FINAL - CHILD SUPPORT DIRECTORS ASSOCIATION of California

advertisement

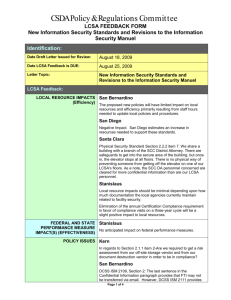

The Realities of Building an LCSA Budget and other Fun Fiscal Topics Introduction / Overview 1 Government Accounting 2 CA State Overview 3 Building a Budget 4 Internal Control 5 Fraud 6 Cash Handling 7 Cost Allocation Government Accounting Why Account? Method of recording transactions System of keeping financial records Way of performing internal audits Aid in analyzing & managing resources Preparation for calculating taxes due Functional Financial Reports Income Statement Balance Sheet (covers a period of time) (snapshot at one point in time) Revenue Expense Assets Liabilities Statement of Cash Flows Basics of Accounting Timing Cash Accrual Modified Accrual Accountability Paramount objective of financial reporting for government Fiscal accountability Operational Accountability Four Accounting Principles • • • • Cost – money talks Accrual – transactions can occur before money changes hands Matching – costs and results put in the same time frame Disclosure – be as comprehensive as possible Four Accounting Assumptions • • • • Business Entity – there are discrete units of accounting Going Concern – business is expected to continue Monetary Unit – things can be measured in local currency Time Period – transactions need to be properly slotted Four Accounting Constraints • • • • Objectivity – measurable Materiality – significant Consistency – comparisons are valid Prudence – don’t overstate! Fiscal Accountability “The responsibility of governments to justify that their actions in the current period have complied with public decisions concerning the raising and spending of public moneys in the short term (usually one budgetary cycle or one year)” Operational Accountability “Governments’ responsibility to report the extent to which they have met their operating objectives efficiently and effectively, using all resources available for that purpose, and whether they can continue to met their objectives for the foreseeable future” Key Environmental Characteristics Different financial objectives for different activities Covering cost (business-type activities) Covering expenditures (governmental activities) Fiscal accountability Annual appropriated budget has force of law More than just a financial plan Users of Financial Information Management Not a “primary” user of external reports Legislative and oversight bodies Investors and creditors Citizens The Governmental Environment Financing Federal – income tax State – income tax/sales tax/vehicle fees Local – property tax/sales tax/transfer payments/user charges/fees/fines/permits Fund Categories (3) Governmental Tax-supported activities Proprietary Business-type activities Fiduciary Resources held as trustee or agent for outside parties and unavailable for programs County Budget Book County Comprehensive Annual Financial Report CA State Overview Have you ever wondered how… The child support program fits into state government? The state budget process works? Child support program funding is spent in California? California child support compares to other states? Executive Branch Headed by the Governor and the elected Constitutional Officers Governor oversees all agencies and departments and many boards and commissions that are not overseen by the Constitutional Officers. Executive Branch (continued) The portion of state government that the Governor oversees is organized into agencies. The “Governor’s Cabinet” is comprised of 12 Agency Secretaries that are appointed by the Governor. The Cabinet serves as the Governor’s chief policy advisory body. Each implements the Governor’s policies throughout the state. More than 60 departments, boards, and commissions report to the Agency Secretaries. The Department of Child Support Services (DCSS) is part of the California Health and Human Services Agency (CHHS). CHHS CHHS oversees 13 departments and other state entities, including the DCSS. CHHS programs provide a range of services including: Health Care and Public Health Social Services Mental Health Alcohol and Drug Treatment Income Assistance Child Support More than 33,000 people work directly for CHHS and its departments and regional facilities throughout the state. Budget Process Quick Facts The state fiscal year runs from July 1 through June 30. The federal fiscal year runs from Oct. 1 through Sept. 30. Each budget cycle focuses on two fiscal years: Current year – non-discretionary updates only Budget year – future year budget proposal Legal authority to spend money in any fiscal year is provided by the annual State Budget Act. Budget Responsibility Development of the annual budget is a shared responsibility. At the lowest level, each department is responsible for developing and submitting budget proposals and cost estimates for the department and the program(s) it oversees. Agencies are responsible to communicate the Governor’s priorities to the departments and to approve or deny departmental requests based on those priorities. Approved requests are forwarded to the Department of Finance. Responsibility – Department of Finance (DOF) Approved proposals and requests are published in the Governor’s January proposal and May revision. The Governor’s Budget proposal is released each year on or about January 10. The May Revision is released each year on or about May 15. The DOF acts as the financial arm of the Governor’s office, providing instruction and oversight for the budget process. All budget proposals and requests are analyzed and either approved or denied by the DOF. Responsibility – Legislative Analyst’s Office (LAO) The LAO serves as the “eyes and ears” of the Legislature. Ensures legislative policy is implemented in a cost efficient and effective manner Reviews and analyzes budget proposals and the state’s finances Makes recommendations for legislative action Responsibility – Legislature The Legislature uses the Governor’s budget proposals as a starting point for budget bill discussions and negotiations. The Legislature determines which proposals will be included in the final budget. Responsibility – Governor Once both houses of the Legislature agree and pass the budget bill, it goes to the Governor for final approval or veto. The Governor may approve the budget bill “as is” or with changes (line-item veto). Once signed by the Governor, the Budget Bill becomes… The Budget Act California Revenues vs. Expenditures 1990-2014 $120,000.0 (in thousands) $100,000.0 $80,000.0 $60,000.0 Revenue Expenditures $40,000.0 $20,000.0 $0.0 National Competition for Funding DCSS Budget State Operations DCSS’ state operations budget includes funding for: CSE ($76 M) Judicial Council of California (JCC) contract ($55 M) State staff (salaries, benefits) and operating expenses & equipment ($50 M) Office of State Publishing contract ($18 M) State Disbursement Unit SDU ($15 M) Locate, SLMS, Fair Hearing & Intercept contracts ($8 M) Federal costs including IRS intercept fees ($8 M) Budget Development The Budget Support Section is responsible for Projecting costs Submitting proposals Requesting budget authority for all aspects of the child support program. Allocations to Counties "Equity" $1,400 $1,200 $1,000 $800 $600 Dollars Per Case $400 $200 $- 0 10 20 Counties 30 40 50 60 County Allocation Alameda Butte Central Sierra Colusa Contra Costa Del Norte Eastern Sierra El Dorado Fresno Glenn Humboldt Imperial Kern Kings Lake Lassen Los Angeles Madera Marin Mariposa Mendocino Merced Monterey Napa Orange Placer Plumas Riverside Sacramento San Bernardino San Diego San Francisco San Joaquin San Luis Obispo San Mateo Santa Barbara Santa Clara Santa Cruz/San Benito Shasta Sierra-Nevada Siskiyou/Modoc Solano Sonoma Stanislaus Sutter Tehama Trinity Tulare Ventura Yolo Yuba $ 25,768,079 $ 8,773,650 $ 4,940,779 $ 682,320 $ 18,331,644 $ 2,249,141 $ 1,389,595 $ 4,747,119 $ 21,582,116 $ 790,733 $ 5,151,250 $ 3,379,746 $ 21,570,320 $ 4,133,667 $ 2,638,737 $ 1,038,022 $ 142,439,904 $ 2,842,396 $ 3,645,241 $ 702,443 $ 3,027,196 $ 9,376,887 $ 10,810,930 $ 4,021,777 $ 53,577,509 $ 6,030,975 $ 840,066 $ 33,892,513 $ 31,873,986 $ 38,143,911 $ 45,234,076 $ 12,037,393 $ 14,489,029 $ 4,439,121 $ 11,171,638 $ 8,971,916 $ 35,538,529 $ 8,362,558 $ 7,318,853 $ 4,051,547 $ 2,850,267 $ 11,874,641 $ 14,025,304 $ 14,707,908 $ 2,969,638 $ 1,828,711 $ 675,774 $ 15,563,451 $ 20,014,027 $ 5,743,171 $ 3,883,527 Cases 34,067 11,941 6,292 793 30,582 2,939 1,575 6,277 60,423 1,776 6,793 11,530 54,856 10,072 2,895 1,744 301,016 6,546 3,038 708 4,918 17,679 17,391 4,109 71,201 9,303 1,022 88,837 80,616 116,395 79,931 14,249 35,251 4,457 11,576 14,189 40,961 8,833 12,993 3,918 3,763 18,399 13,188 30,615 5,236 4,375 798 28,579 21,089 8,334 4,612 Total / averages $ 714,143,731 1,332,680 FTEs 218 97 49 6 153 18 8 53 203 9 46 54 188 54 28 12 1,575 37 24 7 27 79 100 33 579 43 8 333 318 404 469 90 165 41 85 83 300 74 81 26 25 104 96 153 28 21 7 169 193 54 36 $ / Case Cases/FTE $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 756 735 785 860 599 765 882 756 357 445 758 293 393 410 911 595 473 434 1,200 992 616 530 622 979 752 648 822 382 395 328 566 845 411 996 965 632 868 947 563 1,034 757 645 1,063 480 567 418 847 545 949 689 842 156 123 128 132 200 163 197 118 298 197 148 214 292 187 103 145 191 177 127 101 182 224 174 125 123 216 128 267 254 288 170 158 214 109 136 171 137 119 160 151 151 177 137 200 187 208 114 169 109 154 128 7,063 $ 536 189 Diversity Across Counties One Budget Two Categories For statewide tracking purposes, the DCSS budget is divided into two main categories: 1 State Operations 2 Local Assistance Building a Budget Political Environment Public attitude toward government Opposed to increased taxes Want more effective services at lower cost Public salaries and pensions are too high Local political environment Term limits and pending elections Influence of organized labor Difficult decisions now and in the future Budget Status of LCSAs Fully funded by State with (generally) no County General Fund contribution, but expected to participate in countywide budget reduction strategies. County Budget Balancing Strategies Hiring freeze Furloughs Mid-year adjustments Program reductions – Targets for FY Labor negotiations – salaries & benefits Revenue enhancement Other steps? Practical Considerations What makes an LCSA budget unique? Labor contracts negotiated by County, but State/Federal funded Classification management/position control How to look at cuts/strategies Politics of the process No reserves Cash basis, no fund balance or carryover Melding the State, County and DCSS Budget Process State County DCSS Budget Process County Budget Timeline Revenue forecasts – early winter Budget instructions – first of the calendar year Meeting with CAO – early spring Budget hearings – June New fiscal year begins July 1 Final budget - September LCSA Budget Timeline New fiscal year begins July 1 Year-end close for prior fiscal year – July/Aug Adopt final budget for new fiscal year – Sept 1st Quarter CS 356 Claim – due Oct 15 CS 921 Budget Display - winter LCSA Budget Timeline (continued) Mid-year analysis due to CAO – January 2nd Quarter CS 356 Claim – due January 15 Program Plan/Budget narrative due to CAO – Feb Preliminary Allocation Letter – Feb/Mar LCSA Budget Timeline (continued) LCSA Budget Development – in progress Feb/Mar/Apr 3rd Quarter CS 356 Claim – due April 15 Year-end Analysis due to CAO – April County Budget due (BY & BY +1) – April LCSA Budget Timeline (continued) EDP Budget Display – spring Gear up for year-end closing (again…) 4th Quarter Claim – due July 15 Year-end close – July/August And the cycle continues… Don’t for get about Performance Measures during the Fiscal Year! Unique Aspects of LCSA Budget Revenue Sources – 66/34 split Connection to State Budget County target vs. State Budget process Potential level of CAO scrutiny Good & Bad Possibly different COLA assumptions Bottom line: A Balanced Budget!!! Budgeting Tips Own Your Budget Be prepared – analysis and due diligence Be proactive – take control of your budget problems Propose solutions/recommendations LCSA fiscal staff development Develop your relationship with your CAO Budget Analyst Budgeting Tips (continued) Connect Budget and Performance Be realistic about service impacts Take credit for improvements and efficiencies Quantify impacts and clearly communicate them Use your performance to establish credibility Be creative Relationship with CAO Budget Analyst Educate your analyst department background & overview Keep analyst informed and in the loop email and cc: Set expectations Define roles department advocate Establish mutually beneficial relationship Be Nice! More Budget Strategies… Annual Strategic Planning Process Automation/Technology projects One-time investments that yield long-term savings Examples Review service charges Direct vs. indirect costs Spend 100%! Understand the components Consider your lead time EDP Recurring & Non-Recurring Funding Annual LCSA letter requesting budget data Submit via EDP web form M&O funding Current need Historical trend Non-recurring funding New non-recurring projects LCSAs submit requests in January Local Perspective - EDP Things to watch Local definitions of EDP vs. State definitions Local charges usually more detailed Timing issues Staffing and overhead Prior Approval Requirements Administrative and EDP Policy in CSS Letters 04-20 and 05-05 All automation products and services planned for purchase using EDP or Administrative nonEDP funds • including personal computers, servers, printers, integrated voice response units, imaging systems, new and existing software, and web contracting services Administrative and EDP Claim Processes (CS 356) Federal requirement to: Report expenditures Expenditure data used: Reconcile funds advanced to LCSAs To determine future funding For various internal reports Administrative and EDP Claim Processes (CS 356) Laws and Rules OMB Circular A-133 OMB Circular A-87 CFR Part 45, Section 92.25(b) Family Code 17714(b) Administrative and EDP Claim Processes Submit quarterly claim 15 days after the end of the quarter Time certify vs. Time study Time certify when staff are working 100% on one activity or function Time study when staff are spending time on two or more activities or functions In the mid-month of quarters one and four (August and February) Local Perspective - Claims Quarterly process Track expenses ongoing Categorize EDP expenses by claim numbers Remember cash basis accounting Less detail than CS 921 Different detail than CS 921 Depreciation Title 45 CFR, Section 95.705(a) AT 94-5 LCSA Letter 05-24 CSS Letter 04-20 Approved to purchase Recover costs over five years Depreciation Non-EDP Equipment Purchase price over $25,000 Depreciate/claim over five years Equipment cost $60,000 ($60,000/5) Year 1 claim $12,000 Year 2 claim $12,000 Year 3 claim $12,000 Year 4 claim $12,000 Year 5 claim $12,000 Depreciation EDP Equipment Purchase price over $5,000 Depreciate/claim over five years Including EDP equipment purchased with Admin (Non-EDP) funds Example: Training room PCs Local Perspective – Depreciation Understand the asset County “float” Disposition of Assets For Policy: CSS Letter 04-20 and LCSA Letter 05-19 Determine fair market value Notify DCSS of disposal Retain supporting documentation for four years and four months Consider recycling Disposition of Assets Under $5,000 LCSAs may transfer, sell, dispose using county rules Proceeds must be abated as program income on administrative expense claim Disposition of Assets Over $5,000 Transfer equipment Sell equipment: Proceeds must be abated Dispose of equipment using county rules Overhead/Indirect Costs (aka A-87 or Countywide Cost Allocation Plan) Claim State Controller’s Office approved amount only Should claim ¼ of the annual cost on quarterly expense claim Can split overhead costs with EDP An exception to cash basis claiming rule POC/MOU Requirements Title 45 CFR 303.107 for fiscal portion Agreements should include: Budget estimates Covered expenditures Methods of determining costs Procedures for billing IV-D agency Local Perspective Go through your county review process County Counsel Monitor for renewal Timeframes can be different When costs change – amend Must go through your county process Audits Authority OMB A-87 and A-133 CFR 302.10 and 302.14 CSS Letter 04-20 LCSA Letter 05-09 • History and process in this letter Audits Keep supporting documentation for at least four years and four months Two (of six) most common audit findings • Accrual vs. cash basis accounting • Income or program income not abated on Administrative Expense Claim Local Perspective Get used to audits Retain backup for required timeframe Keep findings Scope of work Internal Control What are internal controls? Internal controls should be applied to your personal life as well as to business entities. Personal internal controls are activities you should perform in order to safeguard and protect your assets (cash, investments, valuables, tax records, identity, etc.) from potential loss. Examples of personal control activities: Balance your checkbook Keep valuables in a secure, locked area Keep orderly files (tax returns, bank statements, receipts, etc.) Shred documents containing personal, identifying information if no longer needed Authoritative Guidance The American Institute of Certified Public Accountants (AICPA) identified minimum standards governing the formatting and contents of external financial reports for the public and private sector, referred to as generally accepted accounting principles (GAAP). These practices govern and dictate what aspects of our program should be audited. Authoritative Guidance (continued) SINGLE AUDIT – annual audit of government’s federal award programs Auditors must issue report on internal controls over compliance and have strict reporting requirements when compliance issues related to internal control occur. GFOA Code of Ethics Finance officers must: “…exercise prudence and integrity in the management of funds in their custody and in all financial transactions.” “…not knowingly sign, subscribe to, or permit the issuance of any statement or report which contains any misstatement or which omits any material fact.” Relationship to Internal Control Prudence in the management of public funds Requires adequate controls in place to protect Avoidance of misstatements or the omission of material facts Requires sound framework of internal control to provide a reasonable basis for assertions How Achieved • Management competence • Staff competence • Internal control documentation • Periodic evaluation of internal control • Corrective action plan following periodic evaluation Management’s Mission and Objectives All organizations have a purpose/mission Key managerial objectives arising from management’s mission: Effectiveness Efficiency Compliance Stewardship reporting Elements of a Comprehensive Framework of Internal Control Favorable control environment Continually assesses risk (risk assessment) Establishes and maintains effective control related policies and procedures Effectively communicates information Monitors the effectiveness of control-related policies and procedures Favorable Control Environment • Management is knowledgeable about controls • Management is committed to establishing and maintaining controls • Management communicates support to staff at all levels • Management provides needed resources Management Communication • Code of conduct/official policies • Communicated to staff at all levels In a practical way Reinforced periodically • Communicated to managers at all levels • Swift and appropriate disciplinary action Risk Assessment Management need to anticipate risks External Internal Ongoing process Key Risk Indicators Change Inherent risk characteristics Change as an Indicator of Risk Operating environment Personnel Information systems and technology Rapid growth New programs and services Structure Categories of Policies and Procedures Authorization Properly designed records Security of assets and records Segregation of incompatible duties Periodic reconciliations Periodic verifications Analytical review Segregation of Duties An individual should not be able to commit and conceal an irregularity Separate incompatible duties Authorization Recordkeeping Custody Fraud The Fraud Triangle Three Elements Rationalization Opportunity Justification: Lack of: “I need this…” “I’ll pay it back…” “My family needs this…” Pressure Supervision Review Management approval System controls Financial pressures Personal vices Unrealistic deadlines/expectations at work Embezzlement Study Apparent Motivation • Financial problems • Gambling problem/addiction • Desire to live lavishly • Substance abuse • Support a personal business 4% 27% 60% 2% 7% Embezzlement Study Age of the perpetrator Average age 43 years old Gender of the perpetrator 36% male 64% female Cash Handling Risk “When money passes through hands, sometimes it sticks” Stephen Gauthier, GFOA Cash carries a high risk of theft… Temptation: most everyone desires money Portable: physically small and lightweight, may be stolen discretely Risk Risk of Theft 2 basic categories of theft Category 1 LARCENY stealing cash which has already been recorded in the books and records, such as cash in the safe, cash in register, petty cash, deposits Category 2 SKIMMING stealing cash received directly, upon receipt, before it is recorded ii the books and records How to prevent/detect cash loss Surveillance cameras Reconcile cash deposits to daily sales reports Two employees should be present whenever cash is counted Deposits are safely and securely delivered to the bank Armored car delivery Cash should be entered in the cash register immediately when received Enter cash register transactions while customer is present Issue receipts for all customer transactions Segregation of Duties Cash duties which should be performed separately: Cash receipts/collections Cash deposits Reconciliation of cash Physical Security Limit access to safe and cash drawers to authorized personnel. Change safe combinations/keys when employees terminate or transfer. Consider surveillance cameras. Physical Security (continued) Cash should not be left unattended at any time. Cashiers must store cash in a locked, secure area with restricted access while away on break/lunch. Cash left overnight should be secured in the safe until the next business day. Cost Allocation Why a Cost Allocation Plan? What is a Cost Allocation Plan? • CAP • CoCAP • A-87 • Filed by the county with the State Controller’s Office (SCO) by Dec. 31 each year • Desk-audited yearly, field audited periodically by SCO Cost Allocation Plan and User Supplement Rules Office of Management and Budget Circular A-87 Timing Timeline of Cost Allocation Accounting 6/30 12/31 6/30 12/31 6/30 12/31 6/30 X Costs occur CAP due to state in Central Costs allocated Departments to non-General Fund program Costs paid by non-General Fund programs General Services Expense: RENT Allocation Basis Square footage occupied Potential Issues Mixing old and new buildings Unfinished basement vs. penthouse Auditor Expense: PAYROLL Allocation Basis Number of employees Potential Issues Seasonal swings in numbers Number of pay codes processed Number of deductions processed