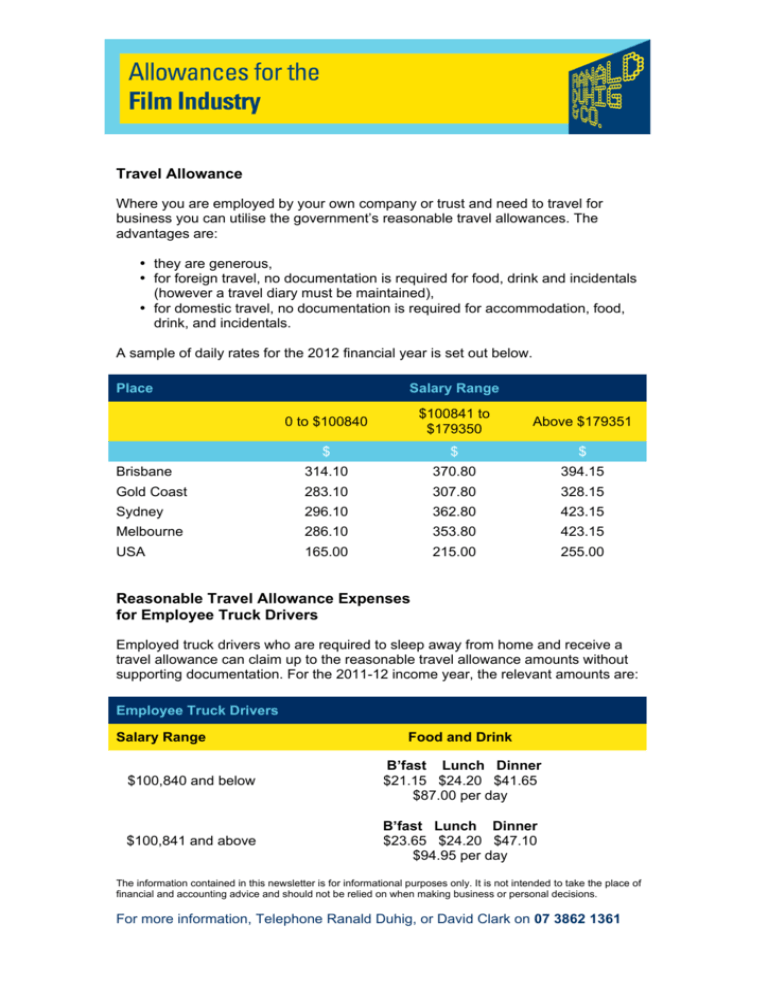

Travel Allowance Reasonable Travel Allowance Expenses for

advertisement

Travel Allowance Where you are employed by your own company or trust and need to travel for business you can utilise the government’s reasonable travel allowances. The advantages are: • they are generous, • for foreign travel, no documentation is required for food, drink and incidentals (however a travel diary must be maintained), • for domestic travel, no documentation is required for accommodation, food, drink, and incidentals. A sample of daily rates for the 2012 financial year is set out below. Place Salary Range 0 to $100840 $100841 to $179350 Above $179351 $ $ $ Brisbane 314.10 370.80 394.15 Gold Coast 283.10 307.80 328.15 Sydney 296.10 362.80 423.15 Melbourne 286.10 353.80 423.15 USA 165.00 215.00 255.00 Reasonable Travel Allowance Expenses for Employee Truck Drivers Employed truck drivers who are required to sleep away from home and receive a travel allowance can claim up to the reasonable travel allowance amounts without supporting documentation. For the 2011-12 income year, the relevant amounts are: Employee Truck Drivers Salary Range Food and Drink $100,840 and below B’fast Lunch Dinner $21.15 $24.20 $41.65 $87.00 per day $100,841 and above B’fast Lunch Dinner $23.65 $24.20 $47.10 $94.95 per day The information contained in this newsletter is for informational purposes only. It is not intended to take the place of financial and accounting advice and should not be relied on when making business or personal decisions. For more information, Telephone Ranald Duhig, or David Clark on 07 3862 1361