The cost of equity

advertisement

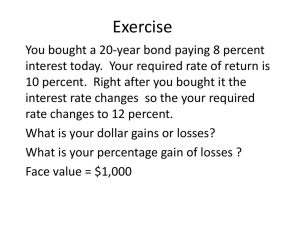

The cost of capital (aka hurdle rate) and NPV analysis The Firm The cash flow generated by those assets represents the payoff to creditors and shareholders. Payoff = PV(CF from assets) The creditors and shareholders want the payoff to be larger than the initial cost. Stating the obvious Calculating PV = discounting CFs What discount rate to use? A fair discount rate should reflect: • perceived project risk • inflation • time preference A question of benchmark If the project has “average” firm risk, use the default benchmark Clarification “Average” risk = Risk comparable to that of firm’s other projects Exemplification Coca-Cola building a new bottling plant in Lennoxville would be a project of average risk Ford planning to launch a satellite would be a project of above average risk Sprint expanding in Eastern Europe with the help of government contracts would be a project of below average risk A question of benchmark The Benchmark is the Weighted Average Cost of Capital WACC WACC: Calculation WACC = we (re) + wd (i) (1-T) we = weight of equity in total market value re = cost of equity wd = weight of debt in total market value i = cost of debt T = corporate tax rate Calculating the cost of equity Method 1: Dividend growth model Method 3: Risk-return model Method 3: HPR approach Method 4: ROE approach The cost of equity: Clarification The cost of equity = The required return on equity Calculating the cost of equity: Dividend growth model Current stock value = PV future dividends P = D1/(r -g) D1 = next expected dividend r = required return g = expected dividend growth rate Calculating the cost of equity: Dividend growth model r = D1/P0 + g Required return = dividend yield + capital gains Where does "g" come from? We want to know how to estimate the capital gain (dividend growth) rate Where does "g" come from? We know that: Earnings1 = Earnings0 + (Ret)Earnings0(ROE) Earnings1/Earnings0 = 1 + (Ret)(ROE) Where does "g" come from? If the retention ratio (Ret) remains constant over time, Earnings1/Earnings0 = Dividend1/Dividend0 = 1+g Remember, Earnings1 = Earnings0 [1+(Ret)ROE] Where does "g" come from? hence, 1+ g = 1 + (Ret)(ROE), that is, g = (Ret)(ROE) The growth in dividend depends on: • • the proportion of earnings reinvested back into the company ROE Dividend growth model: Advantages & Disadvantages Simple to understand and calculate Cannot be accurate without a good estimation of g Assumes the market is efficient Calculating the cost of equity Method 1: Dividend growth model Method 3: Risk-return model Method 3: HPR approach Method 4: ROE approach Risk-return models The return premium per unit of relative risk has to be constant: (r - rf)/b = (rM -rf)/bM r = required return on our stock rf = risk-free rate rM = expected return on the market portfolio b = the beta of our stock bM = market beta, always equal to 1 More on risk-return models CAPM: r = rf +b(rM - rf) beta = relative measure of risk: the amount of volatility our stock adds to the volatility of the market portfolio Calculating beta Run regression with market return as independent variable and our stock return as dependent variable ri = a + b (rM) + e estimated b = beta, the measure of relative risk Beta beta < 1, our stock has below average risk beta = 1, our stock has average market risk beta > 1, our stock has above average risk Risk-return models Advantages: Takes risk into consideration Disadvantages: Beta and the expected market return cannot be estimated reliably CAPM is elegant and appealing, but otherwise useless Calculating the cost of equity: Method 1: Dividend growth model Method 3: Risk-return model Method 3: HPR approach Method 4: ROE approach HPR approach Estimate the holding period return: r = [(PEnd - PBeginning + FVDividends)/(PBeginning)]1/t -1 HPR approach Advantages: Simple to calculate Disadvantages: Difficult to select the horizon Very inaccurate approximation due to market volatility Calculating the cost of equity Method 1: Dividend growth model Method 3: Risk-return model Method 3: HPR approach Method 4: ROE approach ROE approach Use book/market values to approximate the required rate of return: r = NI/Equity ROE approach Advantages: Easy to calculate Disadvantages: Poor approximation due to the volatility of stock prices The cost of debt The yield-to-maturity or the interest on bank loans Has to be adjusted for the tax-saving effect of debt cost of debt = i(1-T) Summary The hurdle rate has to reflect the risk of the project, not the source of funds If the risk of the project is average, use the default rate:WACC If the risk of the project is above or below average, adjust the WACC upward or downward