Environmentalism Through the Enforcement of Trade Laws

advertisement

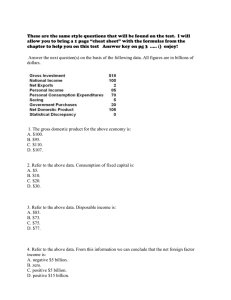

Major Issues in International Trade Currency manipulation Subsidies China has provided billions of dollars in subsidies, directly and indirectly, to its steel industry Attempts to weaken the trade laws China and other Asian countries keep the value of their currencies artificially low to make their exports cheaper and imports more expensive Multinational corporations that want to be able to rely on dumped and subsidized merchandise Climate change Some solutions would encourage U.S. manufacturing to move to China and elsewhere, leading to greater greenhouse gas emissions U.S. Dollar per Chinese Yuan Exchange Rate 0.18 0.17 0.16 0.15 0.14 0.13 0.12 0.11 Mar-07 Nov-06 Jul-06 Mar-06 Nov-05 Jul-05 Mar-05 Nov-04 Jul-04 Mar-04 Nov-03 Jul-03 Mar-03 Nov-02 Jul-02 Mar-02 Nov-01 Jul-01 Mar-01 Nov-00 Jul-00 Mar-00 Nov-99 Jul-99 Mar-99 Nov-98 Jul-98 Mar-98 Nov-97 Jul-97 Mar-97 Nov-96 Jul-96 Mar-96 Nov-95 Jul-95 Mar-95 Nov-94 Jul-94 Mar-94 Nov-93 Jul-93 Mar-93 0.10 U.S. Dollar per Chinese Yuan Source: Pacific Exchange Rate Service Illegal and Abusive Subsidies Discounted Land Costs Discounted Energy Costs Low Cost Loans Debt Forgiveness Lack of Environmental Compliance Chinese Steel Production 1996-2010 700 Estimated 647 mmt by 2010 Millions of Metric Tons 600 500 400 300 200 100 2010 2009 2008 2007 Total Production of Crude Steel – International Iron & Steel Institute (IISI), Steel Statistical Yearbook 2006 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 0 U.S. Trade Deficit 1997-2007 900 Billions of Dollars 800 700 600 500 400 China will account for over 30% of the U.S. Trade Deficit this year! 300 200 100 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 0 U.S. Trade in Goods with World (Seasonally Adjusted) in Billions of Dollars through July 2007 (remainder of 2007 projected); U.S. Census Bureau Trade Deficit U.S. Manufacturing Jobs vs. Trade Deficit (2000-2007) 900 18000 700 600 500 16000 400 300 15000 200 100 0 14000 U.S. Trade in Goods Deficit in Billions of Dollars (Over Previous 4 Quarters) 17000 U.S. Employees in Manufacturing (in Thousands) Manufacturing Jobs Source: U.S. Census Bureau 800 Mar-07 Dec-06 Sep-06 Jun-06 Mar-06 Dec-05 Sep-05 Jun-05 Mar-05 Dec-04 Sep-04 Jun-04 Mar-04 Dec-03 Sep-03 Jun-03 Mar-03 Dec-02 Sep-02 Jun-02 Mar-02 Dec-01 Sep-01 Jun-01 Mar-01 Dec-00 Sep-00 Jun-00 Mar-00 Ohio Manufacturing Jobs 1,050,000 975,000 900,000 825,000 750,000 1997 1999 2001 2003 2005 Nearly One of Every Four Ohio Manufacturing Jobs Has Been Lost in the Last Decade. The Multinationals’ View Large multinational manufacturers and trading companies (“MNCs”) generally oppose any strengthening of the trade laws Their chief focus is maximizing worldwide profits, not achieving maximum production and employment in the United States These companies have a vested interest in bringing dumped and subsidized imports into the United States Because of their size, they have substantial political clout U.S. - China Direct Investment (2000 – 2006) 25 China Direct Investment in U.S. U.S. Direct Investment in China Billions of U.S. Dollars 20 15 10 5 Source: The U.S. Bureau of Economic Affairs, Direct Investment, Direct Investment Position on a Historical-Cost Basis 2006 2005 2004 2003 2002 2001 2000 0 Helpful Federal Legislation Ryan-Hunter, H.R. 782 Applies the subsidy laws to China, makes currency manipulation a countervailable subsidy, and bars China from obtaining more votes in the IMF until it ends currency manipulation. Bunning - Stabenow S.796 Sister Bill of Ryan-Hunter Schumer, Grassley, Bachus, Graham S.1607 Very complex currency bill that has teeth to address ‘misalignment’ but allows wiggle room for Treasury and President to over ride. Very creative play on the dumping laws. Most likely to succeed. Dodd – Shelby S. 1677 Requires Treasury to label China a ‘currency manipulator’. Treasury will not do this. Removed intent from the label and addresses monetary policy. Rockefeller, S.364 Omnibus bill that sharpens trade laws. Davis – English H.R. 1229 Clarifies that subsidy laws can apply to NME.