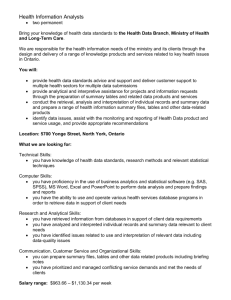

Interactive Ontario * Preliminary Transitional Business Plan

advertisement

If the innovations today are the pipelines of jobs tomorrow then Ontario’s Interactive Digital Media Creative Cluster is well placed to answer the province’s call “to create jobs and grow the economy by investing in people…” as laid out in the Ontario Budget 2014. Interactive Digital Media (IDM) is constantly evolving From console gaming to Internet-based to mobile 1980s Mid - 2000 B.C. and Quebec early adopters of console game development. Companies: Distinctive Gaming, Radical, EA Canada Number of web games & casual games join the console gaming industry, compete for eyeballs. Companies: Zynga, Uken Games Today Mobile Apps, interactive choose-your adventure documentaries, e-learning, transgaming, and digital content studios producing for online broadcasters, take greater market share. Companies: Phantom Compass, XMG, Game Pill, Smokebomb, Blue Ant Tomorrow Interactive content will leverage wearable technologies to make augmented reality, real-time gamified content and more. Companies: Digital Howard, Secret Location The evolution of digital platform has favored SMEs with the explosive growth of mobile apps & games Ontario’s IDM companies are growing and diversified: start-up nation Nova Scotia 10% Outside of Canada 2% • Some large console game companies, and a high # of SMEs in mobile App, casual, web gaming, digital content, e-learning sub-sectors. • IDM revenue in Ontario. • Much of Ontario’s IDM sector has grown as offshoot of strong film and TV studios. Quebec 13% • Ontario has start-up culture: Number of IDM companies across Canada as a % of total British Columbia 33% • Two-thirds BC of companies 7 +years old; no selfdescribed start-ups. • In Ontario 25% of IDM companies are under 3 years &10% self-described start-ups. • Ontario has fewer foreign-owned companies:12% compared to 41% in BC. Prairie Provinces 16% Ontario 26% SOURCE : CIAIC REPORT 2013 AND ESAC SURVEY 2013 AND INTERACTIVE ONTARIO 2012 REPORT multi-platforms + entrepreneurs = great innovation potential Snapshot of Ontario’s IDM Sector Ontario’s IDM sector has all the ingredients for sustainable growth – the talent, the diversity, the entrepreneurship, the innovation (technical + creative), the cost structure and the global opportunity • Employs 16,000 Ontarians. • Generates $1 billion in predominantly export direct revenue; $2.1 billion when enabling and supporting revenues are included. • Contributes $1 billion annually to Ontario's GDP. • Expected to grow on the order of 15% in next 2-3 years. BUT • Ontario is still catching up. • Still only represents 28% of total Canadian IDM revenues. Snapshot of Ontario’s video game industry other 12% • Approximately 100 companies. Ontario 8% • Directly employ 1,821 Ontarians. • Generates $134 million in direct spending;. • 65% of Ontario-based companies have been in business for more than seven years. BUT Quebec 34% Percentage of video game expenditures by province • Relatively small compared to BC & Quebec with their larger, mature, video game core. • BC employs 5,140 in video games and Quebec 8,749. BC 46% • Ontario lagging in video game expenditures (proxy for industry size). Ontario is the tortoise to the BC hare SOURCE : ESAC ESSENTIAL FACTS 2014, ESAC SURVEY 2013 IDM is one of only a handful of sectors that can help drive Ontario’s future • Anchoring talent • Average age of creative/ technical employees is 32 • Employs adaptable labour • Combines technical and creative • 66% of IDM employees have university degrees; 97% had at some university or college education • Training ground for higher education and co-op student placements IDM entrepreneurs have source code for economic growth • 72% of IDM companies facilitate training • IDM average salary 36% higher than average Ontario worker • Six distinct clusters in province; largest in GTA but pockets in Sudbury, Kitchener-Waterloo, Hamilton London & Ottawa; • industry tied to broadband not geography • IDM industry is made up of “gazelles” – fast and nimble SMEs who according to OECD are best generators of IP Source: CIAIC Report 2013 and ESAC Survey 2013 The Map of Growth Interactive Ontario’s member companies have grown substantially between 2007-2014 From Interactive Ontario survey December 2014 The Map of Growth Interactive Ontario’s member companies employees under 30 years old From Interactive Ontario survey December 2014 International Markets Interactive Ontario’s member companies impact global markets From Interactive Ontario survey December 2014 Ontario’s IDM Industry is Diverse Interactive Ontario’s members have a diverse range of business activities – more than B.C. and Quebec. They also work across multiplatforms and do traditional film and television work. % of business activities included in IDM business models 70% web series 59% 60% mobile apps web and console gaming 50% online video, online publishing, tv 40% 29% 30% 20% 10% 3% 0% From Interactive Ontario survey December 2014 31% % of IDM companies that innovate in the following areas: Innovation by IDM 90% organizational method 81% 80% new content for market 75% use new technologies to 70% Interactive Ontario’s members weigh in on how their companies innovate… create new forms of content new marketing method 60% 50% 50% 44% 40% 30% 25% 20% 10% 0% From Interactive Ontario survey December 2014 create proprietary / technical IP vs content % of IDM companies that use the following forms of financing: Financial Streams 80% 75% OIDMTC company investment 70% 63% 60% IDM companies use diverse forms of financing but OIDMTC is critical piece of the puzzle here. While many IDM firms use OIDMTC, the majority say it makes up less than 10% of overall financing plan services 50% 50% 50% 50% CMF convergent 31% 25% 25% 20% 10% market financing IDM fund 40% 30% sales 6% 0% From Interactive Ontario survey December 2014 CMF experimental other tax credits Company Size by Total Revenue under $500,000 Total Revenue 7% $500,000 - $1million 13% $1million - $5million SME’s dominate in the IDM Sector and 13# are in the micro start-up phase. $5million - $10million $10million - $50million 27% 20% SME’s are the biggest generator of IP according to the OECD. 33% From Interactive Ontario survey December 2014 Global Perspective: The Trend is on our side • The global gaming market: $79 billion in 2012, 93 million in 2013 … is expected to reach $111 billion in 2015. • Ontario owns a sliver of this market. • 56 % of IDM companies in Canada are projecting revenue growth of 25% over next 12-24 months. • Opportunity to grow into new markets is tremendous: • 57% of Canadian IDM revenues from exports. • Over 90 % of Canadian Gaming revenues from exports. • 94% of companies are expanding sales to new markets over the next 12–24 months. • Ontario is best positioned to supply talent: Ontario has 38 colleges and universities vs BC and Quebec with 15 apiece. Source: Gartner Report 2013, Source: CIAIC Report 2013 and ESAC Survey 2013 What is the OIDMTC? Key Criteria • A labour-based tax credit to foster production of original interactive digital media content • Ontario company, but can be Canadian or foreign owned • Modeled on pre-existing film and TV tax credits but “technologically neutral” • Support entertaining, educational, or informative • Single most important support mechanism to grow sector • Presented using text, video and or images (2 of the 3) • Used by individuals • Not all user-generated content • No branded content • Allows SMEs to hire top talent and create proprietary IP OIDMTC is tool that supports Martin Prosperity Institute’s thesis that growing “creativity-based occupations ” will drive Ontario’s economy Making the OIDMTC more Efficient and Effective $450,000,000 $400,000,000 • Growth of OIDMTC reflects growth of sector BUT apparent problem with outliers; $350,000,000 • IO supports narrowing the credit to bona fide IDM content and companies (incl. other creative industries) $300,000,000 $250,000,000 • Want to ensure bona fide IDM companies continue to leverage this credit to grow original product with proprietary IP $200,000,000 $150,000,000 $100,000,000 Need clarification of the intent and scope of this review $50,000,000 $0 2008 2009 2010 Value of Tax Credit SOURCE: OMDC ANNUAL REPORTS : 2011 2012 Project Value 2013 2014 Ontario Economic Outlook and Fiscal Review A profile of the video game subsector • Rise of the “casual gamer” and business models organized around mobile game development (i.e., free to play model and in-app purchases). • Industry structure becoming more dramatically split between large and small firms. • Increasing interest in crowdfunding for small independent firms to access financing. • Console game production has the highest budget and largest teams (average $8.7 million) compared to mobile games (average $300,000). • Large studios (500+ employees) comprise 4% of the video games companies in Canada, but employ 68% of the industry’s workforce. • While casual games account for the largest portion of projects completed in Canada, consoles games continue to generate the most revenues (66.5% of total industry revenues). Source: Nordicity, Canada’s Video Game Industry in 2013 A profile of the eLearning subsector Another key IDM segment is Ontario’s e-learning industry, which is made up of more than 120 specialized e-learning development firms, dozens of government sanctioned educational e-learning entities, and thousands of corporate practitioners. These organizations supply educational products in three main categories: 1. academic 2. non-curriculum learning 3. corporate training While there is no economic data available for Ontario, the global e-learning industry is projected to grow 400%, from $27.1 billion (US) in 2009 to an estimated $107.3 billion (US) by 2015. The province’s e-learning industry is poised for growth, and reports stable revenue models and high profitability. (d) Source: (d) Interactive Ontario’s eLearning committee, ONelearning, eLearning Industry Snapshot 2010-2011 A profile of the mobile subsector One of the province’s emerging IDM segments is mobile, which is experiencing explosive global growth. In 2012, 46 billion apps were downloaded worldwide, which generated $12 billion in sales, advertising and in-app purchases. In 2013, the number of app downloads is expected to double, and generate $20 billion in revenues. As highlighted in the recent Taking Ontario Mobile study by OCAD University, Ontario is well positioned to take advantage of mobile’s growth, and has been identified as an emerging global centre of mobile-app development. (e) Currently, there is an estimated 750 companies in the GTA working on mobile content development. (f) Source: (e) Wall Street Journal: “Toronto becoming a Hub for Mobile Apps Companies; 2010 (f) Ontario’s Business report: “T-APP” Toronto’s ever growing app market” Blue Ant: Toronto (Founded 2011) Rock Stars of the Independent IDM Sector • Creates digital media content and distributes internationally across its television, mobile, web and magazine properties • Revenue $50 million • 75% of content licensed; 25% original • Staff grew from 2 to 200 full-time + 30 part-time; 35 staff in U.S. Case Study: 1 Blue Ant • Produce 800 hours original content; 100 million global viewers • Offices in L.A. and New York • Expected growth: triple in staff in 18 months • OIDMTC and other government funding: 5% capitalization • Awaiting OIDMTC payments from 2012 Game Pill: Toronto (Founded 2008) Rock Stars of the Independent IDM Sector • Predominately made PC/Flash games until 2010 • Today 75% mobile gaming company • Revenue: $500,000-1 million; export revenues 80% • Staff grew from 1 to 10 full-time and contract • Service work vs proprietary: 95:05 (U.S. clients Nickelodeon) Case Study: 2 Game Pill • Expected growth: $2 million in revenues and 18-20 staff in 2015 • Government founding represents <2% of capitalization • Never applied for OIDMTC but will apply for original projects Digital Howard: Toronto (Founded 2013) Rock Stars of the Independent IDM Sector • Make App-based and web-based interactive content • Work with emerging technology e.g. iBeacon enabled-devices • Revenue: $500,000-1 million; export revenues 60% • Staff grew from 2 to 6 full-time and contract • Service work vs proprietary: 20:80 (U.S. clients Nickelodeon) Case Study: 3 Digital Howard • Expected growth: $2 million in revenues and 18-20 staff in 2015 • Government founding represents 20 % of capitalization • Applied OIDMTC in 2013; still in queue Secret Location: Toronto (Founded 2007) Rock Stars of the Independent IDM Sector • Digital Agency creates entertaining experiences such as virtual reality, augmented reality, interactive documentaries and websites, mobile content and games, web series • Won over 200 international awards including International Emmy and Cannes Golden Lion --Oscar equivalent in the advertising • Works with emerging technology e.g. Oculus Rift for Frontline PBS Case Study: 4 • Revenue: $5-10 million; export revenues 60% Secret Location • Staff grew from 1 to 55 full-time and 20 contract • Co-owns 20% of the content it produces; as for underlying technology it licenses 30-40% or builds it and owns 70-80% • Government founding represents 25% of capitalization which includes OIDMTC and CMF experimental & convergent