Slide 1 - CHILD SUPPORT DIRECTORS ASSOCIATION of California

Annual Child Support Training Conference & Expo

October 5-7, 2010

|

Orange County, California

Child Support Directors Association of California in partnership with California Department of Child Support Services

State Tools in the Local Budget Process

Moderator: Cheryl Stewart, Regional

Administrator

Panel: Linda Adams, Chief Financial Officer

State DCSS

Keith Johnson, Administrative Services

Manager,

Santa Cruz-San Benito

Topics for Discussion

■ $25 Fee

■ Capital Expenditures

■ ARRA Funds

■ CS 921

■ EDP M&O Budget

■ EDP Tech Refresh

■ CA CS Website

■ A-87

■ Audits

■ Advances

■ Performance

Improvement

$25 Fee

The Federal Deficit Reduction Act of 2005 requires states to charge families that have never received TANF a $25 annual application fee if at least $500 is collected annually on their behalf. Under Federal law, fees may be recovered from the custodial party, the noncustodial parent or the state (using state funds).

Prior to Federal Fiscal Year 2011, the State elected to pay the fee using state funds

Beginning with FFY 2011, the State will continue to pay the fee but will then recoup the fee from the custodial party out of the next collection.

$25 Fee (Continued)

Capital Expenditures

■ Administrative and EDP

✷ Policy in CSS Letters 04-20 and 05-05

✷ Contracts and Purchase orders over $1m require prior

Federal approval, allow 90 days for approval

✷ All automation products and services planned for purchase using EDP or Administrative non-EDP funds require prior approval

• Including personal computers, servers, printers, integrated voice response units, imaging systems, new and existing software, and web contracting service

✷ Relocations, remodels, new property, or increases in property values require prior approval

ARRA Funds

■ What is ARRA?

✷ American Recovery and Reinvestment Act of 2009

✷

✷

Provides for matching federal funds on incentives

Time period is October 1, 2008 – September 30, 2010

✷ Letters: LCSA 10-03 and 10-11

✷ Funds must be reported on county SEFA form

ARRA Funds (Cont.)

✷ Per Title 2 of the Code of Federal Regulations Part 176,

Subpart D, LCSAs are notified that the Federal award number for ARRA funds is 1004CA4002 and the CFDA number for ARRA funds is 93.563.

✷ LCSAs are reminded that they are required to separately identify the expenditures for Federal awards under the Recovery Act on the Schedule of

Expenditures of Federal Awards (SEFA) and the Data

Collection Form (SF –SAC) required by OMB Circular A–

133.

CS 921

■ LCSA letter requests budget data for upcoming state fiscal year

■ Due date February

■ Entered via form on LCSA Secure web site

■ Detailed administrative budget information used to display:

✷ FTEs

✷ Average salaries

✷ Expenditures

■ Data used for various reports

✷

✷

Legislative report

Various internal reports for DCSS’ use

EDP M&O Budget

■ EDP Initial allocation released via LCSA letter in the Spring

■ Web form available for distributing costs between recurring and non-recurring accounts

■ LCSAs must stay within allocation unless specified in letter

■ Final allocation with account numbers released once state budget is passed

EDP Tech Refresh

■ Tech Refresh for BP deployed equipment scheduled to begin in SFY 11/12

■ Tech Refresh will be handled at state level through vendor contract

■ DCSS has a tech refresh group working on schedule – release date expected by end of year

■ LCSA allocation of equipment may go up or down based on analysis of county needs

■ Change in allocation of equipment may impact

EDP M&O Allocation in future years

CA Child Support Central – LCSA Fiscal Administration

■ To access the LCSA Fiscal Administration page: https://central2.dcss.ca.gov/Pages/Default.aspx

■

Information contained on the page includes links to:

✷

✷

✷

✷

✷

✷

✷

✷

✷

✷

Claiming Instructions

Federal Financial Participation

Allocations

Forms

Presentation

Fiscal Officers Forum

SCO Claiming Rules

Frequently Asked Questions

Collections Reports

Handbooks

CA Child Support Central – LCSA Fiscal Administration

CA CS Website

CA CS Website

CA CS Website

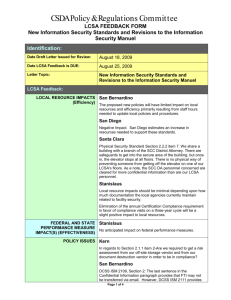

A-87

■ Definition: Plan your county submits to the State

Controller with the schedule of indirect costs for all departments in the county

■ Periodically review the plan and percentages attributed to Child Support

■ SCO approved schedule is sent to DCSS

■ DCSS Accounting enters the annual amount approved into an AEC table

■ LCSA claims ¼ of cost each quarter

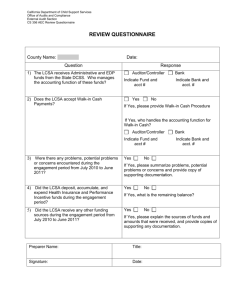

Audits

■ Authority

✷ OMB A-87 aka 2 CFR 225

✷

✷

A-133

CFR 302.10 and 302.14

✷ CSS Letter 04-20

✷ LCSA Letter 05-09

• History and process in this letter

■ Keep supporting documentation for at least four years and four months

■ Three most common audit findings

✷

✷

✷

Accrual vs. cash basis accounting

Interest or program income not abated on Administrative

Expense Claim

No prior approval for capital expenditures

Advances

■ LCSA Advanced 1/12 of Admin and EDP allocation

✷ True-up adjustments occur every quarter and may change the actual amount of the following month’s advance

■ Used to report monthly advance and quarterly adjustments

■ AA190 has 3 sections:

✷

✷

Section 1: Regular Monthly Advance

Section 2: Offsetting expenditures and advances

(Current Claim)

✷ Section 3: Supplemental claims and other (in-house claims etc.)

■ The total remittance on the AA190 is the amount of a warrant issued by State Controller’s Office.

Performance Improvement

■ CSS Letter 10-11 – Cost Effectiveness

■ LCSAs are expected to attain a cost-effectiveness ratio of at least $2.25. Any LCSA with actual FFY 2009 performance below $2.25 is required to develop strategies to meet or exceed this goal.

■ Further, once actual performance data for FFY

2010 becomes available in December 2010, any LCSA with performance below $2.25 in FFY

2010 will also be required to develop such strategies.

Performance Improvement (Cont.)

■ For the purposes of this requirement, the impact of shared services will be factored into the calculations for LCSA cost effectiveness for FFY

2010 and thereafter.

■ In addition, federal funds will not be provided to any LCSA for any expenditures above the

LCSA’s administrative allocation in state fiscal year 201112, if that LCSA’s cost-effectiveness ratio is below the average for its size grouping at the end of FFY 2011.

Performance Improvement (Cont.)

Cost Effectiveness Performance Measure

Based on Table 1.5

Comparative Data for Managing Program Performance

Sample Data

Large (10)

Fresno

Santa Clara

Kern

Alameda

Contra Costa

San Joaquin

Tulare

Stanislaus

Ventura

San Francisco

Total

Expenditures

22,785,593

36,343,119

20,645,137

26,073,447

18,271,459

15,624,594

14,974,024

15,399,014

19,760,072

14,154,197

204,030,656

Collections

83,213,098

90,100,613

66,777,441

79,365,880

58,971,427

51,395,213

38,053,843

46,564,558

50,891,832

28,802,999

594,136,904

Cost Effectiveness

3.23

3.29

2.54

3.02

2.58

2.03

2.91

3.65

2.48

3.23

3.04

Performance Improvement (Cont.)

Cost Effectiveness Measure Time Line

9/2010

End of FFY

12/2010

2010 C/E Determined

9/2011

End of FFY

12/2011

2011 C/E Determined

FFP Allowability

Determined

6/2012

End of SFY 11/12

FFP Determined

Questions???

■ If you have questions about anything not covered today, please call your LCSA Budget

Analyst.

✷ Trudy Lehane at 916.464.3294

✷ Anne Allen at 916.464.5285

✷ Donna Kruger, Manager, at 916.464.5015

✷ Kim Sharp, Branch Manager, at 916.464.5177

Or

✷ Linda Adams, CFO, at 916.464.5156