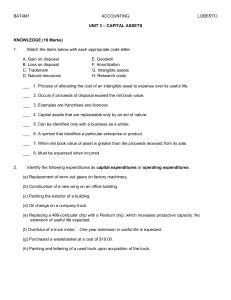

1. The consistency principle states that all accounting methods used by a company should be consistent which means using the same methods every year unless there is a good reason to change a policy. 2. The historical cost principle states that companies record the original purchase price of their assets but not their current selling price or replacement cost. 3. The continuity or going concern assumption states that a business will continue into the future, so the current market value of its assets is not important. 4. The replacement cost accounting values all assets at their current replacement cost – the amount that would be paid to replace them now. 5. The full disclosure principle states that financial reporting should include all significant information: everything that can be important to the users of financial statements. 6. The principle of materiality says that very small and unimportant amounts do not need to be shown. 7. The principle of conservatism says that where different accounting methods are possible, it is necessary to choose that one which is least likely to overstate or overestimate assets or income. 15. The separate entity or business entity assumption states that a business as an accounting unit is separate from its owners, creditors, managers and their assets. These people can change but the business will continue. 8. The objectivity principle says that accounts should be based on facts and not on personal opinions or feelings. Accounts therefore should be verifiable: internal and external auditors should be able to prove that they are true. 9. The revenue recognition principle is that revenue is recognized in the accounting principle in which it is earned. Revenue is recorded when a service is provided not when it is paid for. 10. The matching principle is related to revenue recognition and states that each cost or expense related to revenue earned must be recorded in the same accounting period as the revenue it helped to earn. 11. Depreciation involves reducing the value of assets in the company’s accounts. It makes it possible not to charge the whole cost of an asset against the profits in the year it is purchased. 12. Amortization is an accounting technique used to periodically lower the book value of a loan or an intangible asset over a set period of time. Concerning a loan, amortization focuses on spreading out loan payments over time. When applied to an asset, amortization is similar to depreciation. 13. Double-entry bookkeeping is a system that records two aspects of every transaction. Every transaction is a debit - a deduction – in one account and a corresponding credit – an addition- in another. 14. Inflation accounting takes into account changing prices. This system is used in countries with high inflation. They also use appreciation instead of depreciation. 16. The time period assumption states that the economic life of the business can be divided into official time periods such as the financial (fiscal Am.) year or a quarter of it.