Introduction - NYU Stern School of Business

advertisement

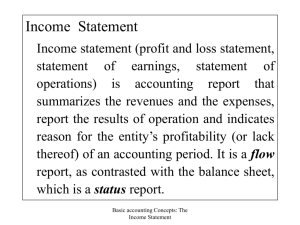

Accrual Accounting and Earnings Management RCJ Chapters 1, 2(48-52), 3(126-132), 7(357-359) Key Issues Accrual accounting Managers’ incentives and reporting abuses Example: Revenue recognition How earnings are managed Paul Zarowin 2 Accrual Accounting Recognizes the financial benefits and obligations accruing to an enterprise over the reporting period regardless of cash inflows and outflows. Objective: Better indication of performance than current cash receipts and payments. Paul Zarowin 3 Accrual Accounting: Characteristics subjectivity assumptions discretion incentives Paul Zarowin 4 Earnings Management The reporting discretion inherent in accrual accounting can be opportunistically used by managers. Manager information Investors Reporting incentives: • Higher bonus • Cashing out on Stock options • Career and personal ego Paul Zarowin 5 Earnings Management (cont’d) Why allow reporting discretion? Rigid rules (e.g. full expensing of R&D) trade-off Flexible rules (e.g. revenue recognition) Reporting biases Enables better reporting of larger number of businesses. No discretion Prone to manipulation Paul Zarowin 6 Earnings Management (cont’d) Important to understand: More often the problem is not the flexibility of the reporting rules, but the fact that the watchdogs are not doing their job!!! Audit failure Poor corporate governance Shareholder involvement SEC enforcement Paul Zarowin 7 Common Earnings Management Practices 1. Shifting income between periods: Revenues Borrowing 1. Premature earnings from the recognition of revenues future Example: Xerox Postponing earnings to the future Expenses 2. Capitalization of expenses Example: WorldCom 3. Deferring recognition 4. Exaggerating current of revenues expenses/losses to create cookie jar Example: Microsoft reserves Example: Microsoft Note: t Earningst = t Cash Flowst Paul Zarowin 8 Common Earnings Management Practices (cont’d): J.E. Actual J.E. 1. Borrowing revenues from the future 2. Deferring expenses to the future 3. Deferring revenue to the future 4. Exaggerating current expenses/losses to create cookie jar DR Cash later: DR Asset Expense DR cash later: def. revenue later: DR loss liability Proper recognition J.E. CR revenue DR cash later: def. revenue CR def. revenue revenue CR cash asset DR expense CR cash CR def. revenue revenue DR Cash CR revenue CR liability/Asset cash Paul Zarowin later: DR CR No journal entry loss cash 9 Common Earnings Management Practices (cont’d) 2. Classification of gains and losses: 3. Classifying one-time gains as earnings from continuing operations Classifying losses from continuing operations as one-time items Hiding Debt in unconsolidated subsidiaries Example: Enron Legitimate Earnings Management (Within GAAP) Violation of GAAP or SEC rules Manipulation of accruals to: I. smooth earnings II. Turn permanent expenses into temporary losses ex. P15-9 10 Example of Scope of Manipulations and Incentives: Xerox Case Xerox sells/leases copy machines, and related service to be provided for several years after sale. Recorded service revenue at the time of sale. According to the SEC investigation, “accounting tricks” boosted pretax profit by 1.5 billion from 1997 through 2000. In November 1999, CFO told management: "When accounting actions were stripped away, Xerox had essentially no growth through the late 1990s.” Q: Which of the 4 categories mentioned in slide #8 does Xerox case falls into? Paul Zarowin 11 Xerox Case: what were the incentives? Without the accounting scheme the company would have missed Wall Street's consensus per-share earnings targets in 11 of 12 quarters from 1997 to 1999. Accounting scheme helped keep Xerox's stock price artificially high in the late 1990s so executives could cash in $5 million in performance-based compensation and more than $30 million from stock sales. Paul Zarowin 12 Example of Reporting Discretion: Seebeyond Case On March 2002 SeeBeyond sold its software product for $2.2 million to a costumer. Revenue recognition: Deployment and payment for 1. Earned the software in stages that could 2. Measurable extend until March 2003. This customer had bought and successfully deployed software from SeeBeyond before. SeeBeyond is interested in including the $2.2 million in the revenues of the quarter ending on March 31, 2002. Is it possible? 1. No. Revenue not earned. 2. No. Revenue not measurable 3. Yes. Revenue is both earned and measurable. Paul Zarowin 13 SeeBeyond Case (cont’d) SeeBeyond held a conference call telling investors that revenues would fall short of the previous revenue guidance by approximately $2 million. The share fell 52% the next day!!! Why? Paul Zarowin 14