annual Allowance? • It is a limit on the growth of your pension for each tax year, while still receiving tax relief. • It was introduced in April 2006 (limit of £215,000) in conjunction with the Lifetime Allowance (limit of £1.5 million) and replaced the Pension Earnings Cap (introduced in June 1989). • It is a personal taxation issue (you are responsible for making arrangements to pay or mitigate a Tax Charge). • Reduced to £1.5 million in April 2012 to generate more tax income for the government. • The limit for the 2014/2015 was £40,000 and the 2015/2016 tax year is £80,000 (as part of the transitional arrangements for Pension Input Period (PIP) alignment). • A Tax Charge would apply if the limit is exceeded in a tax year. Annual Allowance Rates from April 2006 • • • • • • • • • • 2006/2007 2007/2008 2008/2009 2009/2010 2010/2011 2011/2012 2012/2013 2013/2014 2014/2015 2015/2016 • 2016/2017 £215,000 £225,000 £235,000 £245,000 £255,000 £50,000 £50,000 £50,000 £40,000 £80,000 (Transitional Arrangements), split tax year and can only carry forward £40,000 into the second period. £40,000 Tapered Annual Allowance (Annual Allowance limit reduces by £5,000 for every £10,000 earned from £150,000 to £210,000) How is Annual Allowance calculated (Defined Benefit Schemes)? • USS and the NHSPS are Defined Benefit (DB) Schemes. Growth is based on an accrual of service (years and days) and pensionable salary (full time equivalent for Final Salary members, actual salary for Career Revalued Earnings Scheme members). • Pension Input Periods (PIPs) • A valuation of your overall pension fund is undertaken at the beginning of the tax year and increased by the Consumer Price Index from the previous September. • A further valuation of your overall pension fund is undertaken at the end of the tax year. • The value at the beginning of the tax year is subtracted from the value at the end of the tax year and the remainder is contributory to the Annual Allowance. DB AA calculation example • • • • • Pensionable service = 21 years Salary £85,000 Consumer Price Index 2.7% 21 / 80 X £85,000 = £22,312.5 (pension), £22,312.5 X 3 = £66,937.50 ( lump sum) 19 (HMRC Factor) X £22,312.50 + 2.7% = £435,383.81 (fund value at 31 March 2014) • • • • • Pension Input Period 1 April 2014 – 31 March 2015 Pensionable service = 22 years Salary £95,000 22 / 80 X £95,000 = £26,125 (pension), £26,125 X 3 = £78,375 (lump sum) 19 X £26,125 = £496,375 (fund value at 31 March 2016) • • • • Excess of the Annual Allowance £496,375 - £435,383.80 = £60,991.20 Difference – Annual Allowance = Excess subject to a tax charge Tax Charge applies to £20,991.20 How is Annual Allowance calculated (Defined Contribution Schemes)? • Defined Contribution (DC) Schemes are funded based investments. There are usually a range of investment options (low risk, high risk, ethical etc) and you would pay directly into these investments. • There are optional Defined Contribution components to both USS and the NHSPS (Prudential for USS members and Prudential and Standard Life for NHSPS members) as well as open market external options. • The amount paid into a DC arrangement reduces the Annual Allowance by the same amount. • Example • £10,000 paid to the Prudential = a reduction in Annual Allowance of £10,000 Combining DB and DC Annual Allowance • The DB and DC (including external DB or DC arrangements) Annual Allowance components are added together to establish the final Annual Allowance figure. • Formula: • DB Annual Allowance + DC Annual Allowance = Total Annual Allowance Annual Allowance – Carry Forward • You can bring forward any unused Annual Allowance from the previous 3 tax years to increase the amount of Annual Allowance to offset a tax charge provided you were a member of a registered pension scheme during the carry forward period. • • • Example of calculating Carry Forward Annual Allowance is £35,000 for the Payment Input Period 1 April 2011 – 31 March 2012 Annual Allowance limit is £50,000, unused Annual Allowance = £15,000 • • Annual Allowance is £40,000 for the Payment Input Period 1 April 2012 – 31 March 2013 Annual Allowance limit is £50,000, unused Annual Allowance = £10,000 • • Annual Allowance is £38,000 for the Payment Input Period 1 April 2013 – 31 March 2014 Annual Allowance limit is £40,000, unused Annual Allowance = £2,000 • • Total Carry Forward of unused Annual Allowance = £27,000 Total Annual Allowance for Payment Input Period 1 April 2014- 31 March 2015, £27,000 + £40,000 = £67,000 Tax Charge on exceeding the AA limit • The Pension Scheme undertakes an annual AA and Carry Forward check and will produce a statement if the AA limit for the tax year is exceeded. • If you have another pension scheme arrangement (DB, Private or Money Purchase Additional Voluntary Contribution) you would need to compile AA figures for all active elements of your pension if you wanted to establish if you had exceeded the Annual Allowance. • The amount of the Annual Allowance Charge can be in whole or in part at 45%, 40%, or 20% depending on your taxable income and the amount of pension savings that are in excess of the Annual Allowance limit for the year concerned. • You would need to complete an Her Majesties and Customs Self Assessment (HMRC) Tax Return if you exceed the Annual Allowance. • You would need to register with the HMRC if you have not previously completed a self assessment. Calculating a Tax Charge • Example: • Tax Earnings = £130,000 • Amount exceeding the Annual Allowance = £50,000 • Total = £180,000 • 45% Tax Charge applies to amount of total exceeding £150,000 • £30,000 X 45% = £13,500 • 40% Tax Charge applies to the remaining £20,000 below £150,000 • £20,000 X 40% = £8,000 • Total Tax Charge is £21,500 How to pay the Tax Charge • You would need to complete an Her Majesties and Customs Self Assessment (HMRC) Tax Return if you exceed the Annual Allowance. • You would need to register with the HMRC if you have not previously completed a self assessment. • It is not possible to pay the charge over the phone to the HMRC but you could pay by: • • • • • Online or telephone banking CHAPS or Bacs Debit or Credit card online Bank or Building Society or at the Post Office. The deadline for payment is 31 January for any tax owed for the previous tax year (known as a balancing payment). • A scheme pays option is available for Annual Allowance charges exceeding £2,000 Scheme Pays Arrangements • Conditions: • Your benefits in a Payment Input Period are greater that the AA limit. • You have no Carry Forward to utilise from previous years. • Your overall Tax Charge is more than £2,000 • The scheme (USS or NHSPS) will only apply Scheme Pays to a Tax Charge in relation to excess allowance built up in their schemes. • You would have the option to pay part of the Tax Charge and the scheme can pay the remainder, or, the scheme can pay in full. How is Scheme Pays deducted from Retirement Benefits? • • • • • • • • • • • • There are 2 methods of calculating the deduction from your benefits under Scheme Pays both would be subject to increases based on the Consumer Prices Index (CPI). You ask the pension scheme to pay your Tax Charge: At the point of retirement; or As you’re approaching retirement; or If you’re age 65 or over The reduction would be based on the commutation applicable at retirement. This is the same rate that is used to commute pension to extra cash. Example: If the scheme has paid £50,000 and the commutation factor is 17.00 the reduction of pension would be as follows: £50,000 / 17.00 = £2,941.17 reduction of pension per annum (increased annually with CPI) You ask the pension scheme to pay your Tax Charge: When you’re under the age of 65; or You’re not contemplating retirement The reduction will be calculated using the current scheme transfer factors (applies to USS only) Applying for Scheme Pays • You would indicate that you elect for the pension scheme to partly or fully pay your Tax Charge within your HMRC self assessment tax return (no later that 31 January) . You would need to state the amount being paid by: • You and the scheme; or • Fully paid by the scheme. • You would then need to notify the scheme before and no later than the following 31 July. • On line Scheme Pays forms are available on the USS and NHSPS websites. Transitional Arrangements to align Payment Input Periods (PIP) • USS and NHSPS Pension Input • From 6 April 2016, all PIPs will align with the tax year (previously 1 April – 31 March) • The PIPs that were open on 8 July 2015 ended on the 8 July 2015 and a new PIP commenced from 9 July 2015 (to coincide with the Budget). • • Two-part year for PIP purposes: Period 1 – 1 April 2015 – 8 July 2015 = £80,000 with any Carry Forward from previous periods. • Period 2 – 9 July 2015 - 5 April 2016 = £40,000 can be brought forward from period 1 together with any unused Carry Forward from the previous 3 years PIPs • Awaiting further details from USS and NHSPS. Tapered Annual Allowance 2016/2017 • Tapered Annual Allowance (TAA) will be introduced from 6 April 2016. • The Annual Allowance limit reduces by £1 for every £2 earned from an adjusted income of £150,000 to £210,000 • An adjusted income at or above £210,000 will reduce an Annual Allowance from £40,000 (the standard Annual Allowance) to £10,000 • Establishing if tapering applies is dependent on your: • Threshold Income – if £110,000 or above • Adjusted Income - if threshold income is £110,000 or above and adjusted income is above £150,000 Calculating Threshold Income • Includes taxable income from all sources: • Employment Income • Property Income • Dividend Income (shares) • Pensions in Payment • Savings Income • Any income sacrificed under a salary sacrifice arrangement entered into on or after 9 July 2015 (anti-avoidance rules) • Minus employee pension contributions paid from taxed earnings Calculating Adjusted Income • Includes taxable income from all sources: • Employment Income • Property Income • Dividend Income (shares) • Pensions in Payment • Savings Income • Any income sacrificed under a salary sacrifice arrangement entered into on or after 9 July 2015 (anti-avoidance rules) • Plus the value of your employer contribution to any defined benefit arrangement (as per the Annual Allowance calculation) or defined contribution arrangement Example of Tapering • Threshold income £135,000 • Defined Benefit growth is £45,000 – employee contributions of £10,000 = £35,000 • Adjusted income, £135,000 + £35,000 = £170,000 • £20,000 over adjusted income of £150,000 / 2 = £10,000 reduction in Annual Allowance of £40,000 (£30,000). • If annual growth of pension benefits exceeds £30,000 then a tax charge would apply. Voluntary Salary Cap (USS only) • Effective from 1 October 2016 • Allows a member to reduce their growth of benefit to counter the Taper • Pension contributions can be capped at a minimum of £55,000 (resulting in an Annual Allowance of approximately £14,000 p.a.) • Member could continue to pay 2.5% on earnings above the cap to secure full ill health and death cover. • An employer contribution of 2.1% on earnings above the cap would apply for deficit repayment. Further Information and Financial Advice • • Links to the USS & NHSPS websites together with a link to further information on the existing Tax Relief Limits can be found at the following link: Http://www.ucl.ac.uk/hr/pensions/index-home.php • • Technical Information on Annual Allowance is available at the following HMRC link: http://www.hmrc.gov.uk/manuals/rpsmmanual/RPSM06105000.htm • Annual Allowance Calculator – http://www.hmrc.gov.uk/tools/pension-allowance/index.htm • NHSPS Tapered Annual Allowance Factsheet – http://www.nhsbsa.nhs.uk/Documents/Pensions/201617_Tapered_Annual_Allowance_(12.2015)_V1.pdf • USS Pensions Scheme Tax Allowance – http://www.uss.co.uk/news/Pages/Pensionschemetaxallowance.aspx • Individual Protection 2014 – http://www.hmrc.gov.uk/manuals/rpsmmanual/RPSM11107000.htm • • HMRC Self Assessment: register for Self Assessment and get a tax return (SA1) link: https://www.gov.uk/government/publications/self-assessment-register-for-self-assessment-and-get-a-tax-return-sa1 • If you do not exceed the Annual Allowance (with the inclusion of Carry Forward) or Lifetime Allowance, you may wish to consider taking Independent Financial Advice regarding your options. • • USS Members cam visit the following link: http://www.uss.co.uk/SchemeGuide/CareerRevaluedBenefitssection/maximisingyourpension/financialadvice/Pages/default.aspx • • NHSPS Members can visit the following link: http://www.nhsbsa.nhs.uk/Pensions/4203.aspx Independent Financial Advice @ Queen Mary, University of London • Over 17 years experience of advising Higher Education professionals • Provide a ‘financial advice in the workplace programme’ for: Queen Mary University of London; The University of Northampton; and specialist pensions advice to staff members of University College London, Senate House, Heythrop College and St Georges Medical College. • Pre and post retirement advice for individuals in order to maximise pension benefits and mitigate taxation • Specialist advice on AA/LTA calculations, can arrange for AA/LTA calculations & advise on strategies to mitigate • Investment advice and management service which includes a review of existing investments held and also recommendation of suitable future investments • Individual meetings can be held at the work place or at your home Independent Financial Advice – Why? • Queen Mary, University of London, USS and NHS Pensions can: – provide information about the scheme and your benefits – clarify technical issues/queries – direct you to where guidance / information is located to enable you to make an informed decision about the options available / choices facing you. • but CANNOT give financial advice • Complex matters, difficult decisions to make, its natural you will want help in making a decision which is best for you • You should seek advice as your net benefits, even after a potential tax charge, may be greater than the net cost of the contribution paid by you. • Identify / discuss your retirement objectives Gary O’Neill Austin Chapel Independent Financial Advisers LLP St Laurence House Gridiron Place Upminister Essex RM14 2BE 01708 220816 gary.oneill@austinchapel.co.uk