Department of Child Support Services Office of Audits and Compliance

advertisement

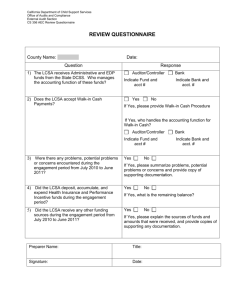

Department of Child Support Services OFFICE OF AUDITS AND COMPLIANCE Department of Child Support Services Office of Audits and Compliance – The Federal Government requires the state to perform oversight of federal funds for the child support program to ensure the counties remain in compliance with Federal Regulations. This includes the following requirements: OMB Circular A-87 /2 CFR Part 225 This circular establishes principles and standards for determining costs for federal awards carried out through grants, cost reimbursement contracts, and other agreements with state and local governments and federally recognized Indian Tribal Governments. OMB A-87 WEBSITE http://www.whitehouse.gov/omb/circulars/a087/a87_2004.html OMB Circular A-133 This circular sets forth standards for obtaining consistency and uniformity among federal agencies for the audit of states, local governments, and nonprofit organizations expending federal awards. OMB A-133 WEBSITE http://www.whitehouse.gov/omb/circulars/a133_compliance/08/08toc.html What do we do? The Office of Audits and Compliance has oversight responsibility for the following audits: – – – – – Trust Fund Close Out Audits Fiscal Compliance Evaluations (CS 356 Reviews) OIG Reviews Internal Control Audits Special Assignments Authority and References Financial Compliance Evaluations 45 CFR 302.10 and 302.14 Uniform Administrative Requirements – Requires adequate accounting systems to support claims for federal funds. – Requires periodic evaluations of local operations LCSA Letters for Grants and Cooperative Agreements to State, Local and Tribal Governments – 05-09 Agreed Upon Procedures of Local Child Support Agency Administrative Costs. Agreed Upon Procedures – February 15, 2005 CSS Letter 04-20 Clarification of Child Support Administrative Claiming and Financial Policies CSS Letter 05-05 Clarification of Non-Electronic Data Processing Automation Requests and Cost Threshold for Equipment Inventories 45 CFR, Part 95 General Administration , Grant Programs Authority and References Financial Compliance Evaluations Welfare and Institutions Code, Section 10084State funding for automation and Annual Cooperation Agreement. Family Code 17702-17714- Performance incentive/excess funds. CSS letter No. 00-12 – The LCSA must submit their supplemental claims within nine months after the end of the quarter in which the costs were paid. CSS Letter No. 04-02 – Clarification of Child Support Administrative Claiming and Financial Policies. (Clarification in CSS Letter No. 05-19) Authority and References Financial Compliance Evaluations 45 CFR, Part 304 Federal Financial Participation 45 CFR, Part 305 Program Performance Measures, Standards, Financial Incentives, and Penalties 45 CFR, Part 307 Computerized Support Enforcement Systems State Plan. Authority and References Financial Compliance Evaluations Plan of Cooperation between LCSA and DCSS states that: – Have in place and maintain accounting standards and systems consistent with uniform accounting procedures prescribed by Federal and State requirements. – Maintain accounting and fiscal record keeping systems sufficient to ensure that claims for available funds are submitted and retained in accordance with State and Federal regulations. – Have policies and procedures in place to ensure timely tracking and monitoring of expenditures compared to budgeted and allocated amounts. Most Common Findings for CS 356 Reviews Health Incentive Funds – Health incentive funds not reverted to the state – Unexpended health insurance incentives – Unallowed health expenditures claimed Lack of Internal Controls – – – – Fixed assets CS 356 Preparation Fiscal Controls/Accounting Procedures Commingling of program expenditures and program income – Incomplete information of property ledger – Inappropriate classifying of county DCSS charges – Inadequate policies and procedures Surplus Fund Balance Most Common Findings for CS 356 Reviews Expenditures – Improper reporting of expenditures – Expenditures not reviewed and inadequate supporting documentation – Double claiming of expenditures – Unallowable operating expenditures-purchasing personal use items, using administration funds to pay off bad debt – Unnecessary expenditures- renting a postage meter instead of requesting mail services from the county. Fixed Assets – – – – Improper reporting of fixed assets expenditure Inaccurate property accounting Improper property tagging Overstated fixed assets Most Common Findings for CS 356 Reviews Abatements – Revenue not reported as abatement – Understated interest abatements Capital Expenditures – No prior approval by the Department – Not claiming expenditures in the period incurred Personnel – Time study and time certifications not prepared – Inappropriate Personnel Expenditure EDP – Improper allocation of EDP – Purchased with Non-EDP funding CS 356 Review The Office of Audits and Compliance (OAC) will be taking over the responsibility for auditing counties to verify compliance regarding reporting of costs on the CS 356 form. The objectives of these reviews: – Determine the accuracy of the expenditures and abatements reported on the CS 356. – Evaluate compliance with applicable laws and regulations. – Evaluate reporting controls. The New Process OAC will be taking a new approach to these audits. – The majority of these reviews will be desk reviews with fewer trips into the field. Although, we will be performing some field trips depending on the adequacy of the response by the county. If need be, we will have auditors sent to the site to gather all pertinent information to complete the audit. 356 Implementation Strategy The Department of Finance has performed grant compliance reviews for OAC in the past. – OAC’s approach will be to perform these reviews with a staff of three external auditors. – We will be using a random sample to select the counties that have not been audited by DOF. Unless we have been given information that requires we focus our direction on a specific county. County Assistance During this process change we will be relying on counties to provide documentation from all areas of review. – We will try and limit the amount of documentation to only areas that are needed to be tested. – The basic fundamental areas will be reviewed as mandated by the Federal Government in working in an oversight capacity. The Basic Components Reviews will be covering the basic areas of the 356 to ensure compliance by counties: – – – – – – – – – Internal Controls, Operating Expenses, All Contracts, EDP Staff and EDP Expenses, Lab Expenses, Personnel Services, Incentives and Grant Programs, Abatements, Walk-In-Payments. General Internal Controls Review process and controls in place to ensure only allowable and reasonable costs are claimed on the 356. Inquire where county maintains their overhead or indirect cost charges. Determine if inventory counts are being performed. Determine if the LCSA receives other funding sources. Review procedures and document overall assessment of the internal controls in place for the CS 356 revenues and expenses. Areas of the CS 356 Reviews As mentioned in one of the previous slides the audit will be comprised of many pieces of criteria. We will be reviewing Federal Requirements but other areas of compliance to be included are: All LCSA and CSS letters pertinent to the review, Plan of Cooperation, Family Code, Welfare and Institutions Code. Operating Expenses/Direct Service Contracts References for compliance – CS 356.1 – OMB A-87 – 45 CFR Sections 304.20304.23,95.13,74.35 and 74.41-74.48 Space Costs – Does the amount paid and reported on the CS 356 agree with the monthly lease and common area costs? – Is the lease signed? – Was the expense incurred during the engagement period? Documents Requested by auditors – Lease agreement Other Facility Operations Were expenditures such as utilities, maintenance, janitorial, repairs, alterations, etc. incurred by the LCSA and paid during the period under review Was the expense amount reported incurred by the county? Ensure that expenses incurred in this category are not already covered in the lease agreement. Types of documents requested by auditors. – Lease agreement – Documentation of expenditures spent in this area. Payments to Other County Agencies Review of any agreement regarding payments to other county agencies to ensure expenditures were spent on child support related costs. Was the payment made during the period under review? Types of documents requested – Detailed list of all LCSA contracts in effect during the engagement period. – Copy of inter-agency agreements in effect during the engagement period. – Copy of any MOU, other contract or arrangement agreement with any public agencies during the engagement period. Other Contractor Expenses Non- EDP If DCSS negotiated contract for LCSAs, do all invoices go directly to DCSS? Did the LCSA have a contract with public or private entities not included in “payment to other county agencies” as required? Was the expenditure incurred and paid during the period under review? Trace the expenditures to the general ledgers and invoices. Ensure adequate monitoring by the LCSA. Types of documents requested: – – – – List of LCSA personnel that were authorized to request and approve contracts during the engagement period. Detailed list of all the other contractor’s expenditures incurred and paid during the engagement period. List of other contracts and/or agreements that were negotiated and signed by the LCSA during the engagement period. Copies of all other contracts and/or agreements in effect during the engagement period. All Other Operating Expenses Determine the composition of the expenditure. Verify the claimed amount reflects the amount paid. Was the expenditure claimed during the appropriate period and child support related? Direct Service Contracts Verify amount paid by the LCSA was amount claimed. Determine if the expenditure was made during the correct period. Determine if it was child support related. Ensure there was adequate monitoring. Documents to be Reviewed – – – Detailed list of all “Direct Service Contracts” that were in effect during the engagement period. Detailed list of all “Direct Service Contracts” expenditures that were incurred and paid during the engagement period. List of LCSA personnel that were authorized to request and approve direct service contracts during the engagement period. EDP Staff and EDP Expenses References – 45 CFR Sections 304.22304.23,95.601,95.701,74.34,95.13,74.41 – OMB A-87 – All pertinent LCSA Letters – Correspondence between DCSS and LCSA EDP Staff and EDP Expenses Ensure that expenditures are authorized and recorded properly to EDP account numbers. Verify if the expenditure was incurred and paid during the engagement period. Verify that the actual EDP expenditure paid is the amount claimed in the 356. Determine if the LCSA followed the DCSS EDP equipment procurement specifications. Verify the LCSA followed DCSS instructions on the required contract language for MOU with the county’s information technology department. Ensure there was adequate monitoring of the contract. Ensure breakout of expenditures are correct with dropdown account numbers. Documents Requested – Copy of listing of equipment for EDP purchases during the engagement period. – List of LCSA personnel that were authorized to request and/or approve EDP purchases during the engagement period. – Copy of EDP physical inventory report that were generated during the engagement period. – Detailed list of EDP equipment allocated expenditures for administrative services and EDP program during the engagement period . – List of LCSA EDP staff for EDP operations during the engagement period. Laboratory References – 45 CFR Sections 304.20-304.22374.4174.48 – OMB A-87 – All pertinent LCSA Letters – Correspondence between DCSS and LCSA Laboratory Expenses Verify the LCSA had a contract with a vendor. Trace and agree the amount reported on the 356 to supporting documents. Ensure contract was adequately monitored. Determine if the expenditure was child support related. Ensure the expenditure was incurred during the period of review. Ensure lab expenses recovered are documented and claimed. Requested Documents – Copy of contract for the Lab expenses pertinent during the engagement period. – Supporting documentation of amounts reported on the 356 during the period under review. Personnel Services References OMB A-87, Attachment B, Section 11 All CSSIN and LCSA Letters pertinent to the area. Personnel Services Ensure the LCSA completed time certification or time studies. Verify costs charged on the 356 related only to wages, salaries and fringe benefits. Trace employees who worked on the program to time sheets/time cards, duty statements and to personnel documents to determine whether the employee worked on the child support program for the amount of time charged on the CS 356. Determine adequate controls are in place for determination of benefit payments. Ensure the salary paid to employee is the amount claimed on the 356. Determine the wages were paid prior to LCSA claiming expenditure on the 356 and in the correct period. Documents Requested – – – – – Separation of Duties matrixes. Payroll Register from the LCSA. Timesheets/Timecards used for Time Study or Time Certification signed by Employee’s and Immediate Supervisors for the engagement period. Copy of payroll authorization signature and approvers lists. Duty Statements for all LCSA Management and staff. Incentives References – Family Code Section 17714 – CSS Letters Incentives Determine the amounts of incentive money received by the county. Determine amount of incentive money expended. Verify the funds have been reconciled and deposited into the correct account. Determine interest earned. Other Fees or Program Income Determine if fees/other program income were earned. Determine if the County followed their procedures regarding disposition. Verify the LCSA reported the income on the CS 356 as abatement and document their analysis. Documents Requested – Itemized list of deposits, accumulation, and expenditures of Fees or program income during the engagement period. – Copy of any grant received by the state and the disposition of those funds. Abatements Reference – 45 CFR Section 74.24, – Government Code Sections 29802, 50050, 50051 and 50055 – Unclaimed Property, – California DSS Policies and Procedures Manual, Section 12-430(k) – Treatment of Undeliverable and Uncashed Warrants, – LCSA Letter 03-10 – CS 34 and CS 356 Reporting Instructions for Undistributable/Abandoned Collections, – CSS Letter 04-22 – Undistributed Collections Instructions and Disbursement Policies, – 45 CFR Subtitle A, Section 74.22 – Payment, – Family Code Section 17714, – LCSA letter 02-36 – Interest Earned on Child Support Funds – Disposition of Equipment, – 45 CFR Section 74.34 – Equipment. Abatements Review the status of any undistributed/unreconciled funds. Determine if the county has escheated and abated any funds on the 356 during the period under review and quantify. Determine any interest earned on funds still not returned. Documents Requested – – – Detailed list of undistributable or abandoned collections during the engagement period. Itemized list of fees or program income received during the engagement period. Detailed list of interest income received during the engagement period. Walk in Payments Plan of Cooperation – The LCSA shall adopt and enforce local, Federal and State procedures to prevent persons who handle cash receipts of support payments from participating in accounting functions that would allow the misuse of such receipts. – This responsibility encompasses the identification of applicable laws and regulations and the establishment of internal controls designed to provide reasonable assurance that the LCSA complies with established local, Federal and State laws and regulations. The LCSA must also comply with the State and county administration manual, Generally Accepted Government Auditing Standards and GAAP. – Ensure bonding requirements have been met to protect the county form losses resulting from employee dishonesty for every person who has receipt of and or disburses, handles, or otherwise has access to any IV-D funds. Walk in Payments Ensure all cash walk-in payment records are maintained, reviewed, and up to date. Review proper segregation of duties. Review bonding of all employees that handle IV-D funds. Verify amounts are recorded and reconciled appropriately. Documents requested – Records documenting all cash payments. – Past reconciliations performed. Review Activities The entrance conference is held via telephone conference or onsite. – – – – Introductions are made. Scope of Evaluation is explained. Designation of LCSA contact. (If Onsite) Facility arrangements are discussed: Office Space, Access to phone, Receipt of documentation, Internet Access. – Auditor Updates to County Management During the course of the audit the audit staff will keep management apprised of any findings or issues that may come up. This is the first chance the county has to provide documentation to refute the finding or criteria that resolves the finding. Reporting Results of the Audit or Evaluation Walk away meeting is scheduled to present the findings to the county staff which includes discussion of: Control or compliance findings and discussion items. Request for any documentation that may change current issues discussed. The county has a chance to respond to the findings by: Asking for an explanation of the criteria used. Provide documentation to refute the finding. This is the second chance the county has to provide documentation Exit Conference This meeting is scheduled weeks after the walk away. The following takes place during this meeting; – – – – – Discussion again of the findings, Discussion of further information needed, Management Representation Letter requested, Explanation of the report process, Estimated date for draft report provided. This is a the third chance for the county to provide supporting documentation to dispute the finding. Post Audit Process Draft report provided to LCSA to respond to the findings – The LCSA response may: Identify further information to refute findings, Dispute findings, Accept findings. This is the last time for the county to dispute the findings. Final Report Issuance Final Report is Issued and the following occurs: – The LCSA’s response is included in the draft report. – The final is created from the draft and the responses of the LCSA. – Report is made final and distributed. Copies are distributed to the following parties: Director of the LCSA and any other parties the counties requested be included, Executive Office of the Department of Child Support Services (Director, Chief Deputy Director, and Assistant Director), DCSS, Office of Audits and Compliance, DCSS, County Allocations. TIPS FOR PREPARING FOR AN AUDIT Understand the auditor’s questions; many times findings are problems with semantics and misunderstandings. – Explain processes clearly – Help the auditors to resolve the issues Keep your management in the loop about what is going on during the audit. TIPS FOR PREPARING FOR AN AUDIT DOCUMENT, DOCUMENT, DOCUMENT! Documentation for expenses, Appropriate Approvals, Audit Trails, Knowledge of Policies and Regulations Remember it is the responsibility of the county to keep adequate documentation to back up any questions auditors may have during the performance of the audit. Questions?