ACCOUNTING STANDARDS

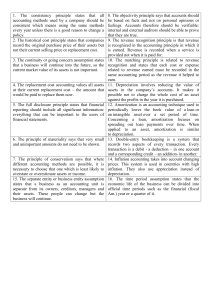

advertisement

ACCOUNTING STANDARDS Enable investors to make financial decisions STAKEHOLDERS shareholders/investors – BS, P&L managers – P&L employees – P&L creditors – CF banks – BS IR – CF auditors – BS, P&L, CF Accounting policies Valuation – how much something is worth Measurement – determining how big something is 1. GAAP (USA) – Generally Accepted Accounting Principles 2. IFRS – International Financial Reporting Standards (International Accounting Standards Board) Historical cost principle • recording the original purchase price of assets • The current value is not important if the business is a going concern (making profit) Replacement cost accounting Inflation accounting (countries with regular high inflation) Values all assets at their current replacement cost Accounting assumptions (generally accepted as being true) business entity – separate from its owners time period – year, quarter going concern – continuity (current value not important) unit-of-measure – financial transactions are in a single currency (consolidated statements) Replacement cost accounting Inflation accounting (countries with regular high inflation) Values all assets at their current replacement cost Accounting principles Full-disclosure – all significant information Going concern – ability to repay debts and other obligations Conservatism – choose the method that is least likely to overstate or over-estimate assets or income Objectivity – based on facts – verifiable Consistency – using the same principles from one year to the next Revenue recognition – the revenue is recorded when service is provided or goods delivered Matching – relating amounts of money paid and received to the accounting period in which they occur Depreciation and amortization Fixed assets – wear out, become obsolete Charge against profits - part of the cost of the asset is deducted from the profits each year Valuation of assets Land – is usually not depreciated (tends to appreciate) Revaluation – a) at current replacement cost (like buying the new ones) b) at net realizable value (NRV) (how much they could be sold for) Depreciation systems straight-line method – charging equal annual amounts against profit during the lifetime of the asset accelerated depreciation – deducting the whole cost of an asset in a short time (reducing profit and the amount of tax) We have learnt Multinationals can choose how to present financial information to _______________. Accounts can have different values depending on whether they follow local _________________standards, _______,or US ___________. It all depends on the __________of the country where the company is registered. Accountants worldwide are familiar with the basic principles: the g_______________concern principle the m______________ principle the c_______________ principle Multinationals can choose how to present financial information to stakeholders (or outside parties). Accounts can have different values depending on whether they follow local accounting standards, IFRS, or US GAAP. It all depends on the laws of the country where the company is registered. Accountants worldwide are familiar with the basic principles: the going concern principle the matching principle the consistency principle Some accounting practises Flexibility is important in accounting. If we want to attract ________________on the capital markets we may want to report bigger _____________ . On the other hand, to pay ____________tax, smaller profits may be better. Flexibility is important in accounting. If we want to attract investors on the capital markets we may want to report bigger profits . On the other hand, to pay less tax, smaller profits may be better. How much accounting vocabulary you have learnt 1. 2. 3. 4. 5. 6. The capital value of an asset goes down over time. ___________________________________ Another word for land or buildings. ____________________________________ The process of including the figures of subsidiaries and affiliates in the account of a holding company. ______________________________ The money that a company or organization receives from its business. _______________________________ The person who examines the business and financial records of a company. ___________________________________________ A person who is considered to be an important part of an organization or of society because they have responsibility within it and receive advantages from it. _______________________________________ 1. 2. 3. 3. 4. 5. 6. The capital value of an asset goes down over time. depreciation Another word for land or buildings. property The process of including the figures of subsidiaries and affiliates in the account of a holding company. consolidation The money that a company or organization receives from its business. revenue The person who examines the business and financial records of a company. auditor A person who is considered to be an important part of an organization or of society because they have responsibility within it and receive advantages from it. staeholder