The Time Value of Money - Electrical and Computer Engineering

advertisement

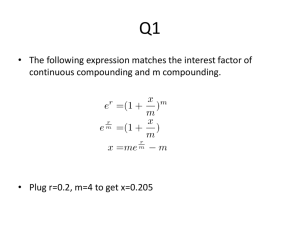

What is Engineering Economics? 1 What is Engineering Economics? Subset of General Economics Different from general economics situations - project driven Analysis performed by technical professionals (not economists) Requires advanced technical knowledge in some cases 2 Lots of Questions: Project/$ driven Why do this at all? Is there a need for the project? Why do it now? Can it be delayed? Can we afford it now? Why do it this way? Is this the best alternative? Is this the optimal solution? Will the project pay? Will we run a loss or make a profit? 3 Sample Engineering Project Hydro vs. Thermal power Hydro: expensive initially far away from load centres (high transmission cost) no fuel required longer life no pollution Thermal less expensive initially can be near load centres require fuel shorter life can cause pollution 4 Other examples Buy vs. rent (car, house, equipment) Good quality (expensive) but longer life vs. poor quality (cheap) but shorter life car, shoes, computers Investments decisions - GIC, RRSP, Bonds, Stocks and Shares 5 Steps in Engineering Economics Study Define alternatives in physical terms Cost and revenue estimates All money estimates placed on a comparable basis appropriate interest rate used time horizon (economic life) Recommend choice among alternatives 6 Engineering Economics on the Web The discipline that translates engineering technology into a form that permits evaluation by businesses or investors. The application of economic principles to engineering problems, for example in comparing the comparative costs of two alternative capital projects or in determining the optimum engineering course from the cost aspect. 7 The Time Value of Money Would you prefer to have $1 million now or $1 million 100 years from now? Of course, we would all prefer the money now! This illustrates that there is an inherent monetary value attached to time. 8 What is Time Value? We say that money has a time value because that money can be invested with the expectation of earning a positive rate of return In other words, “a dollar received today is worth more than a dollar to be received tomorrow” That is because today’s dollar can be invested so that we have more than one dollar tomorrow 9 What is The Time Value of Money? A dollar received today is worth more than a dollar received tomorrow This is because a dollar received today can be invested to earn interest The amount of interest earned depends on the rate of return that can be earned on the investment Time value of money quantifies the value of a dollar through time 10 Uses of Time Value of Money Time Value of Money, is a concept that is used in all aspects of finance including: Stock valuation Financial analysis of firms Accept/reject decisions for project management And many others! 11 The Terminology of Time Value Present Value - An amount of money today, or the current value of a future cash flow Future Value - An amount of money at some future time period Period - A length of time (often a year, but can be a month, week, day, hour, etc.) Interest Rate - The compensation paid to a lender (or saver) for the use of funds expressed as a percentage for a period (normally expressed as an annual rate) 12 Abbreviations PV - Present value FV - Future value Pmt - Per period payment amount i - The interest rate per period 13 Purchasing Power and Value 14 Account Value Case 1: Inflation exceeds earning power N = 0 $100 N = 1 $106 Case 2: Earning power exceeds inflation N = 0 $100 N = 1 $106 Cost of Refrigerator N = 0 $100 N = 1 $108 (earning rate =6%) (inflation rate = 8%) N = 0 $100 N = 1 $104 (earning rate =6%) (inflation rate = 4%) 15 Timelines A timeline is a graphical device used to clarify the timing of the cash flows for an investment Each tick represents one time period PV 0 Today FV 1 2 3 4 5 16 Calculating the Future Value Suppose that you have an extra $100 today that you wish to invest for one year. If you can earn 10% per year on your investment, how much will you have in one year? -100 ? 0 1 2 3 4 5 FV1 1001 010 . 110 17 Calculating the Future Value Suppose that at the end of year 1 you decide to extend the investment for a second year. How much will you have accumulated at the end of year 2? 0 -110 ? 1 2 3 4 5 FV2 1001 010 . 1 0.10 121 or 2 FV2 1001 010 . 121 18 Generalizing the Future Value Recognizing the pattern that is developing, we can generalize the future value calculations FVN PV1 i N If you extended the investment for a third year, you would have: FV3 1001 010 . 13310 . 3 19 Compound Interest Note from the example that the future value is increasing at an increasing rate In other words, the amount of interest earned each year is increasing Year 1: $10 Year 2: $11 Year 3: $12.10 The reason for the increase is that each year you are earning interest on the interest that was earned in previous years in addition to the interest on the original principle amount 20 Compound Interest Graphically 4500 3833.76 4000 5% 3500 10% Future Value 3000 15% 2500 20% 2000 1636.65 1500 1000 672.75 500 265.33 0 0 1 2 3 4 5 6 7 8 9 10 Years 11 12 13 14 15 16 17 18 19 20 21 The Magic of Compounding On Nov. 25, 1626 Peter Minuit, purchased Manhattan from the Indians for $24 worth of beads and other trinkets. Was this a good deal for the Indians? This happened about 378 years ago, so if they could earn 5% per year they would in 2005 have $2,400,000,000 24(1.05) 378 If they could have earned 10% per year, they would now have: $106,000,000,000,000,000 24(1.10)378 22 Calculating the Present Value So far, we have seen how to calculate the future value of an investment But we can turn this around to find the amount that needs to be invested to achieve some desired future value: PV FVN 1 i N 23 Present Value: An Example Your five-year old daughter has just announced her desire to attend college. After some research, you determine that you will need about $100,000 on her 18th birthday to pay for four years of college. If you can 100,000 earn 8% per year on your PV $36,769.79 13 . investments, how much do 108 you need to invest today to achieve your goal? 24 Continuous Compounding There is no reason why we need to stop increasing the compounding frequency at daily We could compound every hour, minute, or second We can also compound every instant (i.e., continuously): F Pe rt Here, F is the future value, P is the present value, r is the annual rate of interest, t is the total number of years, and e is a constant equal to about 2.718 25 Continuous Compounding Suppose that the Fourth National Bank is offering to pay 10% per year compounded continuously. What is the future value of your $1,000 investment? F 1,000e 0 .10 1 110517 , . This is even better than daily compounding The basic rule of compounding is: The more frequently interest is compounded, the higher the future value 26 Continuous Compounding Suppose that the Fourth National Bank is offering to pay 10% per year compounded continuously. If you plan to leave the money in the account for 5 years, what is the future value of your $1,000 investment? F 1,000e 0.10 5 1,648.72 27 Summary Engineering Economics The Time Value of Money Calculating the Future/Present Value Simple/Compound Interest Self-Study: Simple Interest P+P*N*5% 1+1=2 Required: Slides/Book Chapter 2.1 2.2 2.3 2.5 Feedback: Quiz Review before Quiz Feedback: Book Library: waiting for answer 28