Moneyminded - Financial Counselling Tasmania

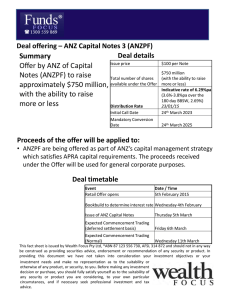

advertisement

Financial Counselling Tasmania Conference 12 October 2015 Delivered by ANZ in partnership with: Reach of MoneyMinded • More than 298,000 people have received MoneyMinded education since 2003 • We have trained more than 1,800 facilitators to deliver MoneyMinded in 20 markets 2 Classification: Public www.moneyminded.com.au 3 Classification: Public MoneyMinded online enables anyone to access financial education for free at any time • Website includes: • 8 interactive activities • progress saved along the way • discussion forum with 220+ posts • everyday case studies • links to MoneySmart tools and calculators. • Facilitators can access the Facilitators Hub. • Piloted the 8 activities with 300 participants. • ‘Really enjoyed doing these activities and learnt new ways to budget, save money and manage my super better. Thank you for this very useful and insightful course.’ (MoneyMinded pilot participant) 4 Classification: Public Links to MoneySmart tools and useful resources RMIT University evaluation results Setting longer-term goals • Before the program, 47% of MoneyMinded online participants had a financial goal to * achieve in the following 12 months and after the program 91% of participants had set a longer-term goal. Improved ability to ‘make ends meet’ and to save • Participants increased their capacity to cover all their expenses. Before doing the program, 27% of MoneyMinded online participants found it very or extremely difficult to cover expenses and after the program only 3% still found it difficult. Managing credit cards • The proportion of MoneyMinded online participants who paid the full balance on their card increased from 18% to 29% after doing the program. The proportion of participants who struggled to pay the minimum balance on their card each month fell from 18% to 6% following the program. Increased understanding and knowledge of financial products • 16% of MoneyMinded online participants took out new insurance cover after doing the program and 20% changed bank accounts to better suit their needs. See: MoneyMinded Report 2014 6 Do you spend $1,000 on coffee a year? 7 Classification: Public Case study – Janelle Assistant Coordinator STEMM - Supporting Teenagers with Education, Mothering and Mentoring • Janelle helped coordinate a program for teenage mothers. • “Very few of our students have any savings and are in great need of practical advice and education on handling their money…many of them live on their own having to manage rent, education and other weekly living costs and are struggling with debt.” • “MoneyMinded online from a teacher’s perspective is a great resource to enable students to engage in financial literacy and retain what they have seen and heard. It empowers the student to take control of their learning by interacting with the program to answer questions relating to themselves and their own money use.” 8 Classification: Public Adult Financial Literacy in Australia The fifth Survey of Adult Financial Literacy in Australia was released in May 2015. Use of digital: • Nearly three quarters of people use online banking, up from 63% in 2011. • Use of mobile and tablets has almost quadrupled from 14% in 2011 to 53% in 2014. Saving and financial control: • 75% of Australian’s regularly save; credit card use has fallen from 71% to 64% since 2011. • 78% feel in control of their financial situation all or most of the time – down from 2011. Information and advice: • Trust in financial professionals has declined since 2011 from 51% to 48%. • 46% of internet users (40% of population) use a website, online calculator or mobile app to compare financial products. Investing and superannuation: • Three quarters of people have super, those in one fund only has risen from 59% in 2011 to 63% in 2014. • Those who could not recognise an investment as ‘too good to be true’ fell from 53% in 2011 to 50% in 2014. See: ANZ Survey of Adult Financial Literacy in Australia, 2015 9 More information? 1. Email ANZ at moneyminded@anz.com 2. www.moneyminded.com.au 3. www.anz.com/moneyminded 10 Classification: Public