Chapter #13 - H. Zafer Yuksel

advertisement

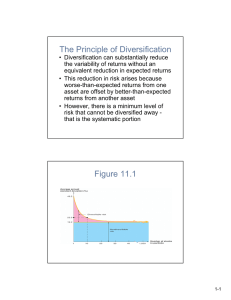

+ Return, Risk, and the SML RWJ-Chapter 13 + Returns Dollar Returns the sum of the cash received and the change in value of the asset, in dollars. Dividends Ending market value Time 0 1 • Percentage Returns Initial investment – the sum of the cash received and the change in value of the asset divided by the original investment. + Holding Period Return (Simple Return) 𝐸𝑛𝑑𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 𝑜𝑓 𝑎 𝑆ℎ𝑎𝑟𝑒 − 𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 + 𝐶𝑎𝑠ℎ 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝐻𝑃𝑅 = 𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 OR 𝐸𝑛𝑑𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 𝑜𝑓 𝑎 𝑆ℎ𝑎𝑟𝑒 − 𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 𝐶𝑎𝑠ℎ 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝐻𝑃𝑅 = + 𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 𝑃𝑟𝑖𝑐𝑒 Capital Gain Dividend Yield + HPR (Simple Return)-Example (1) Suppose you bought 100 shares of Wal-Mart (WMT) one year ago today at $25. Over the last year, you received $20 in dividends (= 20 cents per share × 100 shares). At the end of the year, the stock sells for $30. How did you do? What is your return on this investment? + Dollar Return: $520 gain $20 $3,000 Time 0 1 Percentage Return: -$2,500 20.8% = $520 $2,500 + HPR (Simple Period)- Example (2) Let’s look at Ford 𝐻𝑃𝑅𝐽𝑢𝑙𝑦−𝐴𝑢𝑔𝑢𝑠𝑡 = 𝐻𝑃𝑅𝐽𝑢𝑙𝑦−𝐴𝑢𝑔𝑢𝑠𝑡 Source=Yahoo Finance 9.44 − 9.24 + 0.05 9.44 − 9.19 = = 2.7% 9.24 9.19 9.44 − 9.24 0.05 = + 9.24 9.24 Capital Gain=2.16% % Dividend Yield=0.54% + HPR- Multiple Periods The holding period return is the return that an investor would get when holding an investment over a period of n years, when the return during year i is given as ri: Compounding Return: The cumulative effect that a series of gains or losses on an original amount of capital over a period of time HPR (1 r1 ) (1 r2 ) (1 rn ) 1 + HPR (Multiple Periods)- Example (3) Suppose your investment provides the following returns over a four-year period: Year Return 1 10% 2 -5% 3 20% 4 15% Your holding period return (1 r1 ) (1 r2 ) (1 r3 ) (1 r4 ) 1 (1.10) (.95) (1.20) (1.15) 1 .4421 44.21% + HPR (Multiple Periods)- Example (4) Let’s find compounded return for Ford + Annualizing Return How can I annualize my return over time? Two ways: Arithmetic Average Geometric Average + Example Year Return 1 10% 2 -5% 3 20% 4 15% Average (Arithmetic Return)? Geometric Return? Interpret the results + Risk: What is risk? Webster’s dictionary: “exposing to loss or damage” In finance: Stand-alone basis Portfolio basis + Which one is more risky? Why? + Risk and Return Relation: Is risk a bad? + How to measure Risk? Likelihood that investors will receive a return on an investment that is different from the return they expected to make Two important key words in this definition Expectations Deviation from our expectations + To measure Risk: We need to know two concepts? TIME SERIES ARE GIVEN Expected Return: 𝐸 𝑟 = 𝑡 𝑟𝑡 Expected Return 𝑇 How much “actual return” deviates from “Expected Return”? 𝜎2 1 = 𝑇−1 (𝑟𝑡 − 𝐸 𝑟 )2 𝑡 Variance + To measure Risk: We need to know two concepts? PROBABILITY DISTRIBUTION GIVEN Probability: The chance that event will occur Probability Distribution: If all possible events, or outcomes, are listed, and if probability is assigned to each event, the listing is called probability distribution. + Then: Expected Return: 𝐸 𝑟 = 𝑝 𝑠 × 𝑟(𝑠) Expected Return 𝑠 How much “actual return” deviates from “Expected Return”? 𝜎2 = 𝑝 𝑠 [𝑟 𝑠 − 𝐸(𝑟)]2 𝑠 Variance + Example (5) What is the expected return of Stock X? 𝐸 𝑟𝑥 = 𝜎2 (15% + 0% + 5% + 20%) = 10% 4 (15% − 10%)2 +(0 − 10%)2 +(5% − 10%)2 +(20% − 10%)2 = = 83.33 4−1 𝜎 = 9.12% + d4 d1 d3 d2 𝑑12 + 𝑑22 + 𝑑32 + 𝑑42 3 Standard Deviation + Example (6) What are the expected return for Stocks X and Y? + Example (6)-cont’d You have $10,000, what is your portfolio return if you invest $2000 in Stock X and $8000 in Stock Y + Diversification and Systematic Risk What is diversification? Spreading a portfolio over many investments to avoid excessive exposure to any source of risk + Diversifiable vs. Market Risk To the extent that the firm specific influences on two stocks differ, diversification should reduce portfolio risk With all risk sources independent, the exposure to any particular source of risk is reduced to a negligible level Firm specific risk is called unsystematic, unique risk, idiosyncratic risk, or diversifiable risk The risk remains even after extensive diversification. This risk is called market or systematic risk + Factors Affecting Unsystematic and Systematic Risk Unsystematic (Unique) Risk: Successful or unsuccessful product or marketing program Winning or loosing of a major contract In particular: good or bad news for a firm Systematic Risk: Economic conditions; recession, boom, high inflation, high interest rates + Diversification Unique Risk Systematic Risk + Market Risk + Summary: Based on the studies on capital market history, we know that there is reward, on average, for bearing risk. Since, unsystematic risk can be eliminated at virtually no cost (by diversifying), there is no reward for bearing it. Put another way, the market does not reward risks that are borne unnecessarily. Implication: The expected return on an asset depends only on that asset’s systematic risk No matter how much total risk an asset has, only the systematic portion is relevant in determining the expected return + How to measure systematic risk? Because systematic risk is the crucial determinant of an asset’s expected return, we need some way of measuring the level of systematic risk for different investment. β (Beta Coefficient) tells us how much systematic risk as an average asset Market Beta=1 Risk Free Rate Beta=0 Stock A: Standard Deviation=40%, Beta=0.50 Stock B: Standard Deviation=20%, Beta=1.50 Ford: http://www.google.com/finance?q=ford&ei=pISCUtCmIoG20AH2PA + Portfolio Beta and Security Market Line Weighted average Betas of the stocks in the portfolio 𝛽𝑝 = 𝑤𝑖 × 𝛽𝑖 𝑖 SML: Expected Return and Systematic Risk Relation: + Example (7) Let’s assume that you have a market portfolio (S&P 500) and risk-free rate asset (T-bills). Expected rate of Market Portfolio is 10% and risk-free rate is 3% What is the expected return and Beta if you invest: 100% in risk free rate 75% in risk free rate and 25% in Market Portfolio 50% in risk free rate and 50% in Market Portfolio 25% in risk free rate and 75% in Market Portfolio 100% in Market Portfolio + 𝐸 𝑟 − 𝑟𝑓 𝑅𝑒𝑤𝑎𝑟𝑑 𝑡𝑜 𝑅𝑖𝑠𝑘 𝑅𝑎𝑡𝑖𝑜 = 𝛽 𝐶𝐴𝑃𝑀: 𝐸 𝑅𝑖 = 𝑟𝑓 + 𝛽 × 𝐸 𝑅𝑀 − 𝑟𝑓 Market Risk Premium + The SML and the Cost of Capital: A Preview Risk is an extremely important consideration in almost all business decisions. Therefore, we need to the find the relation between risk and return (the SML) We also need to know what determines the appropriate discount rate for future cash flows: Market risk premium, risk free rate and Beta Why is the SML important: It tells us reward to risk in financial markets In order to find the discount rate: we need to compare the expected return on that investment to what the financial market offers on an investment with the same beta. In other words, the SML line tells us the “going rate” for bearing risk in the economy. + The SML and the Cost of Capital: A Preview Cost of Capital: the appropriate discount rate on a new project is the minimum expected rate of return an investment must offer to be attractive This minimum required rate of return is called “Cost of Capital” We have a much better idea of what determines the required return on invesment.