February 2014 - Ohio University

advertisement

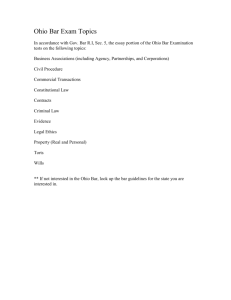

Bu$ine$$ Matter$ February 2014 New Stories ! ! ! Office Moves 1 Tax Updates 1 Tax for International Students 1 New Mileage Rate 2 New JP Morgan PCard Application 2 New Ohio Substitute W9 Form 2 Student Employment Reminders The monthly newsletter of Ohio University Finance The January 2014 Financial Management System (FMS) close reports are now available, to those of you who are report recipients, at: http://www.ohio.edu/ebiz/ebiz.html. Be sure to read below for important information related to your reports and other Finance services. If you need assistance accessing your reports or FMS in general, please contact the IT Service Desk at: 593-1222. If you have further questions or comments, please email fmsreporting@ohio.edu. 2 New Stories 3 Offices Have Moved Print Responsibly Billing Reminder Minimum Wage 3 Accounting Corrections form 3 Helpful Hints 4 Monthly Reminders!!! 4 Prior Stories!!! Do you need to refer to a prior story? The Budget Planning & Analysis team has moved to the 2nd floor of the HRTC building, rooms 241/243. The Payroll Office has moved to the 2nd floor of the HRTC building, room 221. Mary Alexander-Conte is in 218 HRTC and Barbara Kreutzer is in 216 HRTC. All phone numbers are the same. Tax Updates If you receive a 1099 form please send it to Barbara Kreutzer at: 216 HRTC. Click on the applicable month. http://www.ohio.edu/fi nance/gafr/business matters.cfm Tax Workshops for International Students Tax workshops for international students and researchers will be given in Baker 231 from 3-5 PM on February 6, 10, 13 and 17. Students should sign up by emailing finance.glacier@ohio.edu requesting a reservation. 1 IRS Decreases Mileage Rates The IRS has announced a decrease to the standard business mileage rates beginning Jan 1, 2014, from 56.5 cents to 56 cents per mile. New JP Morgan PCard Application form in effect beginning January 2, 2014 JP Morgan Chase will be requiring additional information on Ohio University’s PCard application to enhance their regulatory compliance. The new fields that must be included on each application include: Legal name of applicant Applicant’s country of citizenship Applicant’s home address Applicant’s date of birth This will apply to new applications only at this time but we may be required to collect this information on existing cardholders as well at a date that has yet to be determined by JP Morgan Chase. The Ohio University PCard Program Administrator will also be required to certify the information on the application. JP Morgan Chase will not issue an Ohio University PCard to applicants who refuse to provide the additional information. The additional information is being required due to regulations regarding the Office of Foreign Assets Control (OFAC) which administers and enforces economic sanctions, primarily against countries and groups of individuals, such as terrorists, and narcotics traffickers. The rules generally require that U.S. persons (all persons and entities within the U.S., all U.S. incorporated entities and their foreign branches) are prohibited from transacting with persons on a government sanctions list. As a U.S. entity and a regulated financial institution, JP Morgan Chase is required to ensure that individuals who are listed on a government sanctions list do not use their products. For more information on OFAC and its requirements, visit http://www.treasury.gov/resourcetaxta/faqs/Sanctions/Pages/answer.aspx. New Ohio Substitute W9 Form in effect beginning January 2, 2014 The Internal Revenue Service (IRS) has released a new Form W9, Request for Taxpayer Identification Number and Certification, as well as new instructions. The Form W9 is one of several forms being revised to conform to the provisions of the Foreign Account Tax Compliance Act (FATCA), although they have incorporated additional changes to the taxpayer certification as well as other fields to the form with this new release. Procure to Pay Services cannot accept previous versions of the OHIO Substitute W9 after our release date of January 2, 2014, so please be sure to remove any saved copies of previous versions on your computer or your web pages when the new form is released in mid-December, 2013. Additional information will be provided to CFAOs, on the Procure to Pay website, Compass, and Business Matters in December. For more information on FATCA, please visit http://www.irs.gov/Businesses/Corporations/Frequently-Asked-Questions-FAQs-FATCA--Compliance-Legal Reminders Regarding Student Employment 1. All forms are REQUIRED to be completed BEFORE a student begins working. 2 2. Payroll forms are updated on an as-needed basis. Check the Payroll website for the most up-to-date forms here: http://www.ohio.edu/finance/payroll/index.cfm 3. I-9’s must be completed correctly within 72 hours of employment. Do NOT make copies of identification. Only original documents can be used. Failure to comply could result in $1000 fine. 4. I-9’s for International Students must use List A Passport, I-94, and I-20 information only. Do NOT use ID’s for List B and C. 5. International students must also complete a Glacier Tax Compliance record and submit required document copies. 6. Students MUST use their PERMANENT addresses only on all forms unless they are international students. International students will use their US address. 7. Students have the option to participate in OPERS. Please make sure they complete the appropriate form. a. The Request for Optional Exemption is for students who are enrolled for at least 6 credit hours and do not wish to participate. Do not send the SSA-1945 with the exemption. b. The OPERS Employee Information Sheet AND the SSA-1945 are for those not eligible for exemption or who choose to participate in OPERS. These 2 forms must be together. 8. All forms must be completed in ink. 9. Please encourage your students to sign up for direct deposit. It will soon be a condition of employment. Actual checks are mailed to permanent home addresses only. 10. If the student has not worked since December 2012, all new hire forms should be completed. Print Responsibly Billing Reminder Print Responsibly billings occur quarterly in July, October, January, and April of each year. Files are released to CFAOs and FMGs for review prior to the upload to Oracle. Please contact Chad Burkett if you have any questions at Burkett@ohio.edu. Minimum Wage Increases January 1, 2014 The minimum wage in Ohio will increase to $7.95/hour effective January 1, 2014. Minimum wage for “tipped” employees will increase to $3.98/hour. Guidelines for Submitting Accounting Corrections to Grants GAFR has been asking everyone to use the multi-line tab of the Accounting Correction form for all entries, even two-line ones, because it saves processing time and doesn’t have to be rekeyed. However for individual corrections, Grants prefers the first tab, “Accounting Correction Form.” It allows more detail and provides all the information needed to fully audit a Grant transaction. Please contact finance@ohio.edu if you have any questions about which form to use. 3 Helpful Hints and Shortcuts: When creating any accounting transaction, please verify the account numbers in advance. We have created the “Account Verification Tool” that will check your multi-line form account numbers for you. You can access this tool via the following link. http://www.ohio.edu/finance/gafr/gafr.cfm IMPORTANT: DO NOT SAVE THE ACCOUNT VERIFICATION TOOL TO YOUR DESKTOP AS IT IS UPDATED WEEKLY AND YOU WILL NOT HAVE UP TO DATE INFORMATION!!! Another handy tool available on the web is Cost Center Lookup (cclookup). You may search by project number, by a combination of an account number, or by word. Example: Project UN0000000, Combination 010-040018010, or the word ‘Provost’. You can access cc-lookup via the following link, http://portal.finance.ohiou.edu/cclookup/cclookup Both tools will allow you to see all segment combinations that are listed as valid in our system at the present time. If you have any questions or concerns please contact the General Accounting and Financial Report office at: finance@ohio.edu. Monthly Reminders! TRANSACTION DEADLINES: All Accounting Corrections are due in Finance within 60 days of the FMS effective date. Example: A transaction posting on FMS January 31, 2012 should have an Accounting Correction completed by April 1, 2012. If the correction is past 60 days an exception request form MUST be completed. All invoices for payment, Internal Billing Authorizations, External Billings, etc. are due in Finance within 30 days of the date of service. Example: An Internal Billing for a service performed on January 31, 2012 should be completed by March 1, 2012. Departments that do not bill in a timely manner (i.e. within 30 days from the time of service) may be subject to losing that income. If the billing department has extenuating circumstances that prevent billing within the 30-day time frame please contact general account and financial reporting at: finance@ohio.edu Please note that grant accounts have stricter deadlines and the department with responsibility for the grant account should make sure departments charging those accounts submit the billings within the allowable timeframe for the grant. FINANCE ONLINE TRAINING: Visit our Finance Training web site. You will find Finance Online Training demos, Practice Your Skills and handouts. The training topics include PCard/Concur, Travel, Financial Management System (FMS), and WorkForce. The Finance Training web site contains information on accessing and using Oracle FMS, applying for a purchasing card, reviewing travel policies and forms, Purchase Order Lookup, Invoice Payments, approving Work Force timesheets, and more. We are currently working on additional training demos covering other Finance topics which will be available soon. You may access the Finance Training web site at: http://www.ohio.edu/finance/customercare/training.cfm 4 REPORT DISTRIBUTION MAINTENANCE: If someone in your area changes jobs or leaves the university please ask your planning unit’s FMG to complete a report distribution maintenance form or email any questions to: fmsreporting@ohio.edu . The report distribution maintenance form is located at: http://www.ohio.edu/finance/customercare/controller_forms.cfm ACCOUNT MAINTENANCE/ADDITIONS: If you need any type of account maintenance (accounts or cost centers added, or disabled) please complete a new account/account maintenance form and submit to fmsreporting@ohio.edu. The new account/account maintenance form is located at: http://www.ohio.edu/finance/customercare/controller_forms.cfm ACCESS TO FMS: Please contact fmsreporting@ohio.edu to request online access to FMS. This request should come from the supervisor. Departments are responsible for making sure the employee completes the online training modules PRIOR to accessing the system. PREVIOUS ISSUES OF BUSINESS MATTERS: Previous issues of Business Matters can be found at: http://www.ohio.edu/finance/gafr/businessmatters.cfm. 5