Chapter 4

The Income Statement,

Comprehensive Income,

and the Statement of

Cash Flows

Copyright © 2015 McGraw-Hill Education. All rights reserved.

The Income Statement, Comprehensive Income,

and the Statement of Cash Flows

Income Statement

(Statement of

Operations or

Statement of Earnings)

Displays a company’s

operating performance

Comprehensive Income

(other comprehensive

income (OCI) or loss)

Includes a few types of

gains and losses that are

not part of net income

Statement of Cash

Flows

Provides information

about cash receipts and

cash disbursements

The Income Statement, Comprehensive Income,

and the Statement of Cash Flows

Reports changes in shareholders’ equity

Income Statement

Change Statements

Statement of Cash Flows

Reports events that caused change in cash

Balance Sheet

Position Statement

LO4-1

Income from Continuing Operations

• Includes the revenues, expenses, gains, and losses

pertaining to transactions that probably will continue in

future periods

Revenues

• Inflows of resources resulting from providing

goods or services to customers

Expenses

• Outflows of resources incurred while generating

revenue

• Represent the costs of providing goods and

services

LO4-1

Recognition of Expenses

Causal relationship

Revenues

Yes

Expenses are

reported in the

same period that

the related

revenue is

recognized

Expenses

Is it possible to establish a

causal relationship

between revenues and

expenses?

No

Relate the expense

to a particular

period, allocate it

over several

periods, or

expense it as

incurred

LO4-1

Income from Continuing Operations

Gains and losses

• Increases or decreases in equity from peripheral

or incidental transactions of an entity

Examples

Gains and losses from the routine sale of

equipment, buildings, or other operating assets

and from the sale of investment assets

LO4-1

Income from Continuing Operations

Partial Income Statements

(In millions, except earnings per share)

Years Ended June 30

2016

2015

Single-Step Income Statement

• Groups all revenues and gains together and all

expenses and losses together

LO4-1

Multiple-Step Income Statement

• Reports series of intermediate subtotals

Concept Check √

Which of the following captions would more likely be found in a single-step

income statement?

a. Total revenues and gains.

b. Gross profit.

c. Operating income.

d. All of these answers are incorrect.

A single-step income statement groups together all

revenues and gains.

LO4-2

Earnings Quality

• Ability of reported earnings (income) to predict a

company’s future earnings

Transitory earnings

Result from transactions

that are:

not likely to occur again in the

foreseeable future

likely to have a different impact

on earnings in the future

Permanent earnings

Result from transactions

that are likely to

continue in the future

There may be transitory earnings

effects included in income from

continuing operations

LO4-2

Manipulating Income and Income Smoothing

• Most executives prefer to report earnings that

follow a smooth, regular, upward path

‘bank’ their

earnings by

understating

$

Earnings

15%

15%

Instead of: 30%

Use the banked

profits to polish

results

0

Methods:

• Income shifting - “channel stuffing”

• Income statement classification - “big bath”

accounting

LO4-3

Partial Income Statement—GameStop Corp.

• The extraordinary classification has now been

eliminated from GAAP

LO4-3

Operating Income and Earnings Quality

Restructuring

Costs

Include costs associated with

shutdown or relocation of facilities or

downsizing of operations

Recognized in the period the exit or disposal

cost obligation actually is incurred

Examples

• Termination benefits payable to employees to be

terminated: To be accrued in the period(s) the employees

render their service

• Costs associated with closing facilities: Recognized when

services or goods associated with those activities are

received

LO4-3

Operating Income and Earnings Quality

Long-lived

asset

impairments

Any long-lived

asset

Tangible

Intangible

should have its balance reduced if there

has been a significant impairment of value

Examples of revenue issues affecting earnings

quality:

• A company loses a major customer that can’t be

replaced

• Premature revenue recognition due to pressure to

meet earnings expectations

LO4-3

Nonoperating Income and Earnings Quality

Gains and

losses

Sale of

investments

Current earnings

Significant

LO4-3

Nonoperating Income and Earnings Quality

Example:

In 2000: Stock market boom

Pro forma earnings:

– Management’s assessment of permanent earnings

– The Sarbanes-Oxley Act requires reconciliation

between pro forma earnings and earnings

determined according to GAAP

LO4-3

Income Statements (in part)—Intel Corporation

LO4-4

Discontinued Operations

• Disposal of component(s) that represents a

strategic shift that has, or will have, a major effect

on a company’s operations and financial results

• Reported separately, below income from continuing

operations

Discontinued

operations,

(expense)/

benefit

Discontinued operations,

netnet

of of

$xx$xx

tax tax

(expense)/

benefit

Concept Check √

The Cansela Baseball Bat Company reported income before taxes of

$375,000. This amount included a $75,000 loss on discontinued operations.

The amount reported as income from continuing operations, assuming a tax

rate of 40%, is:

a. $375,000.

b. $270,000.

c. $180,000.

d. $225,000.

[$375,000 (income before income taxes) + $75,000 (loss on

discontinued operations)] × [1.0 – 0.4 (tax rate)] = $270,000

LO4-4

Reporting Discontinued Operations

Income or loss from

operations of the

component

On disposal of the

component’s assets

When the

component has

been sold

From the beginning of

the reporting period to

the disposal date

Gain or loss on

disposal of the

component’s assets

When the

component is

considered held

for sale

From the beginning of

the reporting period to

the end of the

reporting period

An “impairment loss”

if the book value of

the component is

more than fair value

minus cost to sell

LO4-4

Discontinued Operations—

Gain on Disposal

The Duluth Holding Company has several operating divisions. In October 2016,

management decided to sell one of its divisions that qualifies as a separate component

according to generally accepted accounting principles. The division was sold on

December 18, 2016, for a net selling price of $14,000,000.

$14,000,000 On that date, the assets of

the division had a book value of $12,000,000

$12,000,000. For the period January 1 through

$4,200,000 The

disposal, the division reported a pretax loss from operations of $4,200,000.

company’s income tax rate is 40% on all items of income or loss. Duluth generated

after-tax profits of $22,350,000 from its continuing operations.

Duluth’s income statement for the year 2016, beginning with income from continuing

operations, would be reported as follows:

Income from continuing operations

$22,350,000

_

_

Discontinued operations:

Loss from operations of discontinued component $(2,200,000) × 40%

Income tax benefit

880,000

Loss on discontinued operations

(1,320,000)

Net income

$21,030,000

LO4-4

Discontinued Operations—Impairment Loss

The Duluth Holding Company has several operating divisions. In October 2016,

management decided to sell one of its divisions that qualifies as a separate component

according to generally accepted accounting principles. On December 31, 2016, the end

of the company’s fiscal year, the division had not yet been sold. On that date, the assets

of the division had a book value of $12,000,000

$12,000,000 and a fair value, minus anticipated cost

to sell, of $9,000,000

$9,000,000. For the year, the division reported a pre-tax loss from operations

of $4,200,000

$4,200,000. The company’s income tax rate is 40% on all items of income or loss.

Duluth generated after-tax profits of $22,350,000 from its continuing operations.

Duluth’s income statement for 2016, beginning with income from continuing

operations, would be reported as follows:

Income from continuing operations

$22,350,000

_

_

Discontinued operations:

Loss from operations of discontinued component $(7,200,000) × 40%

Income tax benefit

2,880,000

Loss on discontinued operations

(4,320,000)

Net income

$18,030,000

Concept Check √

On October 1, 2016, American Medical Inc. adopted a plan to discontinue its

generic drug division, which qualifies as a separate component of the business

according to GAAP regarding discontinued operations. The disposal of the

division was expected to be concluded by March 30, 2017. On December 31,

2016, the company's year-end, the following information relative to the

discontinued division was accumulated:

Operating loss for 2016

$195 million

Excess of book value over fair value, less costs to sell, at year-end 25 million

In its income statement for the year ended December 31, 2016, American

would report a before-tax loss on discontinued operations of:

a. $170 million.

b. $195 million.

c. $220 million.

d. All of these answers are incorrect.

$195 million operating loss plus a $25 million impairment loss.

LO4-4

Discontinued Operations Disclosure—Eastman

Kodak Company

Concept Check √

The Trident Corporation’s results for the year ended December 31, 2016,

include the following material items:

Sales revenue

Cost of goods sold

Selling and administrative expenses

Gain on sale of investments

Loss on discontinued operations

Restructuring costs

$8,200,000

4,800,000

2,000,000

300,000

1,200,000

280,000

Trident Corporation’s income from continuing operations before income

taxes for 2016 is:

a. $1,120,000.

b. $ 220,000.

c. $1,700,000.

d. $1,420,000.

$8,200,000 – 4,800,000 -2,000,000 + 300,000 – 280,000 = $1,420,000

LO4-4

Accounting Changes

Accounting changes fall into one of three

categories

accounting principle

change in

estimate

reporting entity

• Correction of an error is another adjustment that is

accounted for in the same way as certain

accounting changes

LO4-4

Change in Accounting Principle

• Refers to a change from one acceptable accounting

method to another

Voluntary changes in accounting principles

• Accounted for retrospectively by revising prior

years’ financial statements

Example

Change in inventory costing method from FIFO to

average cost

LO4-4

Change in Depreciation, Amortization, or

Depletion Method

• Accounted prospectively

• Accounted for the same way as a change in an

accounting estimate (see next slide)

• One difference is that most changes in estimate

don’t require a company to justify the change

LO4-4

Change in Accounting Estimate

• Changes due to revision of an estimate because of new

information or new experience

• Accounted prospectively

• New estimate is incorporated in any related accounting

determinations from that point on

• If the effect of the change is material, a disclosure note

is needed to describe the change and its effect on

income

Examples

Amount of future bad debts on existing accounts

receivable; useful life and residual value of a depreciable

asset; and future warranty expenses

LO4-4

Correction of Accounting Errors

• Caused by a transaction being recorded incorrectly

or not recorded at all

Errors discovered in the same year

Erroneous journal entry is reversed and the

appropriate entry is recorded

Material errors discovered in

subsequent years

Require a prior period adjustment

LO4-4

Prior Period Adjustments

• Required when a material error is discovered in the

statements when published and distributed to

shareholders

• Requires that the company record a journal entry

that:

– adjusts any balance sheet accounts to their

appropriate levels

– accounts for the income effects of the error

o By increasing or decreasing the beginning retained

earnings balance in a statement of shareholders’

equity

LO4-5

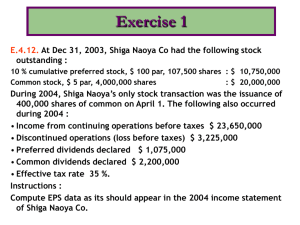

Earnings per Share Disclosures

• Ratio that indicates the amount of income earned

by a company expressed on a per share basis

Reported on the face of

Basic EPS

the income statement

Diluted EPS

Net income – Preferred stock dividends

Basic EPS =

Weighted-average number of common

shares outstanding

Illustration:

$600,000 – $75,000

$525,000

Basic EPS =

=

9

1,000,000 + 1,000,000 ( /12) $1,750,000

= $0.30

LO4-5

Earnings per Share Disclosures

Diluted EPS

• Reflects the potential dilution that could occur for

companies that have certain securities outstanding

that are convertible into common shares or stock

options that could create additional common

shares if the options were exercised

• These items could cause EPS to decrease (become

diluted) because there would be more shares in

the denominator of the EPS calculation

LO4-5

EPS Disclosures—Big Lots, Inc.

LO4-6

Comprehensive Income

• Is the total change in equity for a reporting period

other than from transactions with owners

o Includes net income as well as other gains and losses

that change shareholders’ equity but are not included in

traditional net income

• These other gains and losses are reported as other

comprehensive income (OCI) loss items

OCI items:

• Net unrealized holdings gains and losses on investments

• Gains (losses) from and amendments to postretirement

benefit plans

• Deferred gains (losses) from derivatives

• Gains (losses) from foreign currency translation

Concept Check √

Each of the following would be reported as an item of other comprehensive

income except:

a. Gains from and amendments to postretirement benefit plans.

b. Foreign currency translation gains.

c. Gains on sale of investments.

d. Unrealized losses on investments accounted for as securities available

for sale.

Gains on sale of investments are included in the determination of net

income.

LO4-6

Flexibility in Reporting

Information in the income statement and other

comprehensive income items can be presented as:

Single, continuous

statement of

comprehensive income

Statement of

comprehensive

income

Two separate, but

consecutive

statements

Income

statement

Statement of

comprehensive

income

LO4-6

Comprehensive Income Presented as a Separate Statement

Comprehensive Income–Astro Med Inc.

LO4-6

Accumulated Other Comprehensive Income

• Cumulative total of OCI (or comprehensive loss)

• Reported as an additional component of shareholders’

equity

LO4-6

Shareholders’ Equity—Astro-Med Inc.

($ in thousands)

Balance, 1/31/13

Add: Net income

Deduct: Dividends

Other comprehensive income

Balance, 1/31/14

Retained

Earnings

$36,092

3,212

(2,103)

$37,201

Accumulated Other

Comprehensive

Income

$173

3

$176

Example: Relationship between net income and

other comprehensive income

LO4-6

• Philips Corp. purchased shares for $90 million during the year and sold

them at year-end for $100 million

Accumulated Other

($ in millions)

Balance, 12/31/15

Net income (100 + )

Dividends

Other comprehensive income

Balance, 12/31/16

Comprehensive

Income

$34

Retained

Earnings

$600

106

(40)

$666

+

-0$34

$700

100 – 90 = 10 10 – 10 (0.4) = 6

• If the shares are not sold before the end of the fiscal year but the yearend fair value is $100 million

Accumulated Other

($ in millions)

Balance, 12/31/15

Net income

Dividends

Other comprehensive income

Balance, 12/31/16

Comprehensive

Income

$34

Retained

Earnings

$600

100

(40)

$660

+

$40

$700

LO4-7

Statement of Cash Flows

• Provides information about the cash receipts and

cash disbursements of an enterprise that occurred

during a period

• Cash refers to cash plus cash equivalents

• Presented for each period

• Helpful in assessing future profitability, liquidity,

and long-term solvency

Operating activities

Categories of transactions

affecting cash

Investing activities

Financing activities

LO4-8

Operating Activities

• Inflows and outflows of cash that result from

activities reported in the income statement

Operating Activities

Cash Inflows

• Sale of goods or services

• Interest and dividends from

investments

Cash Outflows

• Purchase of inventory

• Salaries, wages, and other

operating expenses

• Income taxes

• Net cash flows from operating activities: Difference

between the inflows and outflows

Concept Check √

Which of the following items would not be included as a cash flow from

operating activities in a statement of cash flows?

a. Purchase of inventory.

b. Purchase of machinery.

c. Payment of income taxes.

d. Collection of interest on a note.

The purchase of machinery is an investing activity.

LO4-8

Direct and Indirect Methods of Reporting

Two generally accepted formats can be used to report

operating activities:

Direct Method

Indirect Method

Cash effect of each

operating activity is

reported directly in the

statement

Net cash flow is derived

indirectly by starting

with reported net

income and adding or

subtracting items to

convert that amount to a

cash basis

LO4-8

Contrasting the Direct and Indirect

Methods of Presenting Cash Flows from Operating Activities

LO4-8

Direct Method of Presenting Cash Flows from

Operating Activities

Accounts Receivable

Beg. bal.

0

Revenue

90

78

End. bal.

12

Cash

Concept Check √

Bledsoe Motors reported revenue of $7,500,000 for its year ended

December 31, 2016. Accounts receivable at December 31, 2015 and 2016,

were $480,000 and $532,500, respectively. Using the direct method for

reporting cash flows from operating activities, Bledsoe Motors would report

cash collected from customers of:

a. $7,500,000.

b. $7,552,500.

c. $7,567,500.

d. $7,447,700.

$480,000 + 7,500,000 – 532,500 = $7,447,500

LO4-8

Indirect Method of Presenting Cash Flows from

Operating Activities

Concept Check √

Kringle Pastries reported net income of $432,000 for its year ended

December 31, 2016. Purchases of merchandise totaled $304,000. Accounts

payable balances at the beginning and end of the year were $72,000 and

$66,000, respectively. Beginning and ending inventory balances were

$88,000 and $92,000, respectively. Assuming that all relevant information

has been presented, Kringle Pastries would report operating cash flows of:

a. $310,000.

b. $442,000.

c. $422,000.

d. $302,000.

Net income

Deduct increase in inventory

Deduct decrease in account payable

Cash flows from operating activities

$432,000

(4,000)

(6,000)

$422,000

LO4-8

Investing Activities

• Include inflows and outflows of cash related to the

acquisition and disposition of long-lived assets used

in the operations of the business and investment

assets

• Purchase and sale of inventories are not considered

investing activities

LO4-8

Investing Activities

• Cash outflows include cash paid for:

o Purchase of long-lived assets used in the business

o Purchase of investment securities like stocks and

bonds of other entities Other than those classified as

o Loans to other entities cash equivalents and trading

securities

• Cash inflows:

o The sale of long-lived assets used in the business

o The sale of investment securities

o The collection of a nontrade receivable (excluding

the collection of interest, which is an operating

activity)

LO4-8

Financing Activities

• Relate to the external financing of the company

Financing Activities

Cash Inflows

Cash Outflows

• From owners when shares

are sold to them

• From creditors when cash

is borrowed through notes,

loans, mortgages, and

bonds

• To owners in the form of

dividends or other distributions

• To owners for the reacquisition

of shares previously sold

• To creditors as repayment of

the principal amounts of debt

(excluding trade payables that

relate to operating activities)

LO4-8

Noncash Investing and Financing Activities

• Activities that do not involve cash flows at all

• Reported on the face of the statement of cash flows

or in a disclosure note

Example:

Acquisition of equipment (an investing activity) by

issuing either a long-term note payable or equity

securities (a financing activity)

LO4-8

Statement of Cash Flows (beginning with Net

cash flows from operating activities)

LO4-9

International Financial Reporting Standards

U.S. GAAP

IFRS

Income Statement Presentation

No minimum requirements.

Require certain minimum information to be

reported on the face of the income statement.

SEC regulations require expenses be classified

by function.

Allow expenses to be classified either by

function or by natural description.

“Bottom line” of the income statement usually

is called either net income or net loss.

Description of the bottom line of the income

statement is either profit or loss.

Comprehensive Income

Companies are allowed to report

comprehensive income in either a single

statement of comprehensive income or in two

separate, but consecutive statements.

Same as under U.S GAAP. Other comprehensive

income items are similar under both standards.

However, an additional OCI item, changes in

revaluation surplus, is possible under IFRS.

LO4-9

International Financial Reporting Standards

U.S. GAAP

IFRS

Classification of Cash Flows

Cash outflows for interest payments and

cash inflows from interest and dividends

received as operating cash flows.

Dividends paid to shareholders are

classified as financing cash flows.

Interest and dividends paid can be

classified as either operating or financing

cash flows and interest and dividends

received as either operating of investing

cash flows.

Appendix 4

Interim Reporting

Interim reports:

• Issued for periods of less than a year, typically as

quarterly financial statements

To enhance the timeliness of financial information

Objectives

Downside

To provide investors and creditors with additional

insight on the seasonality of business operations

Relative unreliability

Intensified effect of unusual events

Appendix 4

Interim Data in Annual Report—PetSmart, Inc.

Appendix 4

Interim Reporting

Reporting Revenues and Expenses:

• Most revenues and expenses are recognized using

the same accounting principles applicable to annual

reporting

• Most are recognized in interim periods as incurred

• An expenditure that benefits more than just the

period in which it is incurred, should be allocated

among the periods benefited

• Income tax expense at each interim date should be

based on estimates of the effective tax rate for the

whole year

Appendix 4

Interim Reporting

Reporting Unusual Items:

• Discontinued operations should be reported

separately in the interim period in which they occur

– Not allocated among individual quarters

Appendix 4

Interim Reporting

• Earning Per Share:

– Quarterly EPS calculations follow the same

procedures as annual calculations

– Based on conditions actually existing during the

particular interim period

• Reporting Accounting Changes:

– Reported retrospectively by applying the changes to

prior financial statements

Appendix 4

Interim Reporting

• Requires only certain Minimum Disclosures:

o Sales, income taxes, and net income.

o Earnings per share.

o Seasonal revenues, costs, and expenses.

o Significant changes in estimates for income taxes.

o Discontinued operations and unusual items.

o Contingencies.

o Changes in accounting principles or estimates.

o Information about fair value of financial instruments

and the methods and assumptions used to estimate

fair values.

o Significant changes in financial position.

LO4-9

International Financial Reporting Standards

U.S. GAAP

IFRS

Interim Reporting

Costs are accrued or deferred and then

charged to each of the periods they

benefit.

Requires that a company apply the same

accounting policies in its interim financial

statements as it applies in its annual

financial statements. Costs are expensed

entirely in the period in which they occur.

Interim period income is less volatile than

under IFRS.

Interim period income is more volatile

under IFRS than under U.S. GAAP.

Income taxes are accounted for based on

an estimate of the tax rate expected to

apply for the entire year.

Same as under U.S.GAAP.

End of Chapter 4