File

advertisement

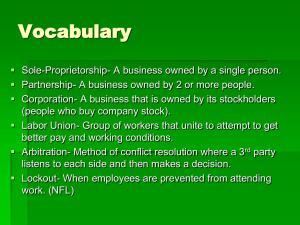

Chapter 8 - Business Organizations “Anyone who tells you money can’t buy you happiness, doesn’t have any.” Movie Recommendations: • Glengarry Glenn Ross • The Boiler Room • Other People’s Money • Wall Street The Boiler Room A wonderfully educational and enlightening film on how to legally steal people’s retirement funds. Wall Street For those of you that want to learn the “Pump and Dump” investment strategy. Also called market manipulation, and highly illegal. “I love money. I love money more than the things it can buy. There's only one thing I love more than money. You know what that is? OTHER PEOPLE'S MONEY. “ 3 Major Types of Business • Sole Proprietorships • Partnerships • Corporations Sole Proprietorship Business owned and operated by a single individual. *They make up only about 4% of sales, but earn about 10% of all profits. What are a few examples? What are some of the advantages of running your own business? Advantages: • You get to keep any, and ALL profits! Remember: “Greed is good.” • The business does not have to pay a separate income tax. Because it is not recognized as a separate legal entity. • It is easy to get out of. Just pay off any outstanding debt, and stop selling goods or services. Not so true if you join the mafia. Oh yeah…… YOU CAN DO WHATEVER YOU WANT!!! YOU’RE THE BOSS!!!!!!!!! Unfortunately, there is a catch. You have what is called “Unlimited Liability.” If anything happens, it’s your fault. You bear all the responsibilities of losses and debts. Also, due the size of smaller businesses, it may be difficult to carry a minimum inventory. Sometimes this can be expensive and difficult to maintain. Partnerships A business that is jointly owned by 2 or more persons. General Partnership: This is the most common. In this case, all partners are responsible for operations, management, and finances of the business. Limited Partnership: At least one partner is not active in the daily running and responsibilities of the partnership. May not be obligated to the debts either. Advantages: • Also easy to start. A handshake is all you need. (However, legal contracts might be a good idea.) • Ease of management • Lack of separate taxes (just like in a proprietorship). • Can usually attract financial capital easier than a proprietorship. Usually larger and have an easier time getting approved for a bank loan. This can help with quicker expansion. • More efficient operations. Law firms, for example, might have a few partners working together to offer services. Disadvantages: • • If one partner causes the firm to suffer huge losses, the other partners are responsible. In a limited partnership, the “limited partner” is only responsible for the debts that total the size of their initial investment. If more money is lost than that, the “general partners” are liable for the rest. How much do you trust your business with someone else? Corporations A form of business organization recognized by law as a separate legal entity, with all the rights of an individual. Do you think businesses should have the rights of individuals? Or should only people have individual rights? Once the corporation is given permission by the government, a charter is issued stating that company’s name, purpose, address, and any other features of its business. The charter also specifies the number of shares of stock, or ownership certificates in the firm. These shares are then sold to investors in order to raise funding to help the corporation. This makes the investors “owners” in the company. If the company is profitable, dividends can be issued. Dividends are corporate earning sent back to the shareholders in the form of cash. One of the fastest and easiest ways to raise funding the quickest is to issue stock. There are two types of stock that can be issued; common stock, and preferred stock. Common Stock: receives a vote for each share of stock owned. These shareholders can elect members of the board of directors, who determine company policies, and hire management. Preferred Stock: nonvoting shareholders. These shareholders do not get a say in company leadership or policy. However, they receive dividends first, and will receive their investment back first if the company goes out of business. Which one would you prefer to own? Which one does Warren Buffet prefer to own? Bonds A written promise to pay borrowed money back at a later date, with interest. The principal of a bond is the initial amount borrowed by the company, government, school district, etc. The interest is what the borrower will pay back, on top of the principal amount. The higher the interest, the more valuable the bond. *Churchill’s ROTC building was payed for with a bond* What do all of these have in common? Franchise A temporary business investment that involves renting or leasing another business firm’s successful business model. The franchisor is the actual owner of the business name, model, and concept, etc. The franchisee is the investor who rents or leases the business name and model. This is a very common/simple way to “own” your own business. Why are fast-food restaurants so commonly franchised? Why not other types of businesses? What is the “heart” of a business? How do you know if a business is “healthy?” What tells you if a business is a good investment? The Income Statement is a great place to start if you want to find those answers. An income statement includes a business’s sales, expenses, net income, and cash-flows for period of time. Every publicly-traded company must submit a report of this to the SEC every year. If you are looking to invest, this is a great place to check on the ‘financial health” of a business. *But this may not tell the whole story of the business as an investment option* Tracking the flow of money through a business is the key to understanding it’s health. Once you understand it’s debts, and expenses, you can tally its Net Income (income after taxes and expenses). However, some assets within a business lose value over time (they depreciate). Capital goods, such as machinery, vehicles, and electronics, wear down and becomes less effective. This must be recorded as these items still hold value, and is included even in the sale of a company. Once this is taken into consideration, you can now calculate a company’s cash flow, or true profits. The more cash that is freed up in a business, the more that cash can be re-invested in that business to allow for growth. *This is one major key to understanding whether a business is a good investment option.* 5/3rds Bank’s assets Even banks have Income Statements, and cash flows. It is common to hear banks advertise to customers and investors, that they are “conservative.” Why is this comforting? How can you tell if a bank is really “conservative” in it’s business? Hint: look at the ratio of securities held vs. loans. Then, what kind of loans are being issued. Mergers Companies can also grow by joining up with others into one legal entity. There are two types of mergers; horizontal, and vertical. Horizontal: firms that produce the same good or service join together. Ex: JP Morgan joining Chase Manhattan to for JP Morgan Chase. Vertical: firms that perform different stages of the business (manufacturing, advertising, marketing, sales, research and development, etc.) join together. Ex: In 2000, America Online combined with media conglomerate Time Warner. The merger is considered a vertical one because Time Warner supplied content to consumers through properties like CNN and Time Magazine, while AOL distributed such information via its internet service. When companies grow so big through mergers and acquisitions, that they have about four or more businesses in different industries, they are considered a conglomerate. When a company operates it’s businesses in multiple countries, then it is considered to be multinational. What are some conglomerates that you can think of? Entrepreneurs have a difficult time competing against these major corporations and conglomerates. However, they do have some unique places they can go for support. Many entrepreneurs learn business basics through “incubators,” or places where someone can go to learn accounting, engineering, and management skills. Universities have often filled this role, and even entered agreements with companies to foster this type of an environment. Why would a company want to enter an agreement with a university? 3 major sources of funding for start-ups Venture Capitalists: A financial provider willing to risk investment into an unknown, possibly in exchange for future ownership. Angel Investor: they like to support start-ups of close family or friends who would not receive help otherwise. “Angel” investors usually have a greater interest in seeing the business become successful. Crowdfunding: using social networking to appeal to potential investors. What examples of crowdfunding have you seen” Nonprofit Organizations An organization that works in a business like way to promote the collective interests of its members, rather than seek financial gains for its owners. Don’t let the name fool you……… We will look at some very well known “non-profits” later. A common type of nonprofit organization is a cooperative, or co-op. These are voluntary organizations that are formed to carry on some sort of economic activity that will benefit its members. The three main categories are: Consumer cooperatives: usually buys goods in bulk at a discount to sell at lower prices. Service cooperatives: provides services such as insurance, or childcare to its members, rather than the sale of goods. Credit Unions are a financial service that accepts deposits and makes loans to its members. Producer cooperatives: mostly made of producers, such as farmers, who promote or sell their products directly to markets or consumers. The Ocean Spray cranberry coop markets theirs directly to consumers. Labor Unions Are cooperatives that organize and represent their member’s interests in employment matters. Labor unions use collective bargaining to negotiate with management on issues such as, pay, benefits, safety standards, health-care, and vacation time. The largest labor union is the NEA, National Education Association. They represent the interests of public school teachers, administrators, and even substitute teachers. Another notable union is the AFL-CIO (American Federation of Labor-Congress of Industrial Organization). It has about 12 million members, and is comprised of 57 other unions and organizations in various industries. Open Shop vs. Closed Shop States Businesses also organize to promote their collective interests. Most communities have a local chamber of commerce, which promotes education programs and lobbies favorable legislation that benefits its member businesses. Some business organizations benefit the consumers. The Better Business Bureau is a nonprofit organization sponsored by local businesses, that provides information on companies, and maintains records of consumer inquiries and complaints. “If a company has a union, they deserve it.” How have Labor Unions benefited us in the past? How can they be problematic?